-

Worldcoin (WLD) faced pressure from Alameda Research’s ongoing sell-offs, affecting its price

Most WLD holders (79%) were “out of the money,” indicating bearish sentiment

As a seasoned researcher who has navigated through countless bull and bear markets, I must admit that the current situation with Worldcoin (WLD) presents a unique challenge. The recent sell-offs by Alameda Research have undeniably added fuel to the fire, causing a significant drop in its price and raising concerns among investors about its long-term viability.

Recently, Worldcoin (WLD) has been making waves in the crypto world, gathering strong positive sentiment and recording impressive double-digit increases.

Yet, the undertaking that combines AI and cryptocurrency, is currently encountering hurdles due to continuous selling actions by Alameda Research.

Alameda Research fuels selling pressure

It was disclosed through blockchain analysis that Alameda Research, a prominent figure in the market, has been offloading its WLD assets. This action led to a significant decrease of almost 5% in the token’s value over the course of just one day.

Based on data from CoinMarketCap, Worldcoin experienced a decrease of 5.20% in its value over the past day and was priced at approximately $1.72 on trading platforms. This drop has caused some unease among investors about the coin’s potential future success.

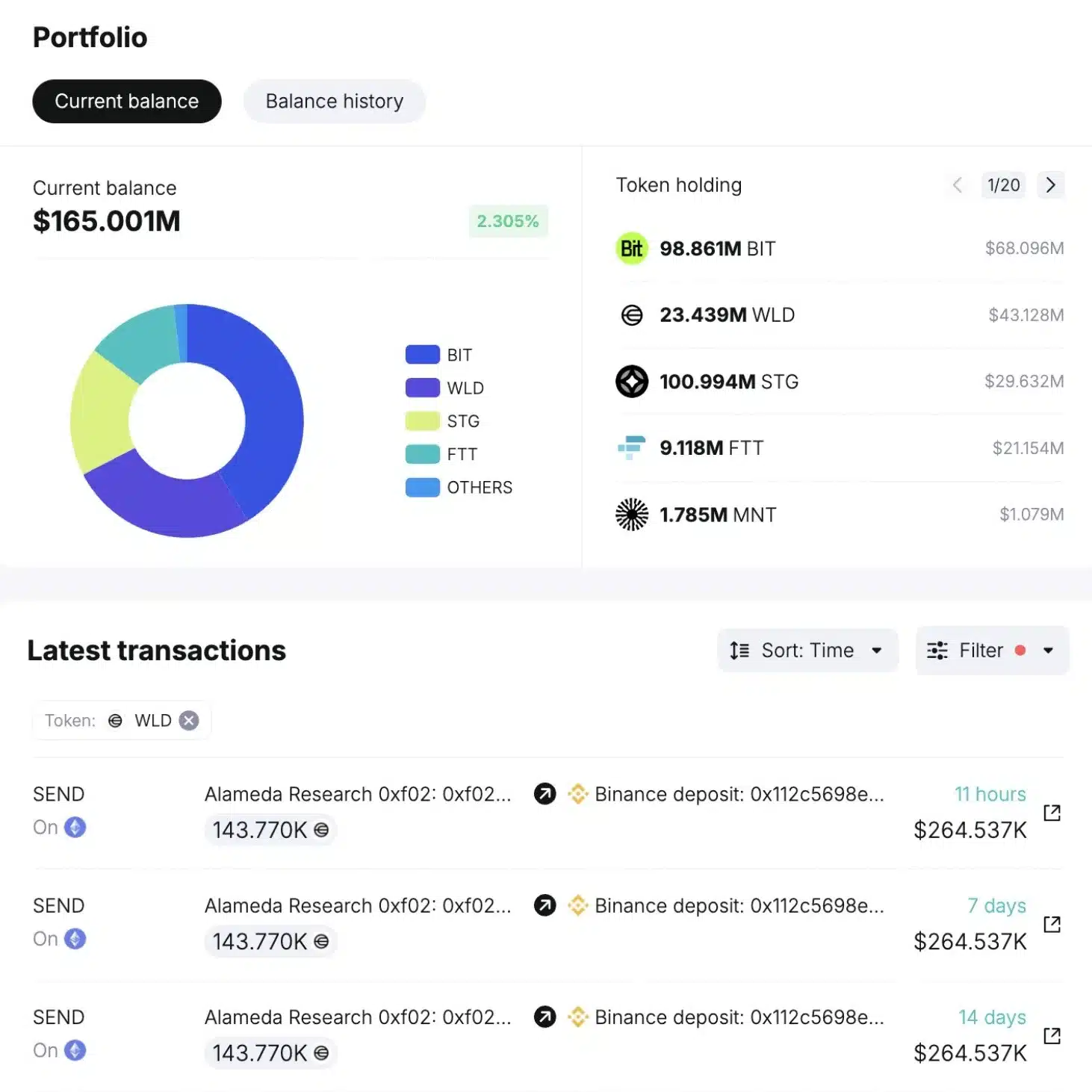

The series of events can be attributed to the fact that a digital wallet connected to the now-defunct FTX exchange and its sister firm, Alameda Research, has been observed moving significant amounts of WLD (Waves Dollar or Wrapped Litecoin).

What’s more?

For context, over the past two months, Alameda Research’s on-chain wallet has moved an impressive 1.56 million WLD tokens to Binance, executing ten separate transactions at an average price of approximately $1.605.

Through this recent sale, approximately $2.51 million has been raised, which seems to be set aside for the forthcoming repayment of FTX clients and creditors. Given that the bankruptcy estate is getting ready to make these payments.

Following the approval of a repayment plan in the FTX bankruptcy court, Alameda Research’s digital wallet is presently transferring 143,770 Worldcoin coins at bi-weekly intervals.

Confirming the same, John J. Ray III, the current CEO of FTX noted,

Moving forward, I am eagerly anticipating our ability to fully reimburse all non-governmental creditors not only their initial bankruptcy claims but also any accrued interest. This task, if accomplished, will make history as the largest and most intricate distribution of assets from a bankruptcy estate ever undertaken by us.

Speaking of which, should FTX and Alameda persist in their refund approach, it might result in more substantial altcoin movements to prominent platforms such as Binance and OKX.

As a crypto investor, I’m excited about the recent sale of Worldcoin to Binance, which has increased my holdings to 23.44 million WLD tokens in Alameda’s wallet. Based on the current rate of liquidation and data from SpotOnChain, it looks like it could take around three years for me to sell off all these tokens at the present pace.

What do on-chain metrics say?

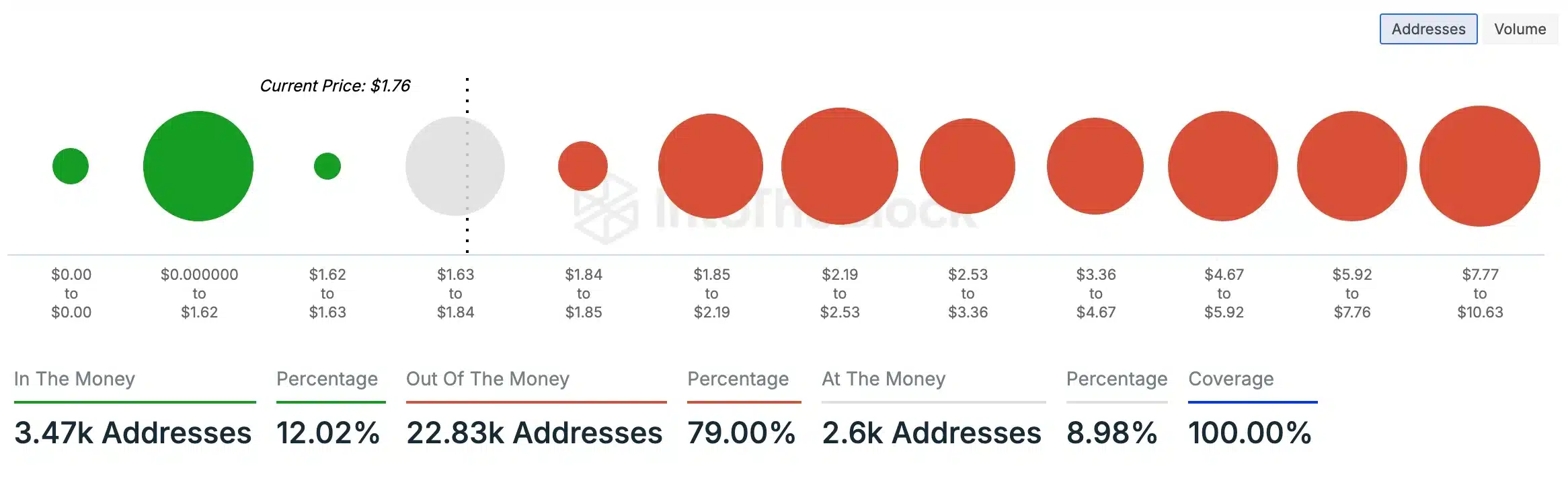

To strengthen the assumption about selling pressure, AMBCrypto scrutinized IntoTheBlock data and discovered that an overwhelming majority (around 79%) of WLD token owners possessed tokens whose worth was less than what they initially paid for them at the current moment, which suggests that these holders are “underwater.

Conversely, a smaller portion (around 12.02%) of the total held WLD tokens which had a value greater than what was paid for them, positioning these tokens as profitable or “in-the-money.

This pointed to bearish sentiment or an ongoing price drop for Worldcoin, thanks to Alameda Research.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-11 12:41