- Worldcoin price is consolidating in a ranging pattern between $4.3 and $6.2 key levels.

- Metrics indicate bullish momentum and profit potential for holders.

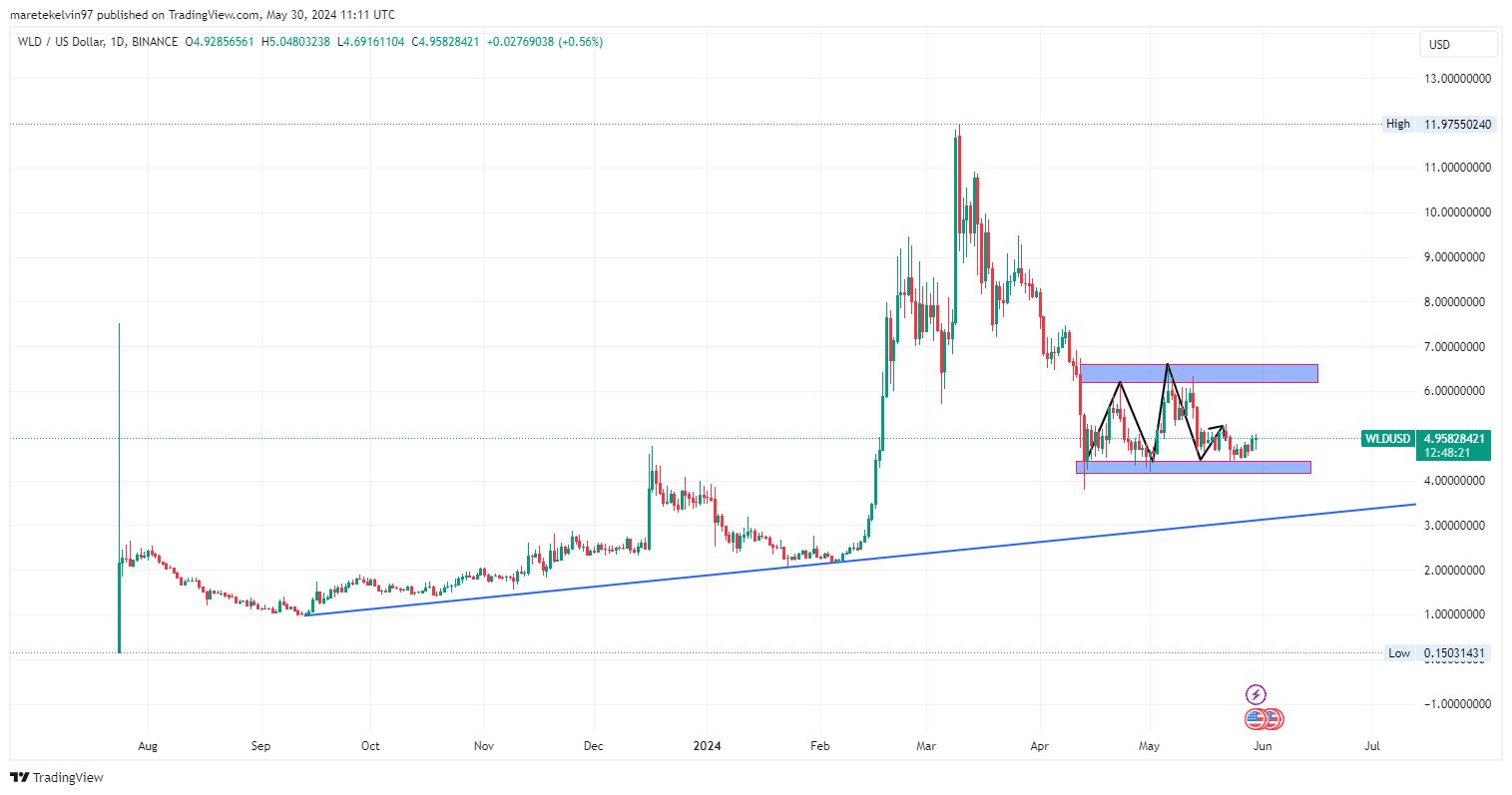

As a seasoned crypto investor, I have seen my fair share of market volatility and consolidation patterns. The current situation with Worldcoin (WLD) is interesting, to say the least. For the past two months, WLD has been trading in a ranging pattern between $4.3 and $6.2 key levels.

⚡ Flash Forecast: Trump Tariffs Could Wreck EUR/USD Stability!

Analysts sound alarms on major forex disruptions coming soon!

View Urgent ForecastFor the last two months, Worldcoin [WLD] has been moving within a fluctuating price band, ranging from about $4.3 to $6.2. Each time the price dips down to $4.3, it encounters substantial purchasing activity, suggesting a robust demand at this level.

The $6.2 resistance level has been tested on three occasions, signaling significant investor attention. At present, WLD is experiencing a bullish trend with a projected price goal at the $6.2 resistance mark.

If the stock price surpasses the $6.2 mark, it may initiate a fresh upward trend. Conversely, if the downward pressure forces the price below the $4.3 support, there’s a possibility of creating a head and shoulders pattern, which could lead to a price decline towards the underlying uptrend line near the support level.

At present, based on data from CoinMarketCap, Worldcoin is valued at $4.83 – marking a minimal 0.01% rise over the previous 24-hour period but a small 1.28% drop within the last week.

As a researcher, I’ve calculated that the current market capitalization of the company is valued at an impressive $1.1 billion. Notably, the trading volume over the past 24 hours reached a significant figure of $507.61 million, which represents a substantial increase of approximately 50.52%.

Worldcoin holders could see light

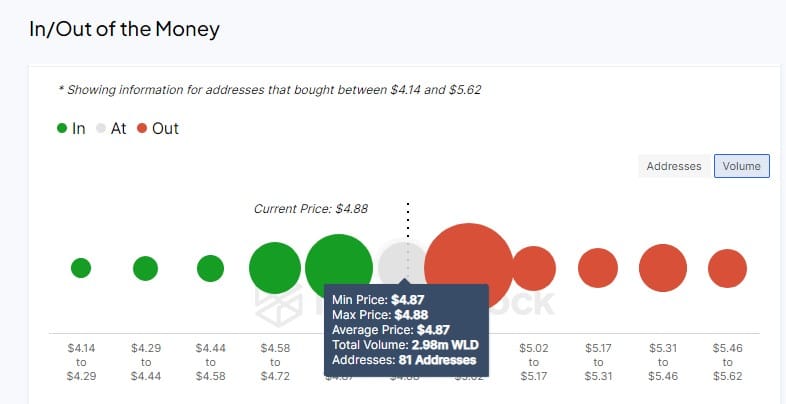

As a researcher studying the cryptocurrency market, I examined the Global In/Out of Money Indicator provided by IntoTheBlock for Wrapped Luna (WLD). The data revealed that approximately 2.98 million WLD were positioned at prices where profit-taking becomes an attractive option.

As an analyst, I would rephrase it as follows: I analyzed a purchase of approximately 241.38 million worth of supply that transpired between the prices of $4.87 and $4.88. Considering the current price sits at $4.84, holders may soon experience profitable moments in this market scenario.

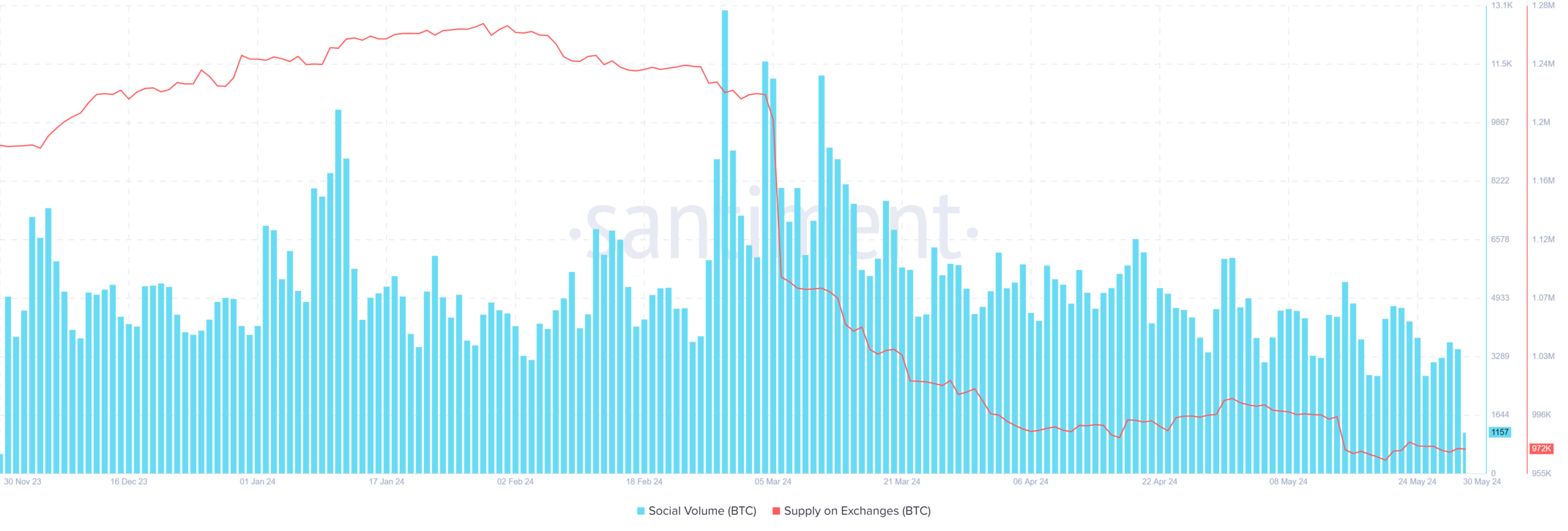

I delved deeper into the insights provided by AMBCrypto, focusing specifically on Santiment’s findings regarding Waldo Coin’s (WLD) supply on exchanges and social media activity from November 2023 to May 2024. The social media chatter displayed numerous peaks, suggesting a high level of market buzz and interest.

The trend in the available supply on exchanges showed a continuous downturn, signifying a bullish outlook among investors who were transferring their Worldcoin (WLD) tokens off these platforms. This observation is consistent with Worldcoin’s ongoing bull market that has driven its price up to $6.2.

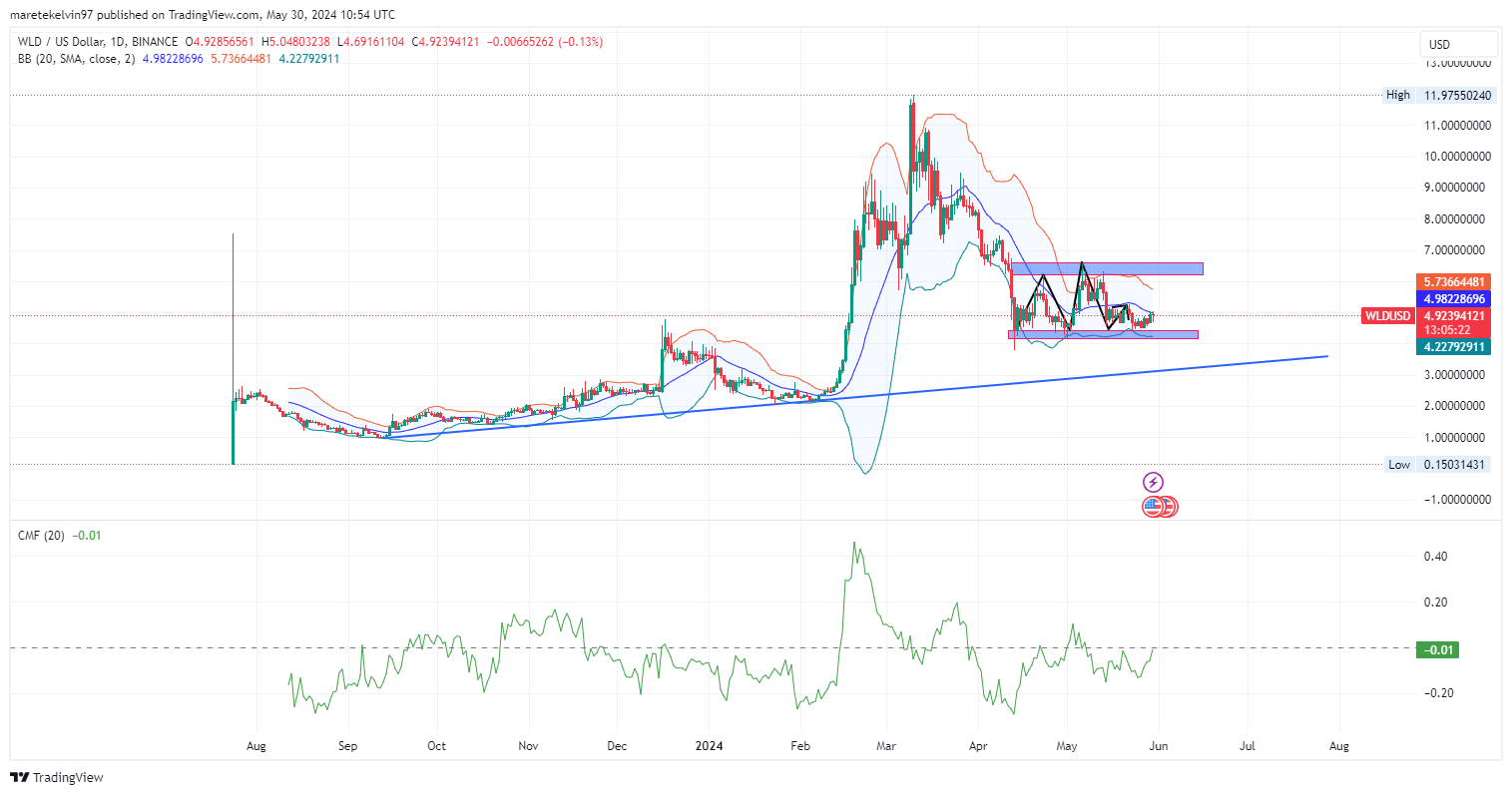

Based on the Tradingview chart, the current WLD price lies within the lower and middle Bollinger Band boundaries. This signifies reduced price volatility and suggests that the asset is recovering from an oversold status.

If the price increases significantly, this might be a sign of an uptrend. The Chaikin Money Flow (CMF) currently stands at -0.01, indicating that traders are uncertain and hesitant, preferring to watch the market’s movement before making a decision.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-05-30 18:15