- Toncoin has a strongly bearish short-term bias.

- Traders need to wait for a deviation beneath the range lows before looking to go long.

As a seasoned analyst with years of experience in the crypto market, I find myself cautiously bearish on Toncoin (TON) at the moment. The recent arrest of Pavel Durov and the network downtime have undoubtedly shaken user confidence, which could lead to further price erosion.

Last week, Toncoin (TON) endured a challenging period. The creator of Telegram, Pavel Durov, was detained in France and could potentially serve a decade in prison. Such developments significantly dampened the spirits surrounding the cryptocurrency tied to Telegram.

1. Additionally, the system experienced over seven hours of outage, causing user trust to wane even further. Yet, as the system was restored, the intensity of the issue gradually lessened over time.

Has TON formed another range?

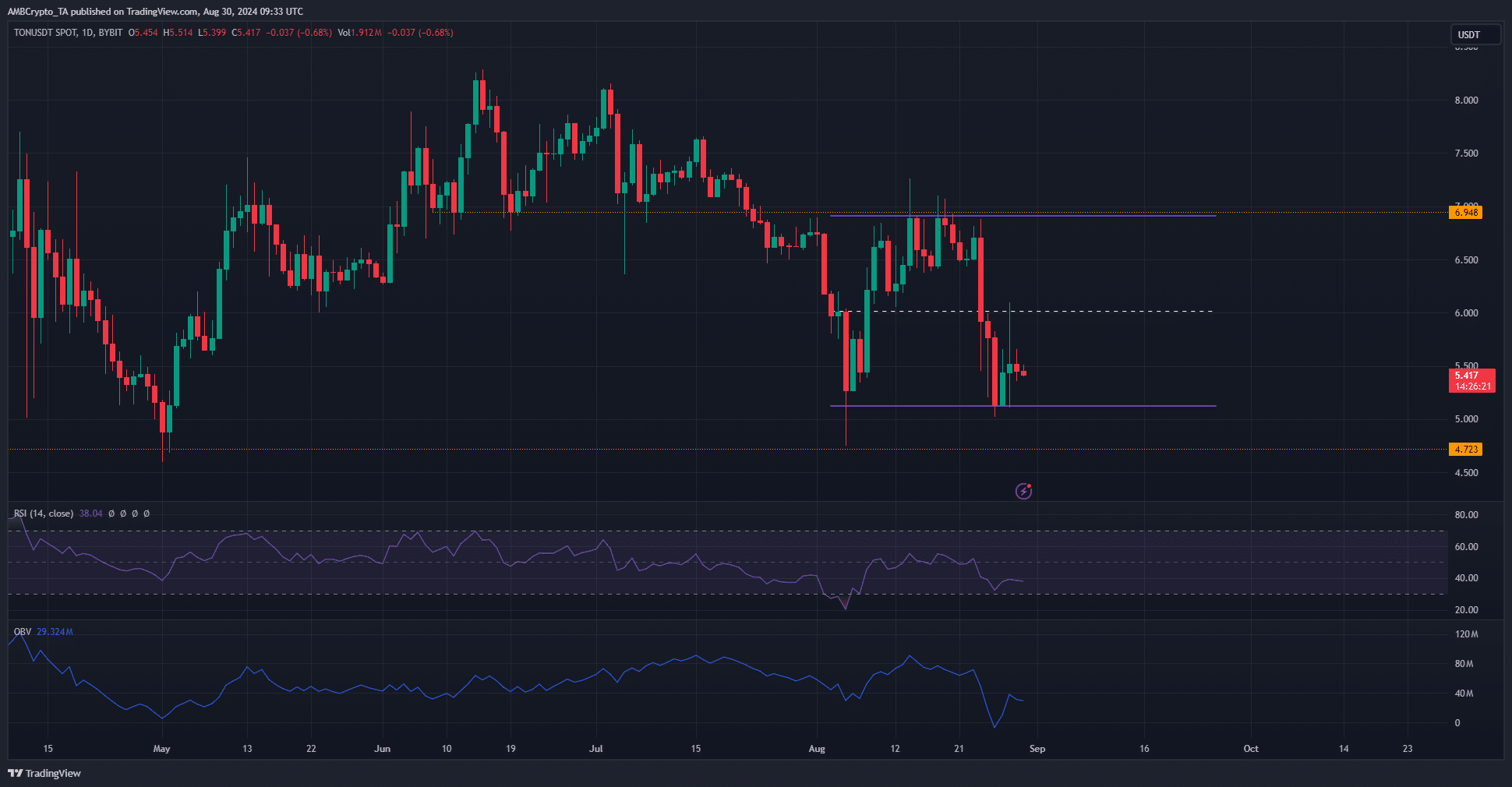

Between June and July, the price of Toncoin fluctuated within a range that reached its lowest point at approximately $6.94. Later in July, strong selling pressure caused the price to drop down to around $4.75, making the previous $6.94 level a significant barrier for any potential upward movement, or resistance.

Based on the price movements over the last month, it seems plausible that we’re looking at a range formation. Over the past week, the mid-range level has functioned as a barrier for further price increases, suggesting a potential resistance. It appears likely that there could be another price drop towards the nearby $5.13 lows.

In simpler terms, the Relative Strength Index (RSI) suggested a downward trend, while the On-Balance Volume (OBV) indicated increased selling activity. This suggests that the odds of a quick Toncoin recovery are not high, and a potential drop to $5 could occur.

Should traders short the token right now?

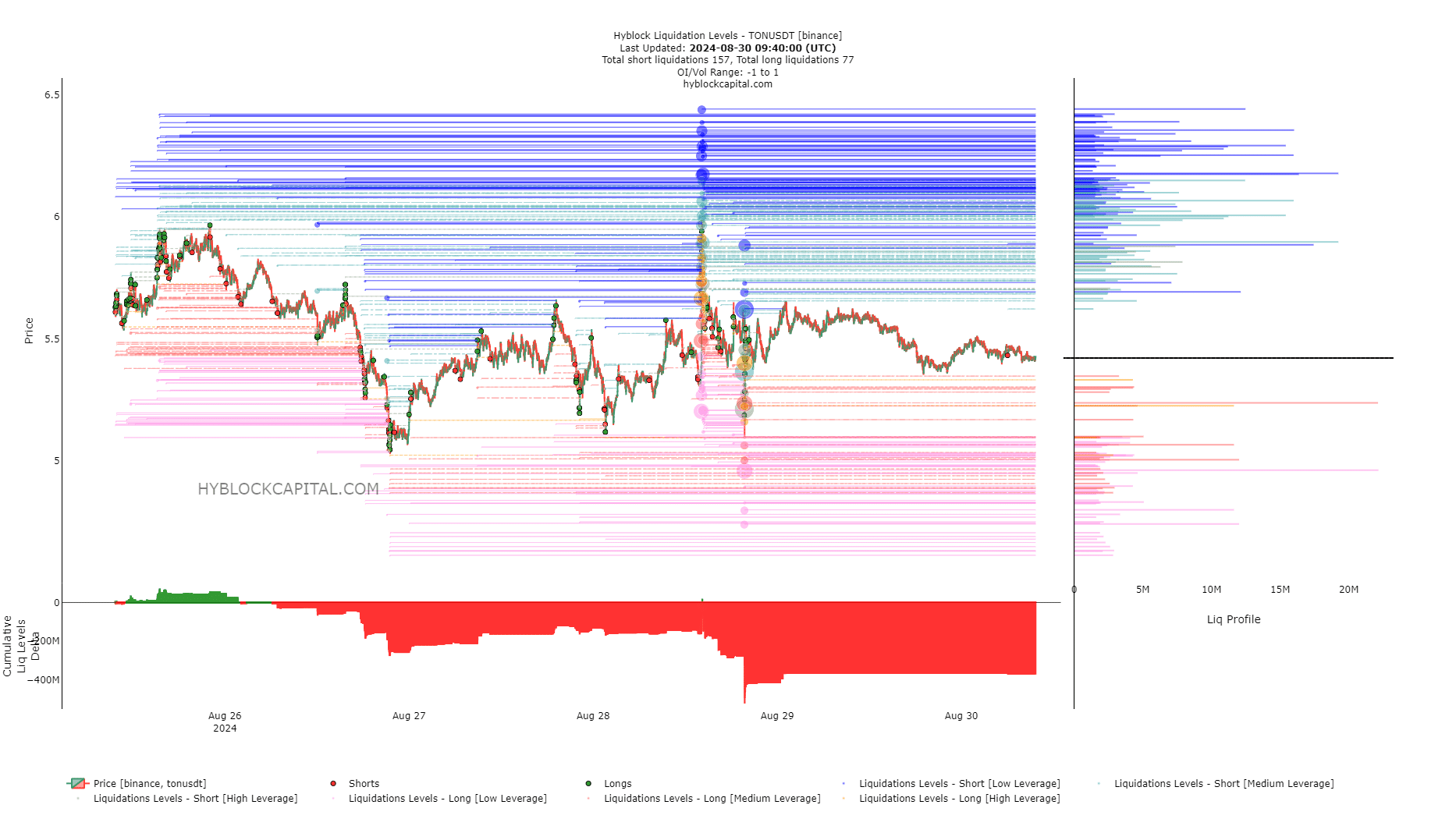

According to AMBCrypto’s analysis, the overall difference between liquidation levels (liq levels delta) has been slightly negative, indicating that there have been more short positions compared to long ones over the past few days, but this gap is not extremely significant.

A short squeeze is possible but unlikely over the next 24–48 hours.

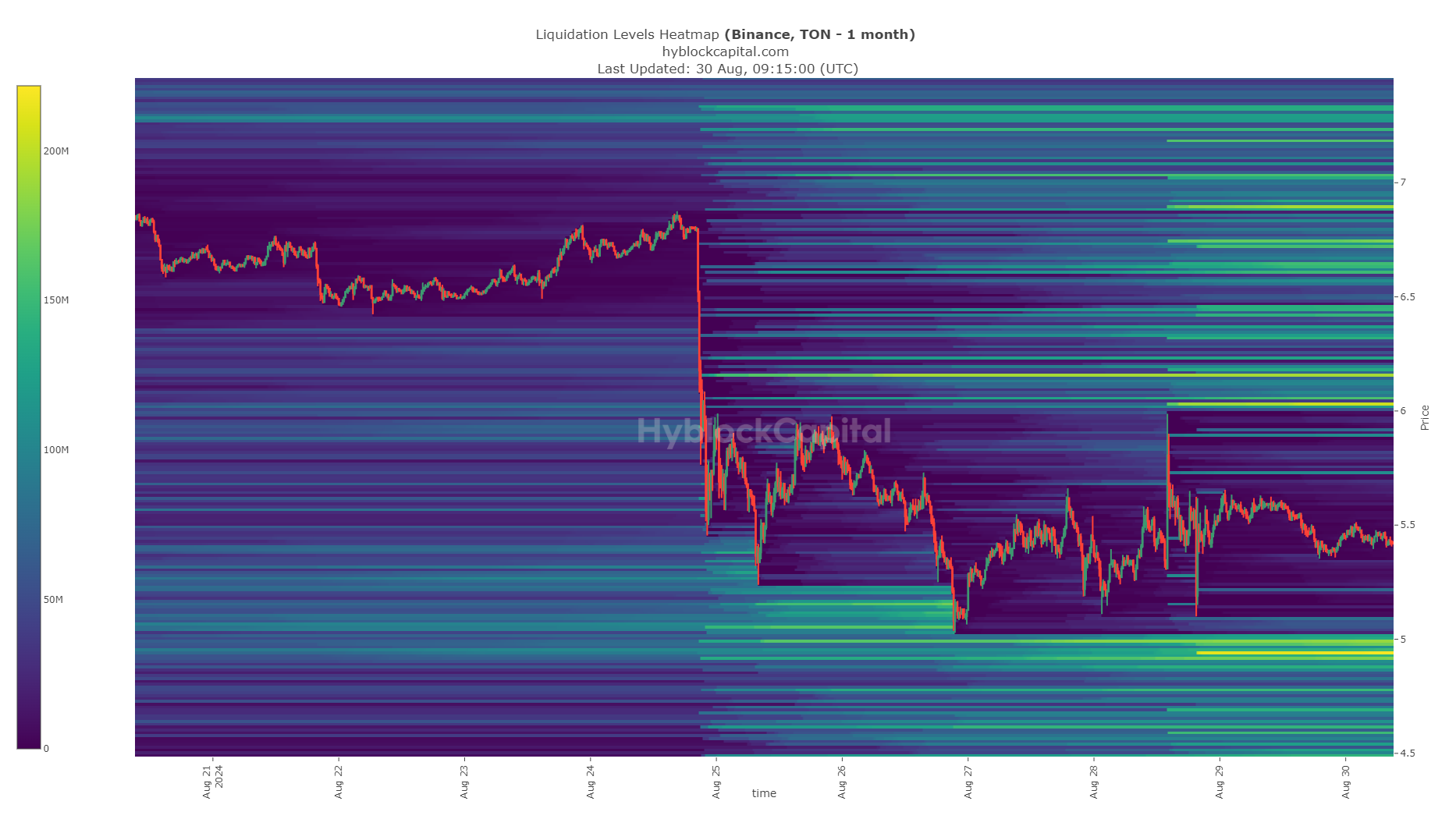

Although the daily graph indicates that the $5.13 area serves as a support for TON, there’s a possibility that the concentrated liquidity pools might pull it downward. The $4.92 to $5 range appears to be heavily packed with long liquidation orders.

If the cost reaches this point, it’s more probable that a recovery will occur. However, during this time, traders need to stay cautious and watch out for brief price rebounds that might aim at draining liquidity.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-31 00:07