-

WLD’s price dropped further as selling pressure from Alameda Research hampered any attempts to gain.

The decline in daily active addresses and Open Interest showed a lack of market interest.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I can’t help but feel a sense of deja vu when I see Worldcoin [WLD] plummeting yet again. The consistent selling pressure from Alameda Research is like a stubborn thorn in my side, making it difficult for me to hold on and believe that the tide will turn.

Today saw a dip in the cryptocurrency market, resulting in a decrease of 11% for Worldcoin (WLD), which currently trades at around $1.50 per coin as I write this.

In the past month, the significant decrease in value has increased WLD‘s losses to approximately 37%, positioning it as one of the poorest performing altcoins.

As a crypto investor, I’ve noticed that one factor affecting the price of WLD lately is the selling pressure from Alameda Research. According to SpotOnChain data, Alameda has been systematically depositing WLD onto exchanges since the 9th of August, which may be contributing to the downward trend in the coin’s value.

Over the past fortnight, the bankrupt company has transferred approximately 1.13 million dollars’ worth of WLD (Worldcoin) to various exchanges. As Alameda currently possesses around 36 million dollars in WLD, it is expected that this amount will be sold to meet its debts, potentially weakening Worldcoin’s ability to surge in value.

Worldcoin remains muted

Worldcoin hit all-time highs in March this year, alongside Bitcoin [BTC]. However, it has since lost 87% of its value.

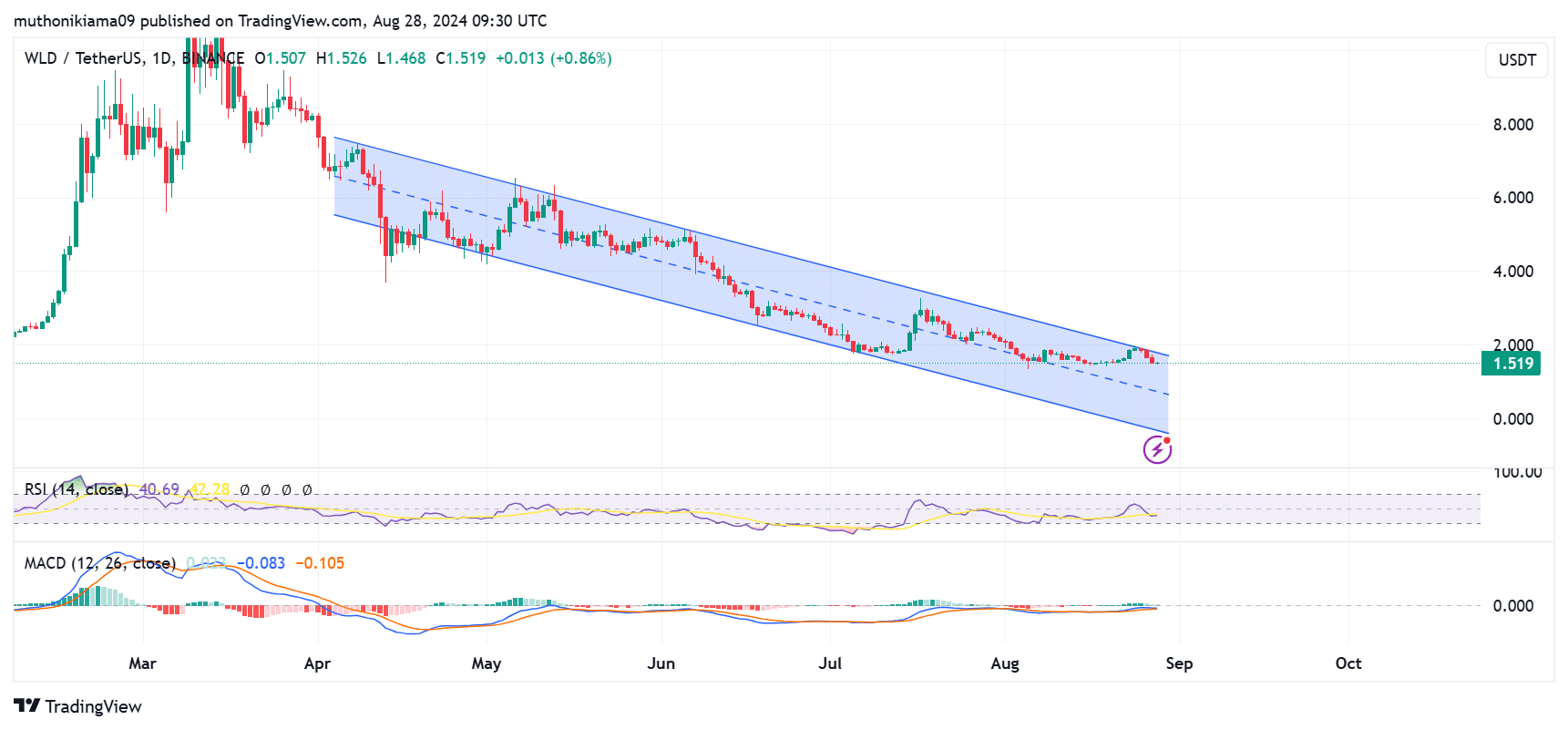

For quite some time now, WLD has been trending in a descending parallel channel, suggesting a continuous decline. This is shown by the fact that the price keeps reaching new lows on the way down (lower lows), and also fails to reach previous highs when it tries to rise (lower highs).

Lately, Worldcoin tried to move beyond its current range, but it met strong resistance at the top boundary. This unsuccessful attempt hints that the price could keep oscillating within this range for a while.

For WLD to confirm an uptrend, it needs to break a key resistance level at $1.95.

In simpler terms, when the Relative Strength Index (RSI) dropped to 40, it indicated a downward trend or bearish momentum for Worldcoin. This low RSI number suggests that buying activity was minimal, making it harder for Worldcoin to bounce back.

During the attempt by WLD to break out of the parallel channel, the MACD histogram bars displayed a green signal as well.

In other words, since the MACD line is below the signal line, a rally for WLD can occur only if there’s renewed buying activity in the market.

WLD, on-chain

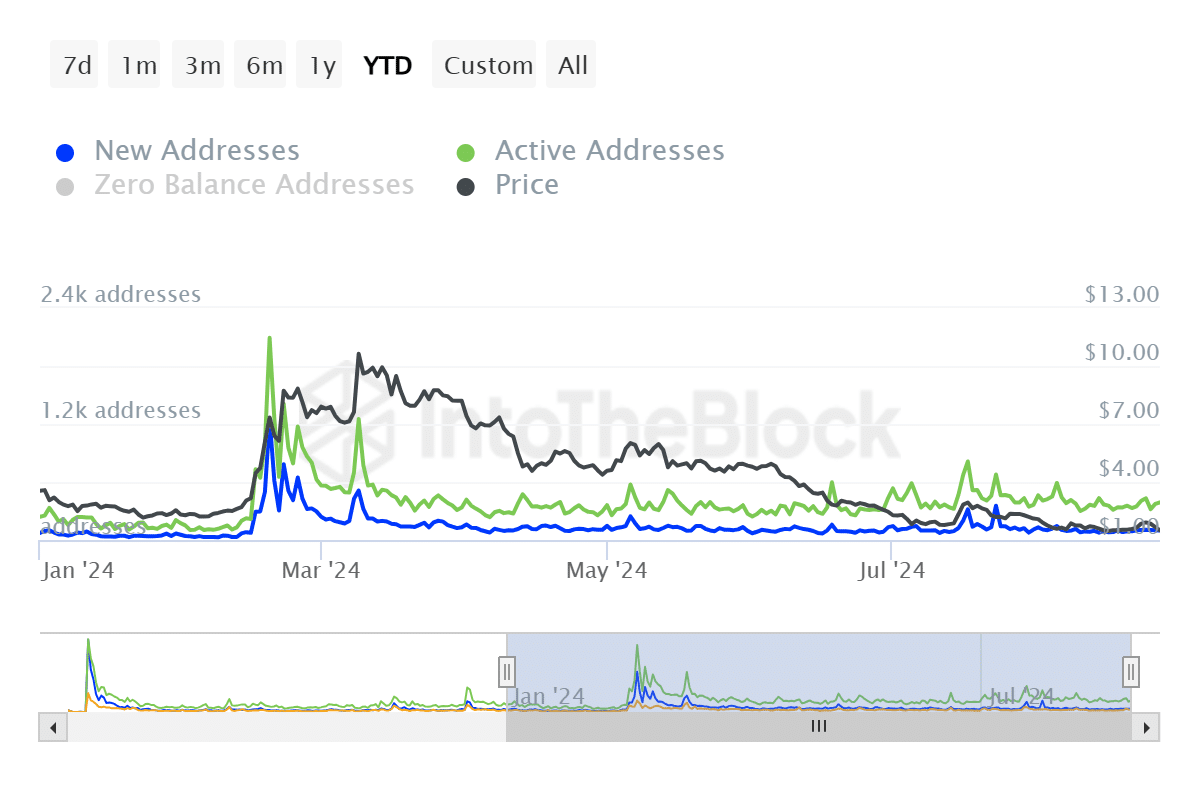

On-chain data does not support a bullish case for Worldcoin as well.

Currently, the number of daily active addresses is at its lowest point this year.

The decrease in the formation of new addresses mirrors this decline, suggesting that there’s insufficient buying activity to keep the upward trend going.

At the current moment, it’s shown that approximately 93% of WLD holders are experiencing losses, whereas just 2% are seeing gains. This suggests a downward trend, as investors in this predicament may opt to sell when the price tries to recover in an effort to minimize their losses.

This trend will muffle any attempts to gain.

Read Worldcoin’s [WLD] Price Prediction 2024–2025

AMBCrypto’s look at Coinglass data showed a significant drop in Worldcoin’s Open Interest. The decrease shows reduced market participation and a possibility of WLD consolidating or market indecisiveness.

WLD’s Open Interest has dropped from over $322M in mid-July to $126M at the time of writing.

Read More

2024-08-28 19:04