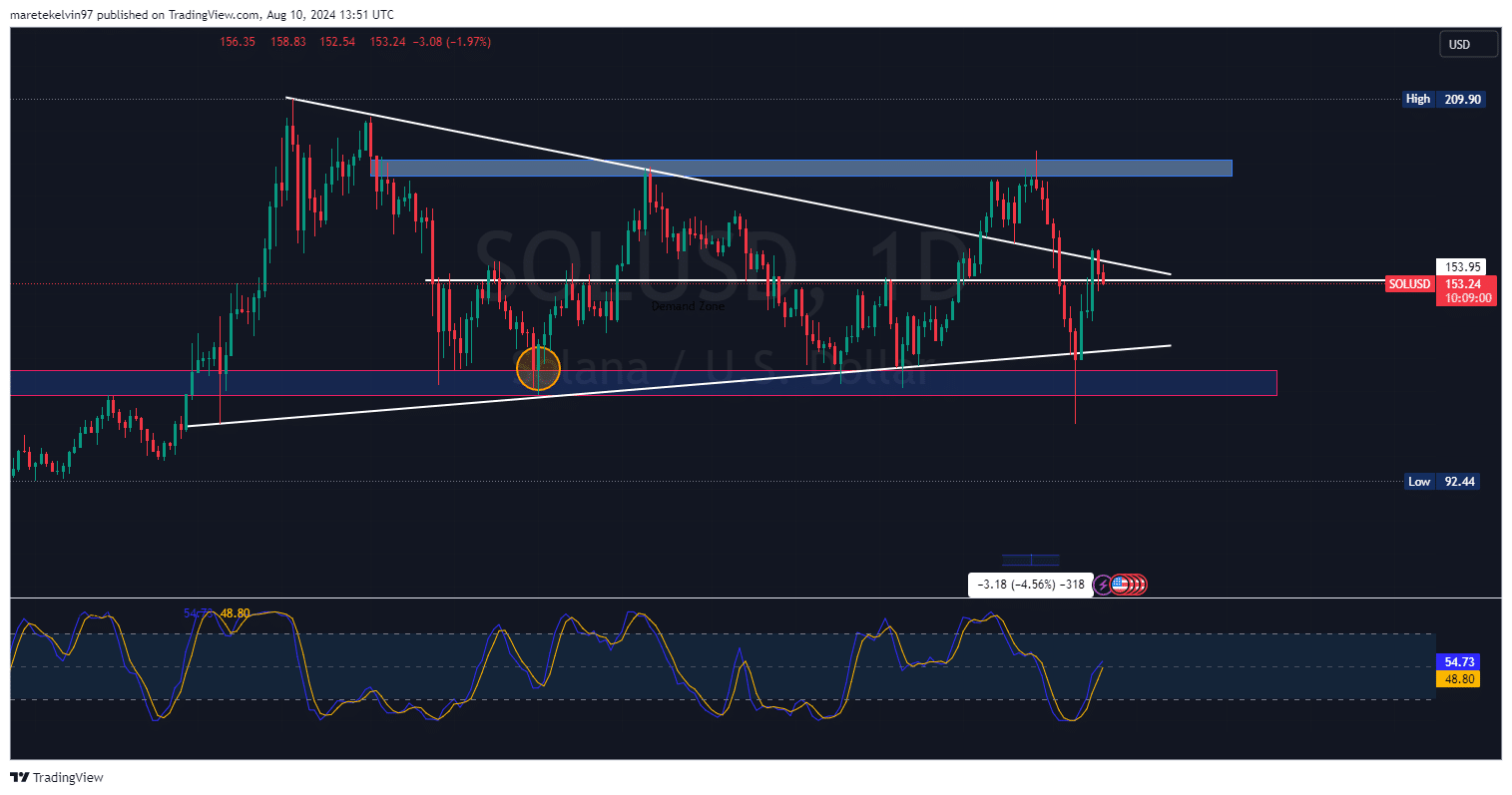

- Solana was testing key support at $153.95 after a sharp 6% pullback.

- Metrics indicate a potential bullish reversal.

As a seasoned analyst with years of market observation under my belt, I find myself standing at the precipice of Solana’s current predicament, much like a tightrope walker balancing precariously on a high wire.

At a pivotal juncture, Solana [SOL] is undergoing a significant test as it approaches the critical support point of $153.95. Investors are keenly observing to determine whether this support level will hold strong following a 6% decline or if the bearish sentiment will compel Solana’s price to fall further.

In simpler terms, the Stochastic Relative Strength Index (RSI) of Solana is moving towards a neutral state from an overbought zone. This strengthens the ongoing bullish trend of Solana, suggesting potential for further price increases. In other words, the conditions are favorable for additional upward price movements in Solana.

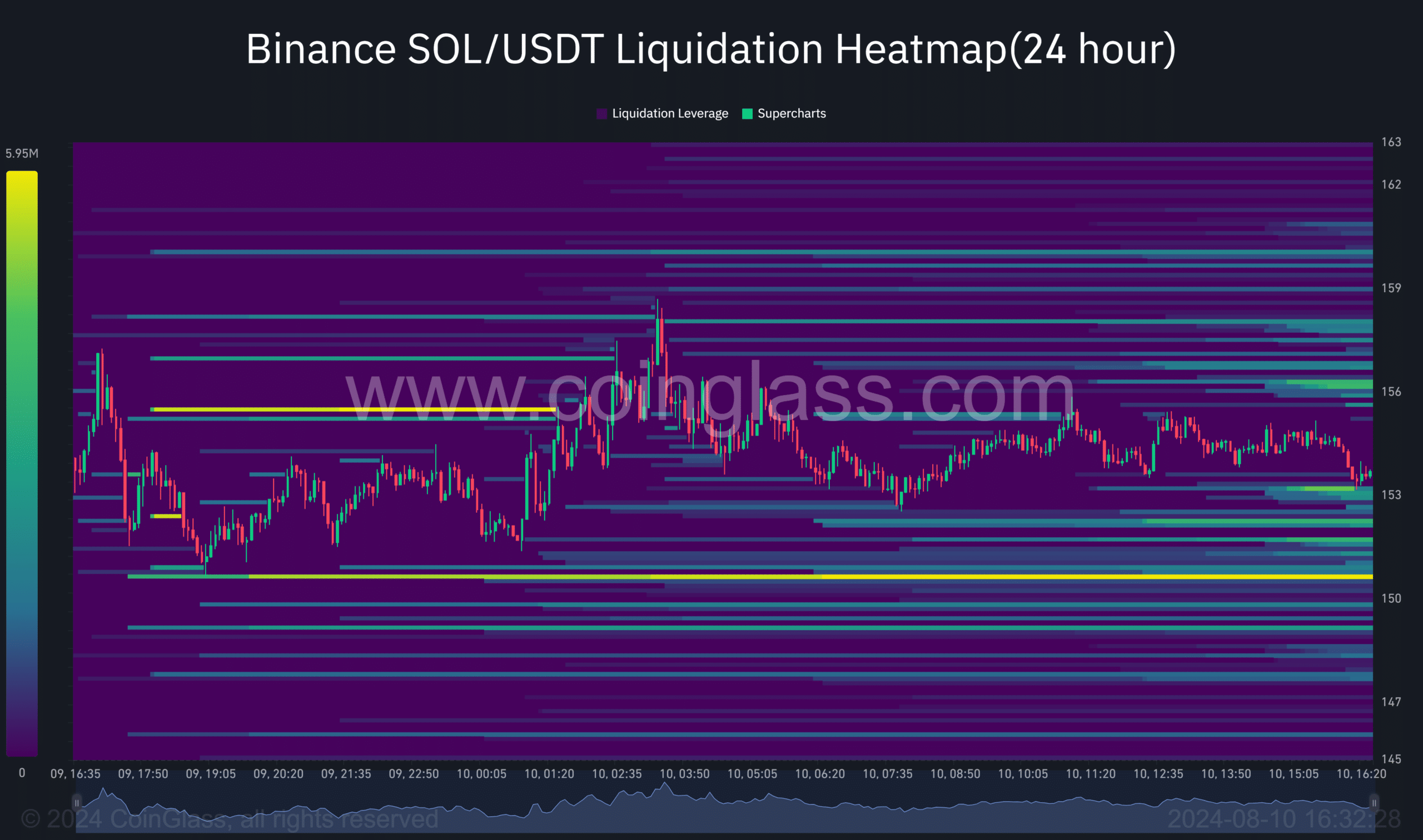

Solana liquidations hint at further downside run

Based on information from Coinglass’ liquidation heatmap, a substantial Solana liquidation pool valued at approximately $5.96 million is located immediately beneath the $153.95 support. This significant liquidation point is primarily concentrated near the $150 price mark.

As a seasoned trader with years of experience under my belt, I’ve seen countless market scenarios play out. In this specific instance, I believe that the current trend could potentially lead to a breakthrough of $153.95 in support for Solana. The massive accumulation of this cryptocurrency may induce compulsory selling as traders aim to hit stop orders, consequently driving down Solana prices even further. This pattern is not uncommon in volatile markets like the crypto space, and I’ve witnessed similar situations unfold before my eyes. It’s essential for investors to stay vigilant and adapt their strategies accordingly when dealing with such market dynamics.

Additionally, significant reserves are found at levels exceeding 153.95 in the liquidation pools. These could potentially act as a base for price stability and even trigger an uptrend if Solana’s bullish forces take over.

Solana bulls fighting back

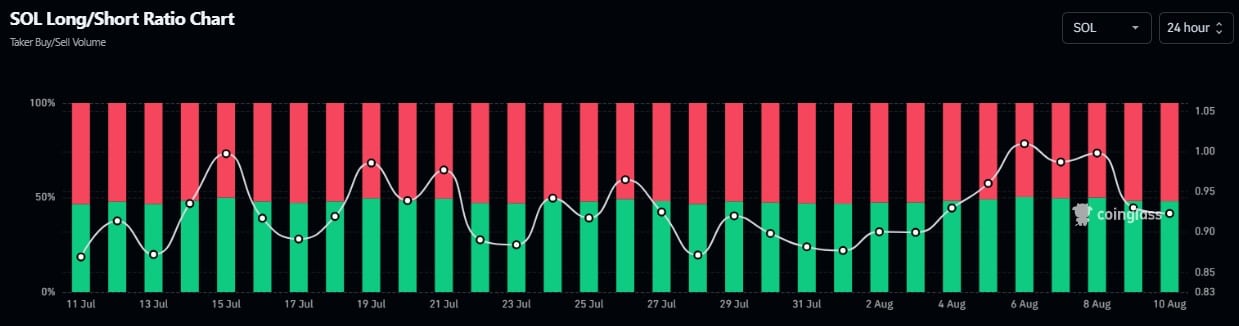

After examining the short-to-long ratio, AMBCrypto noticed a leaning towards bearish sentiment. However, this ratio has shown signs of strength as well.

In the short term, the balance seems to have shifted slightly towards the bears, but recurring fluctuations hint at an upswing for the bulls. If purchasers continue to push things forward, a potential change in trend toward a bull market might occur.

The struggle between those who believe Solana’s value will decrease (Solana bears) and those who think it will increase (Solana bulls) might result in a period of stability, followed by a significant shift upwards or downwards.

If the current level collapses, the price could dramatically drop to approximately $150 – a point with significant support. However, if buyers manage to hold their position at this point, it might trigger a modest upward trend and potentially another attempt to challenge higher resistance levels.

In determining Solana’s future course, the significance of liquidation pools and the balance between long and short positions cannot be overstated.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-08-11 10:15