- USDT led the market at press time, with a commanding 70% share

- At the same time, Bitcoin tested the crucial $60k support level.

As an experienced crypto investor with a keen eye for market trends, I find myself closely watching the dynamics between USDT and Bitcoin, given their commanding roles in the stablecoin and cryptocurrency markets respectively.

At the moment of reporting, Tether (USDT) dominated the stablecoin sector with an impressive 70% market control, while US Dollar Coin (USDC) ranked second with a 20.8% share.

In other words, Stablecoins account for approximately 8.2% of the overall cryptocurrency market, which currently has a total value of around $168 billion.

Just like US Dollar Tether (USDT) is the leading choice among stable coins, Bitcoin (BTC) remains the undisputed king in the wider cryptocurrency market.

any significant actions taken by either of them could cause effects throughout the whole cryptocurrency sphere, making their actions an essential focus of attention for AMBCrypto.

USDT dominance could temper Bitcoin’s surge

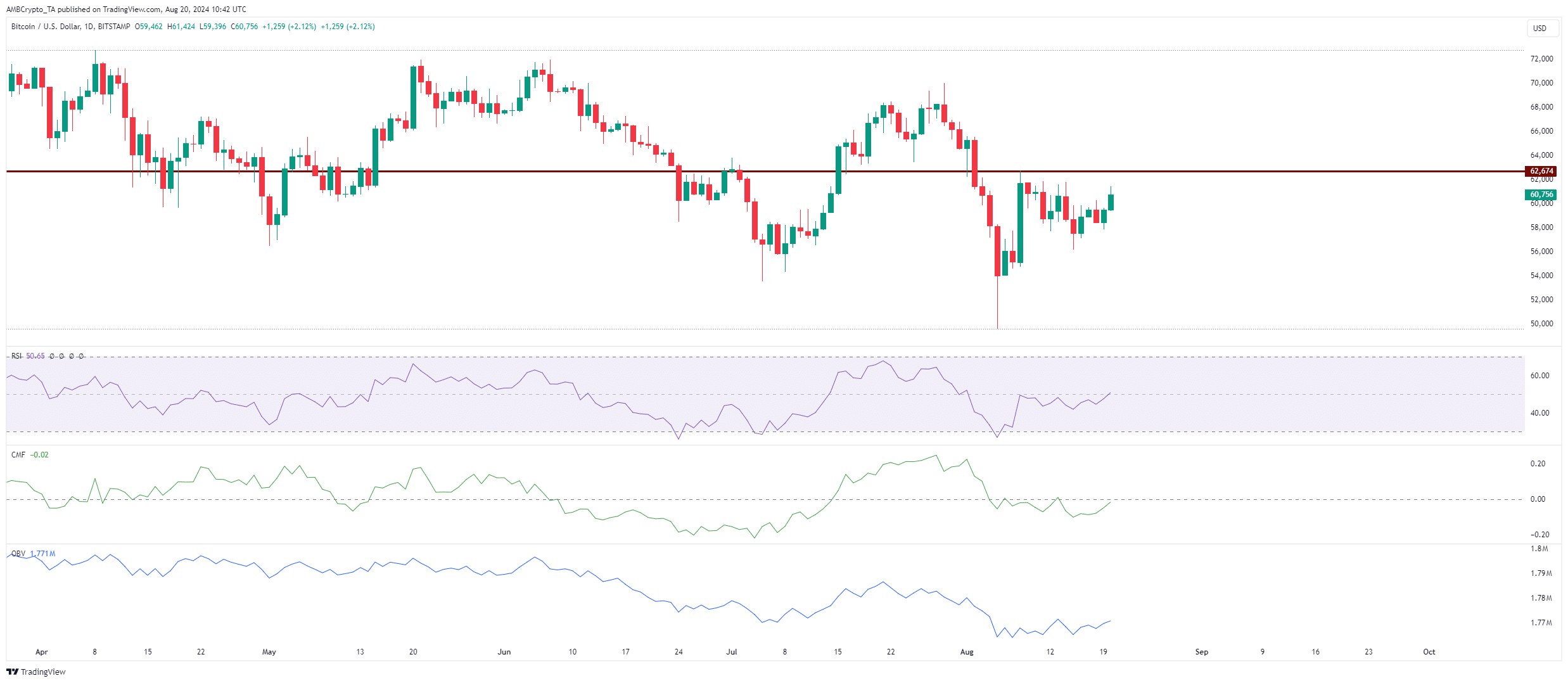

Bitcoin encountered resistance at the $60,000 support level on the 8th of August, and the bulls were unable to maintain the price. For the past ten consecutive days, it has been holding steady, indicating a period of consolidation.

Meanwhile, a significant upward surge has helped Bitcoin break free from its holding pattern, currently trading at $60,941.

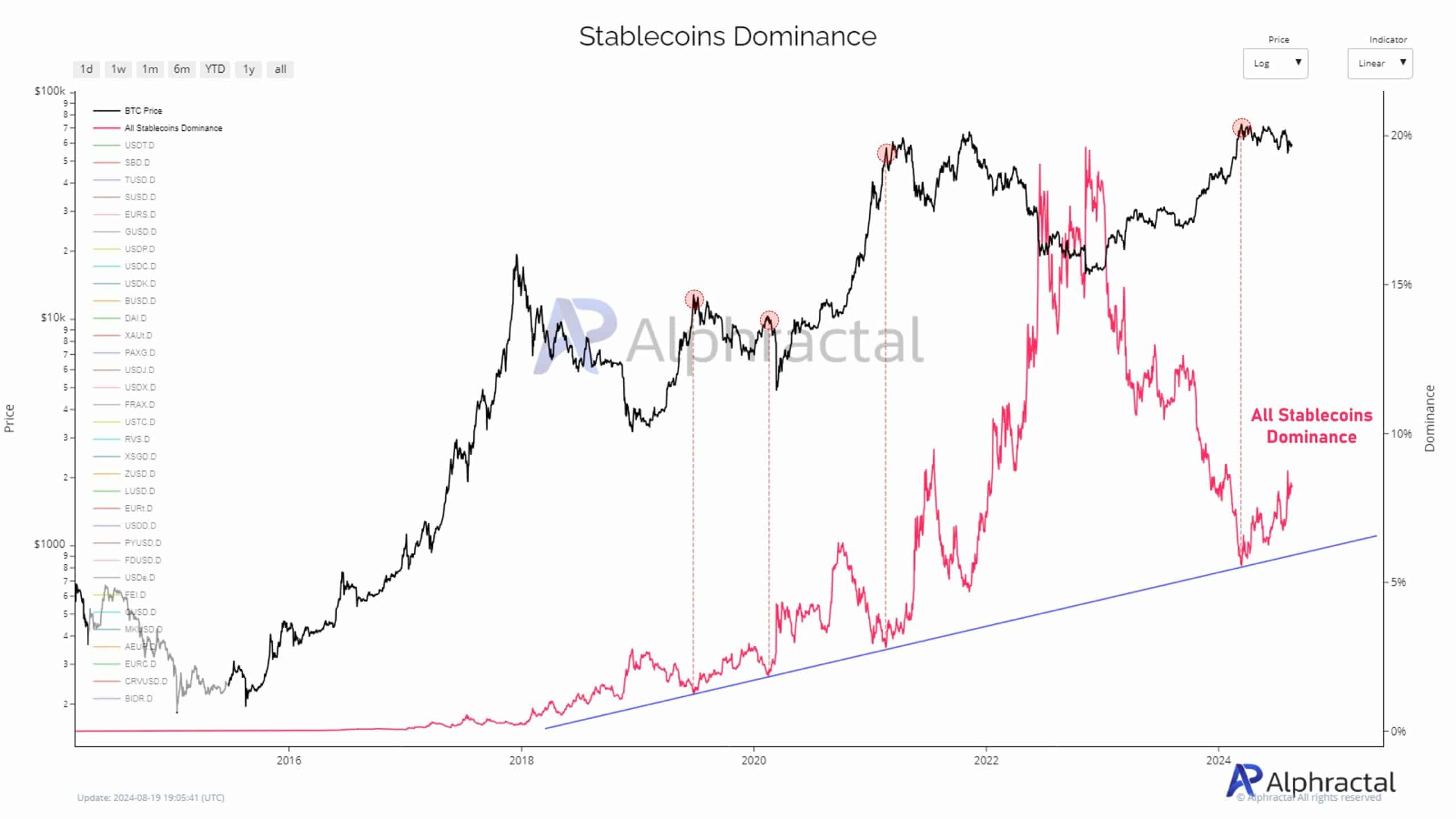

As a crypto investor, I recently stumbled upon an intriguing finding from AMBCrypto’s analysis of a post by data analytics platform Alphractal. It appears there seems to be a connection between the price fluctuations of Bitcoin and stablecoins.

Source : Alphractal /X

In the past, when Bitcoin has approached significant resistance points, there’s often been a corresponding rise in the influence of stablecoins.

Essentially, it means that investors could be becoming more careful in their approach. By swapping their investments into stable digital currencies (like stablecoins), they are essentially safeguarding their assets from the volatile nature of Bitcoin.

In a separate analysis, AMBCrypto explored whether the high USDT dominance could potentially reverse engineer Bitcoin into a downward trend. The study revealed the following insights.

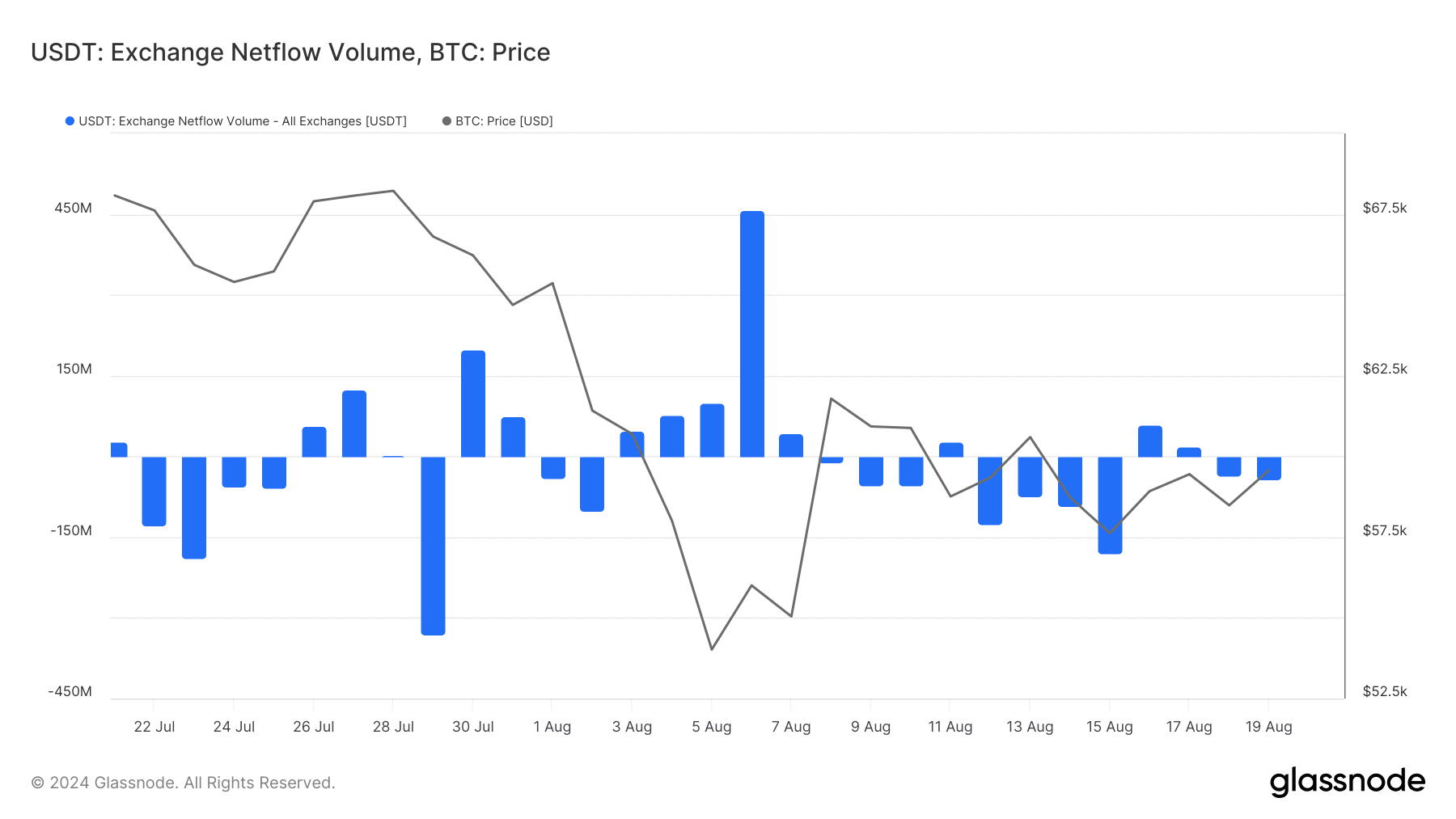

Source : Glassnode

As a crypto investor, I’ve noticed on my one-month chart that the net flow of USDT exchange withdrawals has dipped into the negative territory. This means that there’s been a higher volume of USDT being taken out of exchanges compared to what’s being put in, suggesting a potential trend of users withdrawing their assets.

On the 9th of August, there was an observable surge in USDT leaving exchanges, with around 41 million units being withdrawn – up from the 35 million recorded the day before.

If the current pattern persists, there’s a possibility that it might curb Bitcoin’s upward momentum, making it difficult for its value to exceed the $62k barrier.

Source : TradingView

Altcoin season might not take hold if USDT dominates

In the very same article, Alphractal found that the joint control of Bitcoin and all stablecoins amounted to approximately 65.2%, suggesting a relatively small level of enthusiasm towards other cryptocurrencies (altcoins).

It’s no shock that Ethereum‘s (ETH) value exceeded $2,600, aligning with Bitcoin’s price increase. At the moment of reporting, it stood at $2,651. However, the Altcoin Season Index still indicated a downtrend.

Read Bitcoin’s [BTC] Price Prediction 2024-205

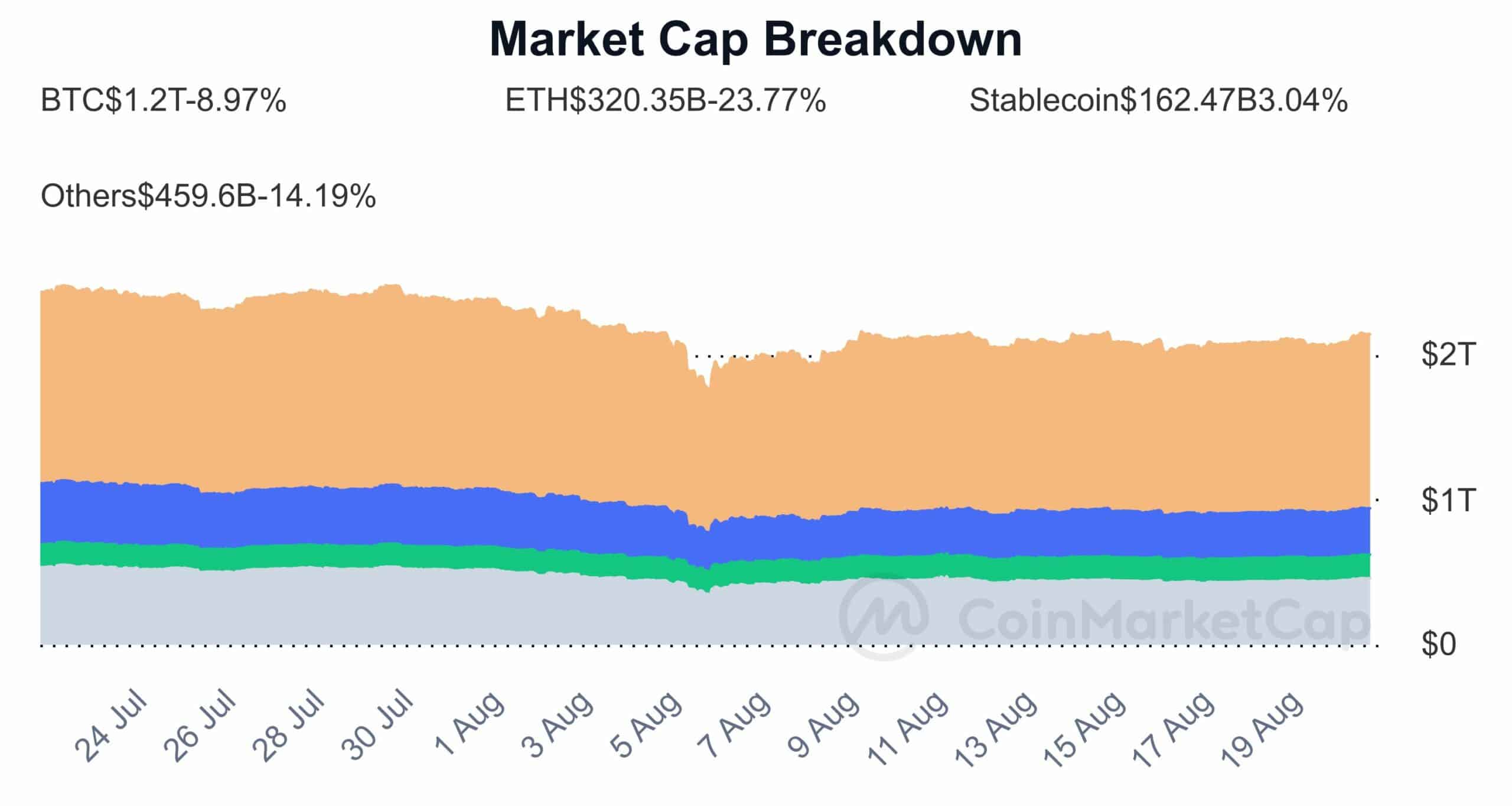

Data from CoinMarketCap revealed a striking trend: while Ethereum’s market cap plummeted by 23.77% and Bitcoin’s by about 9% over the past month, the stablecoin market cap actually grew by 3.04%.

Source : CoinMarketCap

Having closely observed and participated in the dynamic world of cryptocurrencies for several years now, I have noticed a significant surge in confidence towards stablecoins. As someone who has witnessed both the meteoric rise and fall of various digital currencies, I am not oblivious to the potential risks that such shifts can pose. A rapid increase in the acceptance and use of stablecoins could potentially slow down the progress of major cryptocurrencies, as investors may flock towards the perceived safety and stability offered by these assets. While this might seem like a positive development for those seeking a more secure investment option, it is essential to remember that the market remains highly volatile and unpredictable. As always, caution should be exercised when making investment decisions in the ever-evolving landscape of cryptocurrencies.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-08-21 09:12