- Willy Woo based his latest analysis on the VWAP Oscillator’s upward trend

- Retail investment and technical patterns seemed to support a bullish outlook too

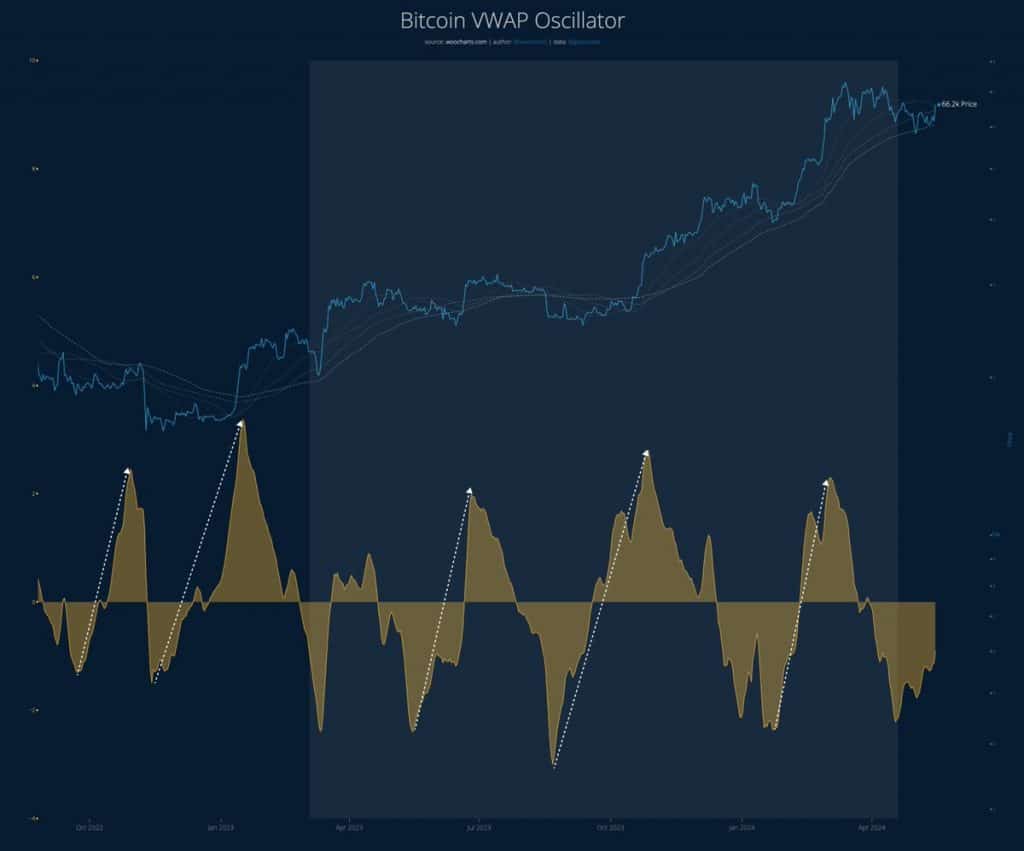

As a seasoned crypto investor with a keen interest in technical analysis, I find Willy Woo’s recent insights on Bitcoin’s price trend based on the VWAP Oscillator particularly intriguing. The upward trajectory of this indicator, as shown by the VWAP Oscillator’s increasing positivity, aligns with my own observations and adds credibility to the bullish sentiment in the market.

Bitcoin experienced a significant surge in value during the last week, registering a 4.9% increase. This upward movement is part of a larger bullish pattern that has been developing in the cryptocurrency market. Analysts are closely studying various key performance indicators to make informed predictions about Bitcoin’s future trajectory.

One analyst, specifically Willy Woo, provided insights into the Volume-Weighted Average Price (VWAP) indicator for Bitcoin and discussed the possible consequences it might have on upcoming price trends in the market.

Woo’s examination of social media platform X explored the Volume-Weighted Average Price (VWAP), a technical marker that calculates an asset’s average price while factoring in transaction volumes at each price point. By emphasizing busier trading levels, this method offers a more well-rounded perspective on price fluctuations.

Regarding Bitcoin, Woo focused on analyzing the Volume Weighted Average Price (VWAP) based on on-chain transaction data. The blockchain’s transparency ensures that this information is readily available and clear to all.

VWAP oscillator’s role in predicting Bitcoin’s path

Woo’s research centers on the Volatility Weighted Average Price (VWAP) Oscillator for Bitcoin. This financial tool calculates the difference between Bitcoin’s current market price and its VWAP, presenting their ratio in an oscillating pattern around zero.

As a crypto investor, I’ve noticed that the VWAP Oscillator, which has been displaying negative readings for several months now, is showing signs of recovery and moving upwards. If this trend persists, we might be approaching the neutral zone soon. This could potentially indicate a change in market dynamics that may impact our investment strategies.

As a crypto investor, I’ve noticed that historical data suggests a potential buying opportunity when the VWAP Oscillator emerges from the red zone and starts to trend upwards. This pattern has often been followed by a bullish market for Bitcoin. The price usually experiences significant growth until the oscillator reaches its peak in positive territory, at which point it begins to decline once more.

As an analyst, I would interpret Woo’s observation as follows: Based on the current market trend, there seems to be significant potential for further gains before a possible correction or pause takes place. This perspective poses a dilemma for investors holding bearish positions.

Retail investors and technical indicators support bullish sentiment

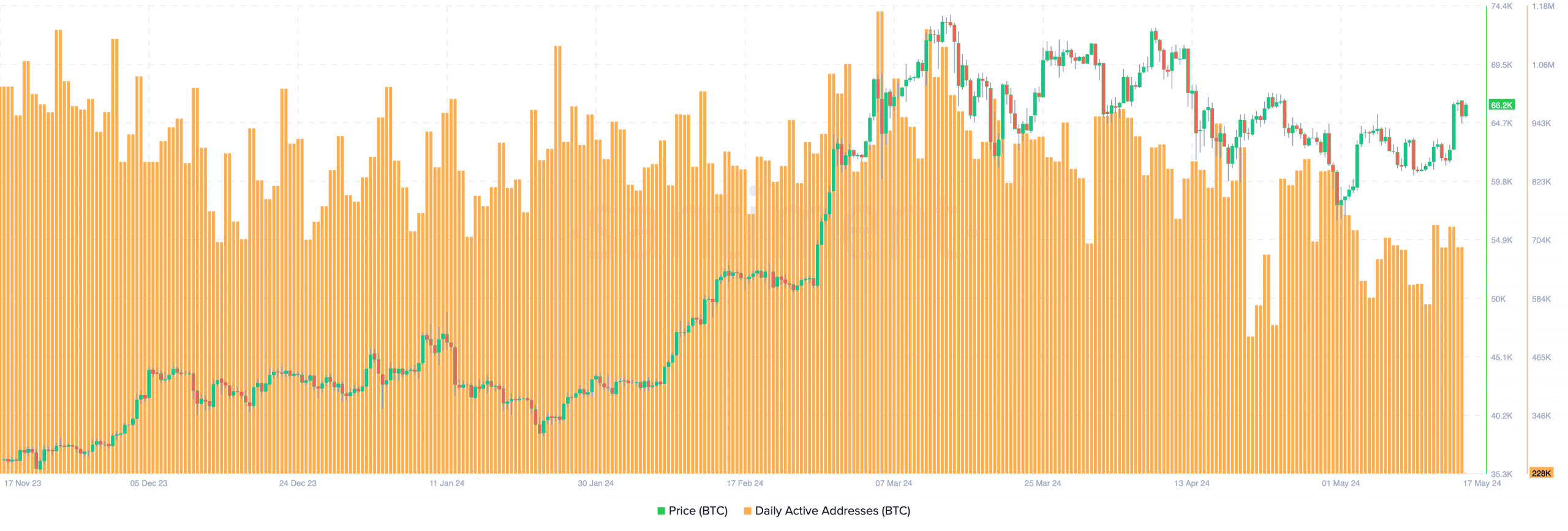

As a CryptoQuant analyst, I’ve been closely monitoring the market trends and I’d like to add some bullish insights to the conversation. Notably, there has been a noteworthy uptick in purchases made by retail investors in the Bitcoin market. Over the past month, these investors have collectively spent approximately $135.7 million on Bitcoin.

The recent purchasing frenzy corresponds with a noticeable increase in the number of daily active addresses on the Bitcoin network, according to Santiment’s statistics. This figure jumped from around 49,000 to more than 66,000 in just one day, indicating a substantial uptick in market activity.

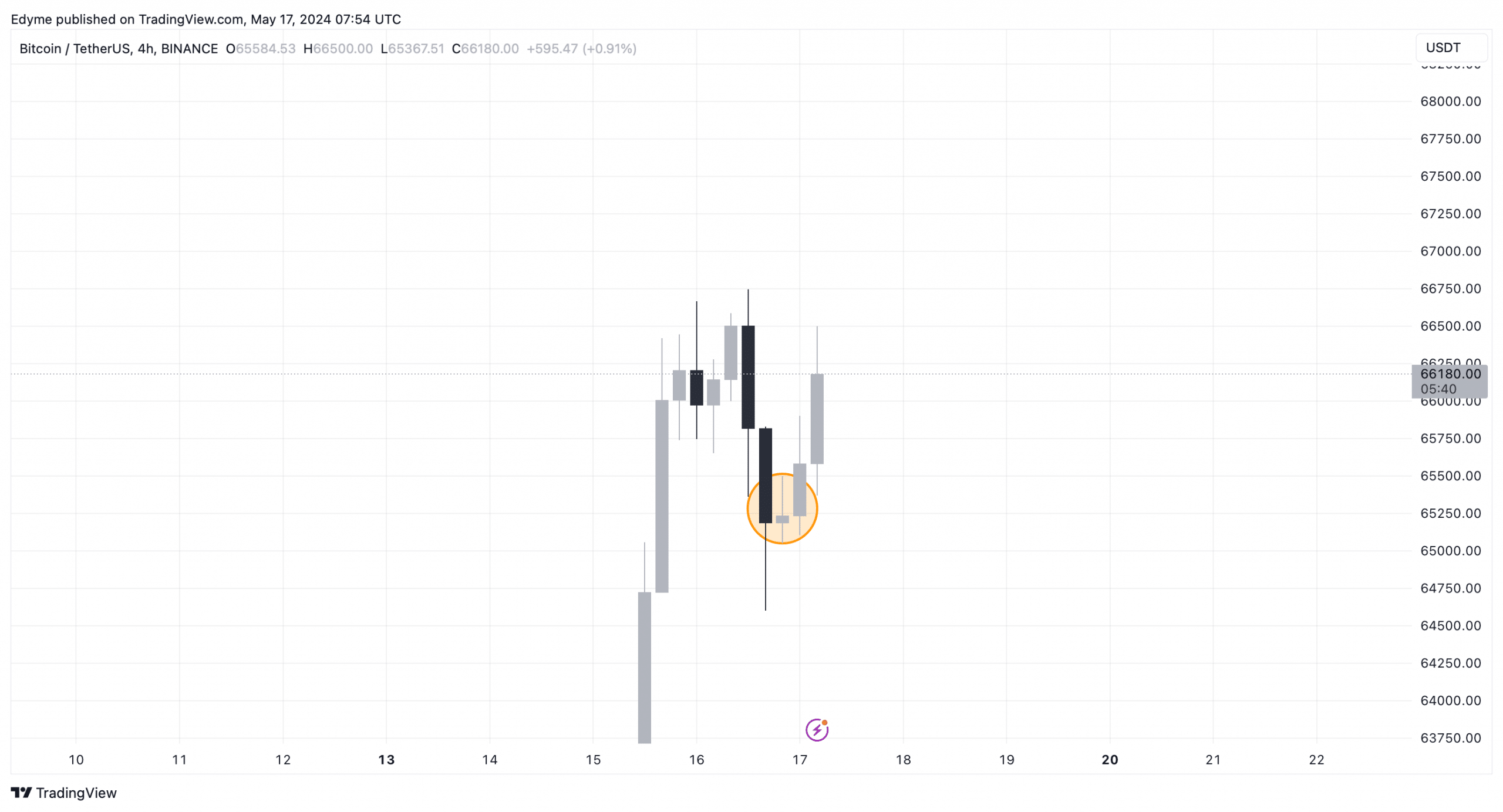

From a technical standpoint, Bitcoin’s 4-hour chart displayed encouraging signals. The emergence of a bullish abandoned baby pattern was followed by a bullish engulfing candlestick, which is an especially optimistic indication as the latter closes above its preceding candlestick.

The technical patterns align well with Woo’s forecast, suggesting that Bitcoin could be preparing for further price increases. It’s worth noting that one significant factor fueling Bitcoin’s recent bullish trend is the unexpectedly lower-than-projected 0.4% inflation rate reported by the CPI data, as previously covered by AMBCrypto.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-05-18 07:03