- Well, bless my soul! The odds of a SOL ETF approval have jumped to a whopping 87% after the CME decided to play nice with SOL Futures. 🎉

- But hold your horses! An analyst predicts that SOL’s price might just be stuck in a rut for weeks or even months. Ain’t that a kicker? 🤷♂️

On the 17th of March, the good folks at the CME (Chicago Mercantile Exchange) finally rolled out the red carpet for the much-anticipated Solana [SOL] Futures trading. Analysts are all aflutter, thinking this might just be the ticket for ETF approval. 🥳

Now, the exchange is offering two flavors of SOL Futures: a standard contract that represents 500 SOL and a ‘micro’ option with just 25 SOL per contract. Because who doesn’t love a good micro option? 😏

Solana ETF odds

According to Mathew Sigel, the head honcho of digital assets research at VanEck, this is a ‘step closer’ to the U.S. giving a green light to a spot ETF. He declared,

“One sizable step closer to a SOL ETF.”

But wait! Sigel was quick to add that while the CME Futures ain’t a must-have for ETF approval, they sure do help. Kind of like a good cup of coffee on a Monday morning. ☕

“There is no need for CME futures to exist to list an ETF; that was a Gensler psyop. But it still helps.”

On the prediction site Polymarket, the odds of SOL ETF approval in 2025 jumped from 81% to 88% after the launch. Talk about a rollercoaster ride! 🎢

Now, let’s not forget that this debut made SOL the third cryptocurrency to strut its stuff on CME Futures, right alongside Bitcoin [BTC] and Ethereum [ETH]. Giovanni Vicioso, the big cheese at CME Group’s cryptocurrency products, chimed in,

“As Solana continues to evolve into the platform of choice for developers and investors, these new futures contracts will provide a capital-efficient tool to support their investment and hedging strategies.”

SOL’s likely price range

Despite all the hoopla, SOL’s price might just be stuck in a range for the foreseeable future. According to crypto trader, Cryp Nuevo, SOL could be bouncing between $120 and $175 if BTC keeps its head above water at $77K. 🏊♂️

“We’ll probably spend some weeks or even a couple months ranging here between $120-$175 if BTC keeps holding the 1W50EMA $77k.”

Now, Nuevo warns that we can’t rule out a downside risk, especially if Bitcoin dominance decides to climb higher than a cat in a tree at 63% and above. 🐱

“It feels quite fragile at the moment, in the way that if BTC.D pumps to 63%-64% at the same time as BTC drops back to $77k, then SOL could easily take out that low and even show <$100 for some hours/couple days.”

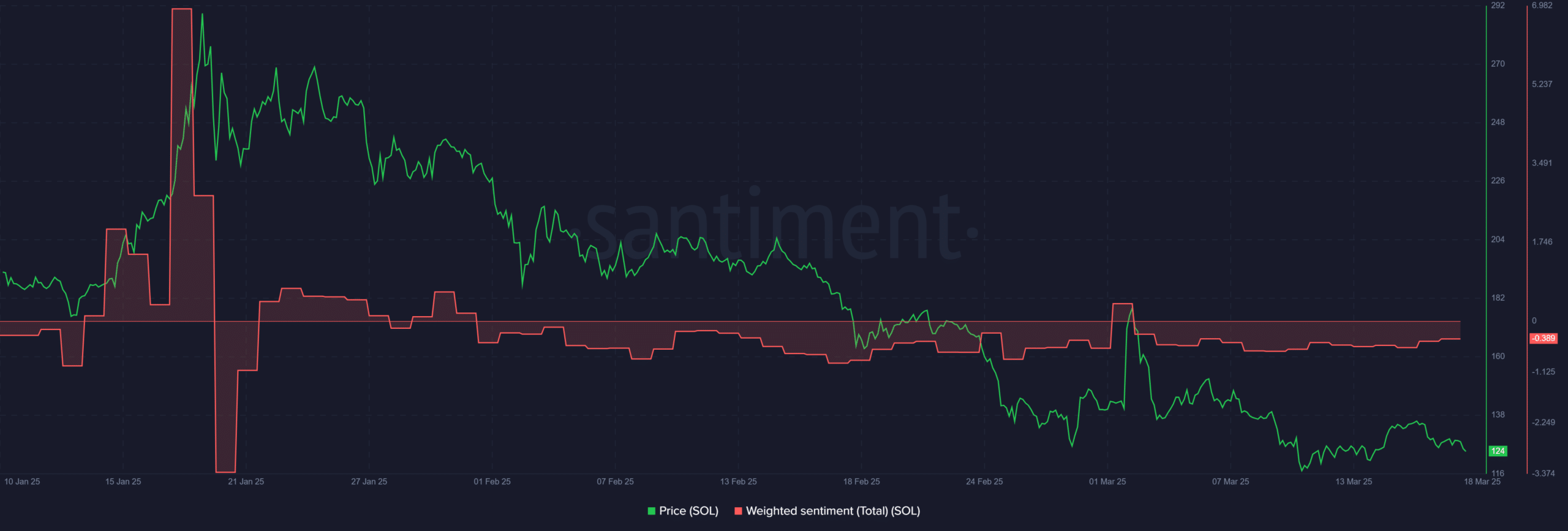

The bearish grip in SOL markets is as clear as mud, with the weighted sentiment being downright gloomy for most of Q1 2025. 🌧️

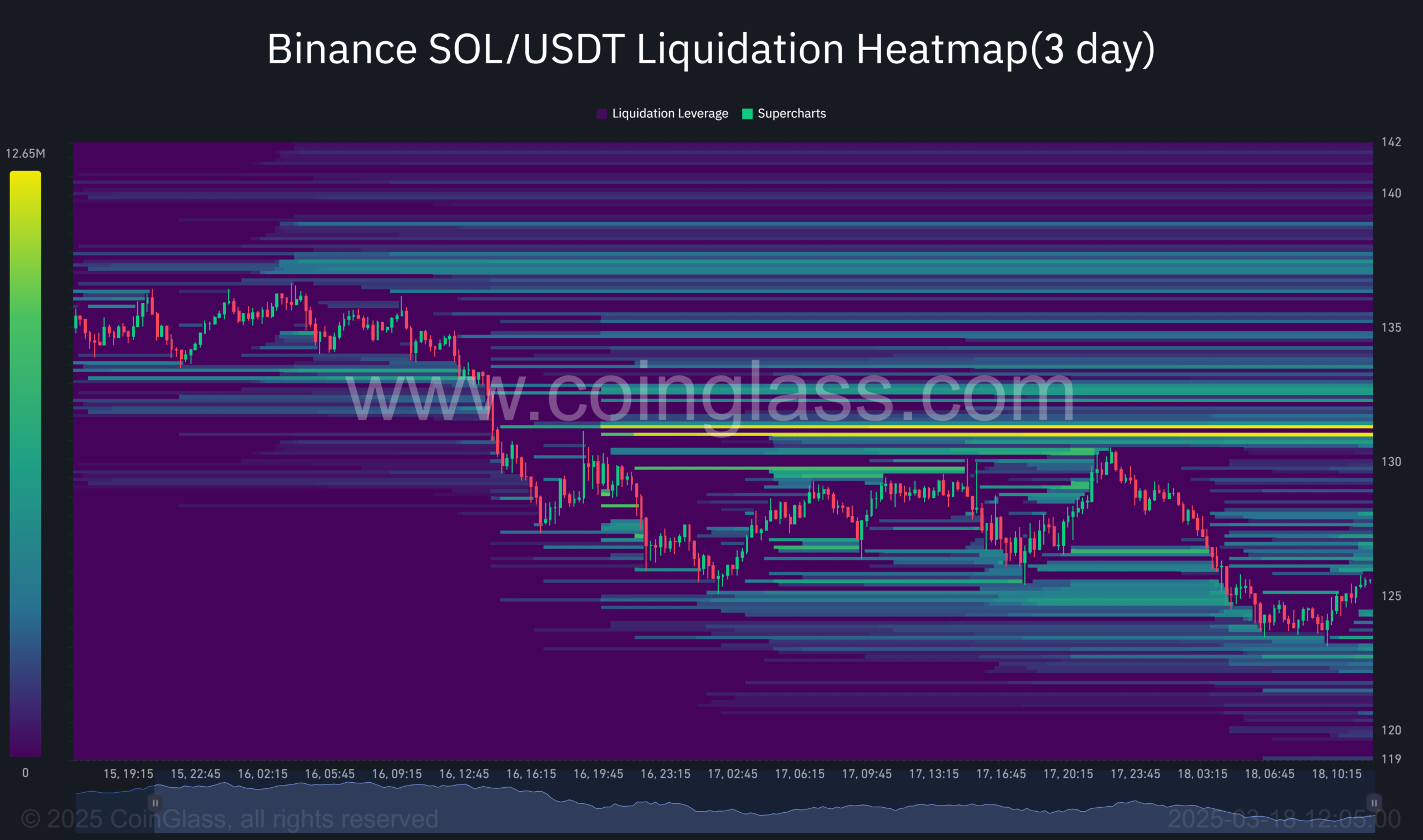

Meanwhile, there’s a heap of liquidity above $130 (that bright yellow area) as traders are opening shorts around that level. This could stir up some price action in the short term if a liquidity-driven pump decides to show up. 🚀

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-03-18 17:16