- Market sentiment around Solana turned bearish in the last few days.

- But there were chances of the sell signal getting nullified.

As a seasoned crypto investor with over a decade of experience navigating the ever-changing crypto market landscape, I find myself cautiously optimistic about Solana (SOL). The recent bearish sentiment has been hard to ignore, but as we all know, the crypto market can be unpredictable and volatile.

Over the past week, the volatility in Solana’s [SOL] price has decreased significantly, with its daily and weekly charts showing little to no activity or movement.

If we examine the most recent figures, it seems that a sell signal has emerged on Solana’s chart, potentially leading to a drop in its price over the next few days. So, let’s explore the current situation.

Solana moves a gear down

As per CoinMarketCap’s data, SOL’s price only moved down by 1% in the last seven days.

Currently, Solana (SOL) is being exchanged for approximately $142.28 per token, boasting a market cap surpassing $66 billion. This positions it as the fifth largest cryptocurrency in terms of market capitalization.

For now, noteworthy crypto expert Ali has shared some insightful information via a recent tweet. According to his post, there was an important indication given by a sell signal on Solana’s 4-hour graph.

Whenever a sell signal appears, it indicates that there are chances of a price correction.

Consequently, AMBCrypto decided to investigate the token’s current condition more closely to determine if any indicators suggested a possible price decline.

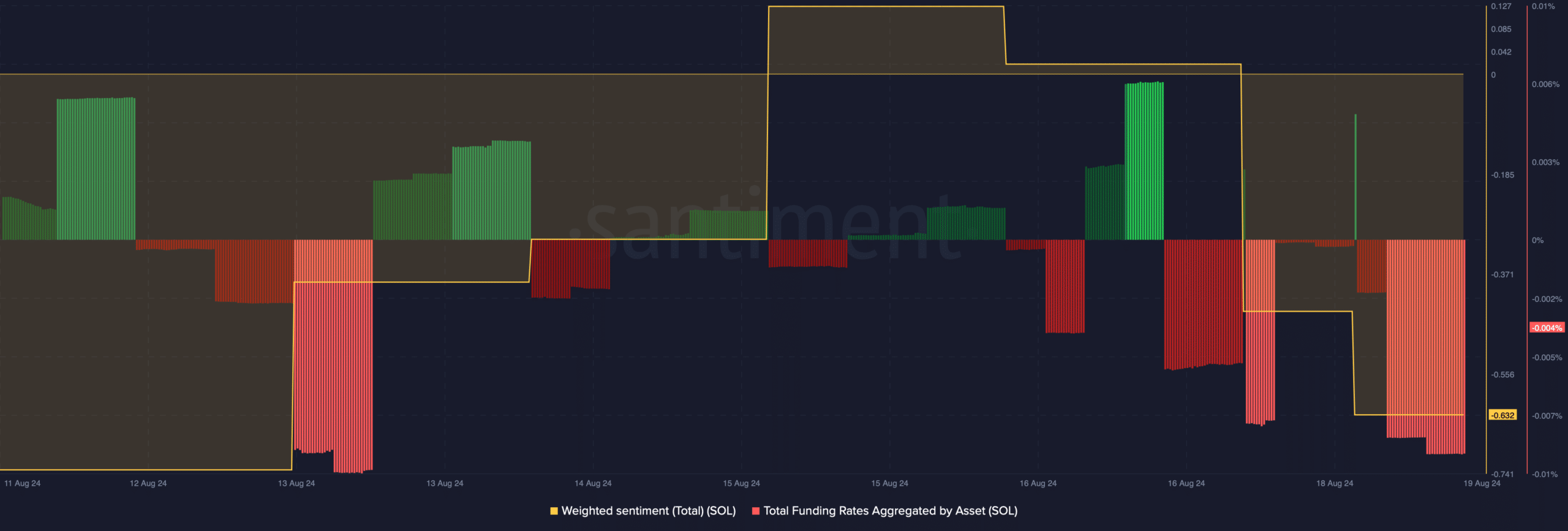

According to our review of Santiment’s findings, the weighted opinion towards Solana (SOL) significantly decreased, indicating an uptick in negative opinions or bearish sentiments about it.

According to information from Coinglass, the long/short ratio showed a significant drop. This indicates that there were more traders holding short positions rather than long positions, suggesting a negative or bearish trend.

Nonetheless, not everything looked bearish, as Solana’s Funding Rate dipped. Generally, prices tend to move in the other direction than the Funding Rate.

Additionally, when I penned this down, Solana’s Fear and Greed Index stood at 38%, indicating that the market was currently experiencing “fear.”

Achieving this index level may indicate an upcoming price increase. Previously, AMBCrypto mentioned that the selling pressure for Solana was minimal, implying a positive or bullish outlook.

Solana’s upcoming targets

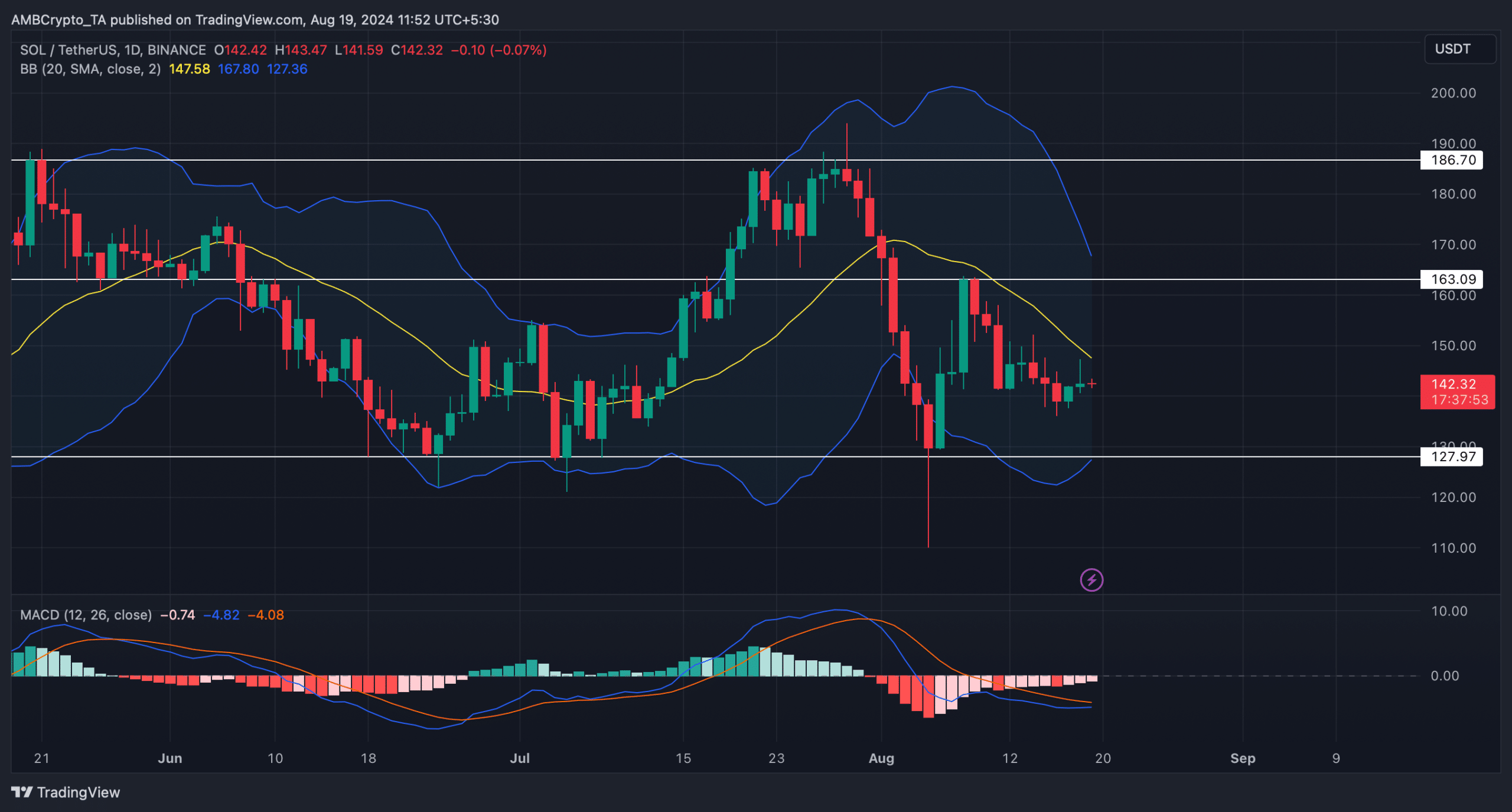

After examining Solana’s daily chart, AMBCrypto sought insights from various market indicators. It was observed that the Bollinger Bands indicated that Solana (SOL) was approaching its 20-day Simple Moving Average (SMA).

Read Solana’s [SOL] Price Prediction 2024-25

The MACD (Moving Average Convergence Divergence) indicator suggests a potential bullish crossover. If this occurs, it could potentially lead to SOL surpassing its 20-day Simple Moving Average.

It’s possible that SOL could initially reach around $163, and then potentially rise towards $186. But if SOL’s bearish trend increases, as indicated by the sell signal, investors may see the token falling to its support around the $129 level instead.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-08-19 18:15