-

BTC losses compounded negative sentiment on crypto bull run prospects

Despite the drawdown, analysts suggested that the market hasn’t topped.

As a researcher with experience in cryptocurrency market analysis, I have observed the recent downturn in Bitcoin’s price and the accompanying negative sentiment. The losses on Monday, June 25th, compounded by the outflows from US spot BTC ETFs, have raised questions about the prospects of the crypto bull run.

On Monday, 25th June, Bitcoin [BTC] experienced further declines, reaching a low of $58,600 during intraday trading due to pessimistic market feelings.

The risk reduction was similarly noticeable among US BTC spot ETFs, with a total withdrawal of $174.45 million recorded on Monday.

As a researcher studying the Bitcoin market, I’ve noticed that the pessimistic outlook towards the cryptocurrency has intensified due to several looming issues. The ongoing uncertainty surrounding the release of Bitcoins from Mt. Gox, German authorities’ potential actions, and the increasing supply from miners have all contributed to this negative sentiment.

On Monday, approximately 57,000 Bitcoins, equivalent to around $3.4 billion, were sold off. This significant sell-off raises the concern: Has the crypto bull market come to an end?

Is the crypto bull run over?

As the market leader, BTC’s movement gauges the pace and state of the crypto bull run.

From my analysis, I’ve observed some intriguing trends when examining the historical RSI data. The Relative Strength Index (RSI), which measures the buying and selling pressure within a financial instrument, indicated potential for further bullish momentum based on past evaluations.

As a market analyst, I’ve been closely monitoring the behavior of the Relative Strength Index (RSI) channel on the platform previously known as Twitter, now referred to as X. Up until this point, this indicator has proven to be quite accurate in signaling both market tops and bottoms. However, at present, it hasn’t yet issued a top alert.

Based on the chart’s analysis, the RSI channel’s retracement indicated the market’s bottom, and the market reaching the upper range signified its peak.

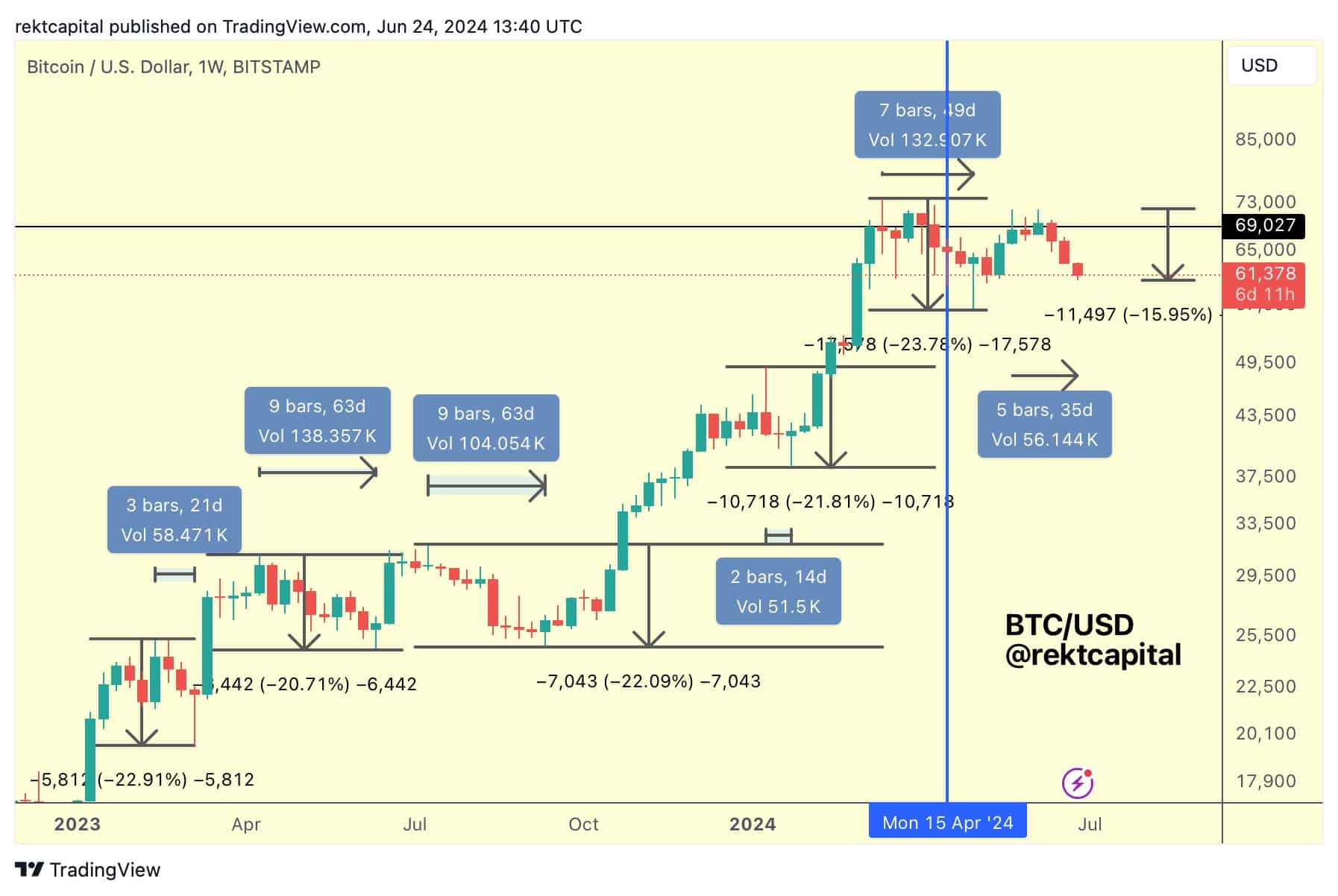

As a crypto investor closely monitoring the price action, I’ve observed Rekt Capital’s analysis of the current Bitcoin market cycle. Contrary to some concerns about recent price dips being the start of a new bear market, Rekt emphasized that these fluctuations are normal and expected in any long-term bull run.

“The typical correction in the market is a 22% decline that lasts for approximately 42 days. The ongoing pullback, however, measures only a 16% decrease and spans 35 days, making it shorter both in duration and less severe in magnitude compared to an average correction.”

Another on-chain data point also suggested the crypto bull run wasn’t over yet.

The MVRV Z score, which measures the difference between Bitcoin’s market value and realized value from a long-term perspective and can help identify market tops and bottoms, has not yet signaled an impending top.

As a researcher studying market trends, I often observe that once a particular metric surpasses the threshold of 6 (denoted by the red line), or when it encounters strong resistance in its upward trend, the market top typically emerges.

As a crypto investor, I’ve noticed some short-term challenges for Bitcoin (BTC). The ongoing supply overhang from exchanges like Mt. Gox could create headwinds, potentially delaying a strong uptrend in the near term. However, based on my analysis of the market trends and long-term projections, I believe there’s still plenty of room for the crypto bull run to continue its extension.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-25 17:12