-

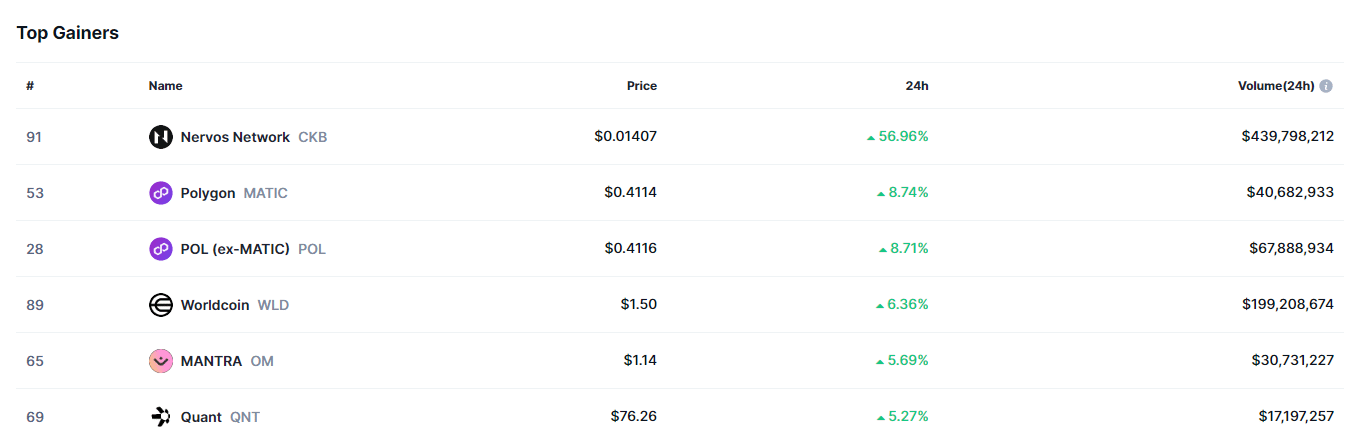

WLD among the top-gaining crypto assets in the market after appreciating by 6.36%

Data suggested that WLD may be ready to climb to $1.89, but under one condition

As a seasoned crypto investor with a knack for spotting trends and analyzing market movements, I’ve seen my fair share of bull runs and bear markets. The recent surge in Worldcoin (WLD) has certainly piqued my interest. With its impressive 6.36% gain in the last 24 hours, WLD is marching towards a potential recovery from its monthly losses.

Worldcoin (WLD) has shown remarkable strength, posting significant day-to-day and week-to-week increases in its chart performance. Yet, it’s worth noting that over the past month, it has experienced a decrease of 9.69%.

If the rally continues, Worldwide Limited (WLD) could possibly regain its monthly losses. Reaching this point might take it back to a trading level similar to what was seen in August.

Price, volume surges indicate that WLD is bullish

For the past day, WLD has surpassed many other assets as per CoinMarketCap’s data. Specifically, it experienced a growth of 6.36%, earning it the 4th spot on the list of top performers.

This growth was accompanied by a significant 99.59% surge in trading volume, totaling $199,208,674.

Increased levels of both trading activity and cost usually indicate robust investor enthusiasm and a positive outlook. In this case, it seems that investors are confident about the future potential of WLD, which could influence the altcoin’s desirability and subsequent pricing.

AMBCrypto also noted another additional positive development for WLD, one that can help it rally.

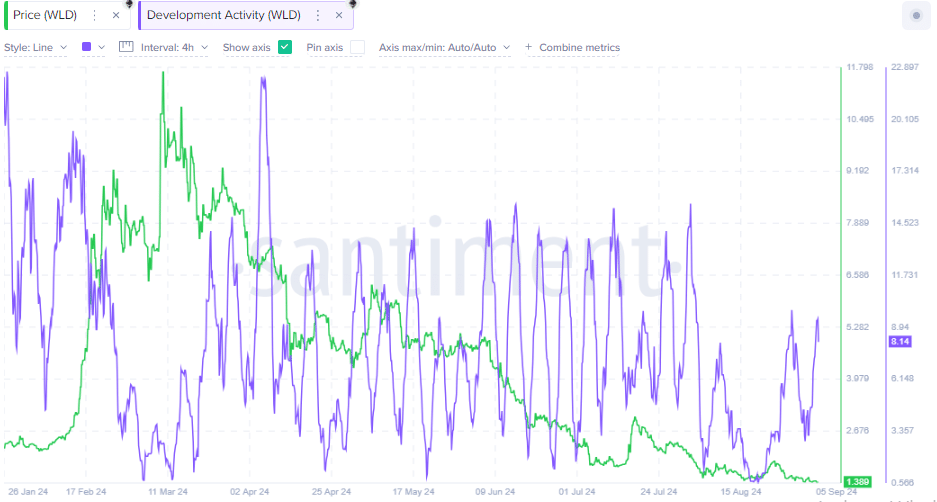

Development activity on WLD skyrockets

According to data from Santiment, there’s been a massive 4960% increase in development activity related to WLD during the past 30 days.

An increase in project development indicates a positive outlook for the token, as it shows the team is actively addressing problems and adding new functionalities to the project.

As a crypto investor, I can say that these improvements significantly boost my trust in the token, prompting me to make more purchases. This increased buying activity, in turn, tends to positively impact the token’s price.

Furthermore, it’s worth noting a significant increase in Open Interest, which is a measure indicating the level of investor involvement with the asset.

According to data from Coinglass, there was a 17.31% increase in Open Interest for the WLD token. This suggests that retail investors are showing increased interest in keeping the token rather than offloading it.

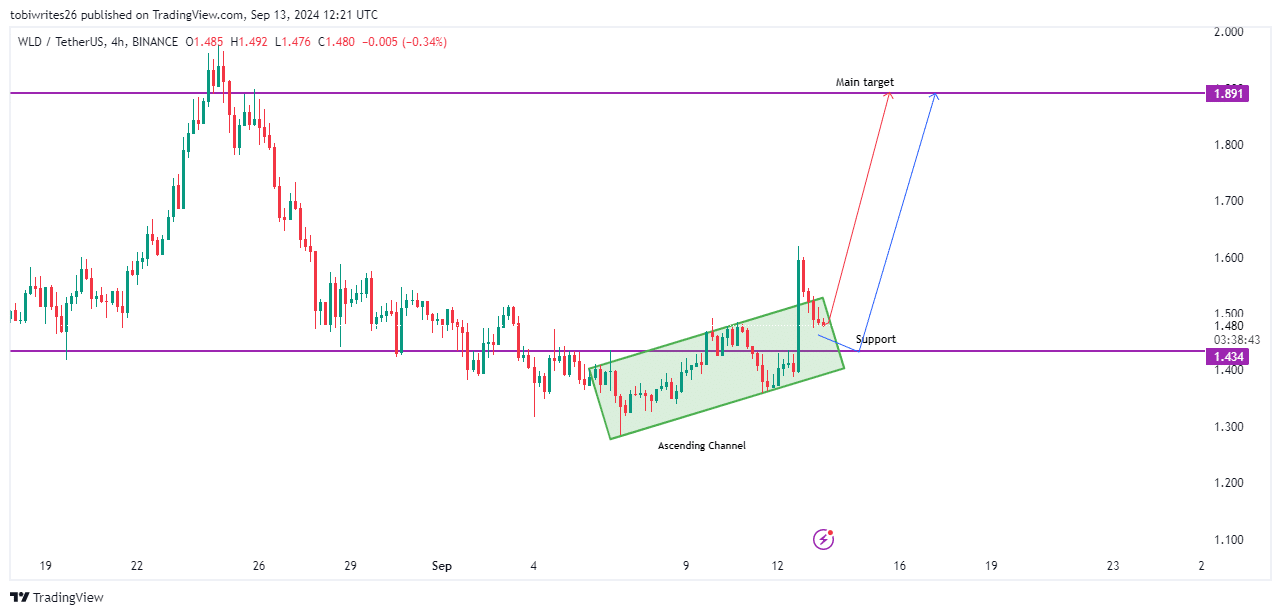

Technical analysis provides conditions and targets for WLD

Technically speaking, WLD has just burst through an upward trendline (ascending channel), but currently, it’s moving back (retracing) at the present moment.

This pattern often signals a downtrend, implying that the breakout might be misleading. Additionally, it appears to suggest a high likelihood of reversal, moving back into the channel, followed by a drop in price.

Despite this, prevailing market developments might present two potential scenarios for a rally –

The cost may change direction from its present level and reach the primary goal of $1.891. Alternatively, it could first decline to the support level at $1.434 and then increase towards $1.891.

If the price drops beneath this support point, it’s probable that WLD will keep moving downward, reaching the base of the rising trendline (ascending channel).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-14 03:03