- SOL has declined by 14.72% over the past seven days.

- An analyst eyes a 40% move if Solana breaks above $214 or below $183.

Over the last four days, Solana’s [SOL] price movement has been relatively stable, not following the overall uptrend it had earlier reached at around $223. Instead, it’s been trading between roughly $184 and $193, showing signs of consolidation.

Currently, at the moment, Solana is being traded for approximately $183, representing a decrease of 1.42% in daily trading. Moreover, it’s also been observed that SOL has experienced a decline on both weekly and monthly charts, with a drop of 14.72% over the past week and 18.68% over the past month.

Over the past period, I’ve noticed a persistent downtrend in the altcoin market that has sparked conversations among fellow crypto investors. Notably, renowned crypto analyst Ali Martinez proposes a significant price shift of approximately 40%, based on his analysis of a symmetrical triangle formation.

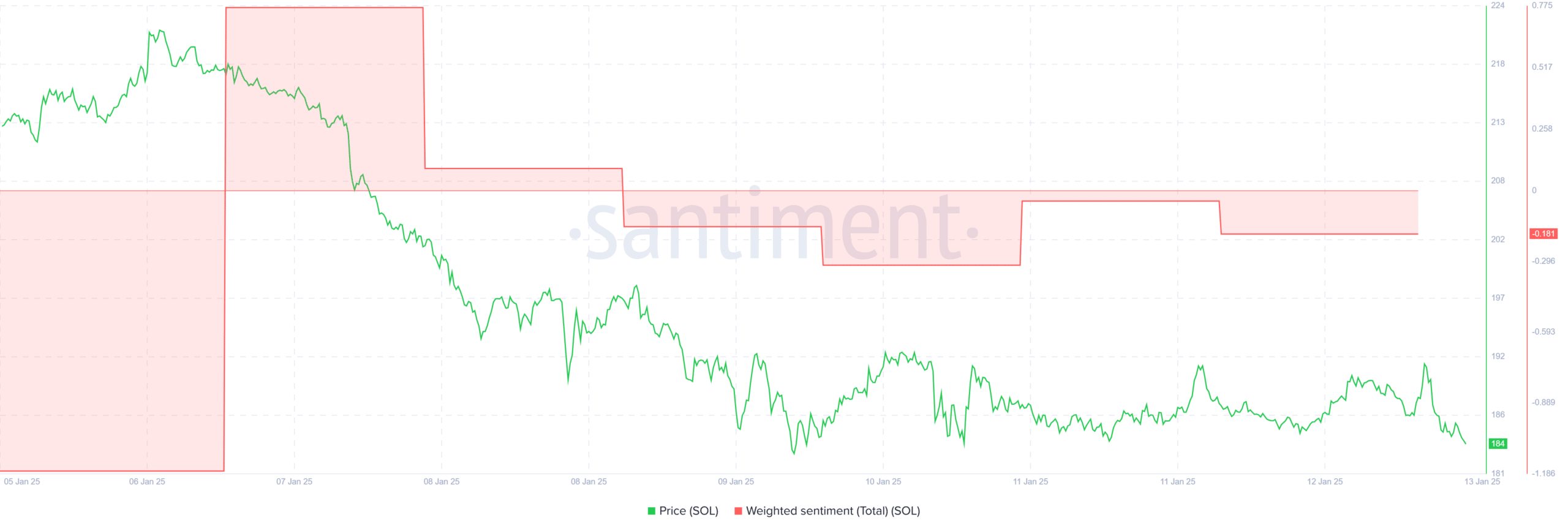

Market sentiment

In his analysis, Martinez observed that Solana is consolidating within a symmetrical triangle.

In simpler terms, when a financial asset forms a triangular pattern where it keeps making successively lower highs but also higher lows, this shows uncertainty in the market. Both buyers and sellers seem to be vying for dominance without either side being able to establish clear control.

Historically, prices usually break out before hitting the apex, accompanied by a spike in volume.

As per Martinez’s analysis, surpassing $214 or falling beneath $183 might instigate a 40% price shift. If we exceed $214, the cryptocurrency could potentially reach $299. Conversely, if it falls below $183, its value might decrease to around $109.

What SOL charts suggest

Based on the analysis, there’s a possibility that Solana’s (SOL) price could head upward or downward. This situation suggests that the market is at a critical juncture, where both sellers and buyers are vying for control over the market direction.

Based on AMBCrypto’s assessment, Solana (SOL) appears to be undergoing significant bear pressure in the near future, which might lead to some decreases in its value.

Over the last four days, I’ve noticed a consistent bearish trend in the market. My analysis indicates that this bearishness is quite profound, as the weighted sentiment has already turned negative some days ago. This suggests a strong prevailing bearish sentiment among traders.

As an analyst, I’ve observed that Solana’s Directional Movement Index (DMI) indicates a significant bearish trend. Specifically, the Positive Directional Index (+DI) has dipped to 13, while the Average Directional Index (ADX) is climbing up to 23. This suggests that the downward momentum is gaining strength.

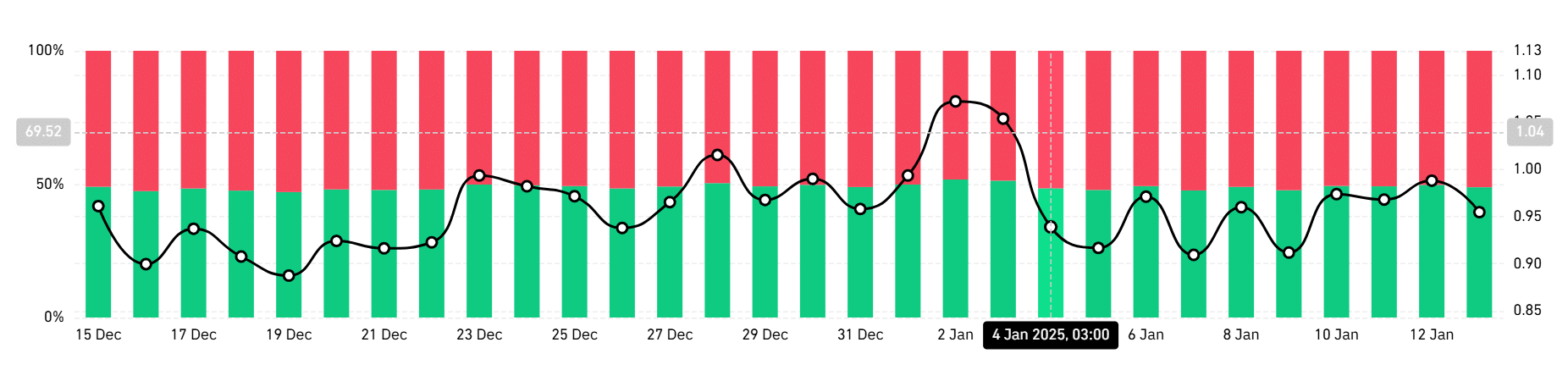

Glancing ahead, the majority seem to be betting on a drop in prices, as 52% of traders are going with short positions, compared to 48% who are opting for long positions. This trend implies that many market participants are pessimistic about the market and anticipate prices will fall.

Read Solana’s [SOL] Price Prediction 2025–2026

Essentially, there’s a significant negative outlook on SOL, which suggests it might drop below the $183 mark.

If it falls below the consolidation zone, it’s likely to encounter support near $175. On the flip side, breaking through this zone could allow Solana to regain its $220 resistance point.

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-13 19:03