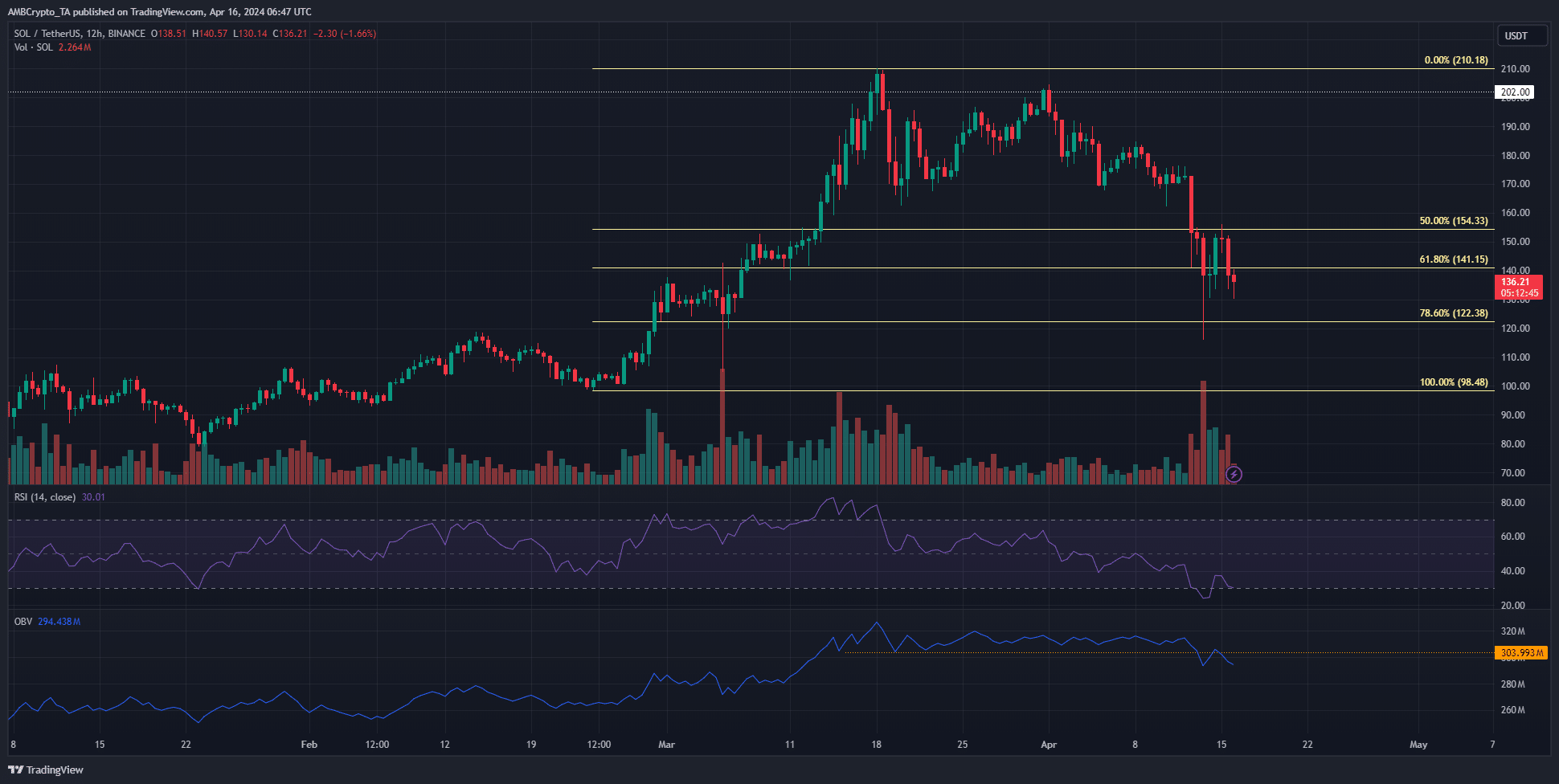

- The bulls ceded the $150 level to the bears recently as selling pressure intensified.

- Further losses appeared likely, and $150-$160 is a firm resistance zone.

On April 14th, Solana (SOL) bulls experienced a momentary relief as the price surpassed the psychologically significant level of $150. It’s possible that the v1.17.31 update played a role in this short-term price increase.

For about a month, bears have been scrutinizing the $155-$162 area as a potential demand zone. However, this zone was breached during the weekend. The Fibonacci sequence indicates that $122 is a significant level for bulls to protect.

Solana’s selling volume has gathered strength

On April 15th, Solana surged up to $156, but this increase was only temporary. The market’s overall sentiment was overbearingly bearish, causing late bears to trigger their stop-loss orders during the price rise.

An alternate expression for the given statement could be: The 12-hour chart of SOL‘s structure in the HTF remained optimistic, with $98.48 marking a significant low point. Dropping below this price would indicate a shift towards bearishness.

In the meantime, the smaller time frames had indicated a bearish trend, foreshadowing a possible decline to the $122 mark.

The past month’s support level could not be held by the OBV (On Balance Volume), indicating that buying power had weakened and sellers took over. The RSI (Relative Strength Index) was significantly below the 50-neutral threshold, reflecting a strong trend toward selling and bearish market conditions.

The argument for a sub-$100 Solana

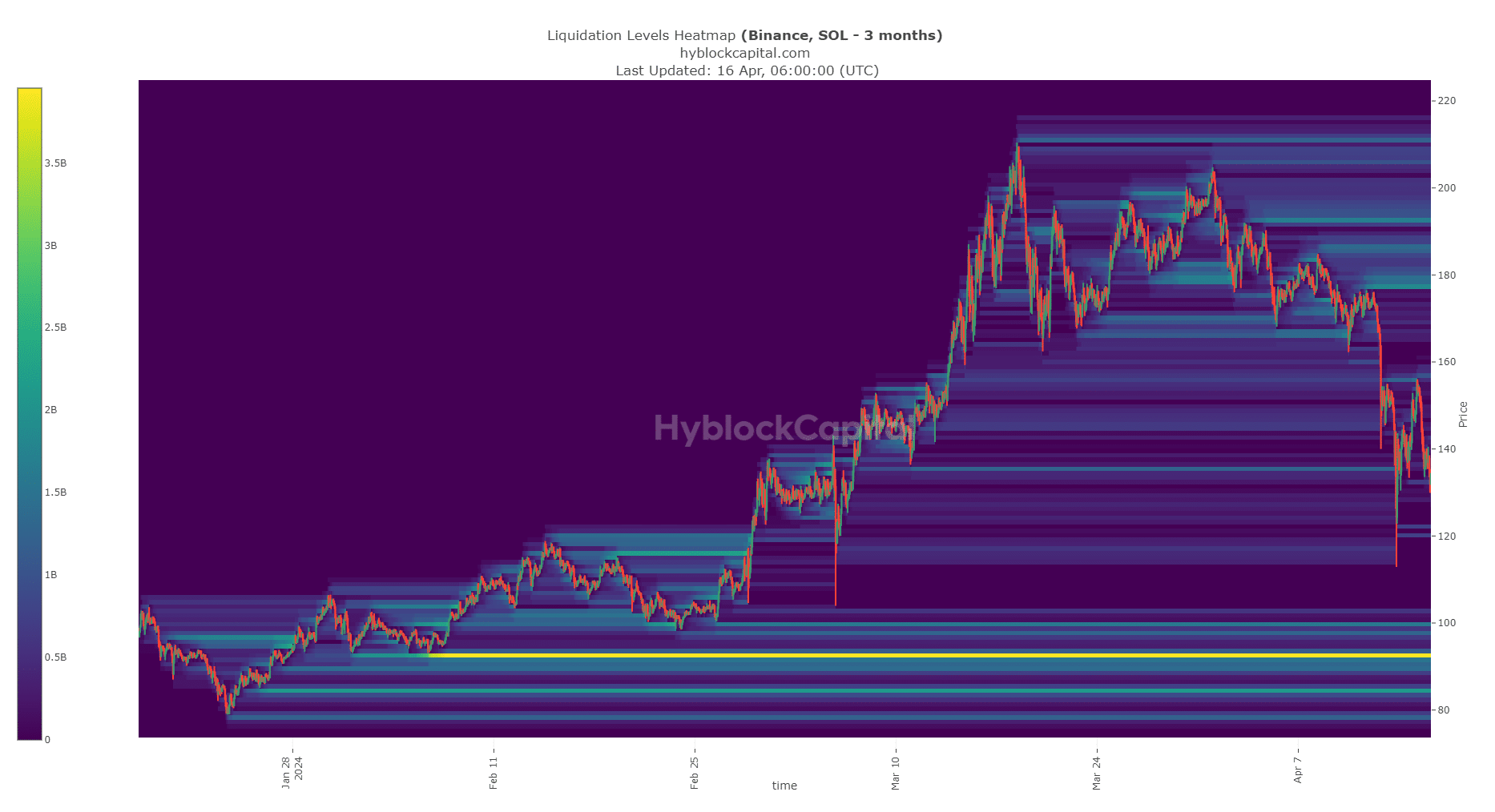

Over the past three months, the heatmap for liquidation levels indicated that $92.57 would be the next significant focus. This level has seen a buildup of liquidation points since February.

In the northern region, there was another magnetically active zone worth approximately $160. However, its magnetic force was significantly weaker than before, and it was plausible for SOL‘s price to decline to around $92.

Although the price doesn’t have to touch every point of available liquidity, a closing price under $122 in one day significantly increases the likelihood of a decline to $92.57.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-17 02:15