Ah, the delightful drama of Worldcoin. Having gallivanted above $2.20 like an overzealous bull in the spring of this very year, it soon found itself dancing back to Earth with a rather *sharp* plummet, slipping like a clumsy dancer into the comforting arms of the Fibonacci retracement territory. Now, it has at least found a somewhat stable footing above the all-important support zone-like a tightrope walker just a little too nervous to move forward but too proud to step back. The question, my dear reader, is: will it rally again, or is this just another temporary pause in an endless game of “catch me if you can” with fate?

While the most recent bounce suggests some hope, a faint whisper of a potential bullish reversal, the technical signals, alas, remain as confusing as a Russian novel-full of intricate details and not a single clear answer. The market finds itself at a crossroads, like a character caught between the path of glory and that of inevitable doom. It’s a moment of great uncertainty.

Riding the SMA9 After Fibonacci Rebound

Our trusty observer, LongTermR, has pointed out that WLD has begun to “ride the SMA9” after bouncing from the sacred Fibonacci retracement box. Yes, *that* box-marked in green, of course, because green is the color of growth, vitality, and optimism, right? It’s in this mystical region that buyers have come back to the scene, like long-lost lovers returning to their old haunts after a hiatus. This is where, after the painful correction from the summer highs, support has been formed and defended, like soldiers guarding their sacred fortress.

Earlier this year, WLD soared above $2.20, only to suffer a significant correction, retreating back to the $1.00-$1.10 range. Alas, the Fibonacci retracement zone became a safe haven for eager buyers, once more defending their beloved support structure as if it were a treasure chest from which they could never part. Now, with the 9-day Simple Moving Average (SMA9) trending upward, it serves as a protective line-one that momentum traders hold dear as a beacon of potential glory. Can this upward trend continue, or is this simply a fleeting moment in the story?

For those with the courage to follow trends, this setup is like a tantalizing morsel dangling before their eyes: a support structure fortified by both Fibonacci magic and a rising SMA9. But, let’s not get carried away just yet-one must move decisively above near-term resistance to truly believe that a new bullish era is upon us. Until then, it’s all rather speculative, isn’t it?

Market Data Reflects Resilient Price Action

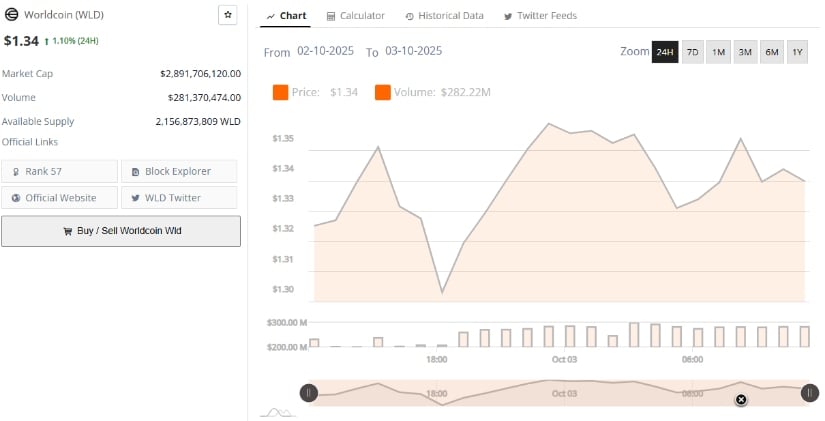

And now, for the numbers, because what would any financial tale be without them? Worldcoin is currently priced at $1.34, a modest 1.10% increase in the last 24 hours. Not an earth-shattering rise, but a rise nonetheless. With a market capitalization of $2.89 billion and daily trading volumes of $281.3 million, it’s clear that traders are engaging, even if not in a feverish frenzy. It’s a steady relationship, not one of wild passion, but still, a relationship, nonetheless.

With 2.15 billion tokens in circulation, WLD ranks a respectable 57th by market capitalization. It’s not the leader of the pack, but it’s certainly not bringing up the rear either. While it’s far from its 2025 highs, its rebound from the September lows is a testament to resilience. There’s interest, both from retail traders and the institutional elite, who seem to be waiting for the next big move. As always, the question is: will it hold this ground, or will it slip back into the shadows of uncertainty?

Technical Indicators Point to Cautious Consolidation

On TradingView, WLD/USDT is trading at a mere $1.352, a drop of 0.15% in the last 24 hours. A minor decline, to be sure, but it reveals a key point: the price action has narrowed, as if it’s waiting, holding its breath before the inevitable breakout. It’s like a plot twist in a Tolstoy novel-no one quite knows where it will lead, but it’s bound to be dramatic.

The Chaikin Money Flow (CMF) indicator, at -0.12, indicates that outflows are slightly dominating, a small negative sign. It’s like a tug-of-war between the bulls and bears, with the bears just barely ahead. The CMF’s negative reading suggests that selling pressure still lingers, a quiet, persistent reminder that we’re not out of the woods just yet. Meanwhile, the MACD shows a slight positive divergence, but nothing to write home about. The momentum is cooling, and until the bulls come charging in with renewed vigor, consolidation seems to be the name of the game.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Mini Review: Milano’s Odd Job Collection (PS5) – A Quirky PS1 Time Capsule Reopened

- Escape From Tarkov 1.0 Must Reward Its Players, or Lose Them

2025-10-03 23:01