- XLM traded at $0.4115 at press time, up 0.77% in 24 hours.

- The altcoin tested the 50% Fibonacci retracement at $0.3685.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I have witnessed the rollercoaster ride that digital assets can take. At press time, Stellar [XLM] is trading at $0.4115, up 0.77% in the past 24 hours, but it’s essential to delve deeper into the price action and market sentiment before making any investment decisions.

At the moment of this writing, Stellar [XLM] is being traded at approximately $0.4115, marking an increase of 0.77% over the past day. During this period, its lowest price was $0.364, while it peaked at $0.4384.

Over the last month, XLM experienced a significant surge of 279%, but it appears to have slowed down in more recent times. The trading volume remains substantial at approximately $1.37 billion, yet the price remains 55.79% lower than its all-time high ($0.9381) achieved in January 2018.

The ongoing small decrease in the value of Bitcoin (BTC) is causing stress on alternative cryptocurrencies such as Stellar, resulting in more significant adjustments or drops.

50% Fibonacci level is key

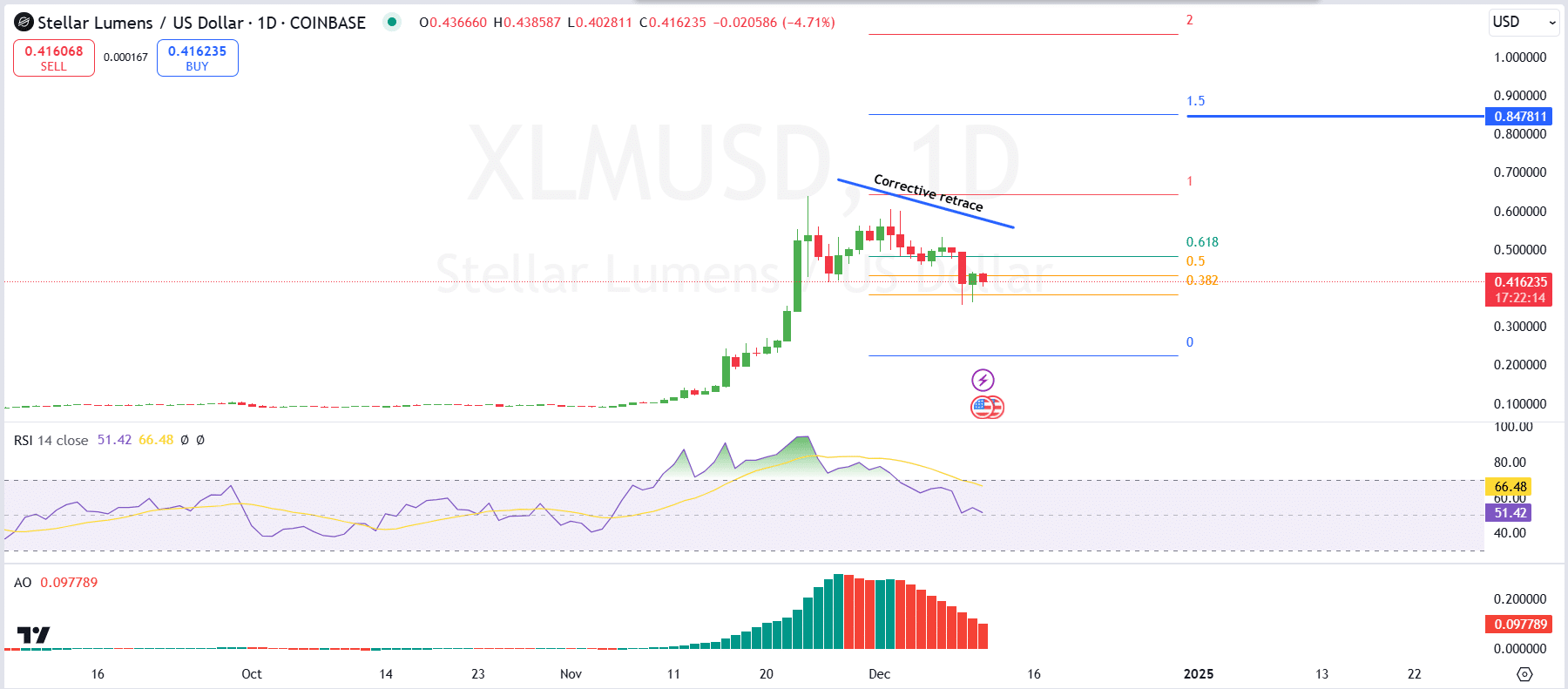

At the moment, the XLM/USD daily chart shows signs of a pullback following a robust upward trend, with the current price standing at approximately $0.4116.

As a crypto investor, I found myself at a crucial point when the price pullback neatly coincided with the 50% Fibonacci level around $0.3685. This significant figure had now transformed into a vital level of support for me, offering potential stability in my portfolio.

Should the cost sustain above its current point, this might indicate a turnaround and foster more upward movement. Conversely, beneath it lies the crucial support zone at $0.3030, which represents the 61.8% Fibonacci level during the recent correction.

If the price recovers from its current position, potential peaks lie at the previous high of $0.8478 and a level reached by extending the Fibonacci sequence to 1.0 at $1.1687.

If the price breaks through the $0.5 barrier, it will strengthen the optimistic outlook, making it more likely that the predicted targets will be reached.

If the price falls below the 61.8% Fibonacci level at $0.3851, it might lead to additional drops and change the market trend toward bearish.

In simpler terms, the indicators showed that the market was neither optimistic nor pessimistic, but rather in a balanced state. The Relative Strength Index (RSI) was reading 51.42, suggesting a lack of significant overbought or oversold conditions.

The Awesome Oscillator (AO) displayed a decrease in bullish momentum, as the size of the green bars became smaller, suggesting a lessening of upward force.

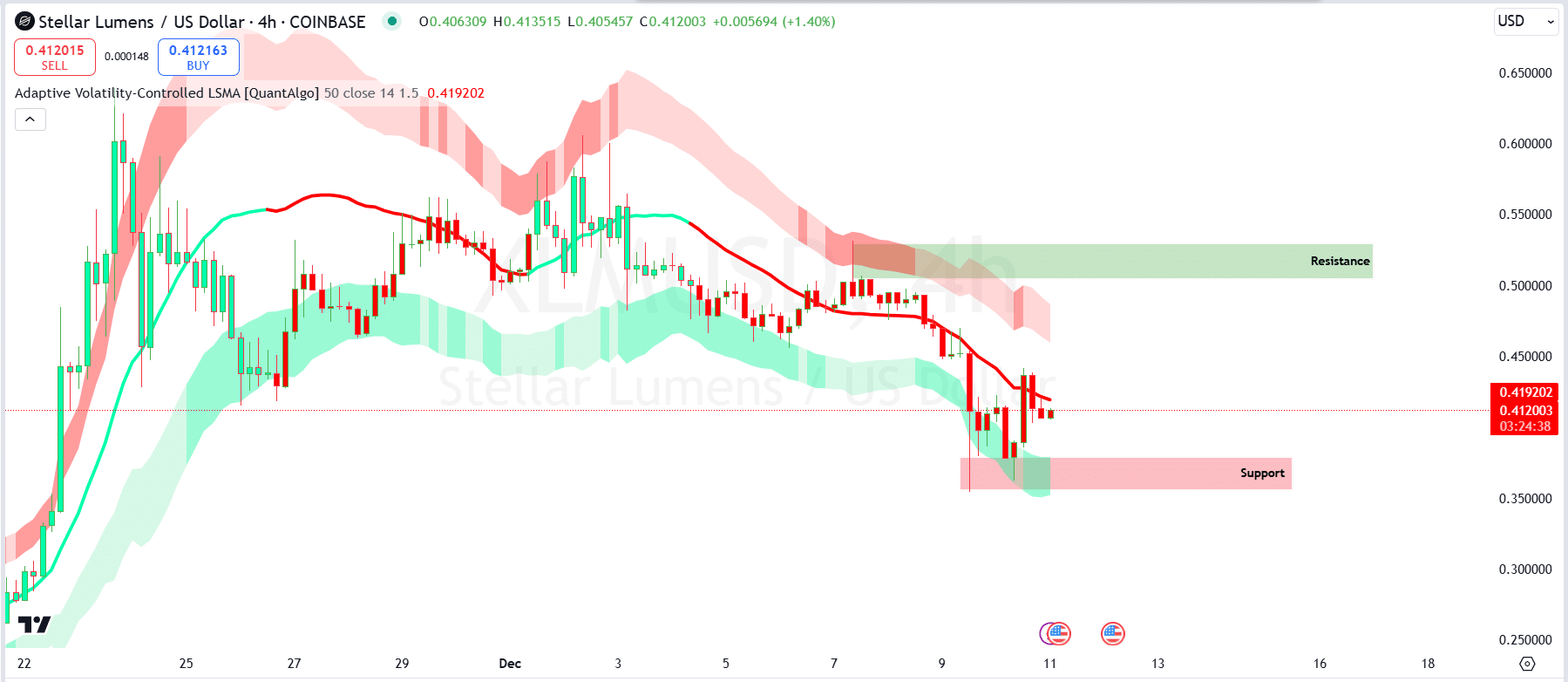

On the 4-hour chart, there was resistance near $0.4191 on the Adaptive Volatility-Controlled LSMA.

If you take a look at the price chart, it seems to be shaping like a double bottom near $0.3500, which is often seen as a bullish reversal pattern. This suggests that if buyers manage to take charge again, we could see an increase in the price trend due to potential upward momentum.

The bottom part of the volatility range could serve as extra backing, hinting at potential stability within this span.

If bullish momentum builds, the price could climb toward $0.5000, a key resistance level.

But if the price persistently rejects at approximately $0.4191 or falls beneath $0.4000, it could lead to a reevaluation of the $0.3500 resistance level as potential support.

Bulls and bears are balanced

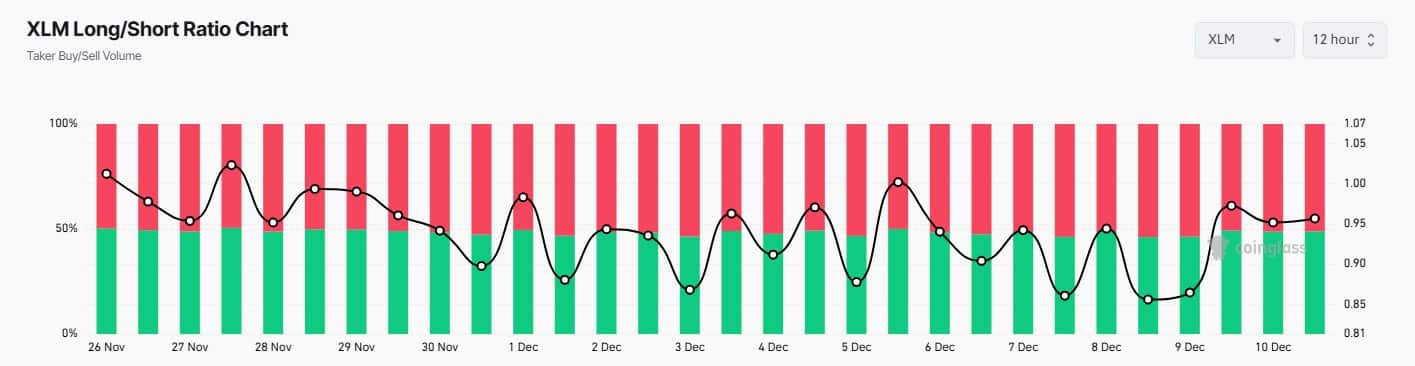

AMBCrypto examined XLM’s Long/Short Ratio, which is calculated every 12 hours, as a means of gauging investor sentiment. A ratio greater than 1 indicates a bullish outlook, suggesting that more traders are opening long positions, anticipating price growth.

In simpler terms, when the ratio is less than 1, it suggests a bearish outlook. This means that people are more likely to take short positions (betting that the price will fall) rather than long ones, as they anticipate a decrease in the price.

The data revealed a fluctuating trend, with sentiment shifting between bullish and bearish positions.

On the 9th and 10th of December, the ratio briefly climbed above 1, showing optimism among traders.

On the other hand, the most recent analysis shows the ratio is just shy of 1, suggesting a relatively balanced sentiment with a slight tilt towards pessimism.

This shift highlights the cautious approach of traders toward XLM’s short-term price movements.

XLM TVL surges in 2024

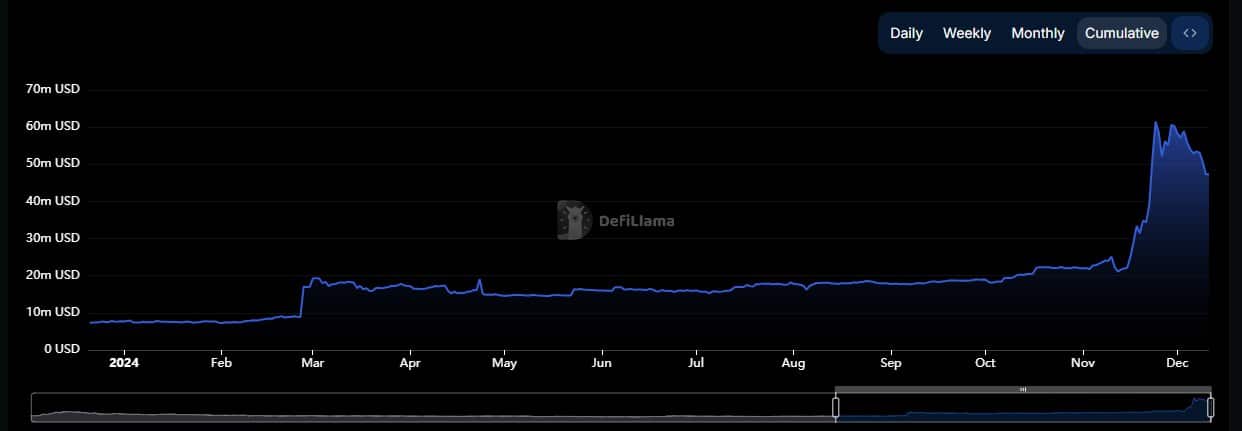

In the early part of 2024, the total value locked in XLM showed a consistent increase, followed by a dramatic surge in late October.

Throughout much of the year, TVL (Total Value Locked) hovered between $10 million and $20 million, indicating consistent network usage and liquidity levels. However, in November, there was a significant spike, with TVL approaching $70 million, suggesting an increase in network activity and a substantial influx of liquidity.

After the 25th of November, the TVL (Total Value Locked) experienced a significant decrease, falling back to around $55 million by December.

Read Stellar’s [XLM] Price Prediction 2024–2025

This decline likely stemmed from profit-taking and broader market corrections.

Despite the pullback, TVL levels remained significantly higher than earlier in the year, showcasing sustained investor interest and confidence in XLM’s network.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-12-11 15:36