- Tron has been bullish over the past week.

- The range formation idea could see the token rejected near $0.14.

As a seasoned crypto investor with a knack for spotting trends, I find myself intrigued by Tron’s [TRX] recent performance. While Bitcoin [BTC] and most altcoins have been on a downturn since August 8th, TRX has bucked the trend, showing a 6% increase in value.

As a crypto investor, I found that the price movement of Tron (TRX) stood out distinctly amongst the significant altcoins following the 8th of August. Contrary to Bitcoin [BTC] and other digital assets in the market, which started to incur losses around the same period, Tron displayed a different trend.

BTC has shed 5.1% since that day, but TRX was up by 6%.

1. It’s worth noting that Tron’s network transactions outpaced those on the Ethereum network. A potential cause could be the increasing use of Tether (USDT) for payments within the Tron network.

Is it an uptrend of a range?

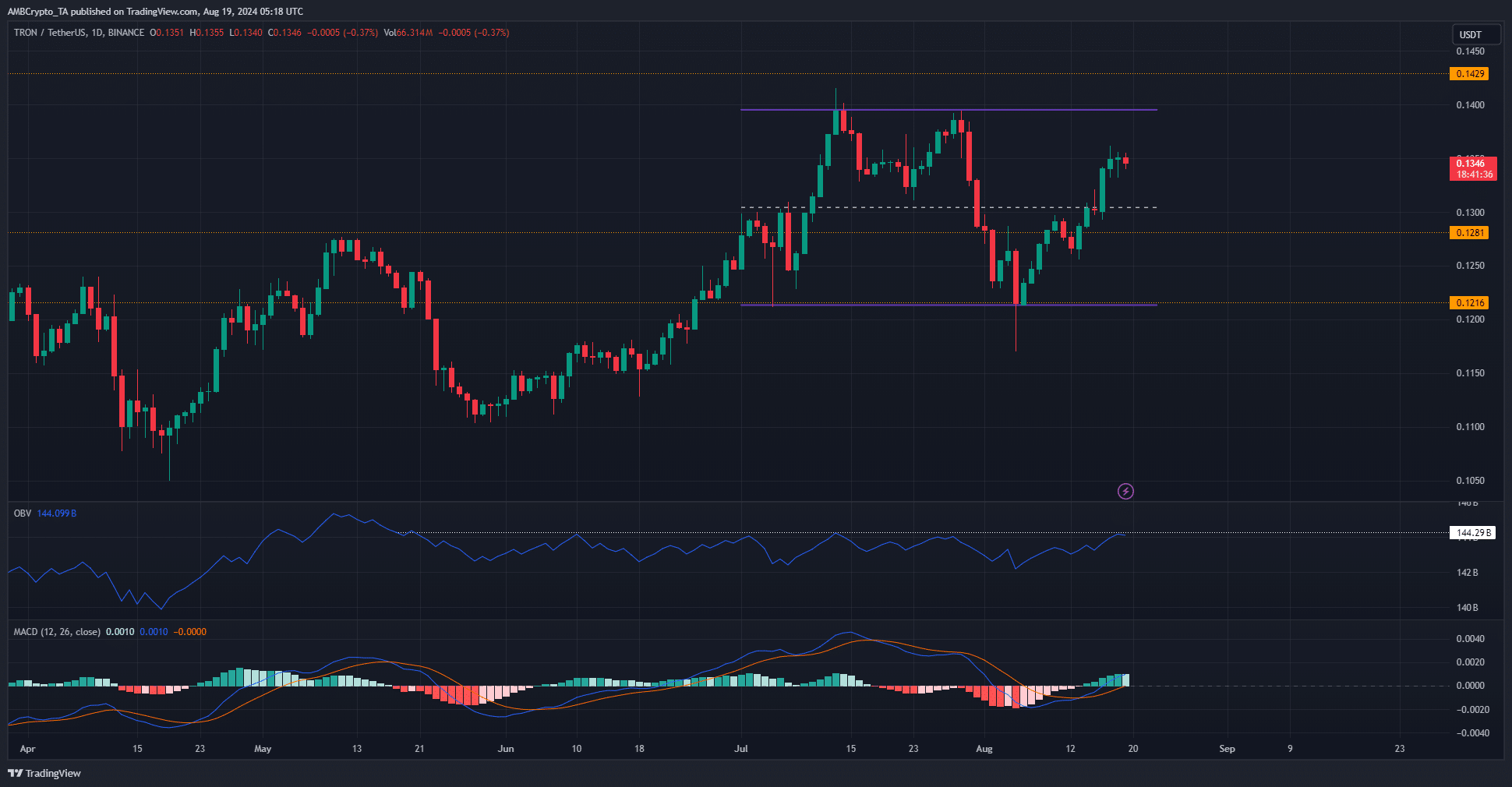

Following the dip down to $0.108 in mid-April, I’ve noticed that TRX has been gradually climbing higher. It put together a string of successive higher peaks and higher troughs right up until mid-July, but since then it seems to have settled into a range formation.

On a daily scale, the market’s structure appeared bullish, yet it could be more profitable for traders to anticipate a refusal at the upper limits of the range rather than pursuing a breakout trade.

This was because the OBV was at a resistance level that stretched back to mid-May.

In simpler terms, the MACD (Moving Average Convergence Divergence) indicator suggested a strong upward trend, and the middle price point of $0.13 shifted from being resistance to providing support. Swing traders might consider purchasing at this level, as they expect the price to potentially rise towards $0.14.

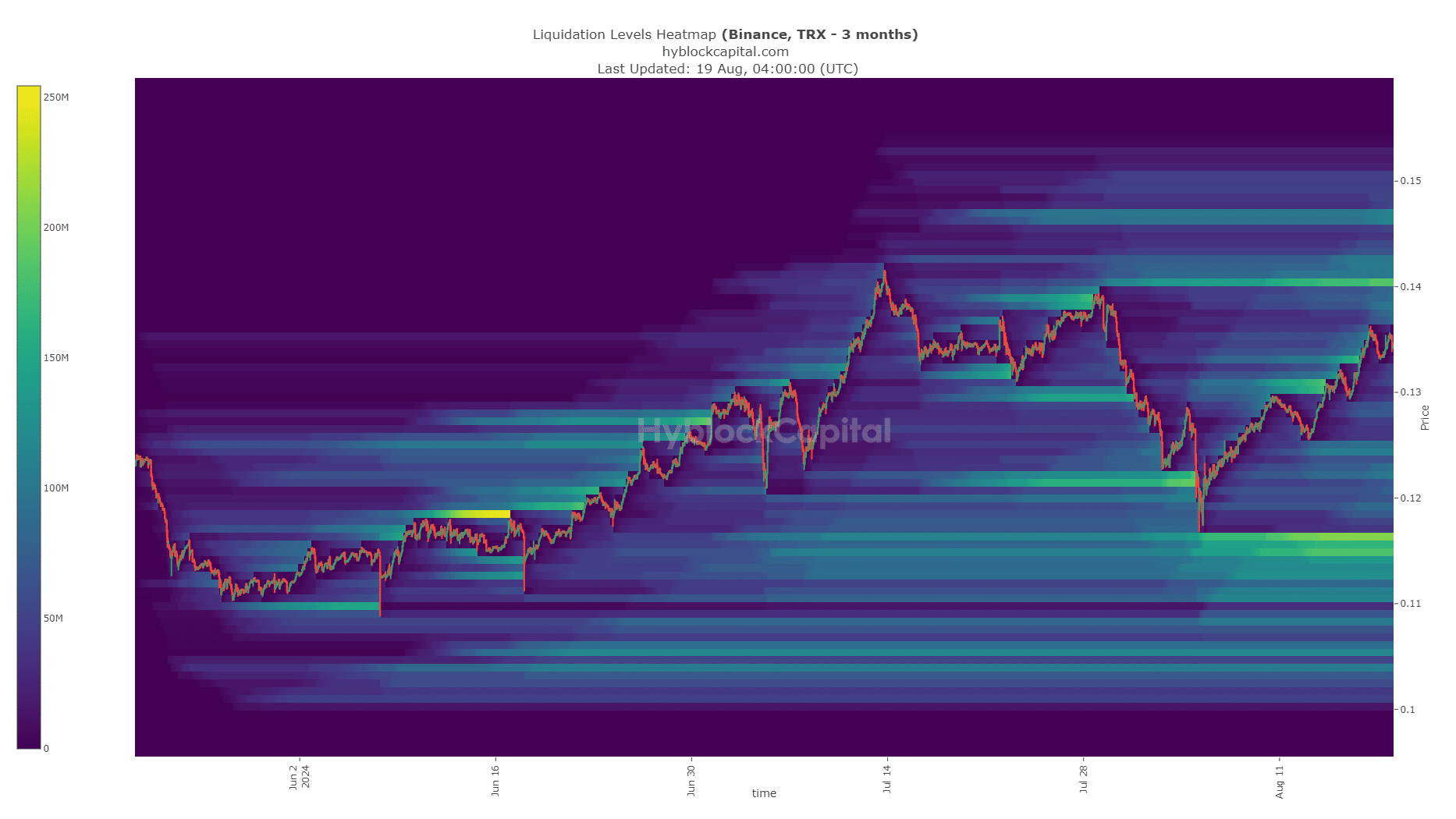

The TRX liquidity pool at $0.14 could be pivotal

The $0.14 level holds significance because it’s where many sell orders are clustered, or “liquidation levels.” Since price tends to gravitate towards areas with more available liquidity, we expect it to move in the direction of the range highs imminently.

Read Tron’s [TRX] Price Prediction 2024-25

It might overshoot it slightly in the event of a liquidation cascade.

After being cleaned, there’s a strong possibility that the price will trend towards the liquidity group around 0.116, which is slightly below the current price range minimum.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-19 16:07