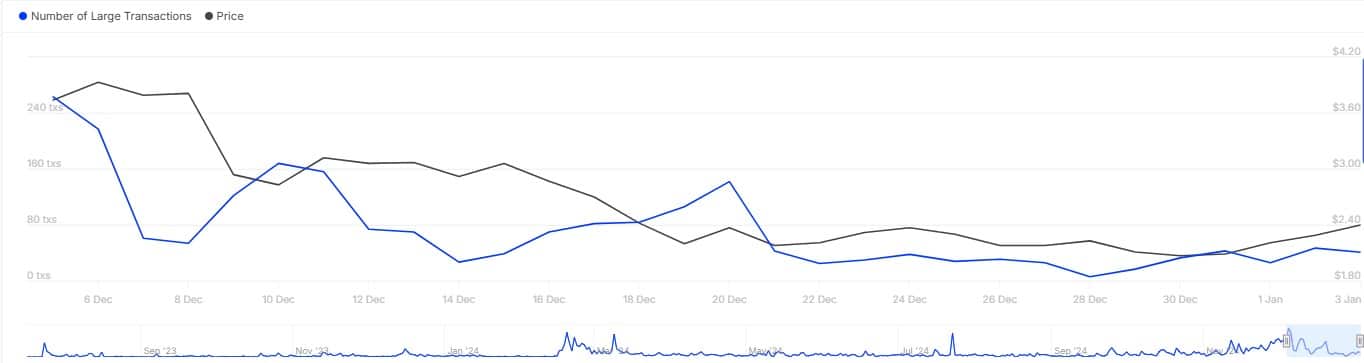

- Worldcoin’s large transactions dipped by 74% over the last 24 hours.

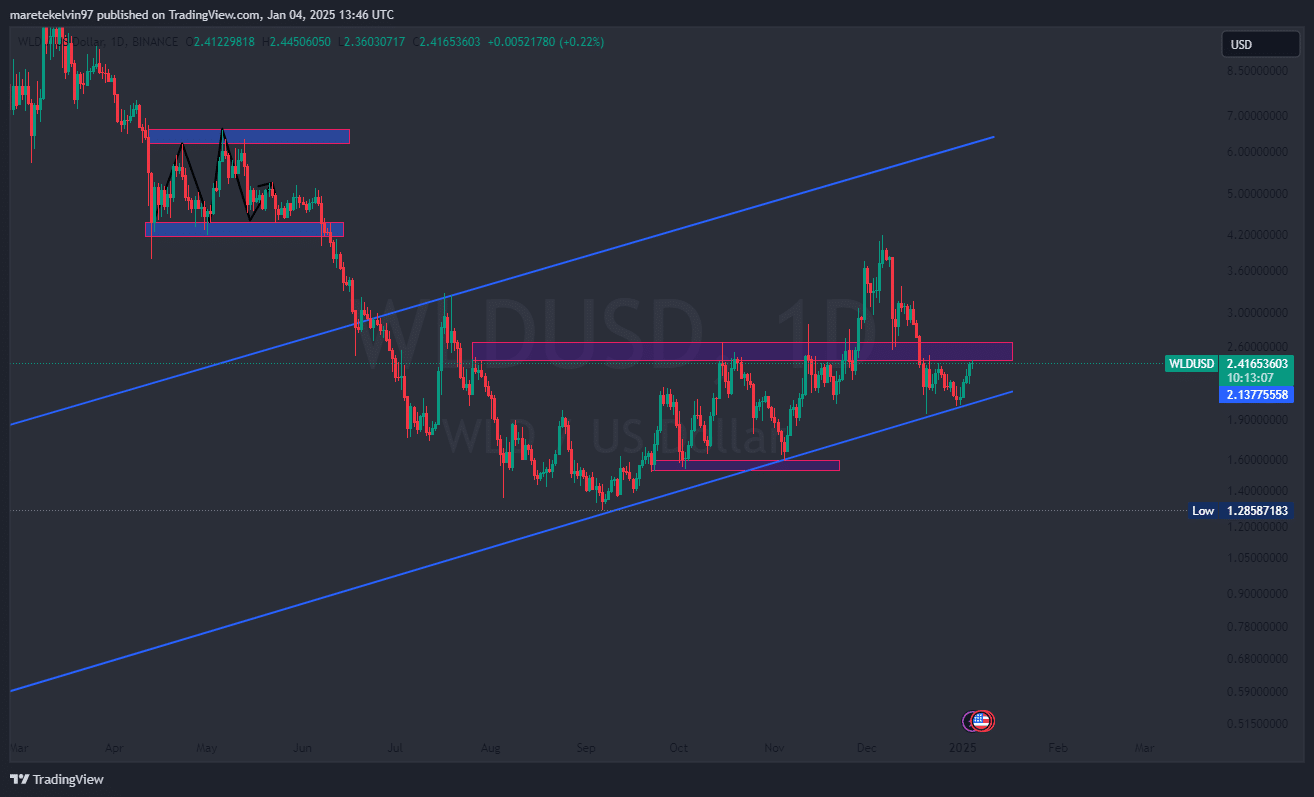

- A test of the ascending trendline support level might be on the horizon.

The buzz surrounding the Worldcoin [WLD] network has been stirred following the latest German decree, which requires deleting iris scan data.

Trying to navigate this situation carefully, particularly regarding privacy concerns, seems to have added complexity to Worldcoin’s attempts at widespread acceptance.

The initial impacts are starting to show up in the market, particularly in the actions of significant players – a crucial factor influencing the surge of WLD’s price.

As an analyst, I’ve observed a substantial 74% decrease in large transactions involving WLD over the past 24 hours, according to data from IntoTheBlock. This marked drop suggests that significant players might be taking a pause or reconsidering their investment strategies in WLD.

Because the behavior of large investors in WLD (whales) tends to reflect market mood, the near-term direction of WLD might significantly impact the current trend.

What whale activity drop means for WLD

As a crypto investor, I can’t stress enough the importance of whale transactions in maintaining liquidity and price stability within the market. The absence of such significant trades could lead to a dramatic increase in volatility for tokens like WLD. In simpler terms, these large transactions help keep things running smoothly and predictably.

A decrease in involvement from major entities could indicate a need for caution, particularly since the project’s objectives for widespread acceptance might be hindered by regulatory uncertainties.

As an analyst, I’d rephrase that statement as follows: When I observe a decrease in whale involvement, it often indicates diminishing trust or faith. This trend, when applied to our context (WLD), might signal a lack of significant growth potential in the short run.

Given that it’s the smaller investors who are bearing the brunt of market fluctuations, a temporary adjustment or dip in prices seems probable.

Testing the ascending trendline

As an analyst, I noticed that the daily price chart of Worldcoin indicated a possible challenge to its rising trendline support. This support line has historically played a crucial role in providing a solid base for the altcoin’s price, especially during moments when selling pressures were high and helped it rebound.

If the trendline doesn’t maintain its position, it might lead to more decreases for WLD, making its already negative outlook even stronger.

Consequently, if the bounce is successful, it could offer comfort to investors and potentially spark a brief surge in prices.

Is a recovery possible?

Although a decrease in whale activity might signal some concerns, the compelling narrative surrounding the growth of WLD may still attract long-term investors.

Even with the occasional obstacles, the project’s ambition remains vigorous enough to pick up speed again once we’ve navigated through all the regulatory hurdles.

Read Worldcoin’s [WLD] Price Prediction 2025–2026

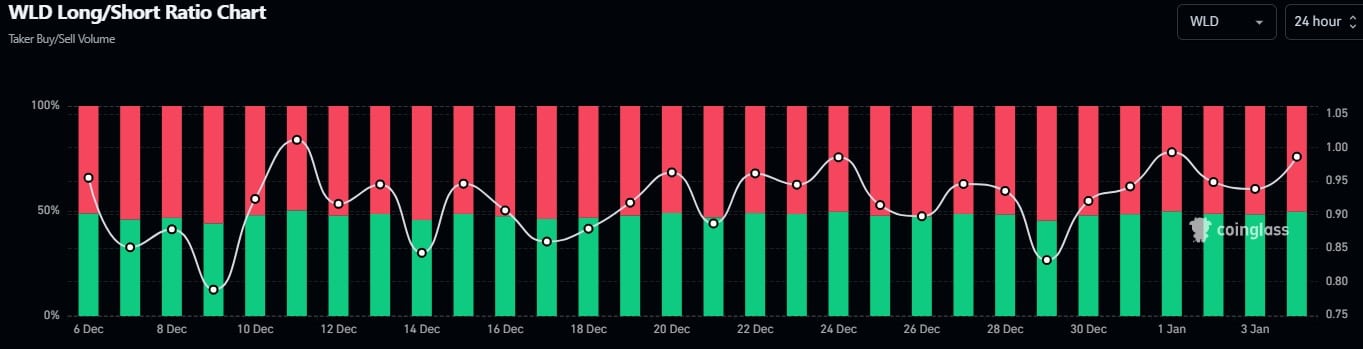

To clarify, data from Coinglass on WLD’s Long/Short Ratio showed an upward trend commencing from the 29th of December.

This implies that slow-moving long position holders might be driving the market, which could potentially lead to a quick price increase in the coming days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-01-05 12:08