-

TON registered its highest number of active addresses

TON’s MVRV, at press time, was well below zero, underlining losses for some holders

As a seasoned crypto investor with a knack for navigating the volatile market, I find myself intrigued by the recent developments surrounding Toncoin (TON). The spike in active addresses, surpassing even those of Bitcoin and Ethereum, is undeniably a remarkable feat that warrants closer scrutiny. However, the bearish trend in TON’s price action leaves me with a mix of curiosity and caution.

As an analyst, I’ve observed a substantial surge in crucial indicators for Toncoin (TON), primarily driven by events revolving around Telegram’s creator. One such indicator that experienced a notable uptick is the count of active addresses on the Toncoin network.

As we speak, data shows a consistent high level of active addresses. However, it’s important to note that the general trend for Toncoin (TON) remains downward, suggesting a bearish market.

A historical number of active addresses

On August 26th, as per CryptoRank’s data, Toncoin (TON) experienced a substantial increase in active user accounts. This surge in usage was so dramatic that it exceeded the number of active accounts on both Bitcoin and Ethereum for that day. The cause of this spike seems to be linked to the arrest of Telegram’s founder, which created panic and stimulated heightened market activity among Toncoin users.

On August 26th, a significant surge in network activity on Toncoin was validated by further examination of data from IntoTheBlock. This increase showed that the number of active addresses surpassed 440,000, indicating sustained interest and usage. Remarkably, this elevated activity did not decline swiftly but rather continued to rise steadily thereafter.

By the 29th of August, the number of active Toncoin addresses exceeded 600,000, setting a new record for the most active addresses ever recorded in Toncoin’s history.

Furthermore, as per CryptoRank’s data, daily active addresses on the network exceeded 3 million, a figure that outpaced Ethereum’s, with only Bitcoin recording a higher number of around 3.7 million.

TON’s price struggles continue

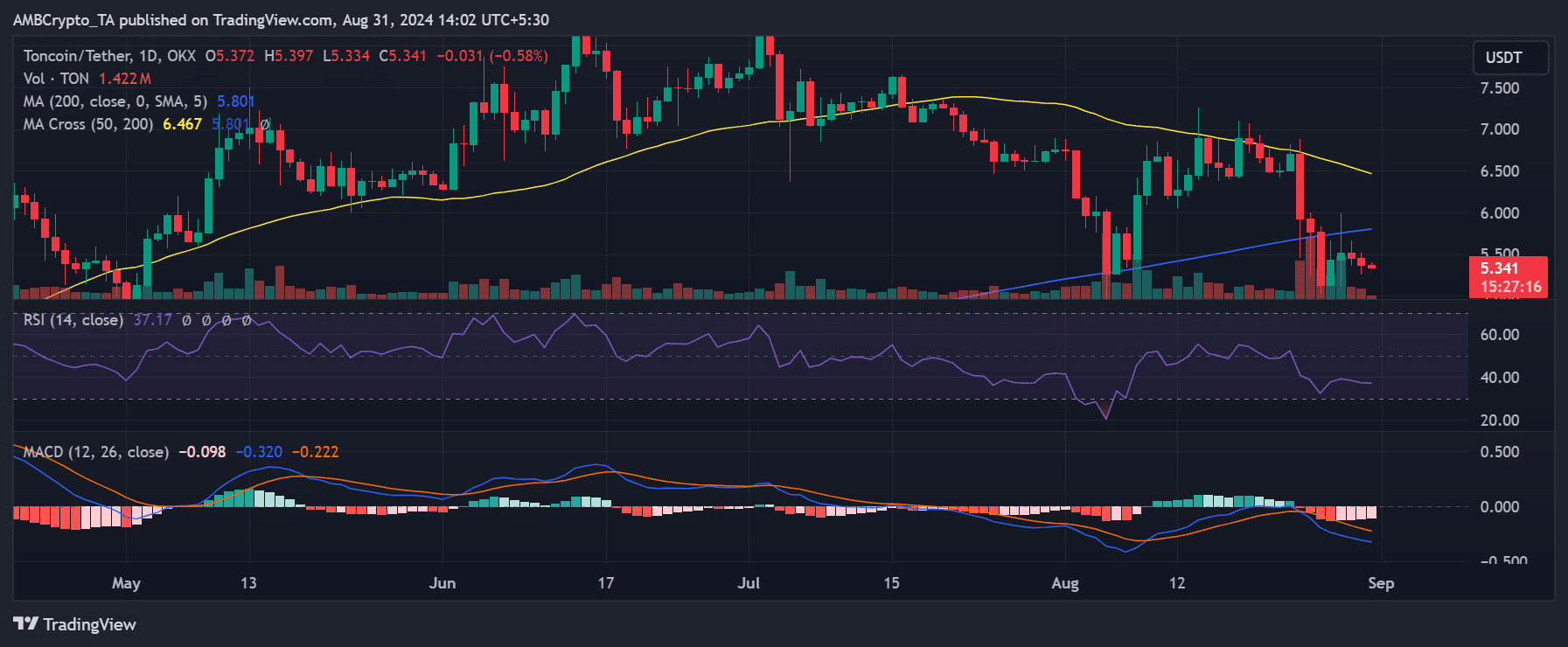

As a researcher, I’ve been closely examining Toncoin’s (TON) price movements recently, and it appears that the cryptocurrency has had a tough time bouncing back from its previous drops. Even though there were brief spikes on the 27th and 28th of August, TON hasn’t managed to maintain this positive momentum. Consequently, we’ve seen a series of downturns in subsequent trading periods.

According to AMBCrypto’s analysis, Toncoin concluded its previous trading period with a drop exceeding 1%, and this downward trend continues as we speak.

In simpler terms, the Toncoin’s Relative Strength Index (RSI) was approximately 40, suggesting that the cryptocurrency is currently in a downtrend or bear market phase.

In this case, it’s important to point out that the current price level could be a good chance for certain traders to buy. This is because Toncoin has historically shown significant support near the $6 value.

Toncoin holders go underwater

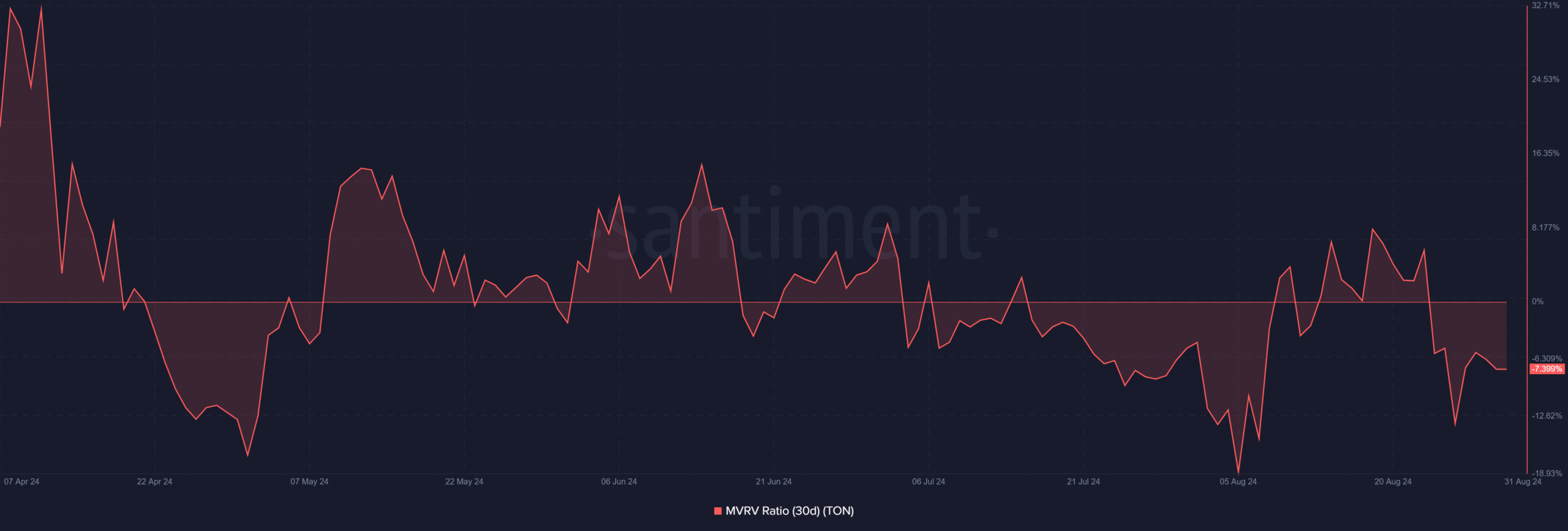

Examining the 30-day Market Value to Realized Value (MVRV) ratio of Toncoin provides insights into the present situation of its holders. Currently, this ratio stands at approximately -7.3%. This negative value suggests that the current market price is lower than the average price at which Toncoin was purchased by its holders, meaning they are currently underwater.

This suggested that they have been holding at a loss, relative to their purchase prices.

Previously this month, Toncoin’s MVRV moved above zero, enabling its owners to reap profits following a lengthy spell where it was negative. Lately, though, this ratio has dipped back below zero – an indicator suggesting that the asset might currently be underpriced.

– Realistic or not, here’s TON market cap in BTC’s terms

A low MVRV (Mayer Multiple Valuation Ratio) often signals that an asset might be underpriced, since its market value falls short of its realized value. This suggests that numerous investors are experiencing losses.

In many cases, this scenario can signal a good chance to buy, since it might indicate an upcoming rise in price.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-01 08:08