- Wormhole broke free from a descending channel, surging 11.45% with high trading volume.

- Mixed on-chain signals and overbought conditions suggested short-term pullback despite bullish momentum.

As a seasoned analyst with over two decades of experience in the crypto markets, I have seen my fair share of bull runs and bear markets. This Wormhole (W) breakout from its prolonged descending channel is intriguing, but it’s not time to pop the champagne just yet.

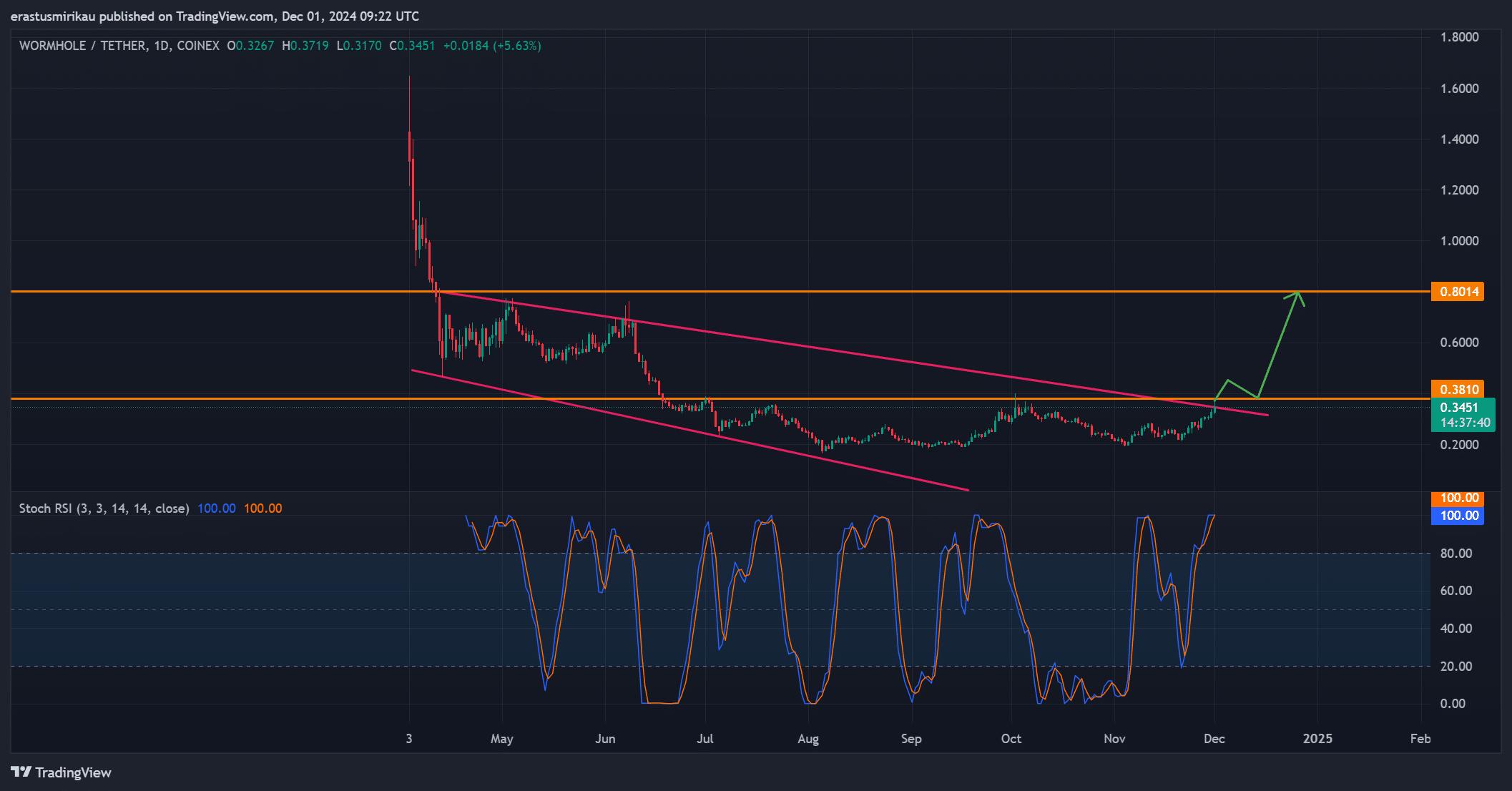

In the last 24 hours, the price of Wormhole (W) has seen a notable increase of 11.45%, reaching $0.35 at this moment, following a breakout from a lengthy downtrend.

After several months of being contained within a specific range, this price surge occurs because the token has managed to break away from a persistent downward trend line.

The significant surge in trading activity, which reached $275.74M (an 112% rise), suggests a change in market behaviors, as traders appear to be responding to the market’s breakout.

As Wormhole gets close to a significant resistance level at $0.38, the upcoming market behavior will reveal whether this upward trend continues or if it’s about to encounter an immediate reversal.

Breakout or temporary spike?

The escape of the Wormhole from its long-term downward trend indicates a substantial shift in market opinion, hinting at a potential alteration in market dynamics.

At the moment of reporting, the token encountered significant obstacles around $0.38, a point which might determine if the upward trend persists.

If W manages to break through the $0.38 mark, it might propel the token’s price upwards towards $0.80. However, the Stochastic RSI reading of 100 currently indicates that the token may be overbought, suggesting potential for a correction or pullback.

As someone who has been trading for over a decade, I have learned that market movements can be unpredictable and volatile. With this breakout, while it appears to be positive, my past experiences have taught me to always exercise caution. The possibility of a short-term pullback before further price action unfolds is something that I have seen happen many times in the past, and it’s important to keep that in mind when making investment decisions. So, while I am excited about this opportunity, I will approach it with a healthy dose of skepticism and cautious optimism.

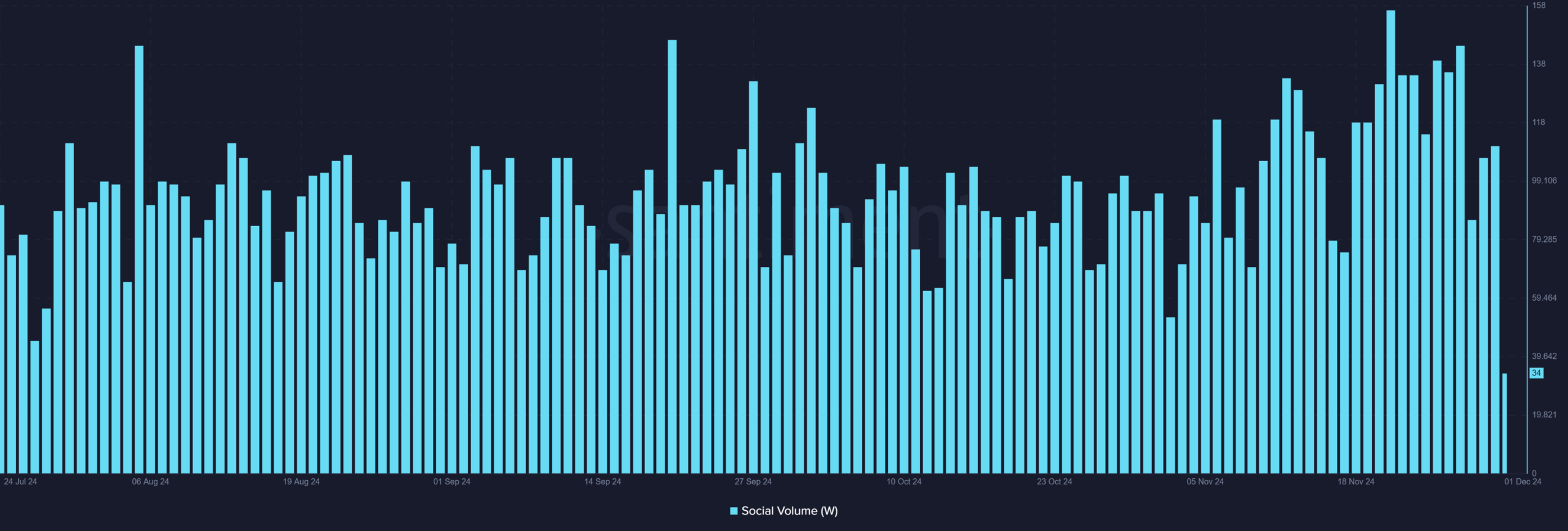

Wormhole social volume: Fading interest or temporary dip?

The number of people engaging with Wormhole on social platforms saw a significant decrease, going from 111 yesterday down to 34 at this moment. This drop suggests a dwindling public enthusiasm, potentially curbing its future growth prospects.

Yet, there’s still time left in the day, and if the price manages to surpass the $0.38 barrier, there might be a resurgence in social engagement. This could lead to renewed retail interest, which might in turn stimulate fresh buying activity.

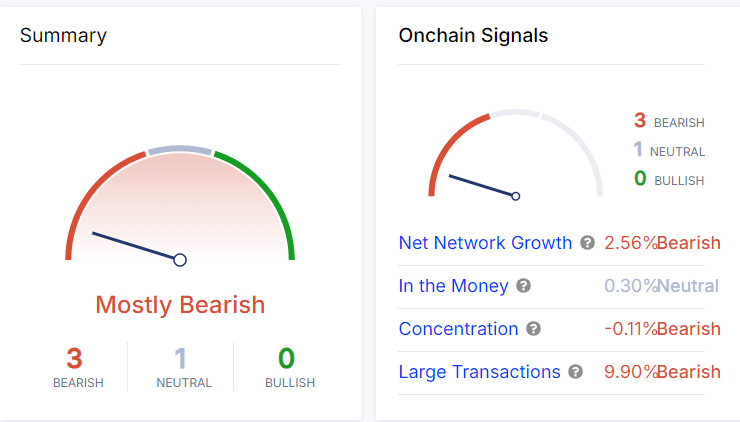

Bearish on-chain signals point to potential selling pressure

The analysis of on-chain data showed a blend of positive and negative trends. Specifically, there’s been a decrease of about 2.56% in the number of nodes joining the network, which suggests a decline in overall activity and potentially a bearish market outlook.

Furthermore, the decrease in concentration metric by 0.11% implies that there could be some large holders offloading their assets. Similarly, a drop of 9.90% in big transactions indicates possible profit-making activities.

On the other hand, the “Into the Money” indicator stands at 0.30% right now, indicating neither a significant buying trend nor a selling trend is taking place.

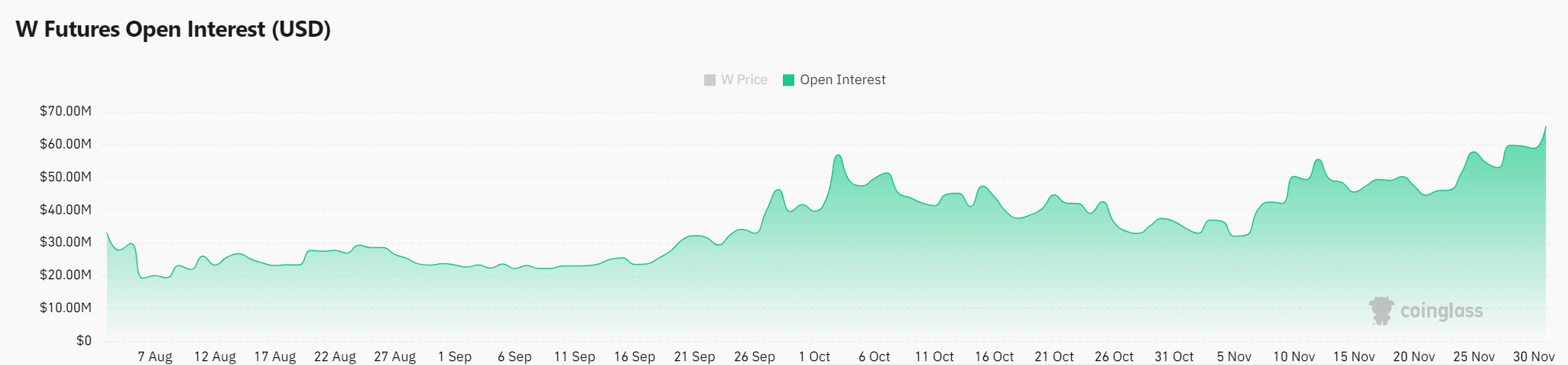

Is market confidence building?

A notable improvement is the 29.04% rise in Open Interest, currently at approximately $80.33 million. This suggests that traders are becoming more confident that the market breakout might persist.

The increase in Open Interest indicates a growing optimism among traders, as it suggests that an increasing number of investors are speculating on Wormhole’s future price trajectory.

Nevertheless, signs of overbuying and pessimistic on-chain indicators imply that a degree of caution remains advisable.

Conclusion: Will Wormhole’s breakout lead to a sustained rally?

The jump of Wormhole to $0.35 looks hopeful, yet it encounters considerable hurdles. The $0.38 barrier is crucial, and although Open Interest is increasing, the market being overbought and negative on-chain signs suggest a possible correction may be imminent.

Investors should watch for price action at $0.38 to determine if the rally will continue or stall.

Read More

2024-12-02 04:08