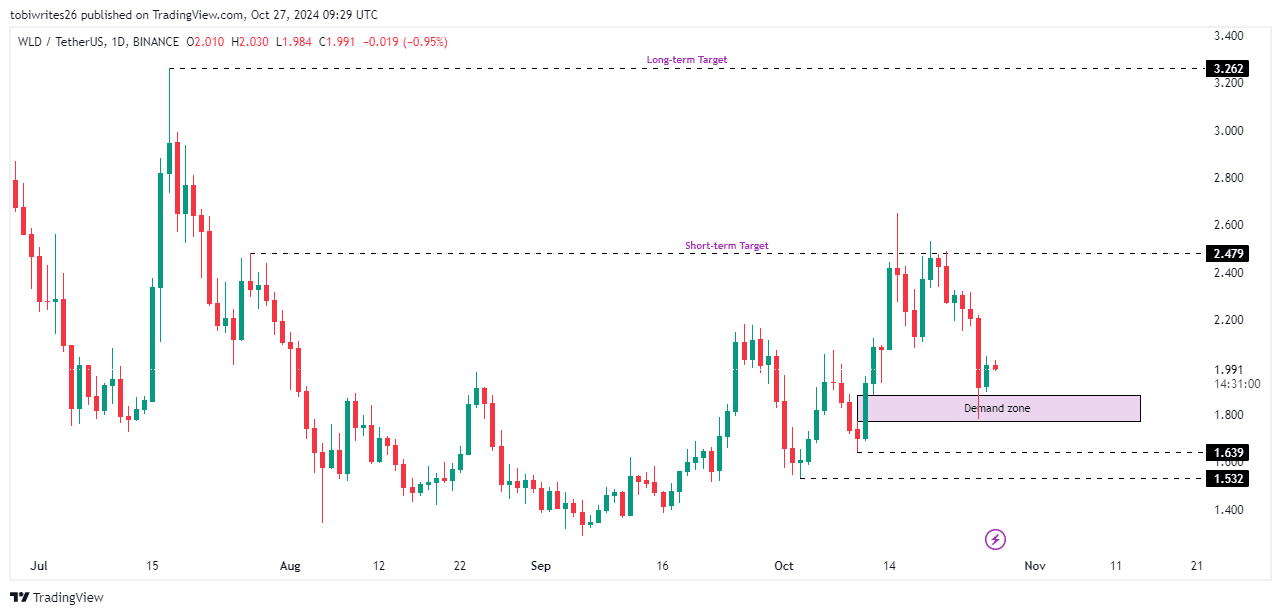

- The asset has recently rebounded from a key demand zone, a move that could help fuel its upward trajectory.

- Despite a prevailing bullish sentiment, one indicator suggested this rally may face some resistance.

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find myself cautiously optimistic about Worldcoin [WLD]. The recent rebound from a key demand zone is indeed promising, and if enough buying pressure builds, WLD could potentially reach its short-term target of $2.479.

Worldcoin (WLD) has faced challenging times due to bearish trends, losing approximately 16.01% over the past week and currently trading at $1.99 as of press time. Nevertheless, there have been hints of market recovery, suggesting potential benefits for WLD. Already, when it entered a bullish phase, WLD has experienced an uptick of 0.17%, according to CoinMarketCap.

WLD takes first bullish step in new rally attempt

After dipping into an area with strong demand, WLD has started a possible upward trend, as indicated by the appearance of a green candle followed by another one being formed now.

As a researcher studying the price movement of WLD, I’ve identified a potential demand zone ranging from approximately $1.880 to $1.720. If substantial buying pressure materializes within this range, it could propel WLD towards a short-term target of around $2.479. On a longer timeline, my analysis suggests a more ambitious goal of $3.262 for WLD.

If Worldcoin can’t maintain its current position, there’s a possibility that the price could fall back into the $1 range. Key support levels it might encounter on this descent are around $1.693 and $1.532.

Based on AMBCrypto’s examination, there seems to be a predominant optimistic outlook among traders, favoring a price increase.

WLD’s rally remains a matter of time

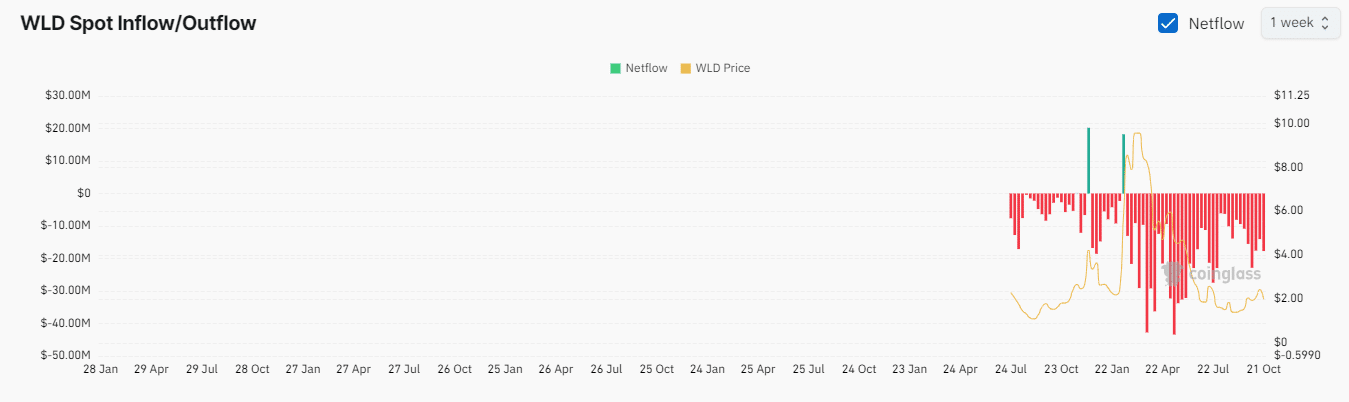

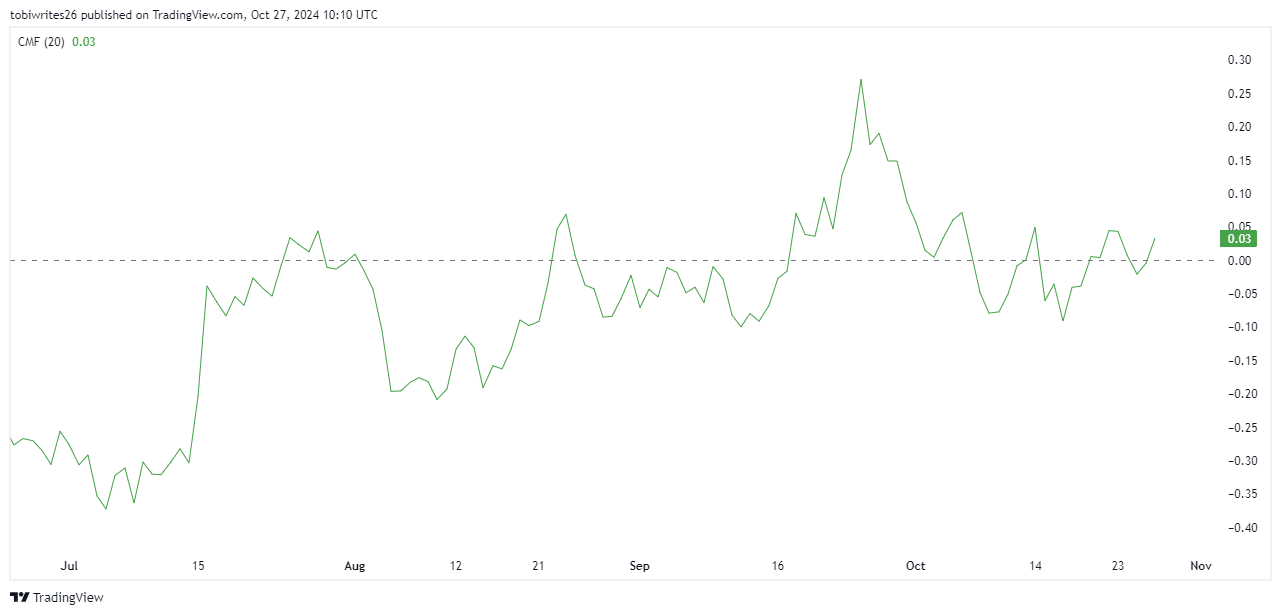

Several indicators on the blockchain suggested that World Love Decentralized (WLD) might experience a substantial price rise. At present, Exchange Netflow and Chaikin Money Flow are showing positive patterns, which could be encouraging for potential investors.

As per Coinglass, Netflow for WLD has primarily shown a downward trend over the past 24 hours and the last week. In the recent 24-hour period and the previous seven days, there have been significant outflows from exchanges amounting to approximately $602,620 and $17,880,000 respectively.

The negative exchange data flow indicates that more Worldcoins were withdrawn from exchanges than deposited, suggesting growing trader trust. This situation might trigger a price surge since there would be fewer Worldcoin assets available for trading.

As an analyst, I observed a fascinating trend with the Chaikin Money Flow (CMF). Although notable outflows were detected, it’s important to note that simultaneous active buying of WLD was also apparent. This suggests a balance between liquidity withdrawals and inflow, which could potentially indicate market interest in WLD despite temporary outflows.

If the current pattern persists, we can expect the need for WLD to grow significantly. As the stock decreases and traders look to profit from the shrinking supply, it won’t be long before there’s a significant increase in value.

Slight delay in the rally

It looks like WLD’s rally might be postponed slightly. Although there’s been growing enthusiasm for the asset and signs of progress, the data on short positions indicates it’s not as favorable as we’d hoped.

Realistic or not, here’s WLD market cap in BTC’s terms

Currently, as a crypto investor, I’m observing that long liquidations have accumulated to a substantial $496,770, whereas short liquidations stand at a much lower $139,110. This suggests that the market is still generally bullish, but the current losses in long positions might delay a significant price surge upward, indicating a potential pause in the bull run.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-28 03:03