-

SOL’s brief rally past its resistance on 20th May was short-lived.

Although its price has declined in the past few days, SOL accumulation continues to climb.

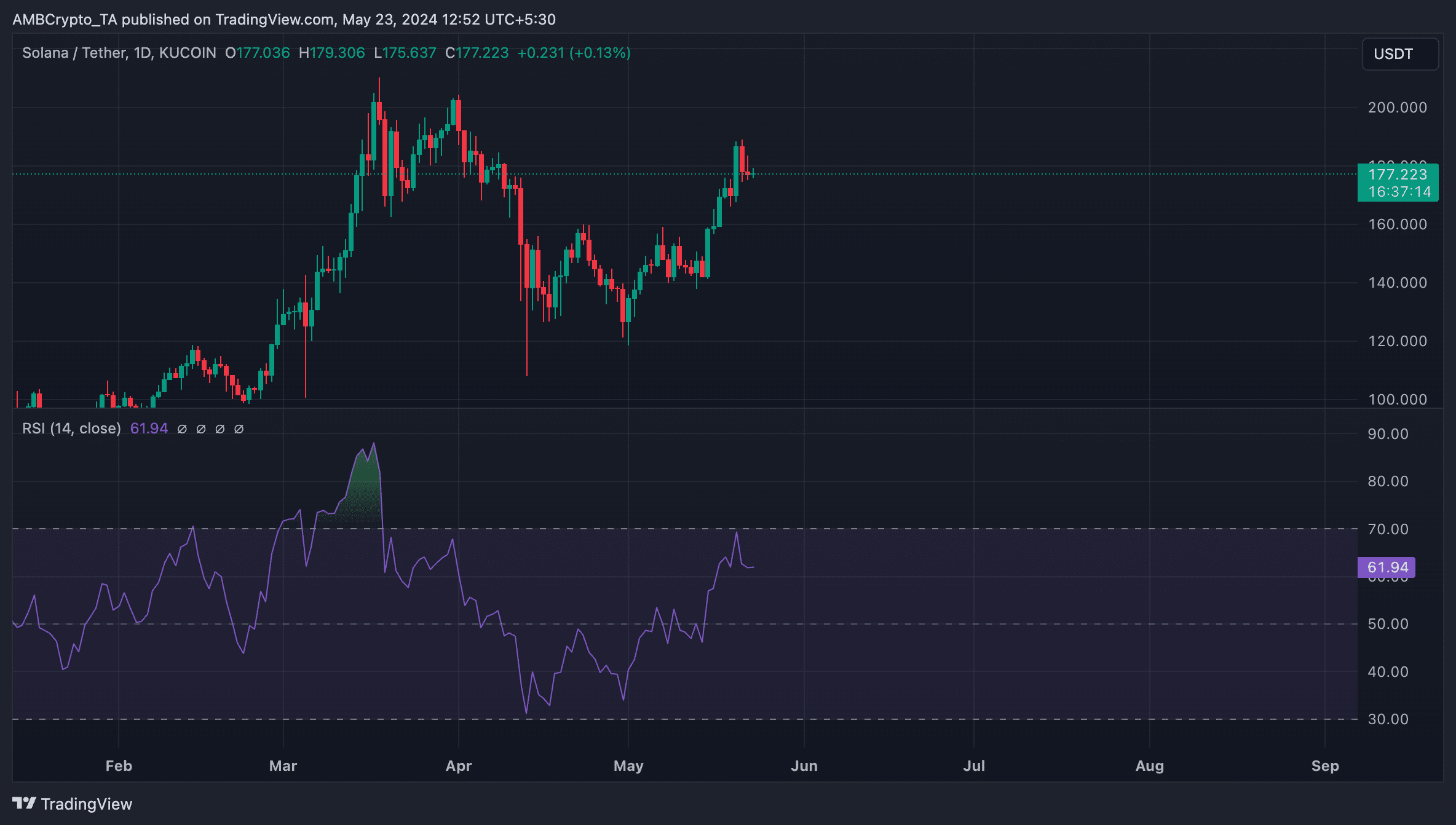

As a seasoned analyst with extensive experience in the crypto market, I’ve closely observed Solana’s [SOL] price action over the past few days. Based on the available data, it appears that the brief rally above its resistance level of $185 on May 20th was short-lived due to selling pressure that pushed the coin’s price below $180.

On May 20th, Solana’s [SOL] price surged past its short-term barrier at $185. However, this upward momentum was halted as sellers stepped in, causing the coin to dip below the $180 mark.

On the 21st of May, Solana’s altcoin price reached its peak of $187.83 for the month. Following this high point, the coin began a decline and is now trading at $177 as per CoinMarketCap’s latest figures.

SOL bears are on the move

I’ve noticed, just as anticipated, that Solana’s (SOL) price decline over the past few days has led to a significant reduction in its daily trading volume. Currently, it stands at approximately $3.74 billion. Compared to the impressive high of $5 billion reached on the 21st of May, this represents a 20% decrease.

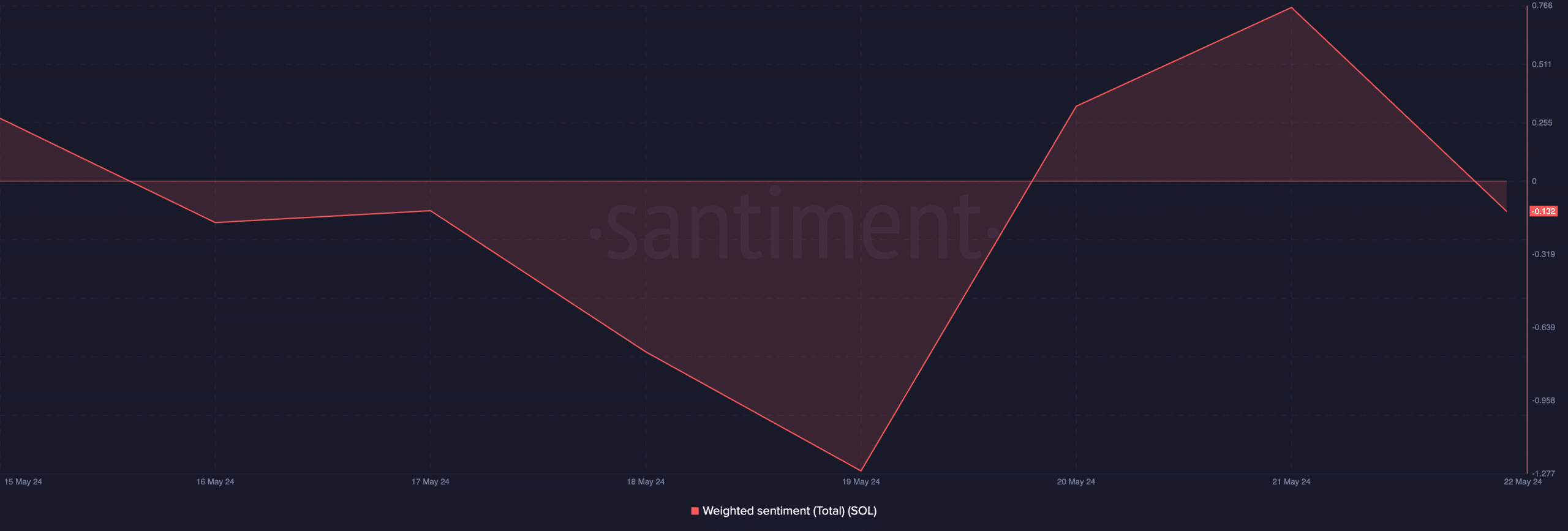

Based on my observation as a crypto investor, the selling pressure that had been building up began to take effect, causing a significant shift in the coin’s sentiment from optimistic to pessimistic. According to Santiment’s latest data, Solana’s (SOL) weighted sentiment stood at -0.13, confirming the broader market shift from bullish to bearish sentiment.

When the weighted emotion towards an asset is more negative than positive, there’s a larger volume of negative chatter about it on social media compared to favorable conversations.

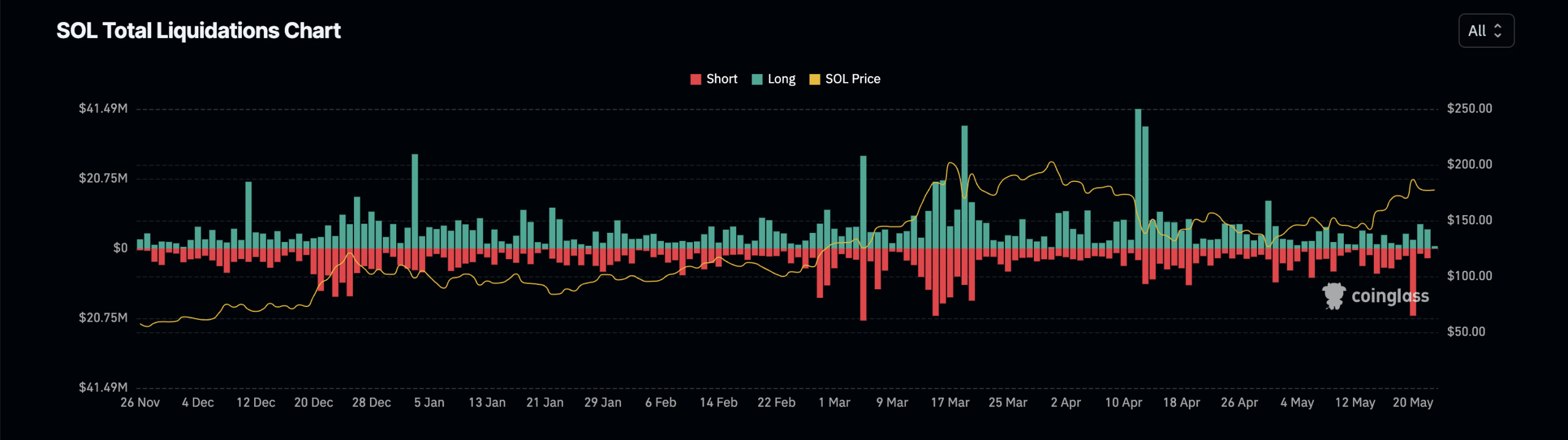

Over the last two days, I’ve noticed a significant trend in the futures market for this cryptocurrency as its price dropped. More long positions have been liquidated compared to short ones. In simpler terms, more investors holding long positions (betting on the coin’s price to rise) were forced to sell their coins at a loss than those who had short positions (betting on the coin’s price to fall).

As a researcher examining market data from Coinglass, I found that approximately $13 million in long positions were liquidated between May 21st and 22nd. On the other hand, only around $5 million in short positions were terminated during this time frame.

During that timeframe, the open interest for SOL‘s futures contracts decreased by 10%. This indicates that traders liquidated their positions and did not establish new ones as a response to the drop in Solana’s coin price.

The bulls remain steadfast

Despite SOL‘s recent price fluctuations, its funding rate remains positive at 0.0159% as of now.

As a crypto investor, I’d interpret a positive futures funding rate for an asset like Solana (SOL) as a sign of robust demand for long positions. In simpler terms, it means that even though SOL is experiencing a downturn at the moment, more traders are buying the coin in anticipation of a price rally.

Read Solana’s [SOL] Price Prediction 2024-25

As an analyst, I’ve observed a notable increase in the accumulation of Solana (SOL) based on its elevated Relative Strength Index (RSI) reading at the current moment.

As a crypto investor, I’d interpret the RSI of Solana (SOL) at 61.94 as indicating a preference among market participants for buying more coins rather than selling them.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-05-24 05:11