-

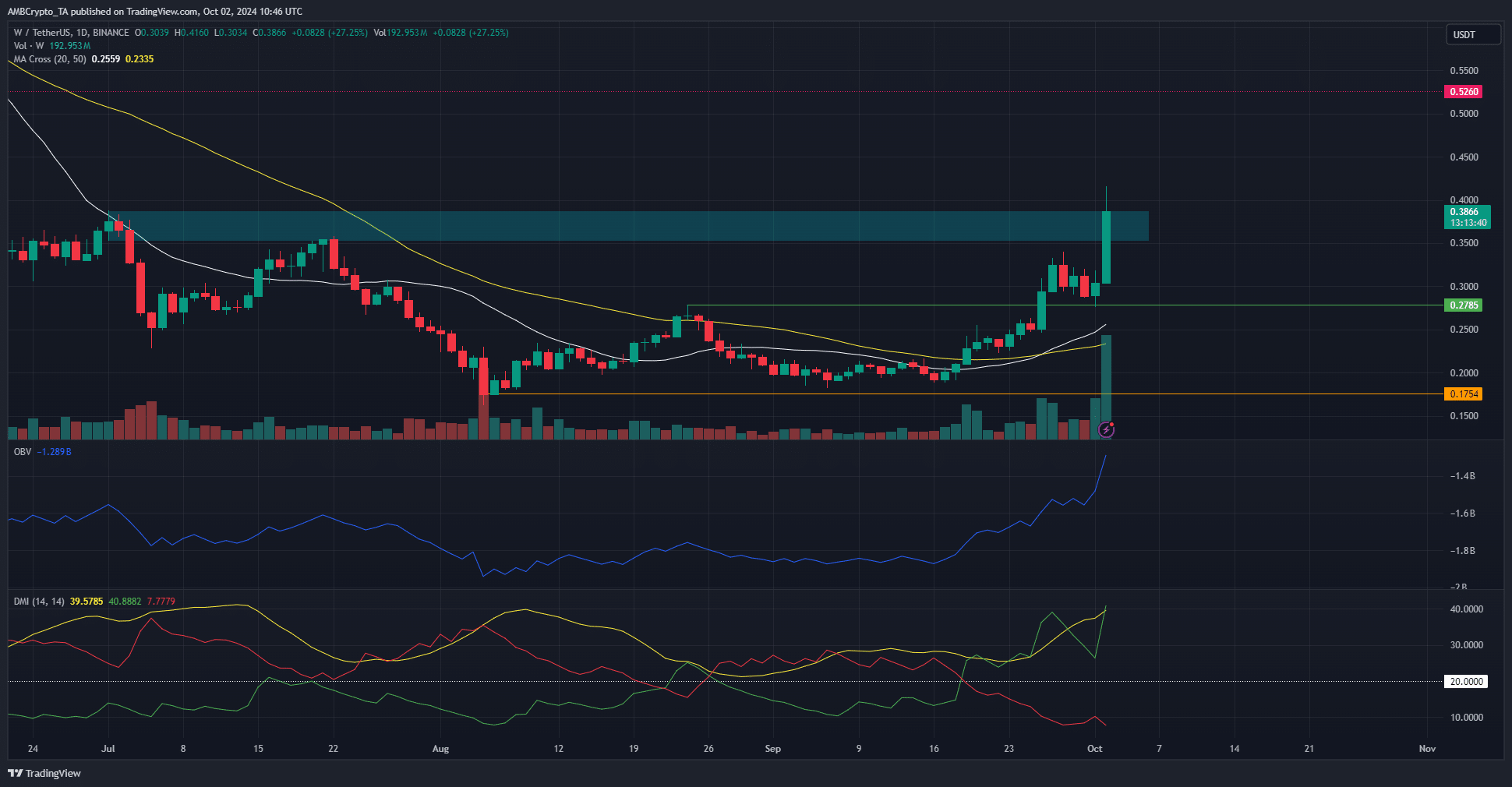

The moving averages formed a bullish crossover, reinforcing the idea of hefty upward momentum.

The bearish order block from July was likely to be breached on W’s first try.

As a seasoned researcher with over two decades of market analysis under my belt, I must say that the recent surge in Wormhole [W] is nothing short of exhilarating. The bullish crossover and the breach of the resistance at $0.278 have set the stage for an intriguing narrative.

Wormhole [W]: In recent times, the bulls have been pushing prices aggressively towards the $0.4 mark. The previously stubborn $0.278 level, which held firm for over a month, was not only broken but also re-established as a supportive floor. Furthermore, trading volume surged significantly compared to the previous week’s figures.

Such development instills optimism among traders and token owners, as they anticipate potential price increases over the next few weeks. The next significant hurdle lies at the $0.52 resistance point.

Wormhole crypto breaks the weekly structure

On Wormhole’s weekly chart, the $0.2785 mark represented a recent low point in its downward trend. However, the price moving above this level indicated a significant shift in the market structure, which could be interpreted as a bullish breakout on the weekly chart. Furthermore, this bullish trend seems to have extended to the daily chart as well, where it has now reversed direction.

Over the last few days, the previous level of stability was confirmed for Wormhole cryptocurrency. Remarkably, it has experienced a substantial increase of more than 40% in the past 24 hours, suggesting potential further growth ahead.

The bearish price range near 0.36 to 0.38 dollars was close to being broken. Swing traders might want to cash out at these prices and then wait for the market to stabilize above the resistance level before considering a new long investment.

On the one-day chart, there’s been a strong upward trend indicated by the Daily Moving Average (DMI), suggesting increased demand for asset W. Given that prices have tested the resistance level from July, it seems prudent for traders to consider taking at least some profits as this retest could signal a potential pause or reversal in the uptrend.

Short-term sentiment flies to the moon

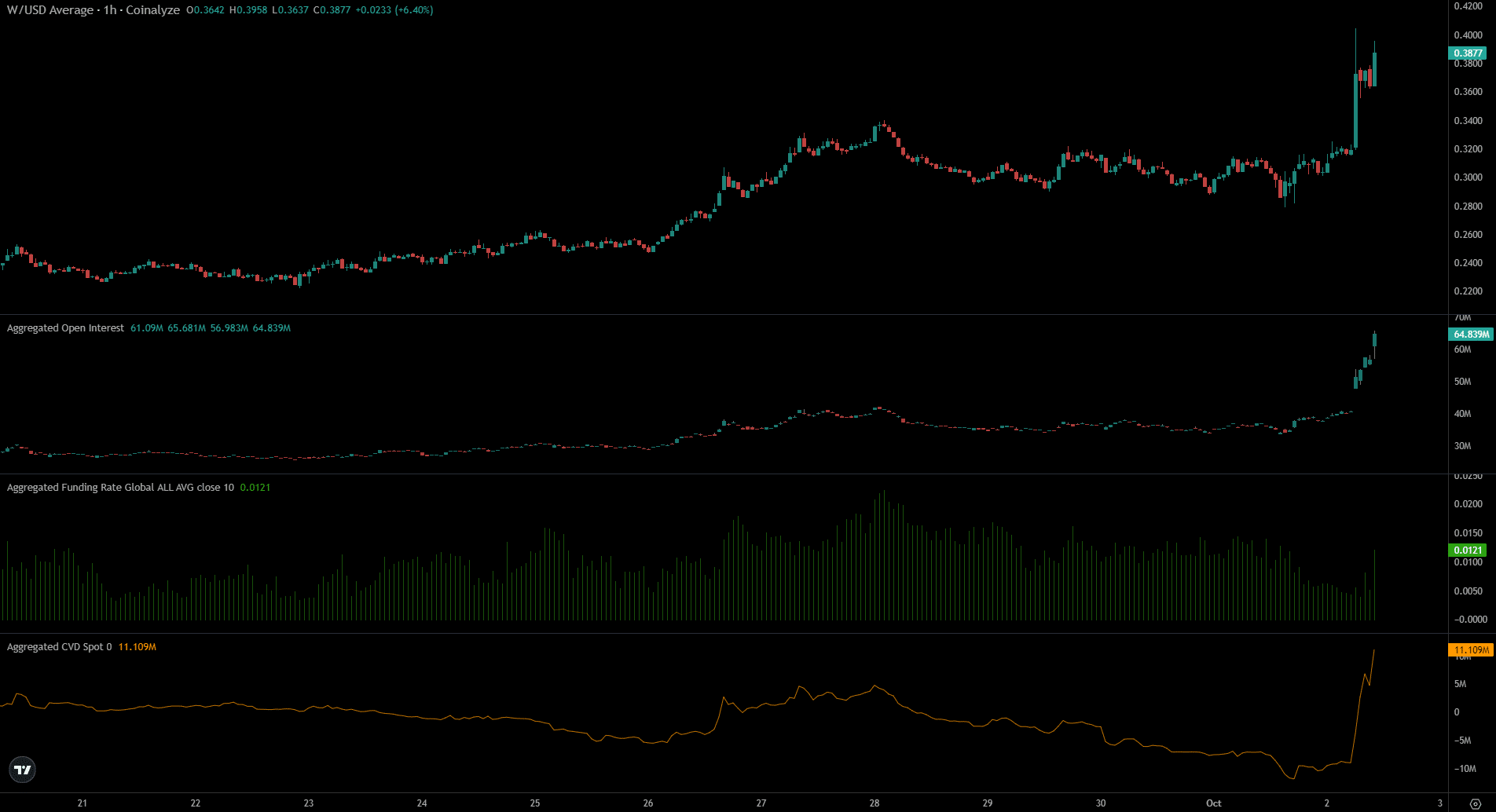

Yesterday’s Open Interest was approximately $44 million. Since then, it has grown significantly, almost doubling to reach $64.8 million, indicating strong bullish sentiment. There appears to be a high demand among buyers for long positions, and this trend is also noticeable in the spot market.

Is your portfolio green? Check the Wormhole Profit Calculator

Over the past few hours, the funding rate decreased, but it subsequently started climbing, suggesting an increase in traders who prefer to buy (go long). The market’s behavior and futures data indicated a strong possibility of the price reaching $0.4.

It remains to be seen whether the rally will continue or if the bulls need some breathing time.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-10-03 05:11