Ah, the world of XRP! A place where the price dances like a drunken pixie at a midsummer festival, all while exchange reserves are doing their best impression of a deflating balloon. According to the sage scribes at 21Shares, we are witnessing a veritable plunge to a seven-year low of a mere 1.7 billion XRP. Yes, you heard that right-1.7 billion! A number so low it might make a cat with nine lives feel positively abundant.

Falling XRP Exchange Supply Meets ETF Demand

Your friendly neighborhood 21Shares has identified three pillars that will shape the price action of XRP in the fabulously uncertain year of 2026: regulatory clarity (because who doesn’t love a good rulebook?), substantial investor demand via spot ETFs, and the real-world adoption of XRPL. Meanwhile, 1.7 billion XRP is hanging around like an unwanted guest at a party, marking its lowest level in over seven years. Perhaps it’s considering a career change?

Now, as the institutional demand for XRP ETFs intertwines with a community of holders who are as steadfast as a goat on a mountain, we have a recipe for a possible supply shock. You know, the kind of shock that makes you want to clutch your pearls and rethink all your life choices-similar to the infamous GameStop revolution on Reddit, but with fewer memes and more spreadsheets.

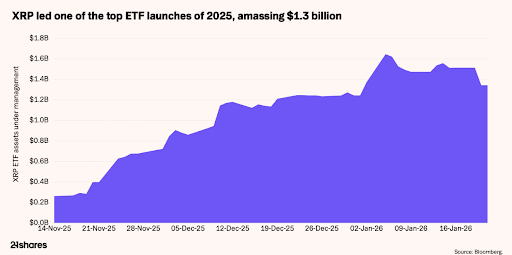

Speaking of which, ETF products in the US have managed to attract over $1.3 billion in a single month, defying market conditions as if they were in a reality show called “The Real Investors of Crypto.” Despite some ebbs and flows, this demand indicates a transition from speculative trading to something that sounds suspiciously like ‘serious business.’ At the time of writing, the cumulative net inflow has dipped to a modest $1.18 billion, which, let’s be honest, still beats finding a dollar bill in your winter coat pocket.

The report also referenced Bitcoin spot ETFs as a benchmark, where nearly $38 billion of net inflows turned Bitcoin’s price from a humble $40,000 to a jaw-dropping $100,000 faster than you can say “cryptocurrency” three times in a row. With XRP’s market cap being a paltry one-eighth of Bitcoin’s, any inflows are bound to make waves-or perhaps a ripple, depending on how dramatic we’re feeling today.

XRP Price Outlook For 2026

Looking forward to the sparkling year of 2026, the wise folks at 21Shares envision XRP’s valuation influenced by a trifecta of regulatory access, sustained ETF flows, and a significant uptick in real-world activity on the XRP Ledger. They’ve even laid out a pricing range: a base case peak of $2.45 (50% chance, because who doesn’t love a good coin flip?), a bull case peak of $2.69 (30%), and a bear case peak of $1.60. Yes, that’s right-a bear case peak, which feels a bit like being told the ice cream truck ran out of your favorite flavor.

The base case assumes everything goes swimmingly, regulatory stability supports steady ETF inflows, and maybe, just maybe, people start using XRP for something other than speculative trading. The bull case, on the other hand, is banking on institutional-scale tokenization and tighter liquid supply, while the bear case sighs heavily at stagnant adoption and capital fleeing like a cat from a dog. Currently, XRP is flirting with the bear case, struggling to stay above $1.60 like a tightrope walker who’s had one too many cups of coffee.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Gold Rate Forecast

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Controller Settings for ARC Raiders

- Goat 2 Release Date Estimate, News & Updates

- Best Werewolf Movies (October 2025)

2026-02-03 19:46