-

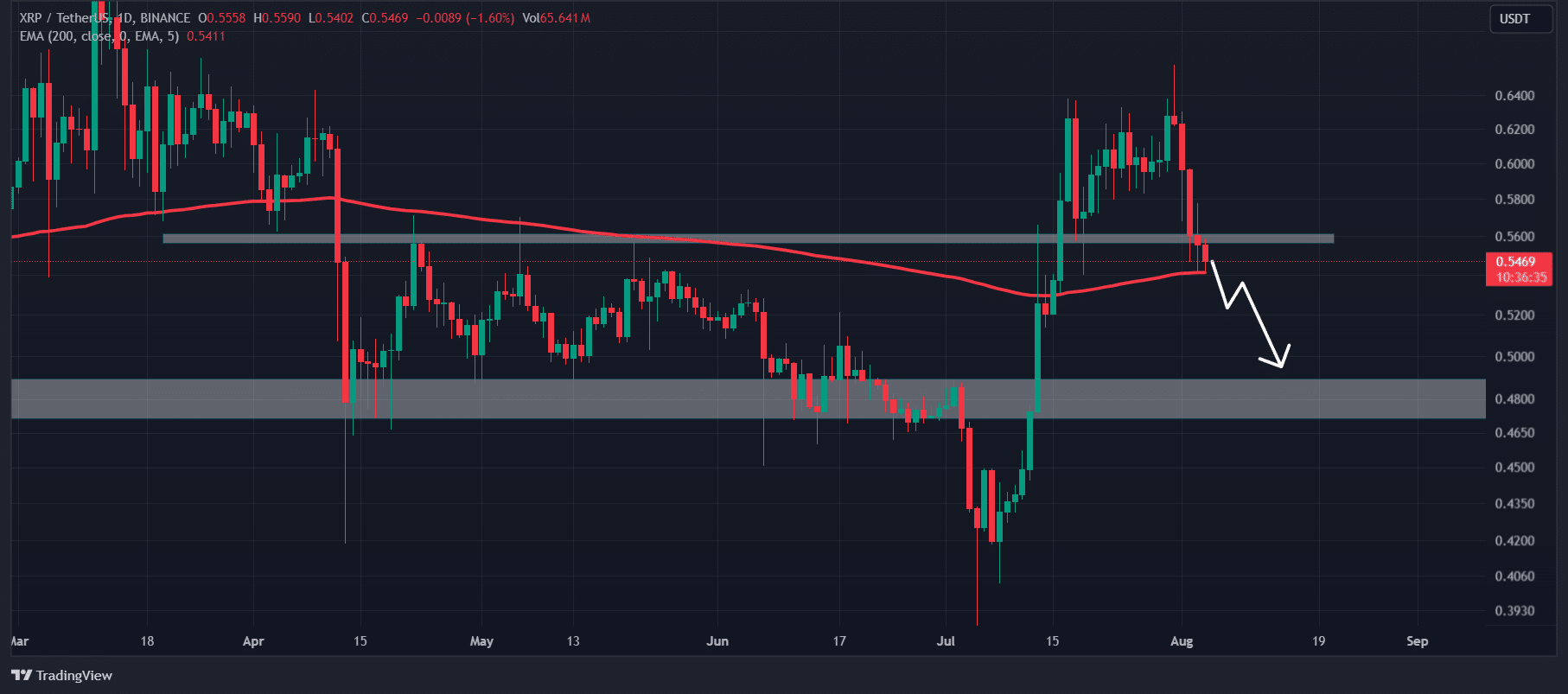

At press time, XRP’s 200 EMA acted as a crucial support level.

$32.41 million in short positions will be liquidated if XRP reaches the $0.587 level.

As a seasoned crypto investor with battle-tested nerves and a knack for navigating the volatile waters of the digital asset market, I find myself standing before XRP at this critical juncture. The cryptosphere is witnessing a downward spiral, with heavy selling pressure taking its toll on Bitcoin [BTC], Ethereum [ETH], Solana [SOL], and our focal point, Ripple [XRP].

Despite persistent selling activity, prominent investments like Bitcoin [BTC], Ethereum [ETH], Solana [SOL], and Ripple [XRP] are consistently decreasing in value.

Meanwhile, the crypto community took notice of XRP due to its breach of the important $0.556 price floor.

Crucial support breakdown

After the recent market event, traders have closed out a total of approximately $2.71 million worth of both long and short trades. More specifically, about $2.41 million was liquidated in long positions, while around $298,400 was liquidated in short positions.

Beyond the recent incident, it’s been reported by Whale Alight, a blockchain transaction monitor, that Ripple has released approximately 1.8 billion XRP coins valued at around $981 million over the past few days.

This token unlock has increased the total circulating supply and made XRP more bearish.

In contrast to the pessimistic market sentiment, a significant amount of 75.36 million XRP tokens, valued at approximately $40.2 million, have been transferred from Binance to an unidentified wallet by whales.

XRP price analysis

In my analysis as of today, I observe that XRP‘s current trading price hovers around $0.54. Over the past 24 hours, there has been a significant drop of over 4.5% in its value. Simultaneously, the trading volume has seen a decrease by approximately 35%, suggesting a wave of apprehension among traders during this period.

Furthermore, over the past 24 hours, there’s been a 7% decrease in Open Interest (OI) for XRP, indicating reduced investment and trading activity among investors and traders amidst the current market slump.

Technical analysis and upcoming levels

Based on the findings from technical experts, the price trend for XRP appeared pessimistic when it dropped below a significant support point at $0.556.

In my analysis, even though there were some challenges, I noticed that the price of XRP was consistently bouncing back to the 200 Exponential Moving Average (EMA). This recurring behavior presents a promising signal for XRP traders and investors like myself.

If XRP doesn’t manage to maintain its position above the 200 Exponential Moving Average (EMA) on a daily chart under the influence of selling pressure, there’s a strong possibility it could drop by another 10% and potentially find support at approximately $0.48.

Major liquidation level

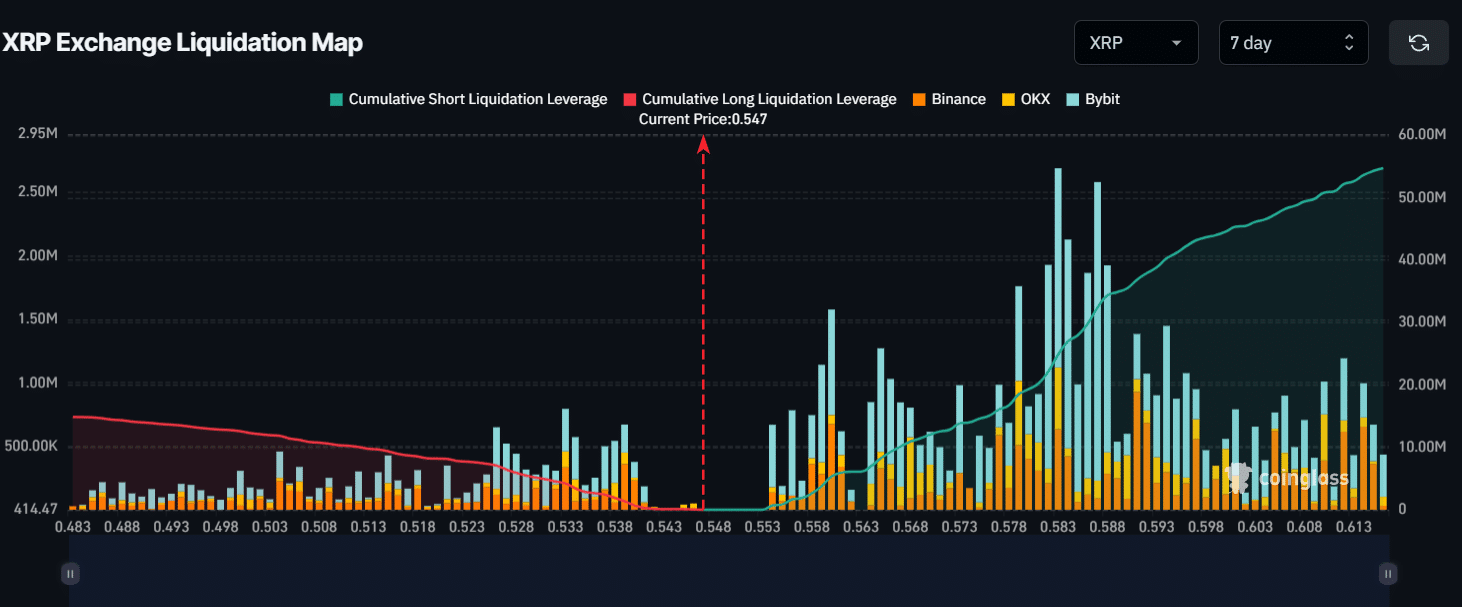

As reported by Coinglass, a firm that specializes in on-chain analysis, the current key selling points for this asset are at approximately $0.526 (downside) and $0.587 (upside), respectively, as of the latest update.

Read Ripple’s [XRP] Price Prediction 2024-25

Should the general market feeling stay consistent and XRP drops beneath the $0.526 price point, approximately $7.09 million worth of long positions could potentially be terminated.

If the mood towards XRP in the market shifts positively and XRP rises to $0.587, approximately $32.41 million worth of short positions could be closed out or ‘covered’.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-08-05 12:07