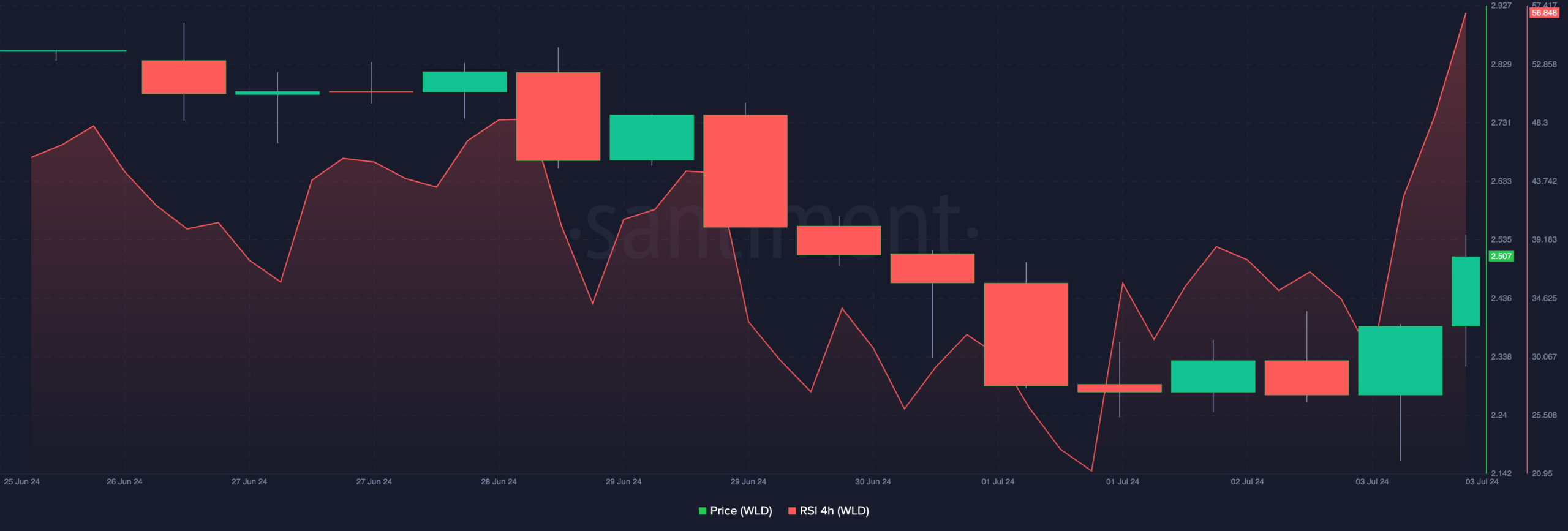

- Worldcoin was oversold up until 1 July and then, the price began to move higher

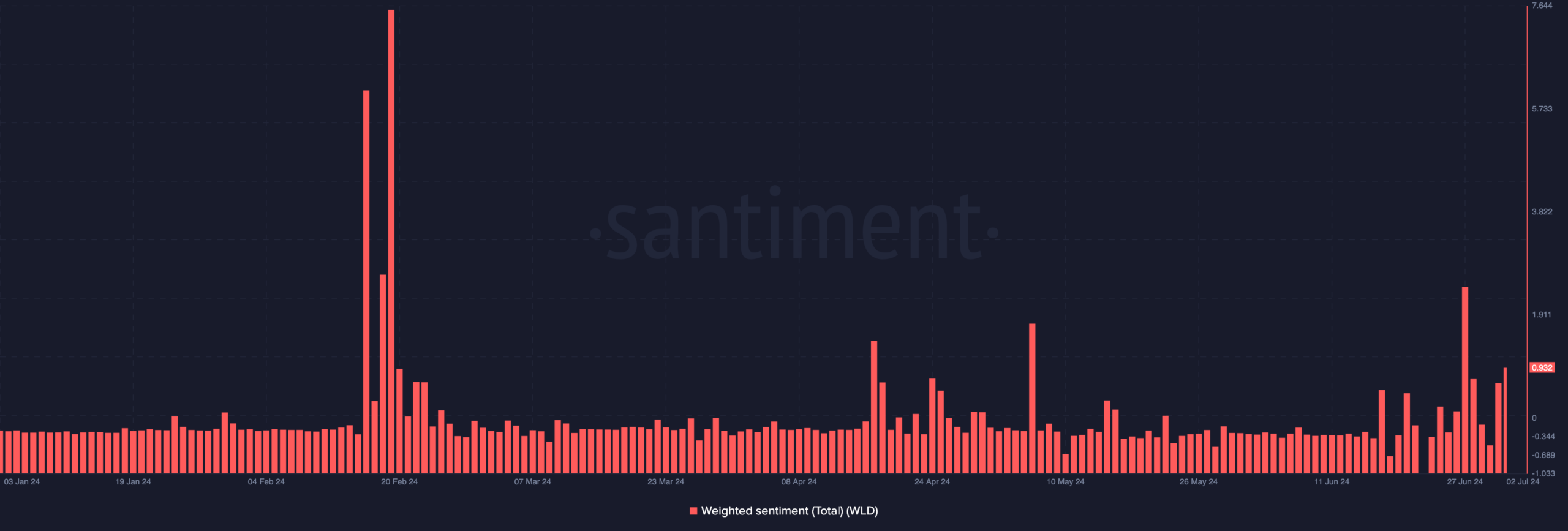

- Sentiment around the token improved, suggesting that demand could be better

As a seasoned crypto investor with a few battle scars from market volatility, I’ve learned to keep an eye on both oversold and overbought conditions in tokens’ price action. The recent turbulence in Worldcoin (WLD) has caught my attention.

🚨 RED ALERT: EUR/USD Forecast Shattered by Trump’s Moves!

Markets react violently to tariff news — stay ahead of the shockwaves!

View Urgent ForecastOver the past three months, the digital identity application’s associated token, Worldcoin [WLD], has experienced significant volatility with a current value of $2.52 at this moment.

The price decline signified a 64.90% reduction over the past three months, marking the cheapest point for Worldcoin since November 2023. Factors contributing to this depreciation may include regulatory issues or profit-taking events.

Down, but not out

In March, the token reached its peak price of $11.82. Yet, since then, it has found it challenging to maintain its upward trend. Over the past few weeks, Worldcoin dipped to oversold territories as indicated by the Relative Strength Index (RSI).

As a crypto investor, I closely monitor the Relative Strength Index (RSI) to gauge the momentum surrounding a particular digital asset. An RSI reading above 70 suggests that the token is overbought and may be due for a correction. On the other hand, if the RSI falls below 30, it indicates that the token is oversold and could potentially experience a rebound.

Based on Santiment’s analysis, the Relative Strength Index (RSI) for Worldcoin on its 4-hour chart stood at 21.04 on July 1st. This figure indicated that the token was oversold at that time. However, as of now, there has been a slight enhancement in this reading.

Sellers seemed to be running out of steam, while buyers capitalized on the markdowns. It’s noteworthy that during the same period, the cost increased by 6.13%.

As a researcher studying the WLD token, I would observe that if the bullish momentum persists, the price could approach the $3 mark in the near future. However, it’s essential to exercise caution. Should the Relative Strength Index (RSI), which currently stands at 56.84, exceed 70.00, then the token may become overbought, potentially leading to a correction.

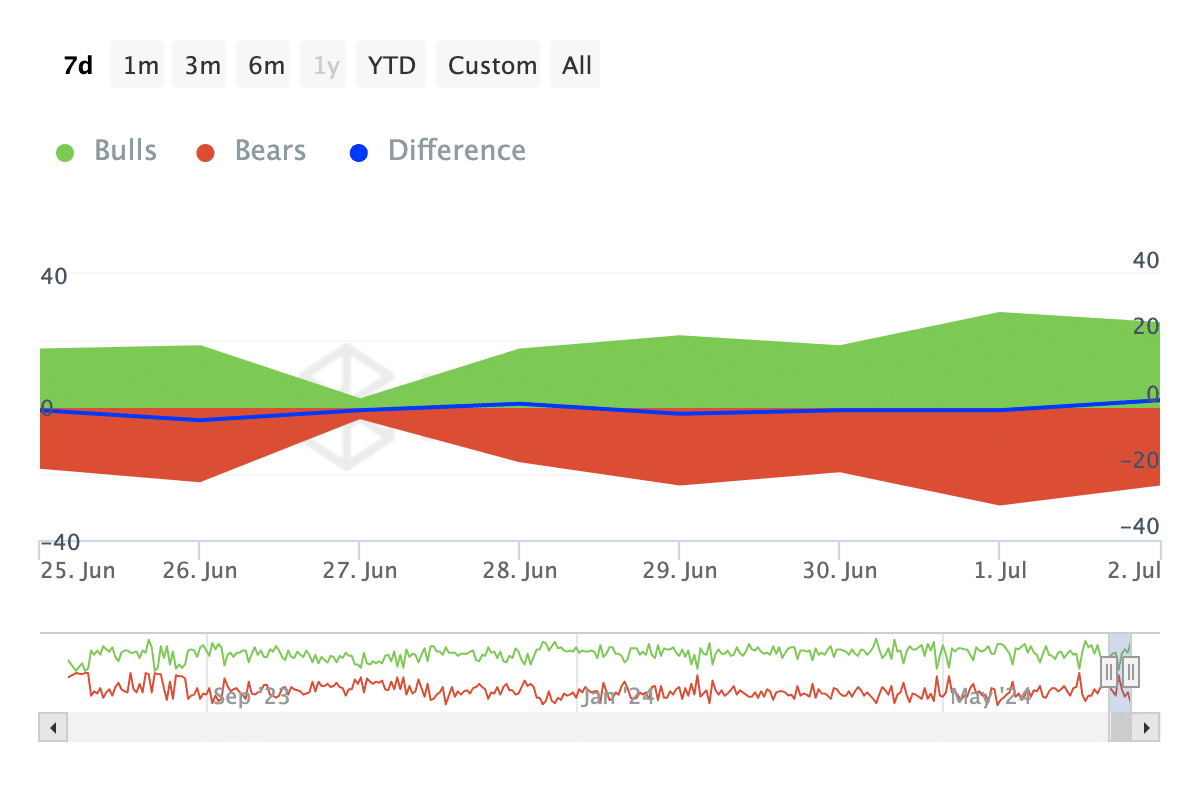

As a crypto investor, I’ve noticed that if an event occurs before the price reaches $3, there’s a possibility that WLD‘s price may correct or retreat. Nevertheless, based on the readings of the Bulls and Bears Indicator, it might not follow that trend.

Bulls are at the forefront

As a crypto investor, I keep an eye on the trading volume and the behavior of both buyers and sellers through an indicator. This tool specifically focuses on identifying those market participants who have transacted over 1% of the total trading volume, whether they’re bulls (buyers) or bears (sellers).

As a researcher studying the market trends of Worldcoin, I have observed that when the number of bulls (buyers) is greater than the number of bears (sellers), it can potentially lead to an increase in the token’s price. Conversely, if the bears outnumber the bulls, there is a possibility of a decline in price. Based on my analysis, I have found that for Worldcoin, the bulls have been more prevalent than the bears.

If sustained, the price of the cryptocurrency would tilt closer to $3 as initially stated.

The public perception of Worldcoin has shifted significantly. Earlier, the prevailing sentiment towards it was unfavorable, as indicated by a Weighted Sentiment score of below par. But now, the situation has improved, with a current score of 0.932, suggesting that the majority of online discourse about the project is positive.

If the favorable opinion persists, the interest in WLD could potentially rise. Additionally, if WLD token owners choose to withhold selling, it is unlikely that the price will fall below the $2 mark.

Is your portfolio green? Check the Worldcoin Profit Calculator

Based on my analysis, WLD‘s price may keep rising. Yet, if bulls encounter difficulties in maintaining their advance, this uptrend could potentially lose steam.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-07-04 14:15