- Solana was at the strong support level of $124 at press time.

- Trading volume surged by 36% signaling investors’ and traders’ participation.

As a researcher with experience in cryptocurrency markets, I’ve been closely monitoring Solana (SOL) amidst the recent market downturn. The selling pressure weighed heavily on most cryptocurrencies, including Bitcoin, Ethereum, and Binance Coin, leading to double-digit percentage losses within 24 hours.

Over the past day, Bitcoin (BTC), the largest cryptocurrency, suffered a significant drop of over 8%, resulting in increased selling activity within the market.

In the past 24 hours, cryptocurrencies such as Ethereum [ETH], Solana [SOL], and Binance Coin [BNB] have witnessed substantial declines of more than 10%, 7%, and 13% respectively, according to data from CoinMarketCap.

As a cryptocurrency market analyst, I’ve observed that at the current moment, most digital currencies are displaying downward trends due to persistent selling activity. In contrast, however, Solana has recently emerged as an exception with a bullish pattern evident on its daily price chart.

Solana: These are some key levels

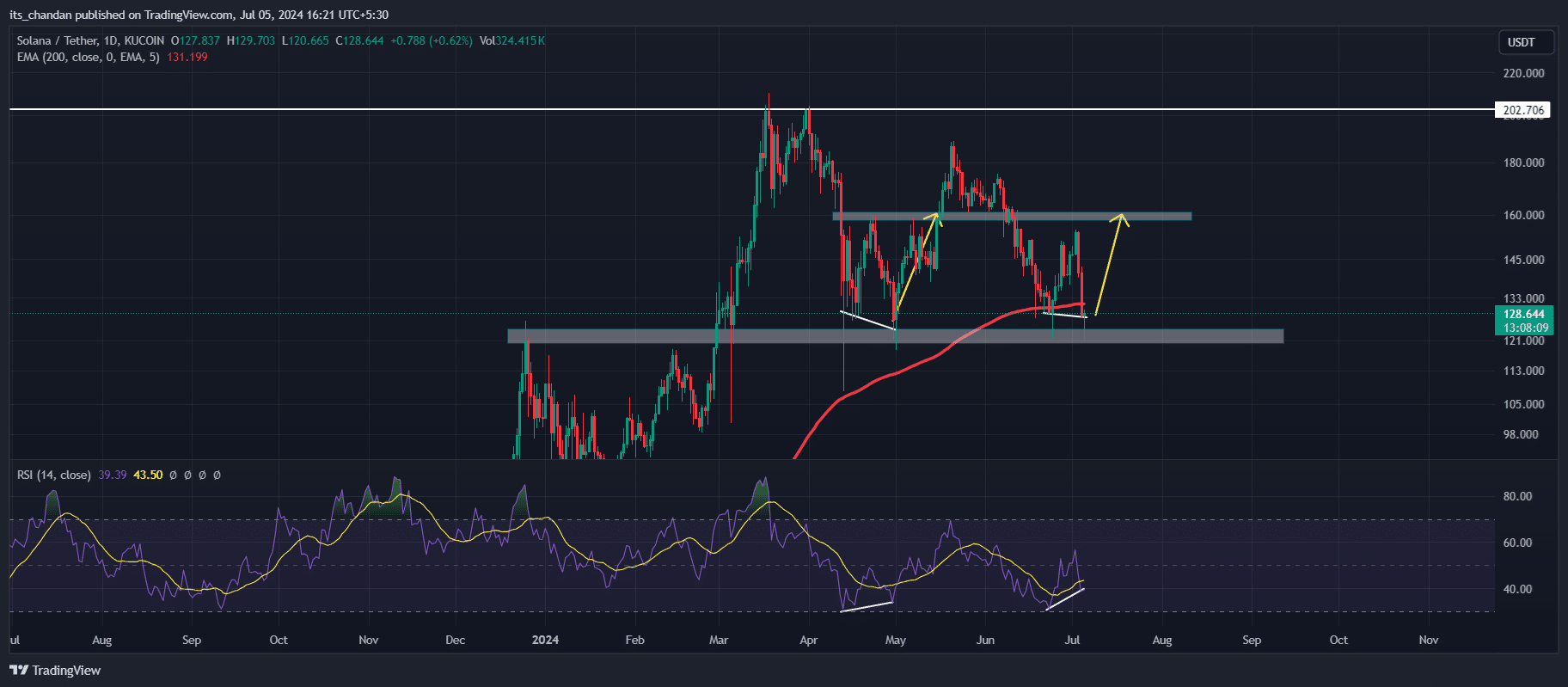

Based on AMBCrypto’s assessment, Solana’s price was holding steady around $124 – a robust support point – beneath its 200 Exponential Moving Average at the moment of writing.

As a crypto investor, I’ve been closely monitoring SOL‘s daily chart and have noticed some promising bullish price action patterns. Firstly, there appears to be a double-bottom pattern forming, which is typically a reliable sign of reversal in an uptrend. This occurs when the price bounces off a support level twice before continuing higher.

This isn’t the first occasion where SOL‘s daily price chart displayed such a pattern. Back in May 2024, a comparable bullish trend emerged around the $124 mark.

Based on past patterns, there’s a strong likelihood that SOL will repeat its actions from May 2024, which could lead to a significant price increase of approximately 22% and reaching the $160 mark within a short timeframe.

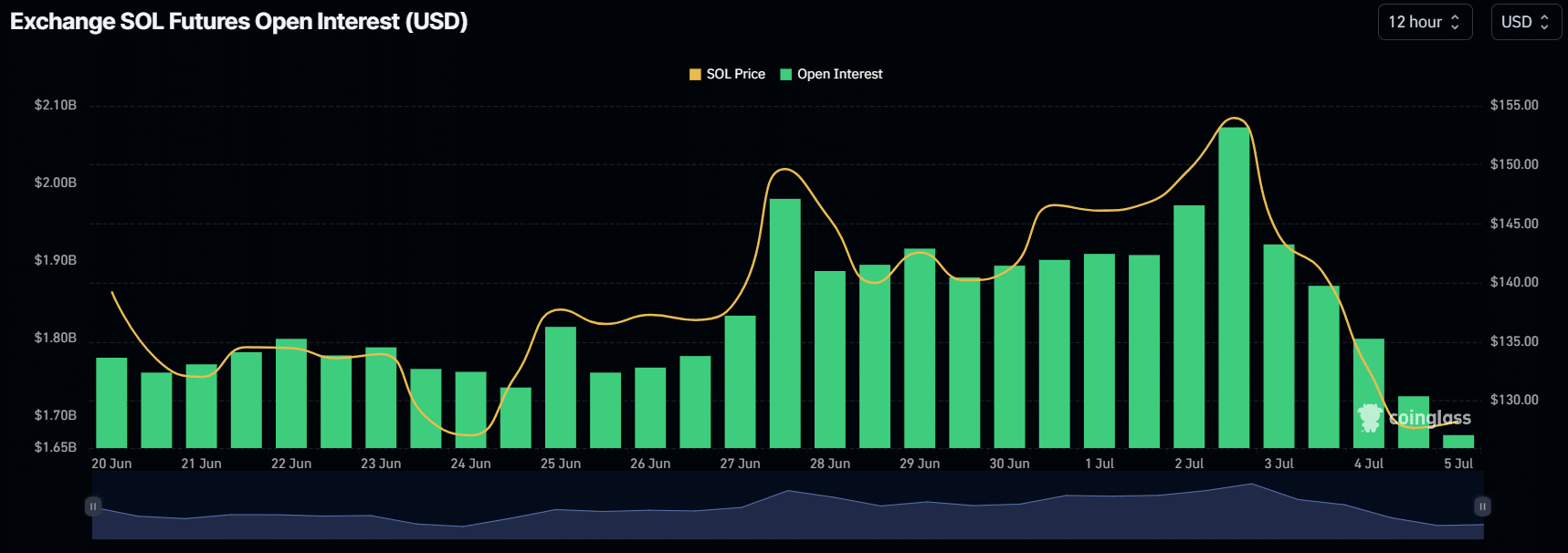

As an analyst, I’ve noticed a somewhat contradictory trend in the cryptocurrency market: while the bullish sentiment is strong, the 24-hour Open Interest (OI) has decreased by 7%, based on data from Coinglass. This suggests that there may be fewer investors and traders actively engaging with this complex market despite its potential rewards.

As a researcher studying recent market trends, I’ve noticed that over $25.5 million in positions involving various assets have been liquidated, resulting in a decrease in overall open interest (OI). Among these assets, SOL saw one of the most substantial liquidations, ranking it third-highest in this regard.

Whereas, the highest liquidation occurred in Bitcoin and Ethereum.

Price-performance analysis

At present, the value of SOL was approximately $126 on the markets. Over the past day, there had been a significant decrease of 7% in its price. The trading activity for SOL saw a substantial increase of 36%, indicating heightened interest from investors and traders.

Over a prolonged observation, SOL experienced a decline of over 11% within the past week. In contrast, during the previous 30-day span, SOL gave up almost 26% of the value it had previously gained.

In addition to Solana (SOL), the prices of other cryptocurrencies built on the Solana platform, including Render (RNDR), Bonk (BONK), and Pyth Network (PYTH), experienced comparable declines.

Based on data from CoinMarketCap, the prices of RDNR, BONK, and PYTH decreased by 9%, 12%, and 13% respectively over the past 24 hours.

In contrast, Dogewhiz (WIF), a well-known meme token on the Solana network, and The Graph (GRT) saw significant gains of 12% and 2%, respectively, during the same timeframe.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-05 23:03