- Worldcoin bulls finally appear to be taking over after months of hiatus.

- This resurgence could be fueled by shorts liquidations, and could be temporary.

As a seasoned researcher with years of experience in the crypto market, I have witnessed numerous bull and bear cycles. The recent resurgence of Worldcoin (WLD) has piqued my interest, especially after months of downtrend. However, my past experiences have taught me to be cautious and evaluate the situation thoroughly before making any hasty conclusions.

After a prolonged five-month decline, the demand for Worldcoin [WLD] is picking up once again.

From an initial perspective, it appears that we are witnessing the beginning of another significant rally. However, upon closer examination, there are indications suggesting a possible divergence in outcomes.

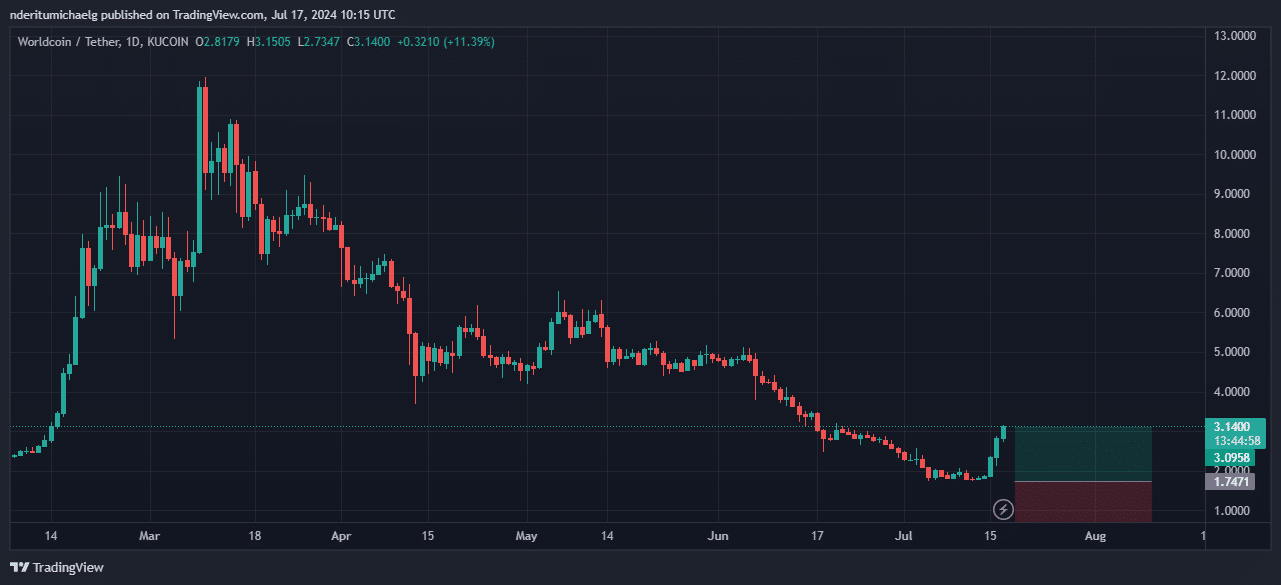

In recent days, WLD‘s price graph has soared at an extraordinary rate, shooting up from its previous low of around $1.72-$1.77. This surge was in line with the positive market sentiment that emerged among the leading cryptocurrencies, reflecting a bullish trend.

As an analyst, I can tell you that at the present moment, Worldcoin is trading at a price of $3.12 – marking a significant rebound of 77.2% from its lowest point this month.

WLD’s latest rally is not the first bullish attempt since its epic decline, which started in March.

In May, there was a prior unsuccessful effort that caused the market to experience a significant decline of approximately 89%, bringing it down from its peak reached in March 2024.

Not a typical Worldcoin rally

Initially, the worsening downside and the drop in price beneath its previous February levels indicated that the buyers’ control was weakening and a shift to bearish sentiment could ensue.

Based on my extensive experience in financial markets and having witnessed numerous market corrections throughout my career, this observation strikes me as a potential harbinger of significant short liquidations. The recent announcements, which have fueled growing bearish sentiments, may serve as the catalyst for investors to cut their losses and exit their short positions en masse. Such mass exits can lead to a self-reinforcing cycle of selling pressure that can further exacerbate market declines.

The Worldcoin Foundation made an announcement earlier this month, revealing that they have prolonged the deadline for WLD grant reservations. As a result, individuals now have the opportunity to secure tokens for an additional year.

The Worldcoin Foundation has made an additional announcement: beginning on July 17th, early contributors, team members, and investors will begin receiving access to their tokens. Previously, this access was set to start after three years, but now the timeline has been extended to five years.

Following the announcements of token unlocks, there was a significant increase in the quantity of short positions on WLD. This indicated that numerous traders anticipated the increased supply to result in a downward pressure on the price of Worldcoin.

Regrettably for the shorts, their position against WLD proved unfavorable as persistent buying pressure caused prices to climb, resulting in a squeeze.

Will WLD extend its rally?

As a researcher studying the cryptocurrency market, I would explain that the liquidation of short positions on WLD (Web3 Domain) contributed to its significant price increase. This event enhanced WLD’s upward trend, resulting in it outperforming most other major coins with considerable percentage gains.

Although the recent surge in Worldcoin’s price bears a striking resemblance to its initial parabolic growth in April 2024, it’s important to note that history does not always repeat itself. The events leading up to and following this price increase could significantly differ from what transpired then.

As a analyst, I would express it this way: Upcoming unlocks could potentially dampen investor sentiment and lead to decreased demand.

The upcoming unlocks may not result in a significant increase in the token supply.

Is your portfolio green? Check the WLD Profit Calculator

Both possibilities are plausible for Worldcoin’s future development. Consequently, we will closely monitor its progress to determine which scenario unfolds.

Should WLD‘s rally persist, it’s likely that resistance will emerge around the $4.75 mark, as this price point has historically been significant.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-07-18 06:16