- The SUI circulating supply is set to increase by over 2%.

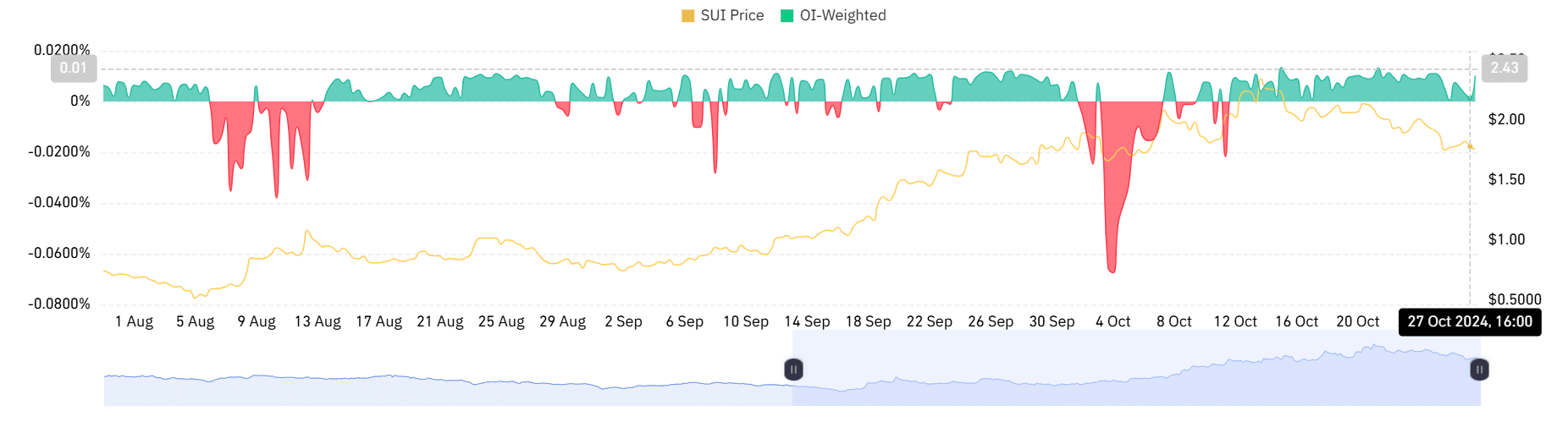

- The funding rate remains positive despite the upcoming unlock event.

As a seasoned analyst with over two decades of experience in navigating the volatile crypto market, I have seen more than my fair share of token unlock events. The upcoming SUI unlock event is no exception and presents an interesting challenge for investors.

This week, approximately 64.19 million SUI tokens, worth over $100 million, will be made available as part of a planned token release. This release constitutes around 2.32% of the total circulating supply of SUI, leading to discussions about how this event might influence the token’s price.

Currently holding a market value around $4.6 billion with a circulation of about 2.76 billion units, it finds itself at a pivotal moment, gearing up to deal with the consequences of the upcoming launch.

Unlock could increase selling pressure on SUI

With the release of 64.19 million SUI tokens into the market, there could be an increase in the urge to sell, due to this situation often occurring during token unlocks. These events typically allow early investors and team members to have access to assets that were previously unavailable.

If a significant portion of these tokens (representing more than 2% of the total supply) are put up for sale in the open market, it might lead to an increase in supply and potentially cause the price of SUI to decrease, as some holders may choose to dispose of their tokens.

At the moment of reporting, SuI was hovering near $1.69, suggesting it may be losing some strength compared to its recent peaks. This is backed up by the Relative Strength Index (RSI), which currently stands at 41.96, signaling a tilt towards bearish feelings among traders.

If the pace of sales increases significantly, it might intensify the feeling, potentially causing SUI’s price to approach its support thresholds.

Key SUI support levels to monitor

If the market experiences a sudden drop following an unlock event, SUI’s price might approach crucial lower bounds or support areas. One key support level is currently located around $1.69, represented by the 50-day moving average.

If broken, it may result in a continued drop towards the $1.50 level, where potential buyers’ interest could increase significantly.

Previous instances of similar events show that market turbulence may intensify, as traders often respond dramatically when there’s a sudden surge in supply.

If it doesn’t hold its existing price range, it might face temporary difficulties in bouncing back. On the flip side, if it manages to stay above its 50-day moving average, this could stimulate investors to rejoin the market.

Long-term holders may find opportunity despite short-term volatility

Even though the token unlock could potentially cause short-term problems, those who have held onto their tokens for an extended period might consider it as a brief interruption instead of a lasting obstacle in their long-term strategy.

Based on information from Coinglass, the funding rate continues to be favorable. This indicates that there are more individuals looking to buy rather than sell within the market, leading to a higher number of long positions being held.

Essentially, the end result of the token release hinges on the actions taken by the holders. If the market bounces back swiftly after the release, it might indicate that SUI successfully managed the additional supply, thereby maintaining its market standing.

As an analyst, I must acknowledge that should a substantial wave of sell-offs occur, the price of SUI could potentially encounter temporary hurdles in the near term. These tests would scrutinize not only the asset’s inherent strength but also the resolve of its investor community.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- LUNC PREDICTION. LUNC cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-28 19:04