- Worldcoin noted high capital outflows in recent months, leading to an 81% price drop.

- A price bounce of 9%-10% could commence on the 19th of August.

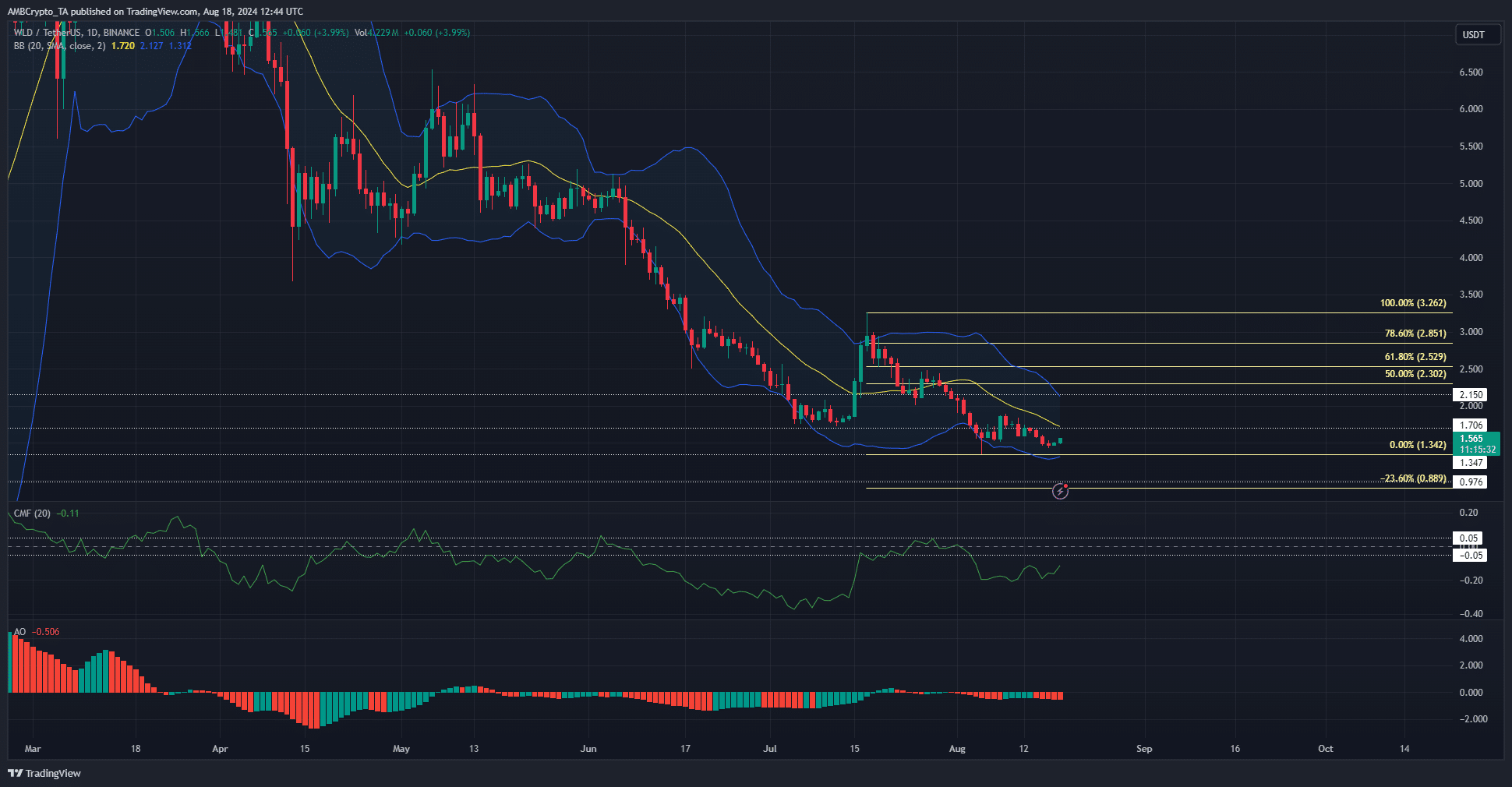

As a seasoned researcher with a keen eye for market trends and an even keener sense of humor, I must say that Worldcoin [WLD] is currently in a precarious position. The recent price drop of 81% has left many investors scratching their heads and wondering where the bottom might be.

Recently, the value of Worldcoin (WLD) has been on a steady decline and shows no signs of abating just yet. An earlier report indicated that Alameda continues to hold approximately 24 million Worldcoin tokens.

This added concerns of selling pressure in the future.

It appears the steep declines in prices aren’t about to stop soon. Could you elaborate on the potential future price targets and the estimated timeline for the bulls to consider resuming their long positions?

The $1.7 is a confluence of resistance

The cost was less than the 20-day moving average, signaling a decline in momentum. This 20-day moving average coincided with the $1.7 level, a point that functioned as support back in early July.

The Awesome Oscillator reflected bearish momentum as well.

The CMF was even more negative and has not stayed above +0.05 for multiple days since March.

Over a span of approximately five months, Worldcoin experienced a significant drop in value, going from $8.3 down to $1.565. This represents an 81% decrease in its worth.

The projected Fibonacci extension level at approximately $0.89 could serve as the next potential bearish goal, but it’s also plausible for the price to rebound to around $1.7 or $2.15 prior to reaching that point.

Clues from Worldcoin’s liquidity level

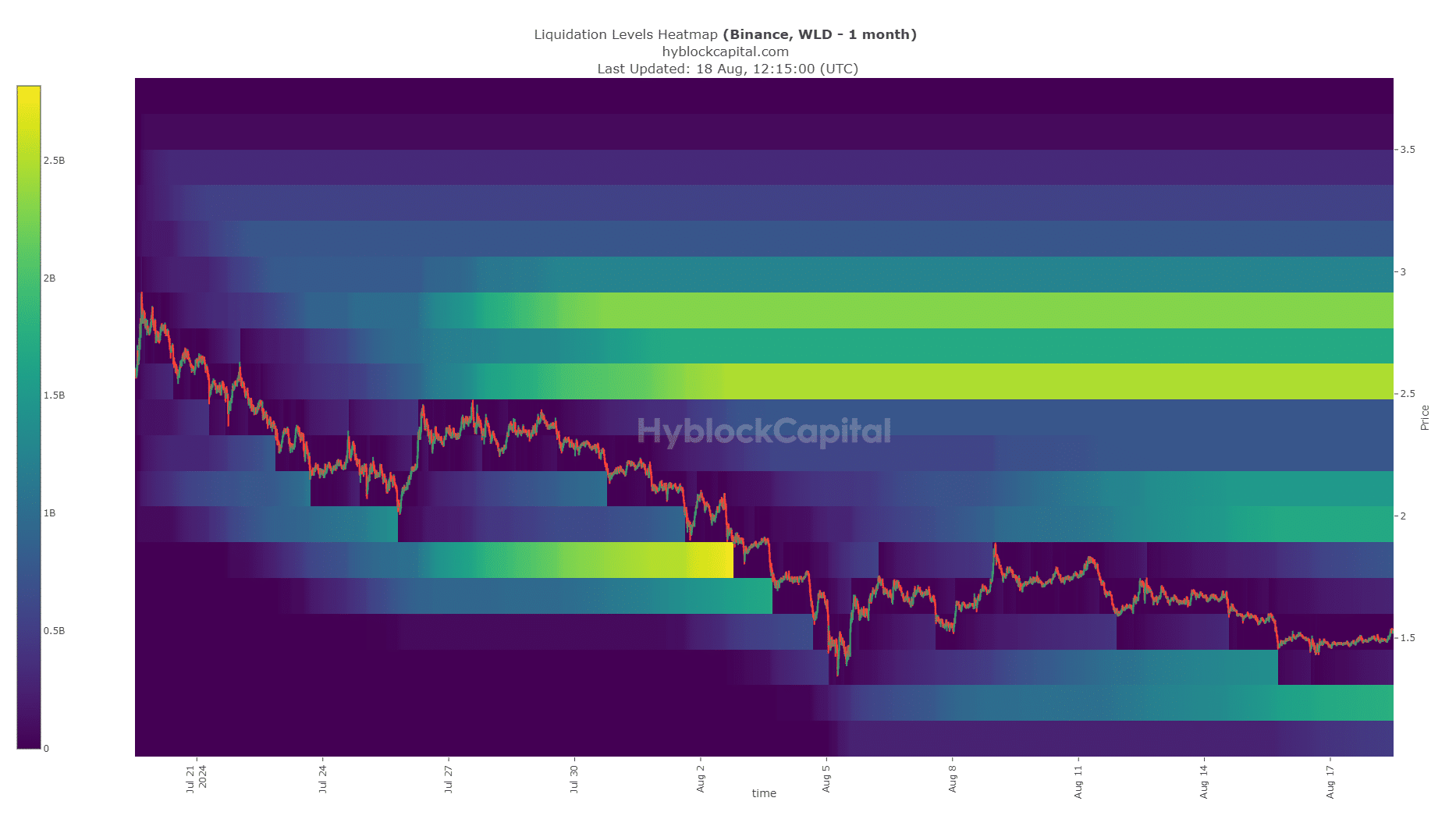

The $1.96-$2.11 was a large liquidity cluster above the current market price. To the south, the $1.22 was a region where Worldcoin bullish reversal might occur.

Based on the technical analysis, the indicators suggested a strong bearish trend, implying a higher probability of the price dipping towards $1.22. A potential precursor to this could be a brief uptick in prices.

Realistic or not, here’s WLD’s market cap in BTC’s terms

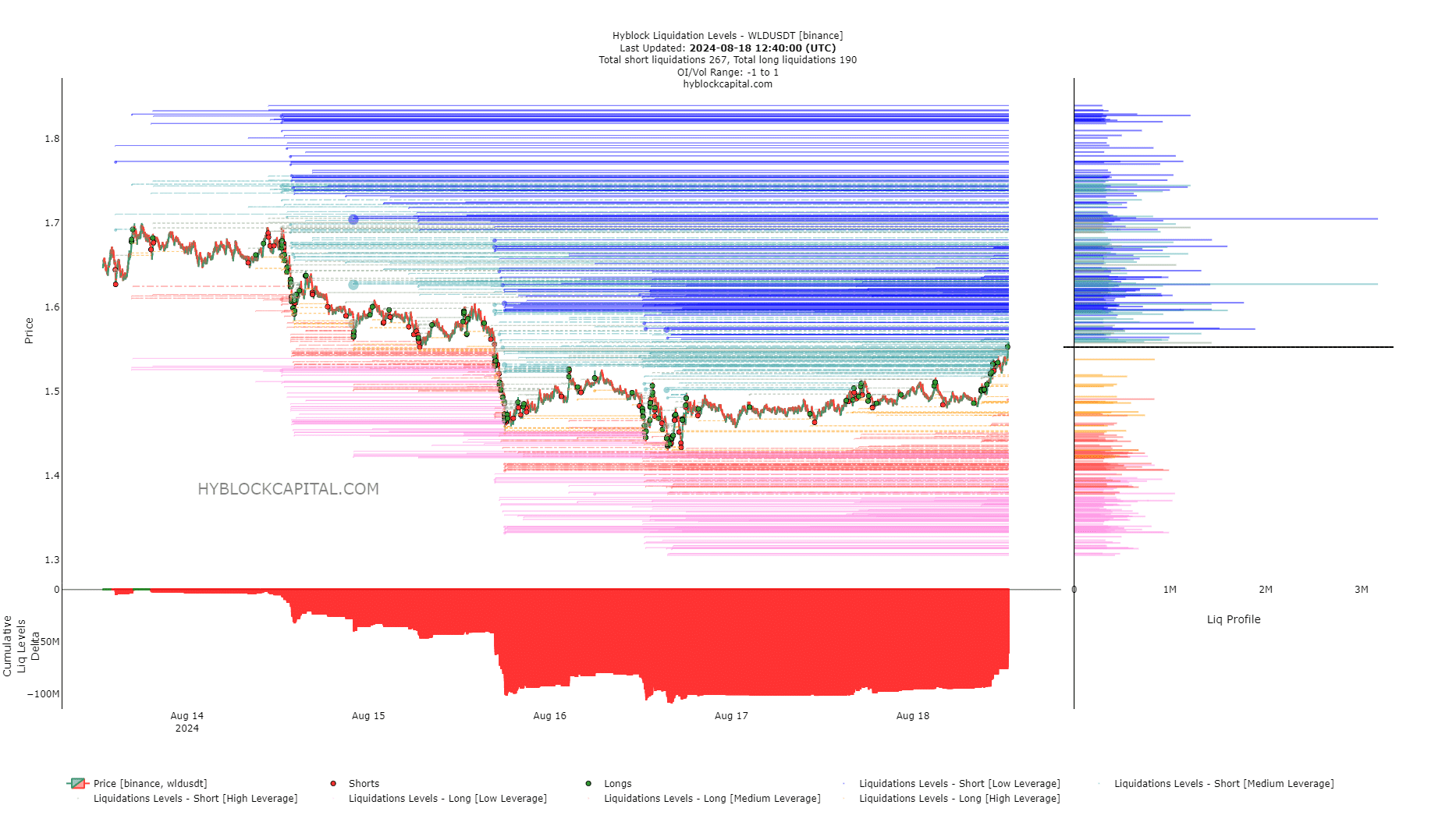

The liq levels delta was highly negative, showing that Worldcoin is likely but not guaranteed to bounce higher to balance this out. The largest liquidity pools overhead were at $1.62 and $1.7.

Consequently, it might be advantageous for short-sellers to be patient and look for a price rebound to these levels, followed by entering short positions, aiming to realize their profits near the $1.22 region.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-08-19 10:15