-

Solana’s revenue failed to pick up despite low congestion on the network

Volatility around SOL decreased, indicating that a breakout was not close.

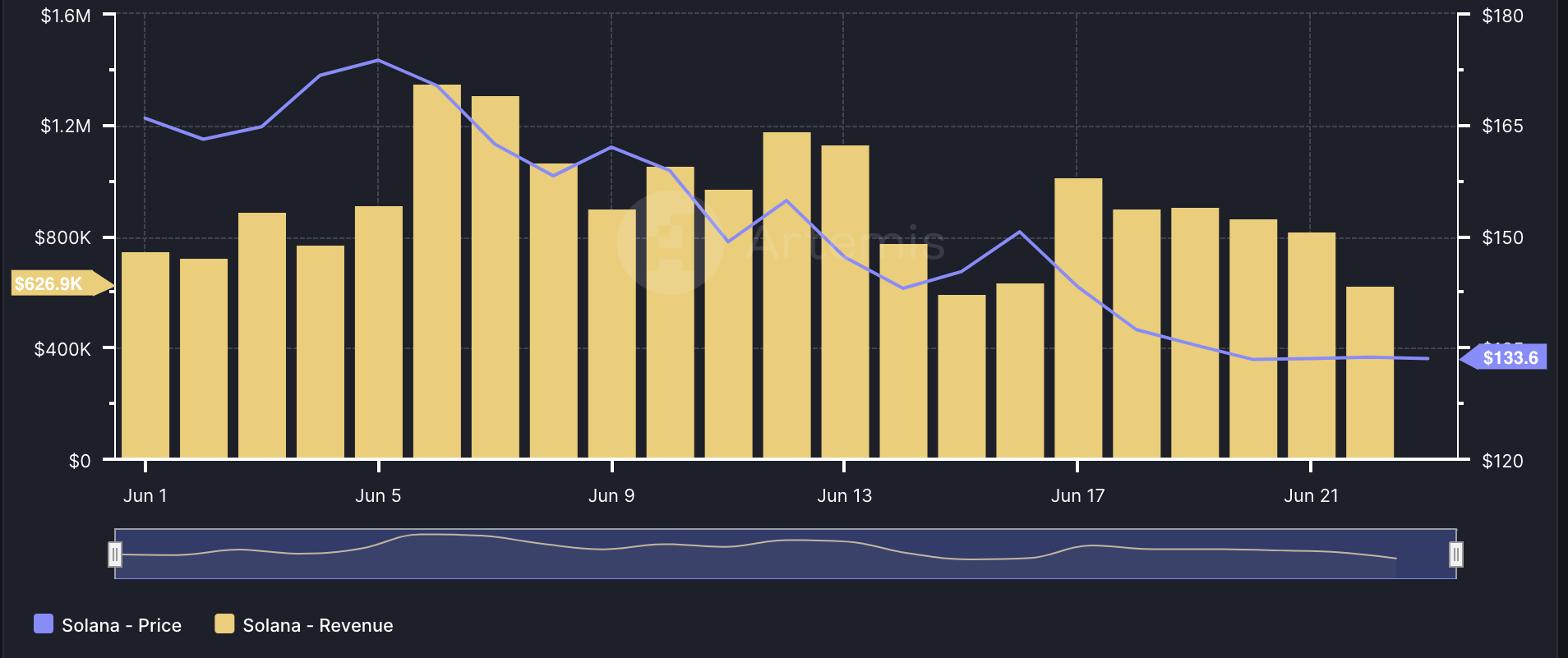

As a researcher with experience in blockchain technology and cryptocurrency analysis, I find Solana’s [SOL] recent revenue drop concerning. Despite the network experiencing low congestion, the project failed to generate significant revenue, which was only $626,900 on June 23rd.

On the 23rd of June, the Solana [SOL] blockchain experienced a significant decrease in earnings, with revenues reaching their lowest point over the past week, amounting to approximately $626,900.

“The value signified the economic significance of Solana. Recently, a Solana upgrade led to a notable drop in earnings.”

On the 10th of June, AMBCrypto reported how the project asked validators to upgrade to a new node.

The goal of the development was to address the long-standing issue of traffic jams on the blockchain.

After this, the fees on Solana remained reasonable instead of being excessively high. The network continued to process between 2,000 and 3,000 transactions per second (TPS).

Success is not final for Solana

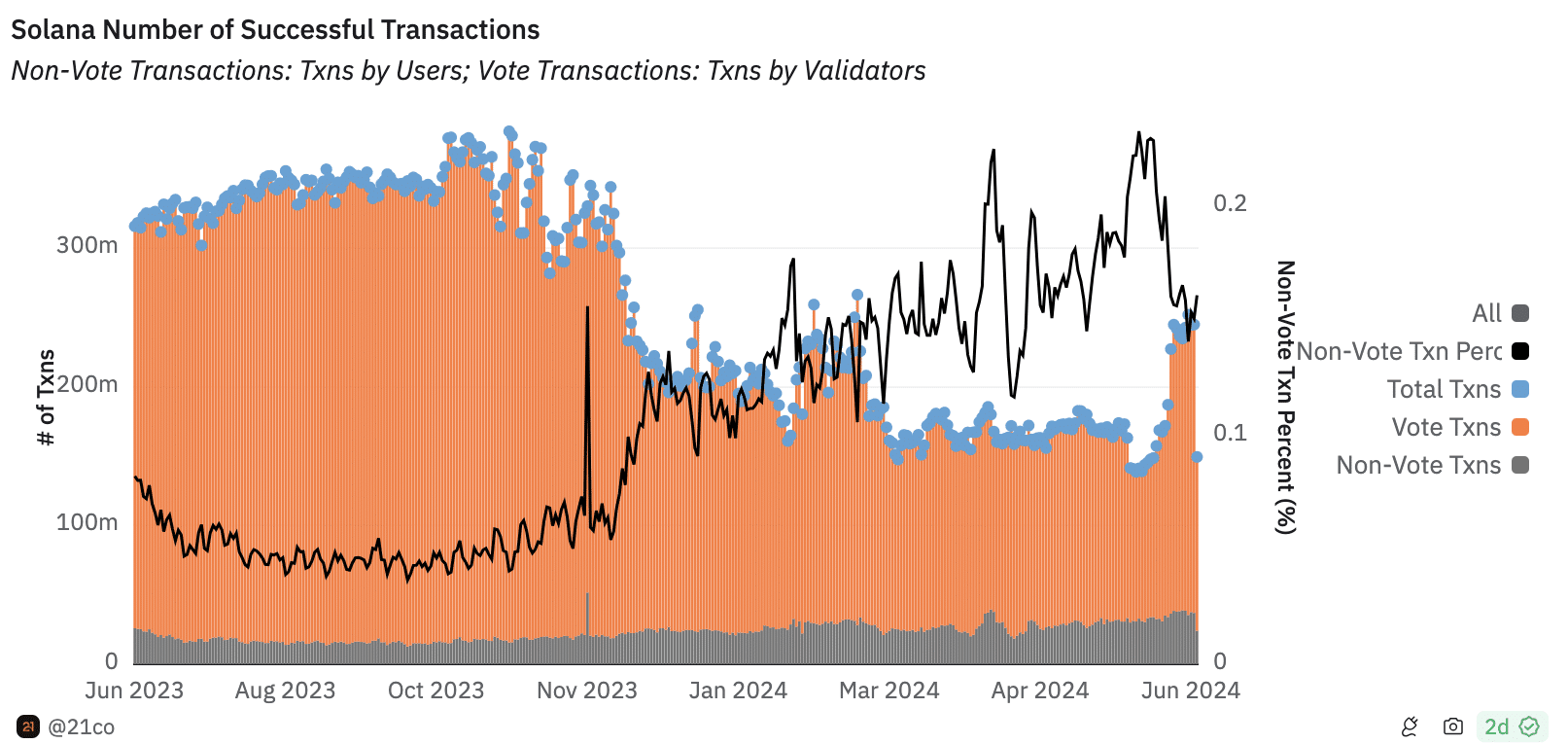

As a researcher examining the data from Dune’s platform, I found that a substantial number of transactions occurred – specifically, there were approximately 206.94 million vote transactions. In contrast, the non-vote transactions amounted to around 37.57 million.

In simpler terms, a non-vote transaction refers to the exchange of Solana’s cryptocurrency (SOL) between different accounts or smart contracts within the Solana network. On the other hand, a vote transaction denotes the submission of a transaction by validators as part of the blockchain consensus process.

As a researcher examining transaction data, I discovered that a larger number of transactions were successful during this timeframe, suggesting that the majority of transactions were processed rather than the previous period where approximately 75% of non-voted transactions failed.

As an analyst, I would note that this recent development could potentially influence my assessment of Solana’s (SOL) price trend. At present, the token is trading at approximately $133.71. On the 22nd of June, SOL made an attempt to surge past the $140 mark. However, bearish forces managed to thwart this advance.

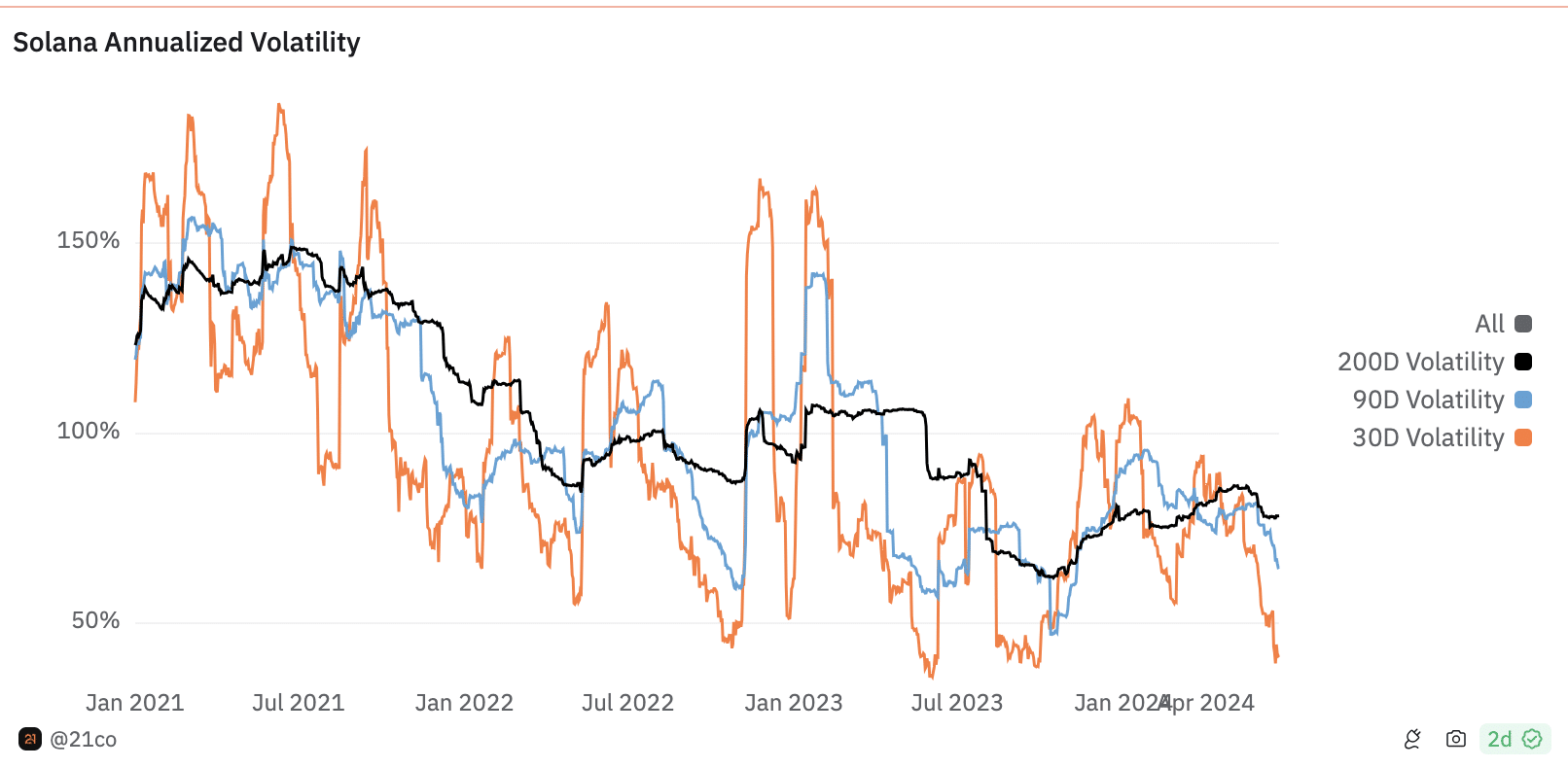

The token might find it difficult to reach a higher price level in the near future due to its high annualized volatility.

SOL to continue sideways movement

As a researcher studying financial markets, I would describe volatility as the measure of how rapidly the price of an asset changes in value. When volatility is elevated, it indicates that significant price swings can occur in a relatively brief timeframe, potentially reaching extreme heights.

Despite a low volatility rate, Solana’s numbers suggest otherwise. Its annualized volatility over the past year stood at 77.80%, while the last 90 days saw a decrease to 66.30%.

Based on the latest data from Dune, I’ve observed that my SOL investment has dipped by approximately 39.60%. This reduction indicates that Solana could potentially continue trading within a narrow band in the upcoming days.

If the current condition continues, the price of the cryptocurrency is expected to fluctuate between approximately $130 and $140.

As an analyst, I’ve observed that the Relative Strength Index (RSI), which is a common momentum indicator, signaled a bearish trend in the cryptocurrency’s price movements. The RSI calculates the size and speed of price changes to determine the strength and direction of momentum.

In simpler terms, a reading greater than 70 on the Relative Strength Index (RSI) for the SOL/USD pair implies the asset is overbought, while a reading below 30 suggests it’s oversold. At the current moment, the RSI for this chart stands at 45.00.

Read Solana’s [SOL] Price Prediction 2024-2025

The downtrend of the indicator revealed that the momentum was bearish.

The price of SOL may decrease in the near future based on current trends. However, this prediction could change if the broader market experiences upward price movements.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-06-24 06:15