-

Selling pressure on XRP has increased in the last seven days.

Most technical indicators suggested that XRP wouldn’t test the bearish pattern.

As a researcher with experience in cryptocurrency analysis, I’ve been closely monitoring XRP‘s price action over the past week. While the token had an optimistic start, with its price increasing by over 2%, recent technical indicators suggest that a bearish pattern has emerged on XRP’s chart.

XRP experienced a positive week with its price rising more than 2%, yet volatility decreased. However, the recent lethargic price trend may signal an upcoming price decline, as a bearish pattern started forming on the token’s price chart.

XRP’s bearish outlook

As a researcher analyzing the cryptocurrency market data from CoinMarketCap, I observed that the token’s price experienced minimal movement within the last 24 hours, resulting in a decline in momentum. At the moment of my investigation, XRP was priced at $0.5297 and boasted a substantial market capitalization exceeding $29.3 billion, positioning it as the seventh largest crypto asset in the marketplace.

In the meantime, a bearish pattern emerged on the token’s daily chart.

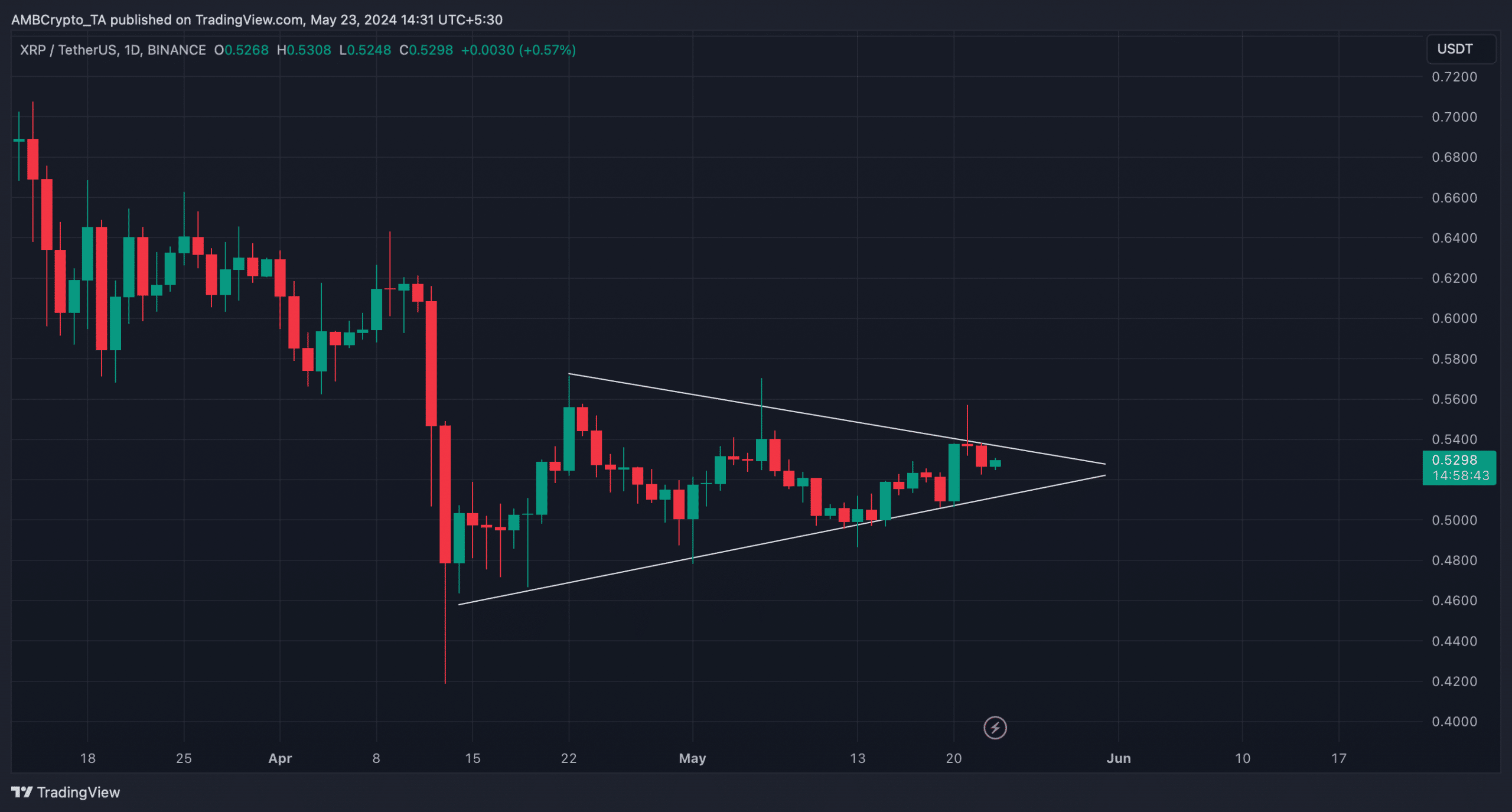

Based on AMBCrypto’s examination, a bearish pennant shape emerged for XRP around mid-April following a significant price decline. The token’s value has since remained contained within this configuration.

Should XRP adhere to this pattern, its price is likely to become increasingly bearish. A drop beneath the lower trendline could ensue, leading to a more substantial decline in value.

After examining the data provided by Santiment, AMBCrypto assessed if the metrics supported the hypothesis of a potential price drop.

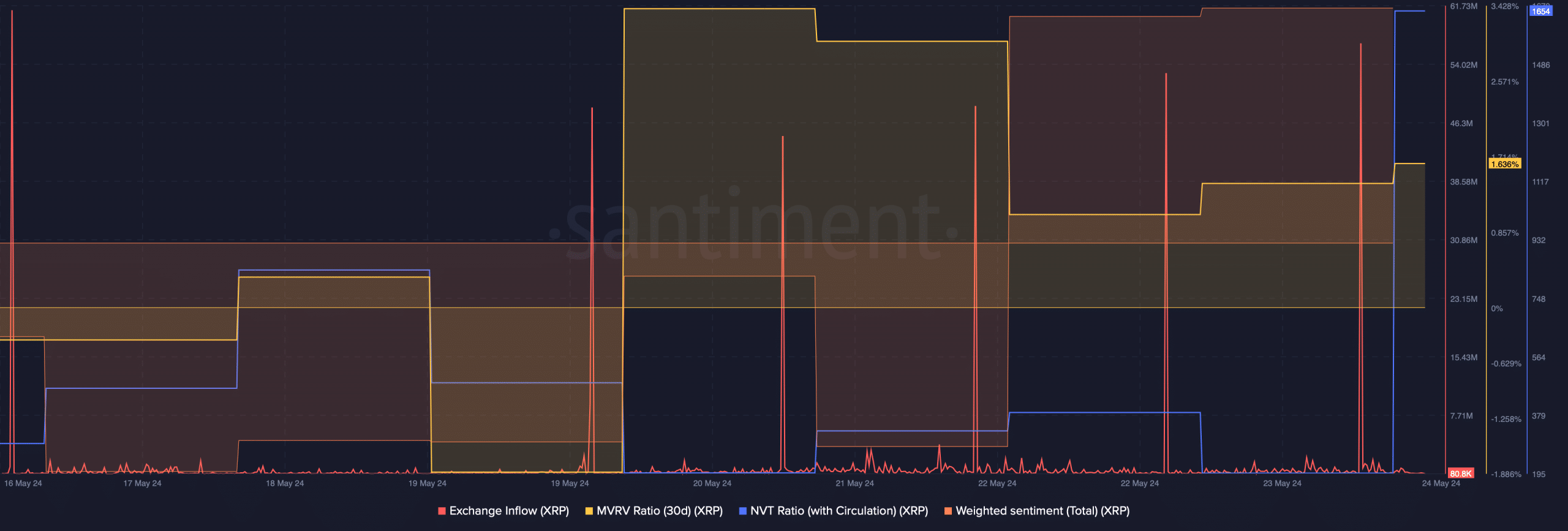

Based on our recent examination of the data, I noticed that XRP‘s exchange inflows experienced notable surges over the past week. This increase in inflows indicated that investors were offloading the token in large quantities. Consequently, this trend suggests a significant amount of selling pressure within the XRP market.

As a crypto investor, I’ve noticed an intriguing development regarding XRP. Its NVT ratio experienced a significant spike on May 24th. For those unfamiliar, the NVT ratio is a valuation metric that compares a coin’s market value to its network value. When this ratio rises sharply, it often suggests that the asset may be overvalued. If an asset is indeed overvalued, it can lead to a price correction. So, keep an eye on XRP’s price action around this key indicator.

Another bearish metric was the MVRV ratio, which declined in the last few days.

Instead of “However, a few of the other metrics looked pretty optimistic,” you could say “Some of the other key performance indicators showed promising signs.” And instead of “This meant that investors were confident in the token, as bullish sentiment around it was dominant in the market,” you could paraphrase as “This suggested that investor confidence was high towards the token due to the prevalent bullish sentiment in the market.”

As an analyst, I recently examined the data from Coinglass that was presented by AMBCrypto. Notably, I observed that the token’s long/short ratio experienced a significant uptick within the past 12 hours. A high long-short ratio indicates a bullish trend because it signifies a stronger inclination among investors to acquire this asset rather than sell it.

Which way is XRP headed?

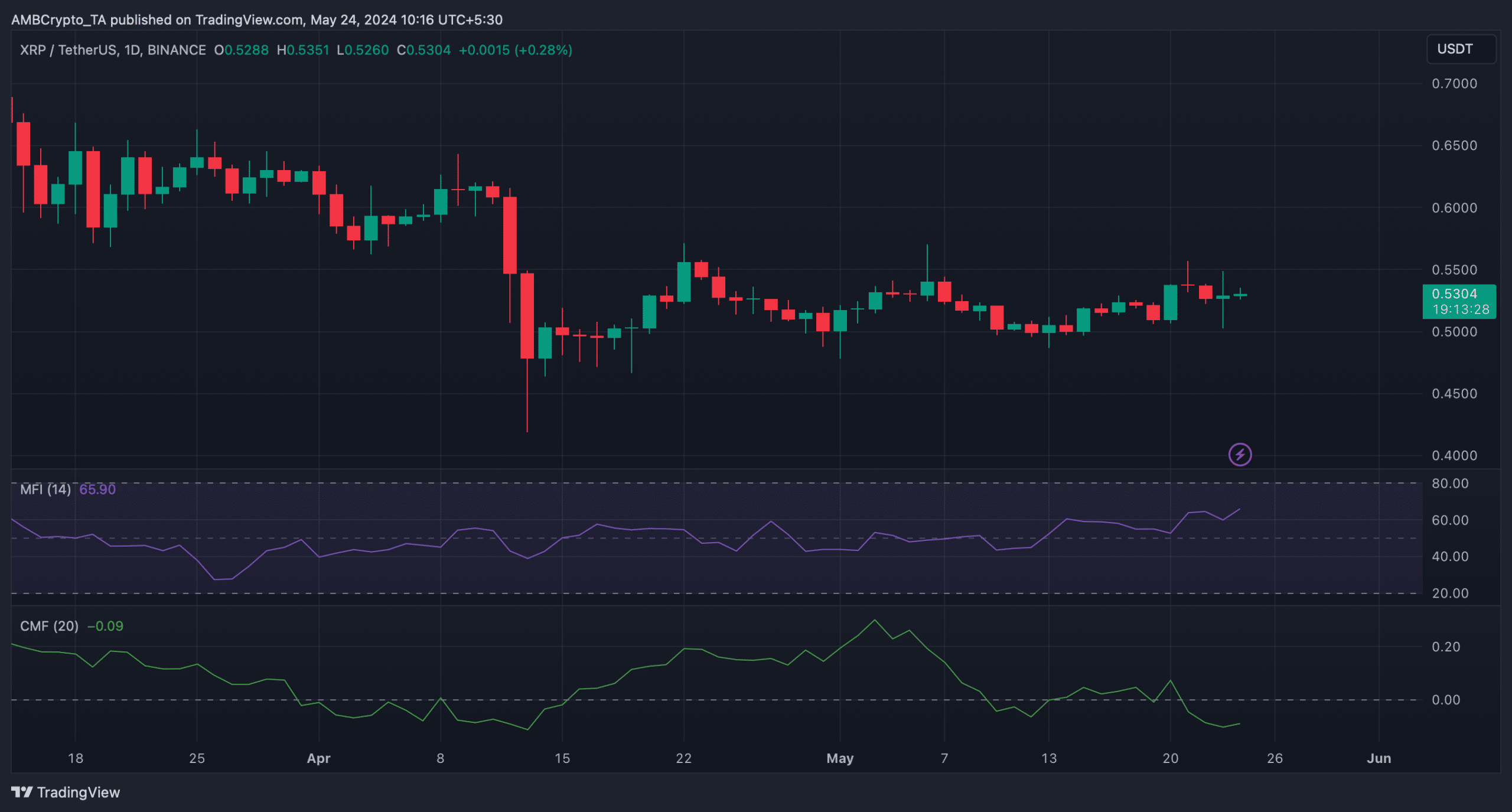

As a crypto investor, I closely monitor the market trends of various digital assets, including XRP. To assess its potential bearishness, I examined XRP’s daily chart. Notably, after experiencing a dip, XRP’s Chaikin Money Flow (CMF) indicator registered an uptick, signaling buying pressure and potentially positive price movements.

The Money Flow Index (MFI) upward trend suggests that XRP‘s price is on the rise according to this technical indicator. If this holds true, then the bearish pennant formation for XRP might not materialize and its bullish trend could persist instead.

As a researcher studying the price movements of XRP, I have observed that if this cryptocurrency continues to trend bullishly, it may first reach a price of $0.544. This is due to the fact that at this level, liquidation could potentially rise significantly. Generally speaking, high levels of liquidation are often associated with price corrections in financial markets.

If XRP follows a bearish trend, its price could potentially drop down to $0.47 within the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-05-24 13:11