-

XRP’s +20% upswing reversed August losses.

Short and long-term holders were in profit and could be tempted to take profits.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent surge of XRP following Ripple Labs’ victory against SEC’s $2 billion claim. The 20% upswing not only reversed XRP’s August losses but also outperformed Bitcoin on the XRPBTC ratio, a significant development in the crypto world.

On August 7th, Ripple Labs’ victory against a $2 billion claim by the SEC caused a surge of more than 20% in the price of their native token, XRP. This development suggests that the prolonged lawsuit may be nearing its end, which has positively impacted the public perception and demand for XRP as an altcoin.

XRP reverses August losses

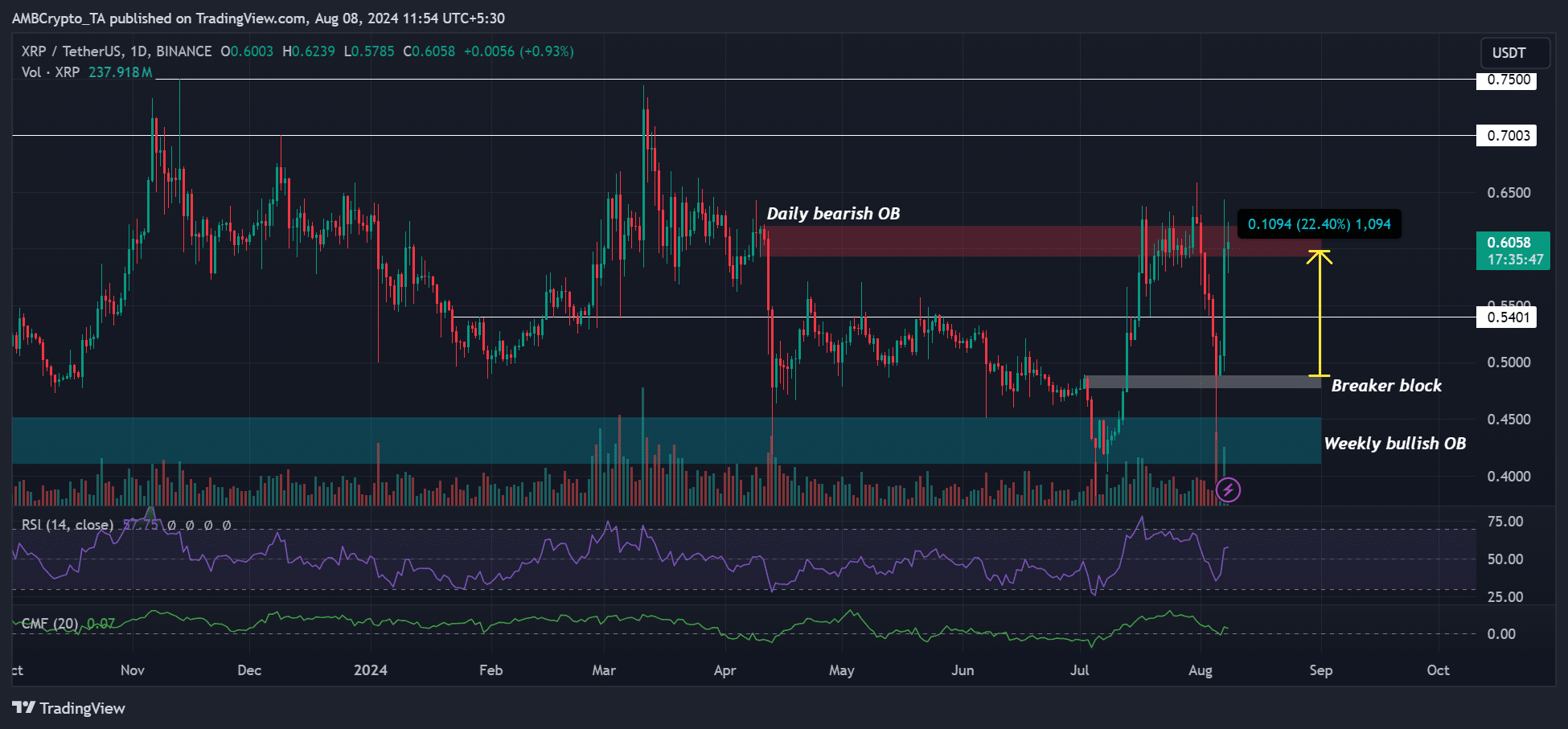

1. The recent update and 20% surge successfully recovered XRP‘s losses from August. At this moment, the digital currency has returned to its late July price of $0.6. Furthermore, the surge in value caused XRP to surpass Bitcoin [BTC] as the XRPBTC ratio increased by more than 20% on the 7th of August.

Simultaneously, the $0.6 price point served as a supply area and a daily resistance level for bears (marked in red).

In my analysis, when I encountered this resistance level for the altcoin, I found myself pondering whether to short it, especially if the bullish momentum didn’t extend further. This suggests that sellers might be enticed by the same opportunity.

From my perspective as an analyst, should the supply zone (previously red) effectively transition into a support level, it could potentially prolong the bullish trend, pushing prices upwards to around $0.7 or even $0.75. This scenario presents an opportunity for additional gains of approximately 12% at $0.7 and a more substantial 20% if we reach $0.75.

Instead, If additional sellers take advantage of the profit-taking opportunities in the XRP supply area, it could potentially drop to around $0.54. It’s worth noting that significant XRP whales have been offloading their holdings, which suggests a possible trend reversal might have occurred near $0.6 and may not be easily reversed.

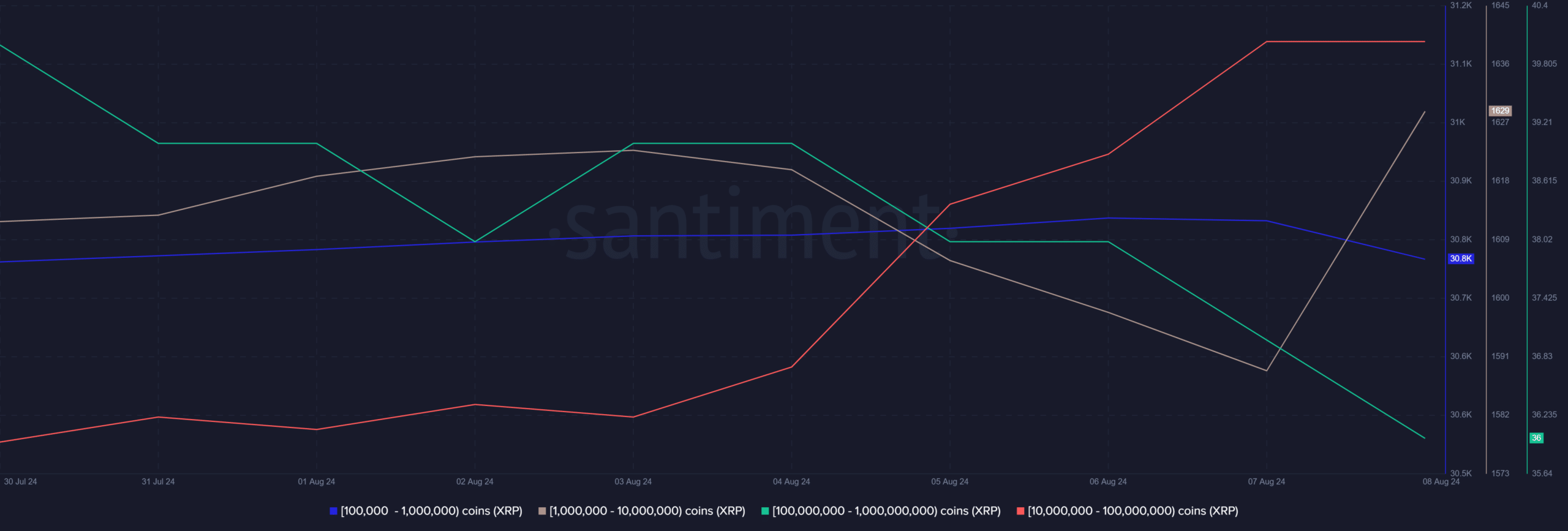

According to Santiment’s data analysis, investors with a significant amount of XRP (between 100 million and 1 billion dollars worth) have been selling off their XRP holdings, which amounts to approximately $60 million to $600 million. Additionally, those holding between 100,000 and 1 million XRP tokens have also joined in the selling trend.

As a crypto investor, I’ve noticed that there are groups (let’s call them ‘whales’) holding between 10 million and 100 million units of this cryptocurrency. This means that their actions could potentially balance each other out if the overall market sentiment doesn’t deteriorate any further. In simpler terms, it seems like these whales might be counteracting each other’s moves due to the size of their investments.

Holders in profit?

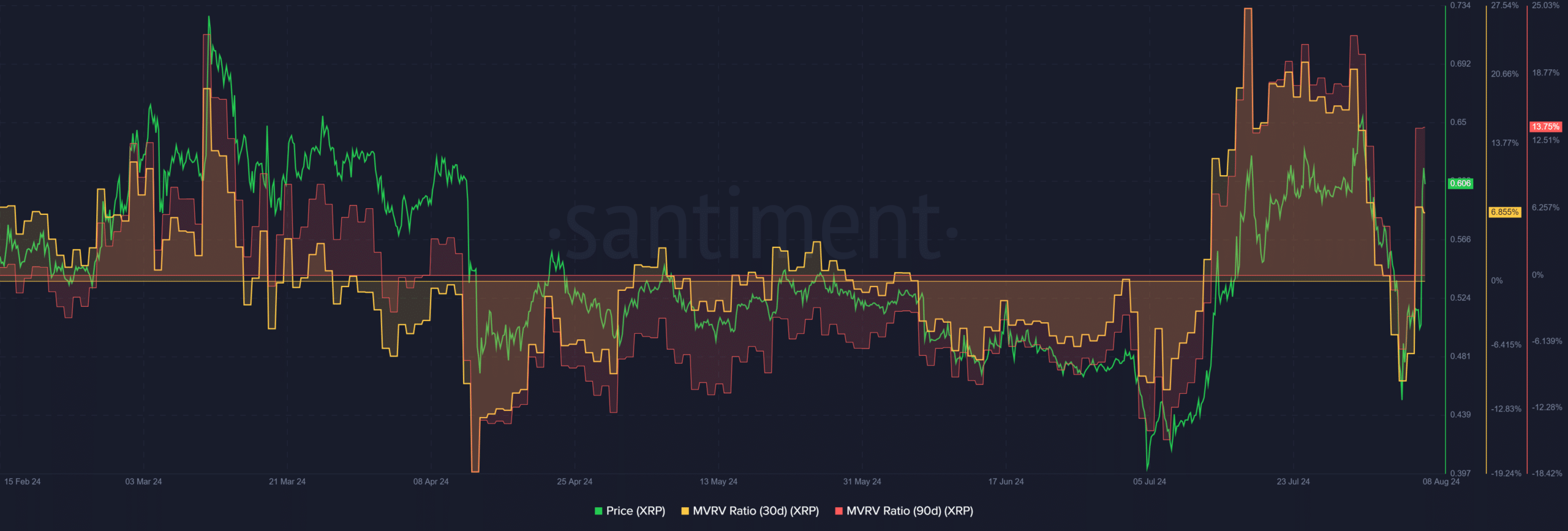

It’s worth noting that following the SEC ruling, both short-term and long-term investors experienced different benefits. For example, those who had purchased XRP a month prior witnessed a substantial increase in their portfolios by approximately 6.8%.

Instead, individuals who held their assets for more than 90 days experienced a 13.75% profit, as indicated by the MVRV (Market Value to Realized Value) ratio over that period.

From one perspective, the growing MVR (Maker’s Value Ratio) suggests that the altcoin might be progressively more overpriced relative to the initial investment cost for most investors, implying potential decreased value.

Based on my personal investment experience, when I see a potential trend reversal happening, especially if there are increasing unrealized profits, it often prompts me to consider taking some profit. This is because I learned from past experiences that holding onto investments too long can sometimes lead to missed opportunities for gains elsewhere. It’s always important to keep an eye on market trends and make informed decisions based on the current situation.

As a crypto investor, I kept my eyes peeled on the significant level of $0.6 as it served as a crucial point to monitor for potential short-term upward momentum.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-08-08 15:03