- Turbo crypto soared 25% on Christmas Eve amid strong AI sector traction.

- With 85% in profit, will Turbo crypto recovery extend?

As a seasoned analyst with over two decades of experience in the crypto market, I find myself intrigued by the meteoric rise of Turbo crypto on Christmas Eve. With its impressive 25% surge and a daily trading volume that doubled overnight, it’s hard not to be captivated by this memecoin’s performance.

Turbo crypto rallied 25% on Christmas Eve, a ‘Santa rally’ that lifted AI agents and NFT segments by 8% and 5% on average, respectively.

As an AI memecoin, Turbo crypto benefited from the sector’s traction. Its daily trading volume surged to $370M, a whopping 200% increase.

This enabled the token to almost regain half of its losses from December. However, will the progress continue?

Turbo crypto hits roadblock

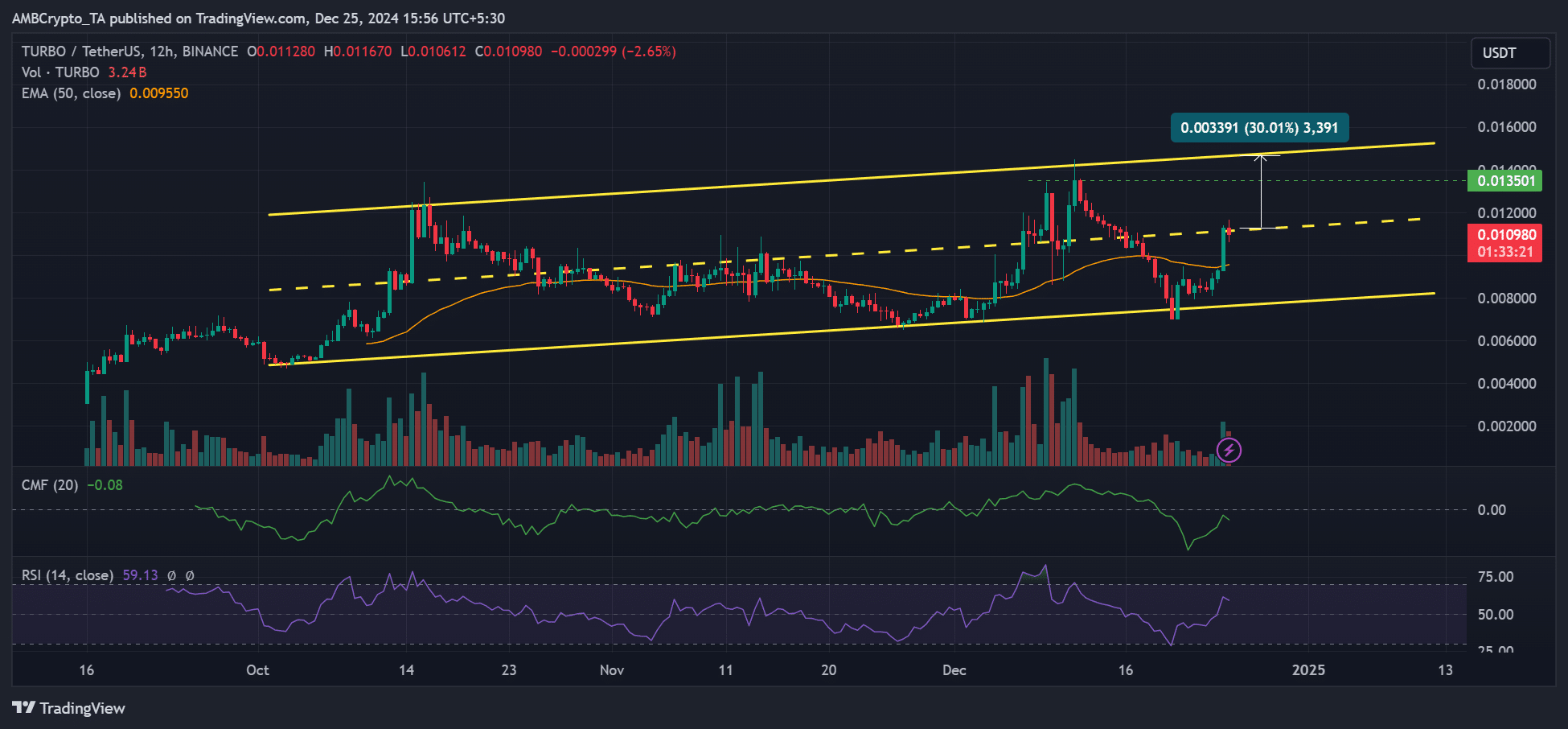

Turbo’s October adjustment has softened and rebounded to its lowest point within the channel. Similarly, the decrease in December occurred. As it stands now, however, the token is hovering around the mid-point of its range. If past patterns recur, Turbo cryptocurrency may stabilize at this mid-range level before aiming for the range-high of $0.014. If this happens, late investors might accumulate at this level with a potential gain of 30%.

Conversely, if the price significantly drops beneath the 50-day Moving Average, the projection becomes void.

On a 12-hour scale, the Relative Strength Index (RSI) suggests that there may be more opportunities for growth before the Turbo reaches an overly heated and overbought state.

At the present moment, the Common Market Fund was performing below its usual standard, indicating that investments were not yet flowing as robustly as typical, potentially hindering a swift recovery.

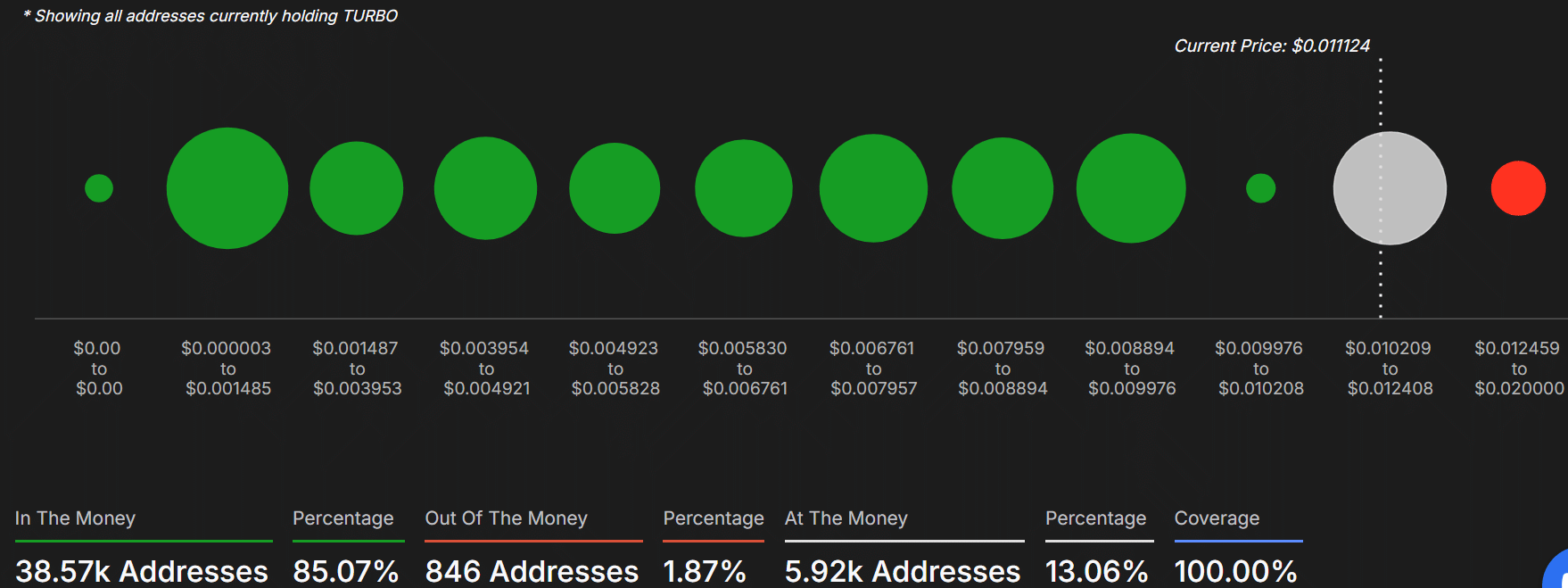

85% Turbo crypto holders in profit

85% of Turbo cryptocurrency owners are currently making a profit, which suggests that if the price levels off and stays within its mid-range for a while, there may be a tendency for profit-taking among these investors.

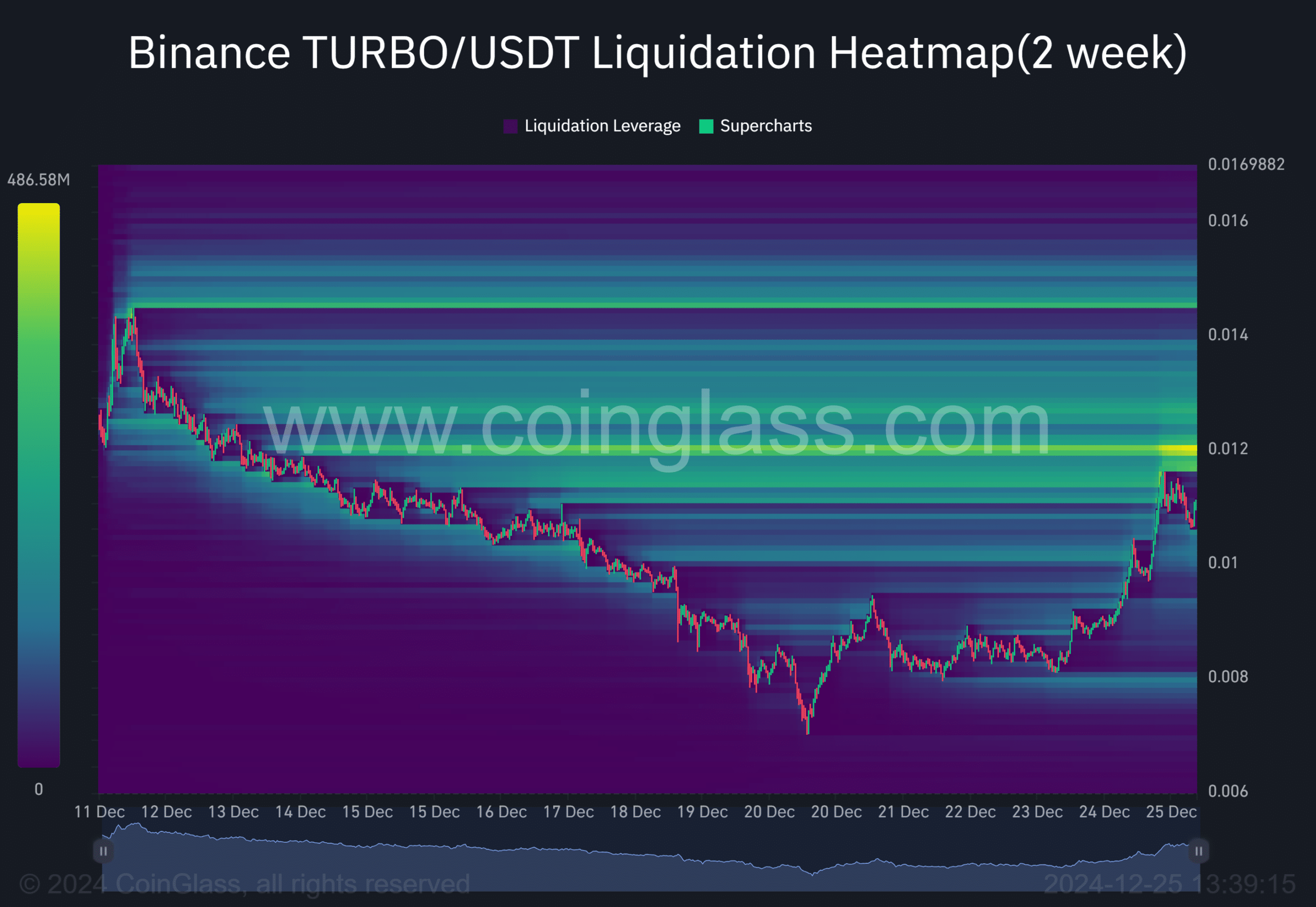

The theory discussed earlier became clear due to the accumulation of highly-leveraged short positions at $0.012, as demonstrated in the liquidation map.

Read Turbo [TURBO] Price Prediction 2025-2026

This meant that Futures traders were shorting the meme-coin slightly above the mid-range level.

If Turbo doesn’t experience a strong push upwards due to a sudden surge in buying activity (a violent short squeeze), it may struggle to move higher and instead drop towards its 50-day moving average or reach the lower end of its current trading range.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-12-26 07:03