- The Worldcoin structure and momentum were on the sellers’ side in the 1-day timeframe

- The short-term gains were more of a respite than a recovery due to lack of demand

Worldcoin (WLD) revealed plans for the upcoming Layer 2 solution, Worldchain, slated to debut this summer. The WLD token will have a function and be used for transaction fees in conjunction with Ethereum [ETH].

The announcement caused prices to rise slightly, but it didn’t reverse the overall decline that WLD has been experiencing for an extended period.

The first step will be a move beyond $7.48, but are the bulls strong enough to achieve this?

The WLD indicators and price action both showcase one direction forward

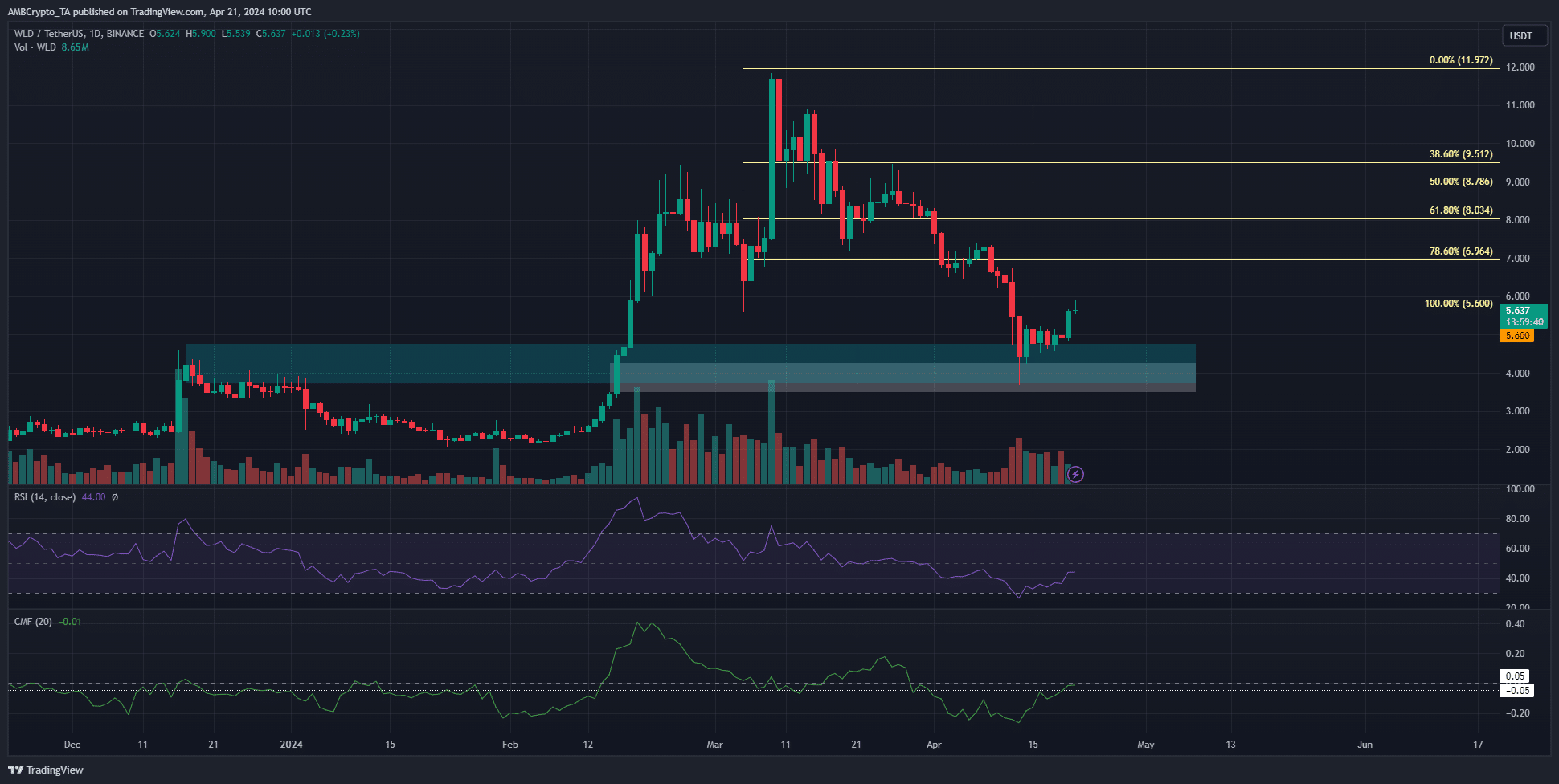

The Fibonacci lines in pale yellow indicated that the recent pullback’s low of $5.6 was lower than the previous decline’s bottom.

On April 13th, the price broke through the resistance level (bullish breaker block in cyan) of $3.7 to $4.2, which was also the price gap representing fair value (white).

After hitting a low point on that day, WLD‘s price has surged by 52%. However, its one-day chart displayed a clear bearish trend.

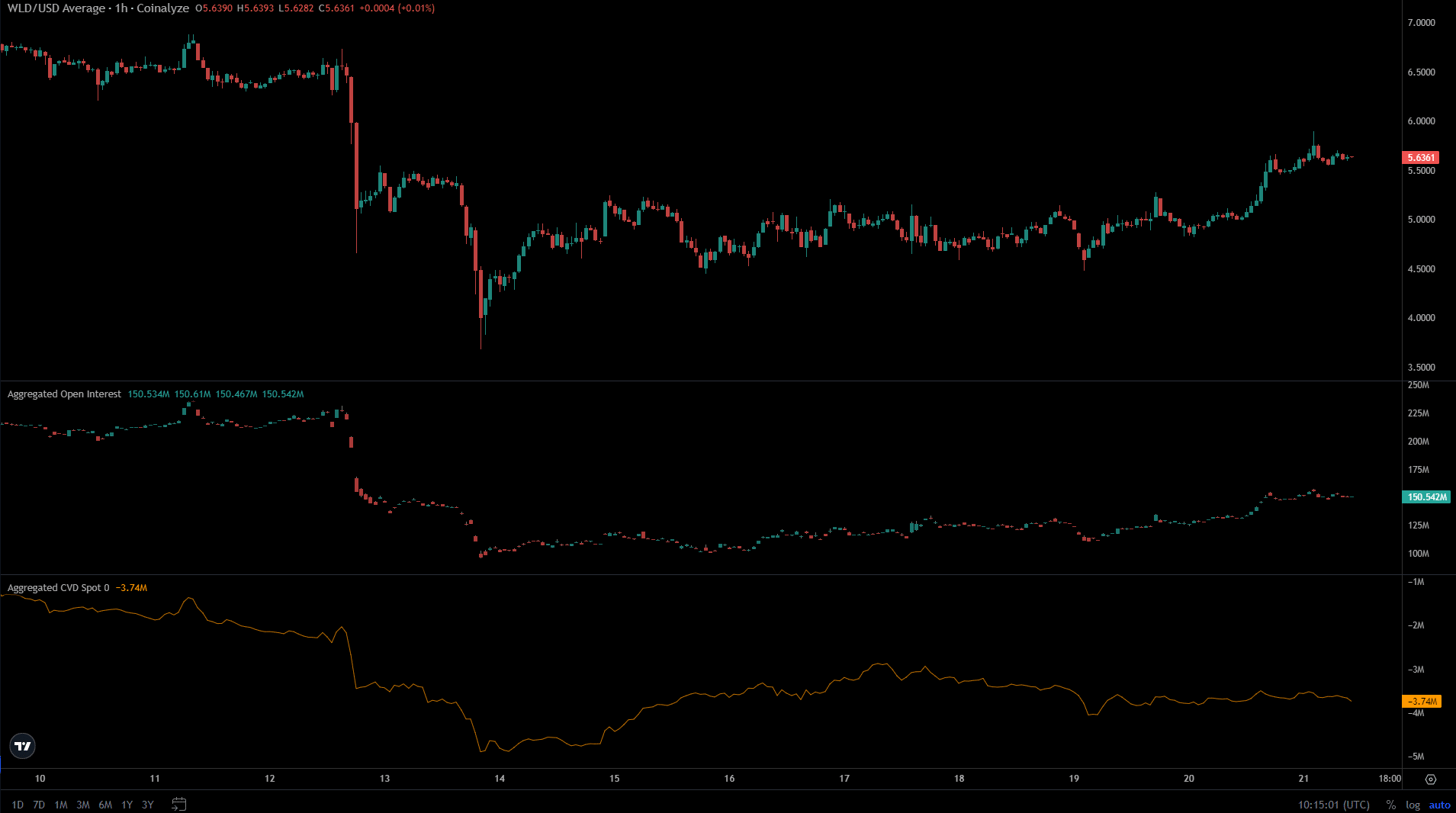

On the shorter time frames, defending the $5.4-$5.5 range was crucial for buyers to maintain their optimistic outlook in the near term.

The daily chart’s Common Moving Average (CMA) stood at a value of -0.01. This indicated that buying demand was still weak and suggested that price increases were unlikely to occur soon.

In a comparable manner, the RSI remained under the 50-mark, indicating that the bearish trend’s momentum persisted even with the price recovery.

The short-term market sentiment was tiptoeing toward bullish

Over the last several days, there has been a significant increase in Open Interest, with a jump of more than $50 million between April 15th and 21st.

This showed speculators were willing to bid WLD and believed in its upward momentum.

Read Worldcoin’s [WLD] Price Prediction 2024-25

In contrast, the demand for CVD in the spot market experienced a slight increase between the 14th and 17th of this month. However, over the past four days leading up to now, there has been a decline in demand in the spot market.

Hence, WLD’s short-term bullish enthusiasm might meet an early end.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-04-21 21:11