- Solana’s record active addresses signaled strong network growth, with transaction volumes surging alongside adoption.

- Whale accumulation and increased staking indicate long-term confidence, despite some short-term profit-taking.

As a seasoned analyst with over a decade of experience in observing and analyzing market trends, I find Solana’s current state intriguing. The record-breaking active addresses and surging transaction volumes are reminiscent of a well-oiled machine, hinting at strong network growth and adoption. However, the whale dance of accumulation and profit-taking adds an element of uncertainty to the equation.

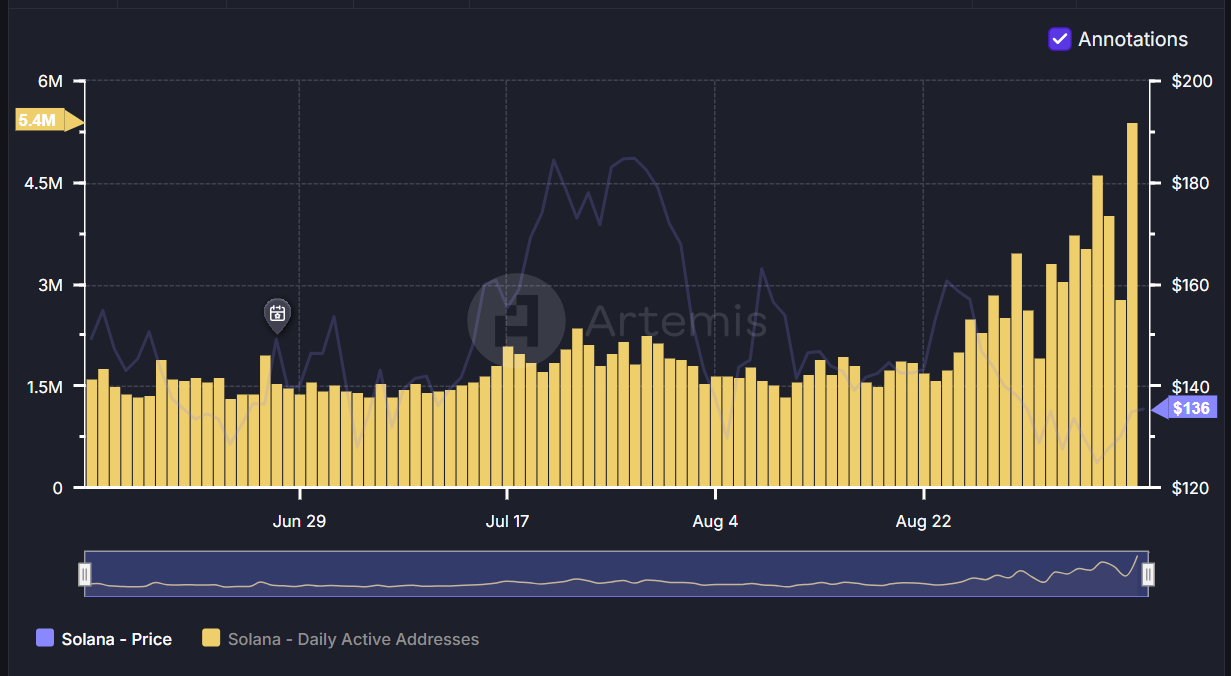

Just moments ago, Solana’s [SOL] daily active address count soared past 5.4 million, igniting discussions about an impending surge in the value of its native token due to this impressive milestone.

As a crypto investor, I’ve noticed an increase in network activity which has sparked curiosity about whether this on-chain expansion and underlying technical elements are hinting at a potential bull market.

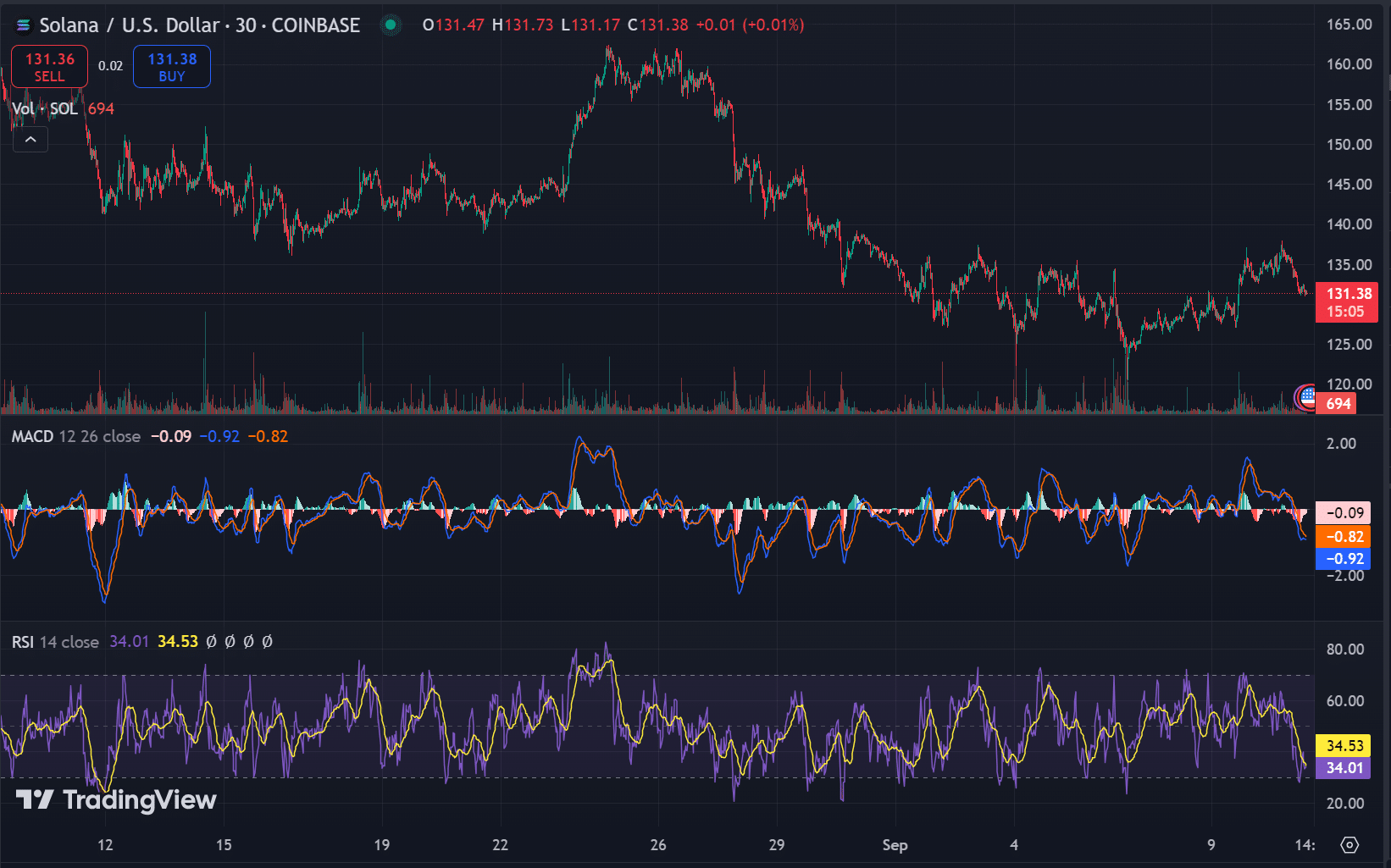

Currently, Solana (SOL) is being traded for approximately $131.36, representing a decrease of 2.63% in its value over the past 24 hours. With a market capitalization of around $61 billion, Solana ranks fifth among all cryptocurrencies when considering their total market value.

The amount of trades for this token has experienced substantial ups and downs, partly due to the large-scale transactions made by some prominent investors.

Although there’s a temporary negative outlook on Solana, the robustness of its network and the substantial increase in active users underscores its expanding influence within the blockchain industry.

Technical indicators signal breakout rally?

Technically speaking, the price of Solana hit a barrier at around $140. If it’s to increase significantly, this level might be important for buyers to overcome.

As a crypto investor, I’ve found solace in the resilient $125 support level. It’s been a reliable barrier, significantly lowering the immediate risk of any further drops.

At the moment of reporting, the 200-day moving average stood near $135, which is an important signal for longer-term market trends.

Currently, Solana’s Relative Strength Index (RSI) stands at 34.53, suggesting that the token is approaching oversold conditions. This typically signals a possible upcoming bounce-back.

The key to Solana’s on-chain surge

The number of daily active addresses on Solana has hit an all-time high of 5.4 million, indicating a rise in user engagement. This surge in users is typically associated with higher token demand, potentially leading to increased prices due to supply and demand dynamics.

To add on, there’s been a substantial rise in transactions on Solana, up by 41% over the last 24 hours. This surge suggests growing market attention and activity.

Nevertheless, although Solana has a significant number of active addresses and increasing transaction volumes, the presence of conflicting whale activities has sparked concerns.

At the current moment, certain whales were amassing and locking up their holdings, while others were cashing out, suggesting a brief period of ambiguity about future trends.

Is this a bullish sign for SOL?

A rise in the number of daily active addresses, coupled with a surge in transaction volumes and significant whale acquisitions, suggests a positive trend or bullish prediction for Solana.

Historically, when a cryptocurrency’s activity on the blockchain increases significantly (on-chain growth), it tends to be followed by price surges. Moreover, the RSI (Relative Strength Index) indicates that the market is currently oversold, suggesting there could be an impending upward trend.

Read Solana’s [SOL] Price Prediction 2024–2025

To keep rising in price, Solana must surpass the significant barrier at approximately $140.

As the level of staking increases and the network continues to thrive, it appears that Solana may experience a positive trend once significant technical thresholds are surpassed.

Read More

2024-09-12 09:12