-

STX surged by 15.68% over the past week.

An analyst eyed a 140% increase to $3.78.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless bull and bear runs, market manipulations, and trends that defy logic. However, when it comes to Stacks [STX], my bullish sentiment is hard to ignore.

Over the last month, I’ve noticed an attempt by the altcoin market to bounce back, with some notable progress. Interestingly, among all these coins, Stacks (STX) stands out as the most consistent performer during this recovery phase.

Currently, the stock price for STX stands at $1.61, representing a significant weekly growth of 15.68%, and an uptrend of 5.78% over the past month.

Even though it saw a significant increase, STX is still 58% lower than its all-time high (ATH) of $3.92 achieved on March 31st. Nevertheless, the recent price fluctuations have sparked renewed hope among analysts who are optimistic about the altcoin’s future prospects.

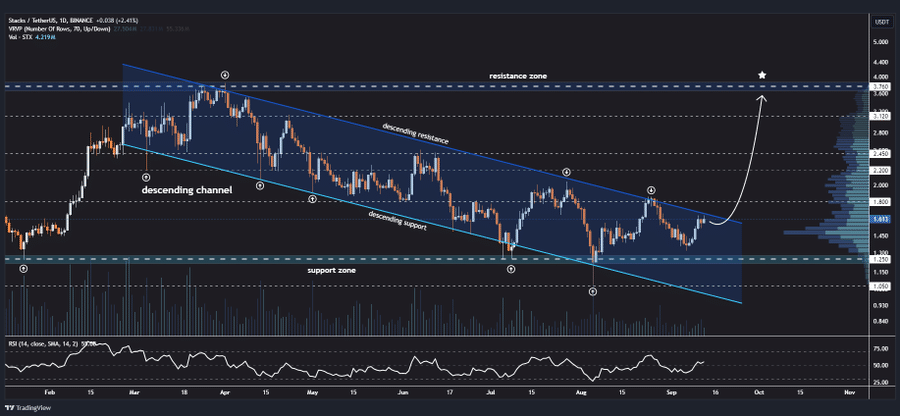

For instance, the Popular crypto analyst Johncy Crypto predicted a 140% increase for STX, citing breakout from the downward channel.

What prevailing market sentiment suggests

According to Johncy’s assessment, he pointed out a significant sign suggesting that Stacks was primed for a significant price surge.

As a crypto investor, I’ve noticed an exciting development with STX – it appears to have shattered its prolonged downward trend channel. This rupture suggests a possible turnaround in the trend, which could mean good things for my investment!

In this scenario, surpassing a prolonged negative trendline suggests that the downward trend is becoming less dominant, as the buying force started to grow stronger.

As a crypto investor, I’ve noticed a significant change in the market trend – we seem to be moving away from periods of bottomed-out lows and modest highs, and instead, are witnessing increased lows and higher highs. This transition signals the beginning of an uptrend, which is encouraging news for us investors!

Thus, STX could surge toward the $3.78 target, post a 140% increase.

What STX charts suggest

According to Stack’s Directional Movement Index, the positive momentum index surpassed the negative momentum index. Specifically, the positive index stood at 22, higher than the negative index which was 17.

This suggests that buyers are increasingly controlling the market dynamics, hinting at a potential rise in prices or an ongoing robust uptrend.

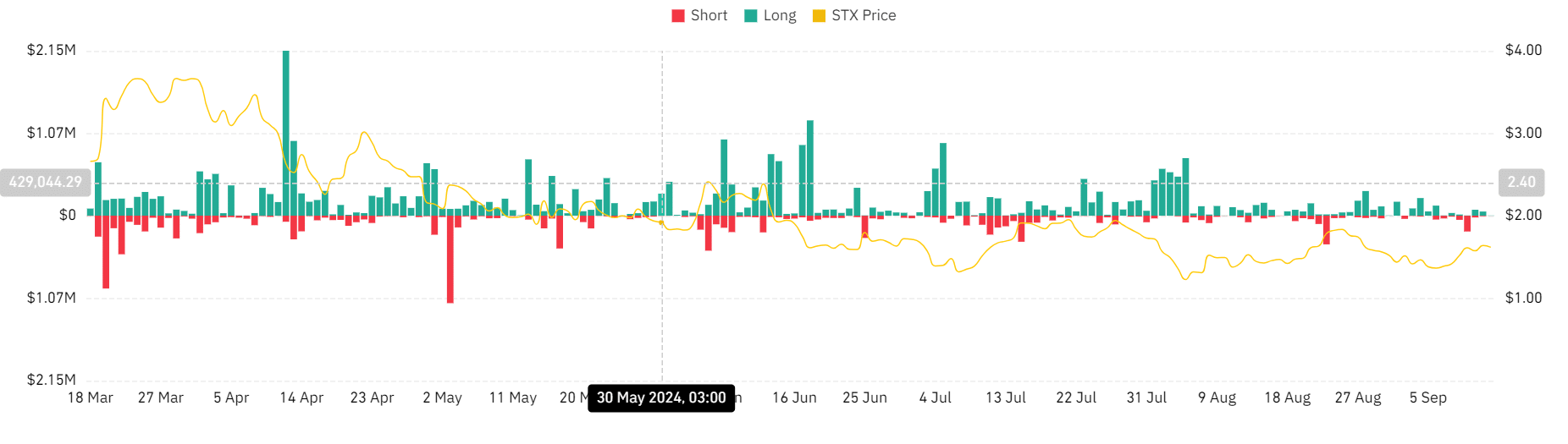

Over the past few weeks, I’ve noticed that the liquidation for my long positions in STX hasn’t gone beyond the half-million dollar mark – a level it last reached following the significant market downturn on the 5th of August.

It demonstrated that STX had gained favor with long-term investors, implying they were optimistic about its potential future in the altcoin market.

To conclude, the Open Interest in US Dollars for STX has been on an upward trajectory over the last week, rising from a bottom of $14 million to $19.6 million as we speak.

This implied that fresh opportunities for new roles were emerging, as investors remained invested in their current positions.

Read Stacks’ [STX] Price Prediction 2024–2025

Consequently, following Johncy’s observation, it seems that STX is poised for more growth. If the current bullish market atmosphere persists, Stacks might surpass the $1.8 resistance level.

A breakout from this level will strengthen the altcoin to attempt the $2.1 resistance level.

Read More

2024-09-13 20:08