- Worldcoin risks losing a key support level that has so far prevented a deeper fall.

- Certain developments could mitigate additional losses.

As a seasoned crypto investor with battle scars from countless market cycles, I can’t help but feel a sense of déjà vu when looking at Worldcoin [WLD]. The consistent downtrend and approaching support level have all too familiar ring to them.

Over the past month, Worldcoin [WLD] has consistently declined, losing 11.70% of its value.

On a daily basis, this downward trend persists, causing a decline of 5.74%. This suggests that bears have firm control, making it more probable that we’ll see further decreases.

AMBCrypto discusses the potential impacts of the present market pattern and offers insights about possible future developments for cryptocurrencies.

A drop to September lows?

As a researcher, I’m observing that Worldline Digital (WLD) is approaching a significant support level where its price has historically increased. Yet, this time around, it appears that the situation might unfold differently.

Lately, the value of the asset experienced a substantial decrease following an obstacle at around $2.398, causing it to drop by approximately 5.78%. It’s possible that the asset (WLD) might recover from its support level, but there’s also a chance it could continue falling further.

Should this situation unfold, it means a further drop of approximately 41.88% for WLD, plunging it back to the September low of $1.284 that I had seen earlier.

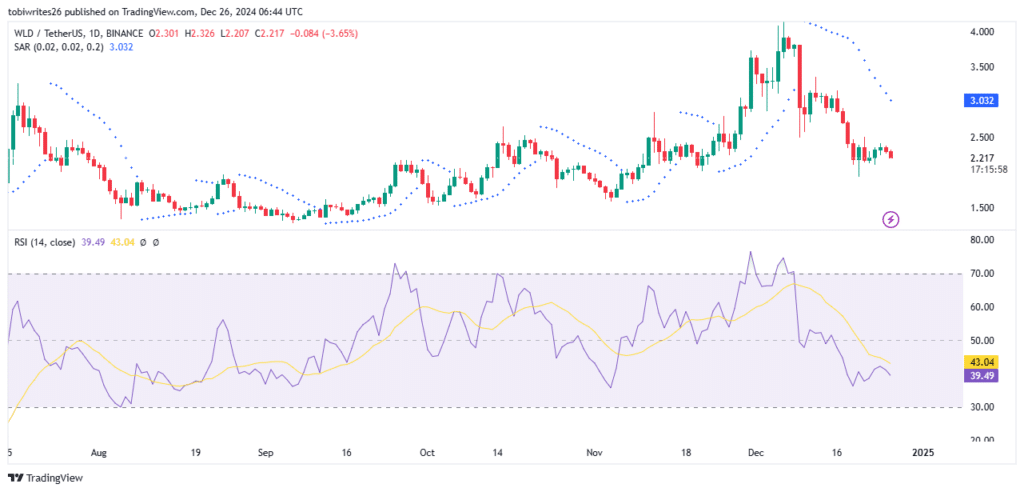

Based on certain technical analysis tools like the Parabolic Stop and Reverse (PSAR) and the Relative Strength Index (RSI), it seems that additional price drops could be imminent.

At present, the Parabolic SAR (Sarahan Oscillator), a tool that measures market feelings by placing marks above or below price points (indicating sell or buy respectively), shows a bearish outlook as the dots are found above the current price levels. This situation exerts a downward influence on the market.

In similar fashion, the Relative Strength Index (RSI), which gauges market sentiment by scoring it from 0 to 100 with numbers below 50 indicating heavy selling activity and figures above 50 pointing towards buyer interest, currently stands at 39.49. This low value suggests a dominant bearish trend, implying that the price of WLD might continue to decrease.

Contract closure increases

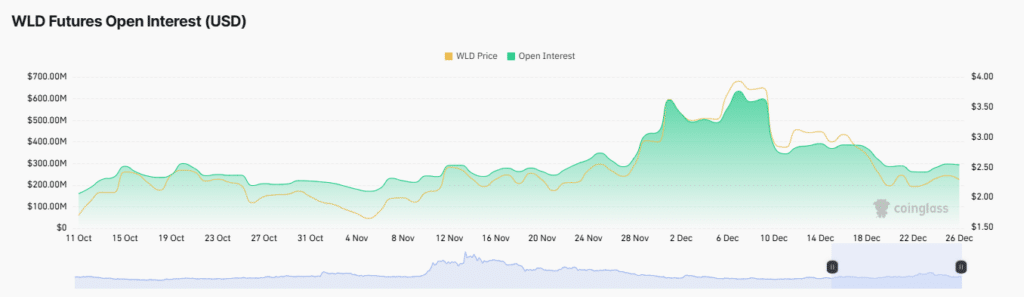

The level of open interest, representing the count of unresolved derivative agreements in the market, suggests that negative market feelings are growing stronger.

The amount of Open Interest decreased by 4.52%, now standing at $286 million, hinting that market players are wrapping up their positions. Furthermore, a significant decrease of 17.97% in trading volume to $431 million indicates that bears have substantial control, increasing the possibility of additional price drops.

Based on the current data, it appears that WLD might approach its September minimum levels. Yet, additional examination indicates that a potential drop could be postponed.

Will development activity sustain WLD?

According to Chain Broker’s latest rankings, the innovative Worldcoin project, which uses WLD as its currency, has shown a significant surge in development activity. Over the last month, this activity has skyrocketed by an impressive 240%, placing it among the leading projects, just behind others such as Arbitrum.

Read Worldcoin’s [WLD] Price Prediction 2025–2026

An increase in construction or progress usually indicates continuous efforts being made to better the entire project, resulting in an experience that is generally more favorable.

As a researcher, I am observing a trend that suggests a potential delay in Worldwide Luxury Devices’ (WLD) impending price decrease, prior to any further downward movement. This could mean that the anticipated price drop might be postponed for some time, given the current trajectory of this trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-26 19:35