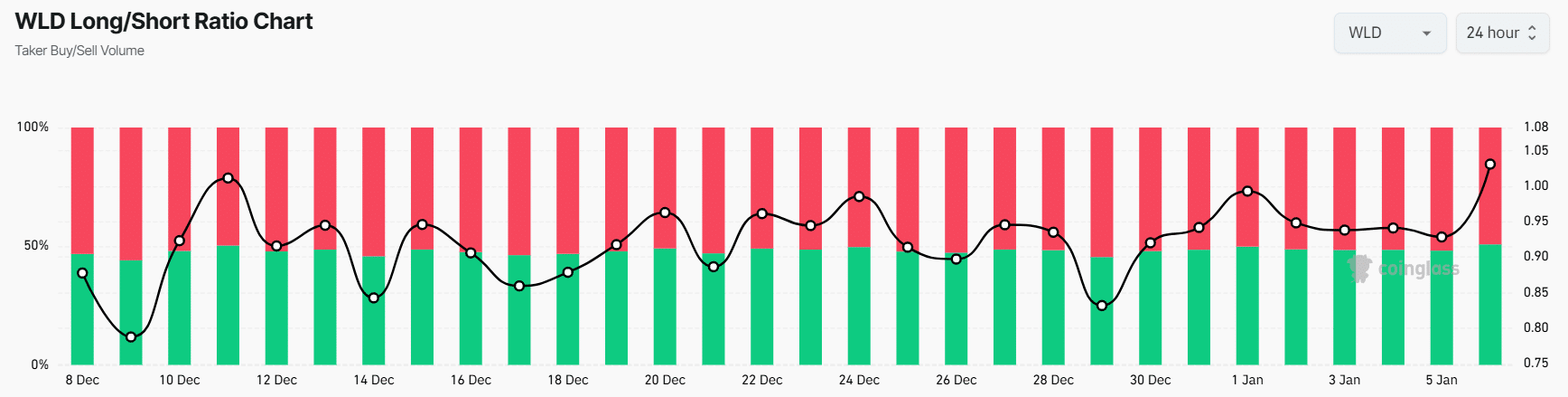

- WLD’s long/short ratio stood at 1.03, indicating strong bullish sentiment among traders.

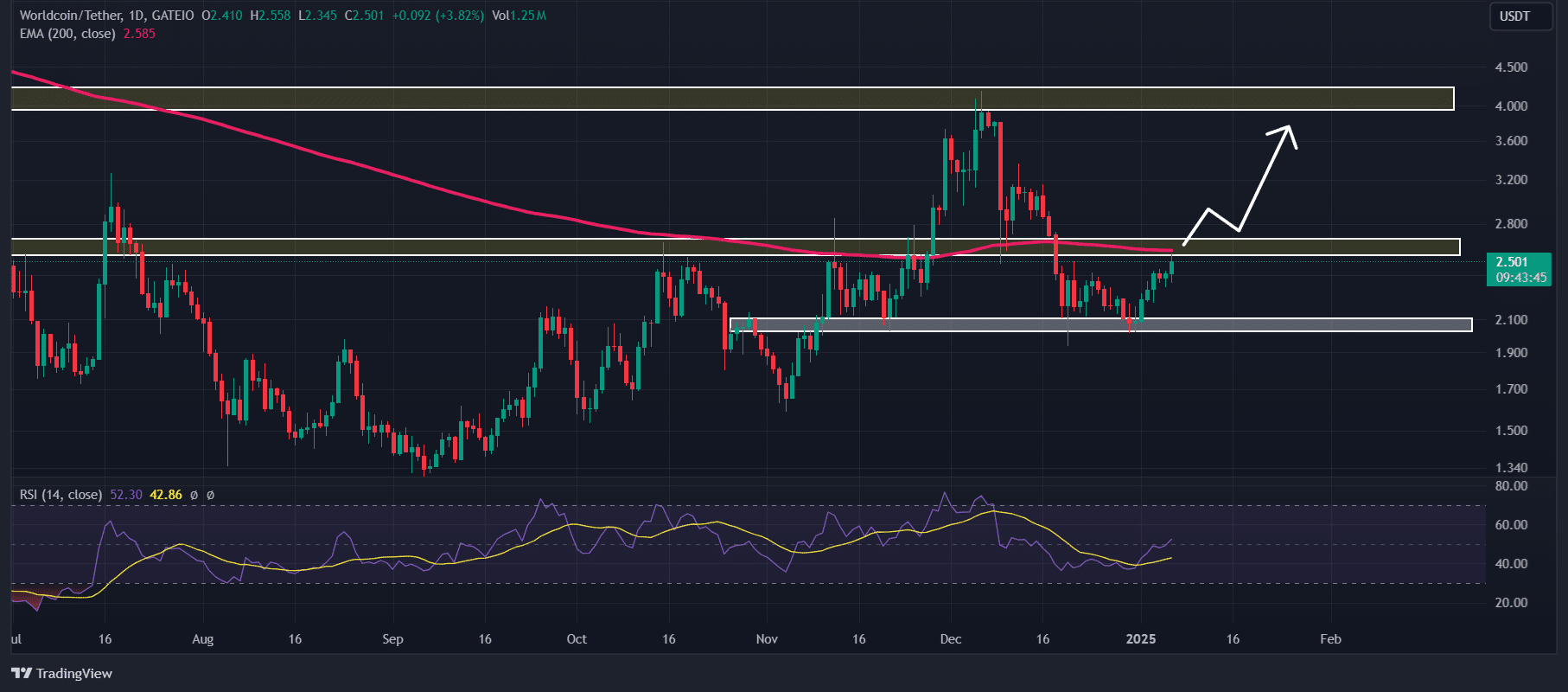

- WLD could soar by 60% to hit the $4.22 level if it closes a daily candle above the $2.70-level

At the current moment, it seems that the price of Worldcoin’s native token, WLD, may drop as a result of its upcoming token release, which is expected to take place between January 5th and January 12th. Interestingly, a popular social media platform focused on blockchain technology has recently shared on X (previously known as Twitter) that Worldcoin plans to unlock approximately 37.23 million WLD tokens, valued at around $90.09 million.

Will WLD’s price fall?

Release of this unlock could lead to increased selling activity because it introduces a significant portion (around 4.5%) of the current total supply into the market. Previous occurrences of similar token releases have typically resulted in selling pressure and periods of price decline, as shown by past data.

WLD’s current price momentum

At the moment, the general feeling about the crypto market is somewhat puzzling. While Bitcoin (BTC) appears to be surging forward with strong upward momentum, many other digital currencies seem to be experiencing difficulties.

Despite the chaos, WLD showed no signs of being affected, instead rising by a impressive 7.5% over the past 24 hours as reported at the time of press. Moreover, this significant price increase seems to have caught the attention of traders and investors, causing a substantial 85% increase in trading activity, according to CoinMarketCap.

Bullish on-chain metrics

Based on data from the analysis firm Coinglass, it appears that short-term traders are becoming increasingly hopeful about this price rise. Over the past day, there has been an increase in positions held by these traders, as indicated by a 27% rise in WLD’s Open Interest.

In simpler terms, the balance between long and short trades in the WLD market was slightly tilted towards buying (long positions), with a ratio of 1.03. This suggests that most traders are optimistic about the market’s growth, as they are more inclined to buy rather than sell (short). Specifically, approximately 51.5% of leading traders are holding long positions, while around 48.5% are holding short positions.

WLD technical analysis and key levels

Based on AMBCrypto’s technical assessment, it appears that the WLD price encountered a barrier at approximately $2.55, which is a flat resistance level, and also at the 200 Exponential Moving Average (EMA) on the daily chart. The price has been having difficulty surpassing this obstacle to sustain its upward trend.

Given the current trend in its pricing, if World Acceptance (WLD) manages to surpass the resistance at $2.70 and close a daily candle above this point, there’s a strong likelihood that it could experience a 60% increase, potentially reaching the $4.22 mark in the near future.

As I’m typing this, WLD’s Relative Strength Index (RSI) is significantly lower than the overbought zone, indicating that there is potential for the token to continue its upward trend in the near future.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-01-07 10:15