-

WLD lost some of its gains from its previous trading sessions

Alameda still holds over 24 million WLD tokens

As a seasoned analyst with years of experience navigating the turbulent waters of the cryptocurrency market, I can’t help but feel a sense of deja vu when observing recent developments surrounding Worldcoin (WLD). The latest move by Alameda, transferring a significant portion of WLD tokens, comes at a time when the token is already stuck in a bear trend.

Lately, Worldcoin’s graph has been pointing downwards. But it’s important to note that recent moves by Alameda might worsen things for this digital coin tied to artificial intelligence, further affecting its trajectory.

Alameda moves part of Worldcoin’s reserves

As a crypto investor, I’ve noticed a recent focus on the transfer of Worldcoin (WLD) tokens, particularly with the latest updates regarding Alameda, the trading division of the collapsed FTX. According to Lookonchain’s data, Alameda has recently moved around 205,387 WLD tokens, equivalent to roughly $352,000. This transfer has sparked some intrigue in the crypto community.

It’s noteworthy that this transaction occurred concurrently with a major judicial decision: A New York court mandated Alameda to repay $12.7 billion as part of a settlement in a lawsuit brought forth by the Commodity Futures Trading Commission (CFTC).

As a seasoned financial analyst with over two decades of experience in the industry, I find it deeply concerning to learn that FTX and Alameda are required to pay $8.7 billion in restitution and an additional $4 billion in disgorgement due to their violations of the Commodity Exchange Act. This is a significant sum of money, and given my background, I understand the potential impact this could have on the lives of many individuals affected by these actions.

Currently, as I’m typing this, it’s been disclosed that Alameda currently owns approximately 24.795 million WLD tokens, valued at around $43 million. Over the next few days, there could be an increase in the movement of these tokens.

Worldcoin stuck in a bear trend

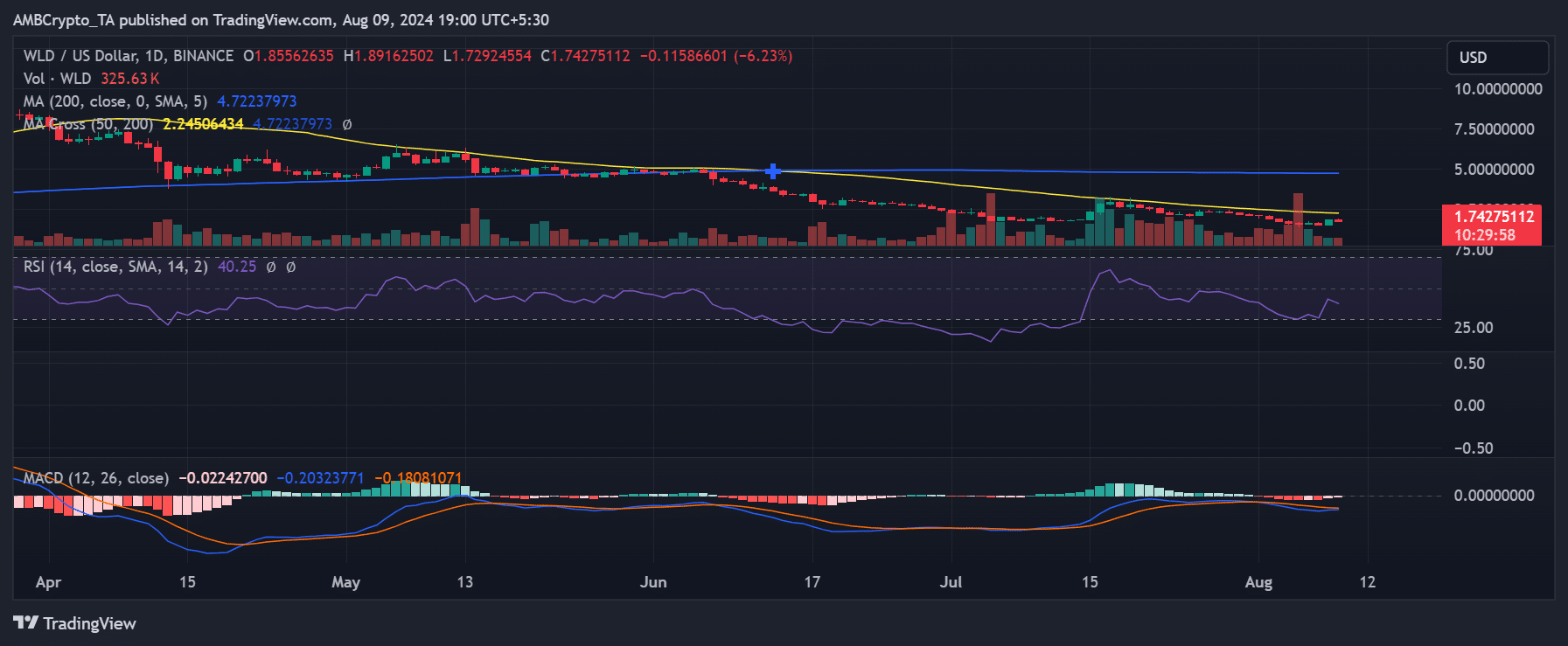

Over the past several weeks, the value of Worldcoin (WLD) has been generally decreasing. However, despite this overall decline and the recent news about Alameda, there was a significant increase in the price of WLD on August 8th.

Moreover, the trek coincided with an overall uptrend in the crypto market, as evidenced by numerous digital currencies. To be specific, based on AMBCrypto’s study, WLD experienced a gain of about 20.22%, causing its value to escalate from roughly $1.5 to $1.8.

Nevertheless, the advancements didn’t last long for Worldcoin. In fact, it has reversed some of those gains since then. Currently, it is being traded at approximately $1.7, which represents a decrease of 6.52% compared to its latest high point.

Additionally, further examination found that WLD continued to experience downward pressure, evidenced by its location beneath the non-bullish 50 level on the Relative Strength Indicator (RSI).

WLD gets dominated by shorts

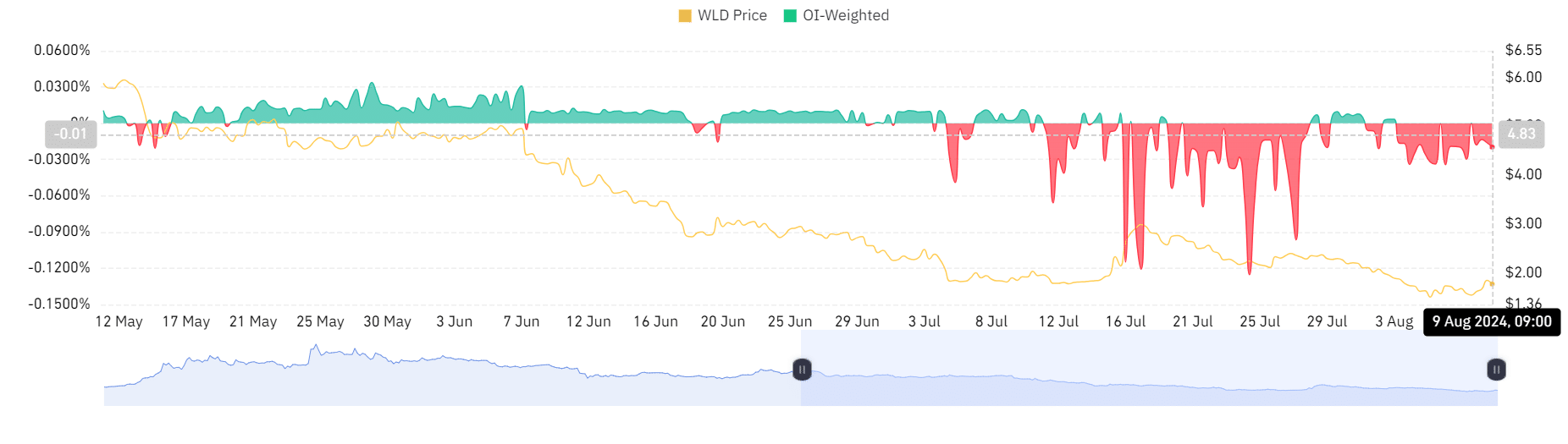

More recent data on derivatives has added weight to the downward trajectory observed in Worldcoin (WLD), particularly with regards to its funding rates.

Over the recent days, a review of data from Coinglass shows that the WLD‘s funding rate has been running at a loss, specifically -0.0197 as I am writing this.

As a seasoned investor with over a decade of experience in the financial markets, I have observed that the current market dynamics seem to favor short sellers more than long-term investors. This is due to the fact that they are being remunerated for keeping their positions open, which is a trend I’ve noticed becoming increasingly prevalent.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-10 08:08