BREAKING: Stellar (XLM) has catapulted a shocking 10% in just 24 hours (cue dramatic music), and a swashbuckling 25% over the past month. Yet here we all are, collectively hovering around the $0.30 mark since early March. It’s like trying to diet in December: the ambition is there, but reality remains cruelly unmoved. XLM simply refuses to budge.

For anyone with at least two technical indicators on their phone (or just curious what “bullish” means), Stellar is now plastered with all the right kinds of signals: RSI leaping up, the CMF rumor mill finally churning out a little green, and traders getting giddy about a possible golden cross. Basically, optimism levels currently mirror that of the English on a sunny bank holiday, but beware—XLM is now staring down resistance at $0.279 like a character in a Jane Austen novel facing an unwanted suitor. 🧐

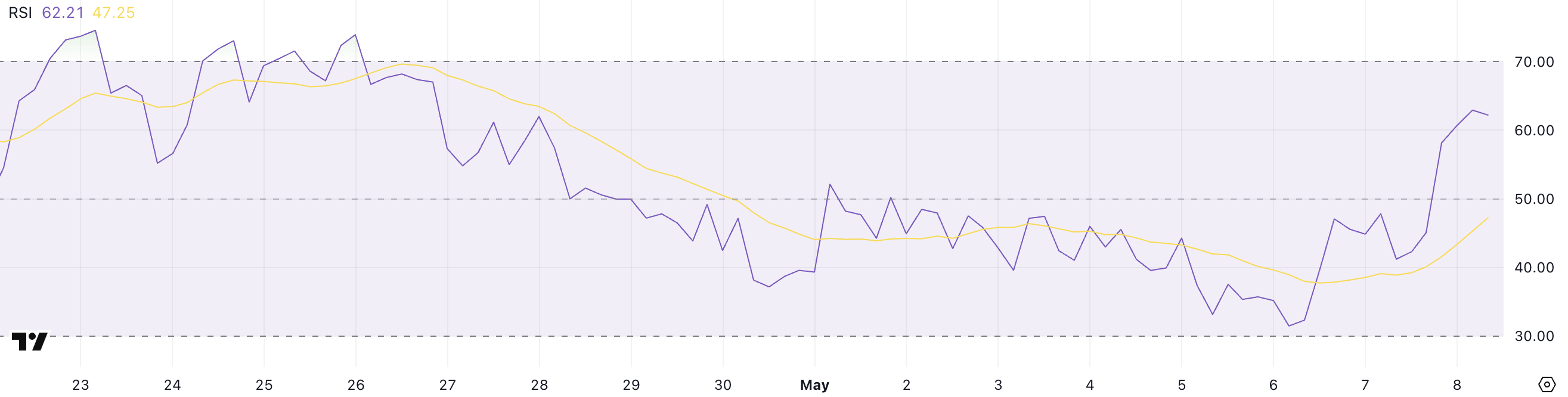

RSI Rockets: Is XLM About to Have Its Bridget Jones Moment?

In the past two days, XLM’s RSI (not to be confused with a new kind of vitamin) has shot from 31.47 to 62.21.

What does this actually mean? Traders are flocking back in, hoping for that cinematic comeback, and XLM is rebounding from its recent malaise. There’s a definite vibe shift in the market—call it the “maybe I should ditch my ex and finally buy crypto instead” phase. Momentum is rising, and if XLM keeps this up, we might all be muttering “bullish breakout” into our morning coffees any day now. Or at the very least, daring to dream.

A quick primer for the uninitiated: RSI tells you just how overheated (or neglected) an asset is. Below 30? Crying on the kitchen floor. Above 70? Might need to call its friends for an intervention. 62.21? XLM is positively glowing (some might even say “dewy”) but hasn’t quite gone full Bridget-at-the-party mode yet. There could be more to go if buyers don’t suddenly ghost.

But, as in life, all good rallies need to pace themselves. Once RSI hits 70, expect the hangover—or in crypto terms, possible price exhaustion. Take that as your cue to avoid FOMO-induced purchases at 3 a.m.

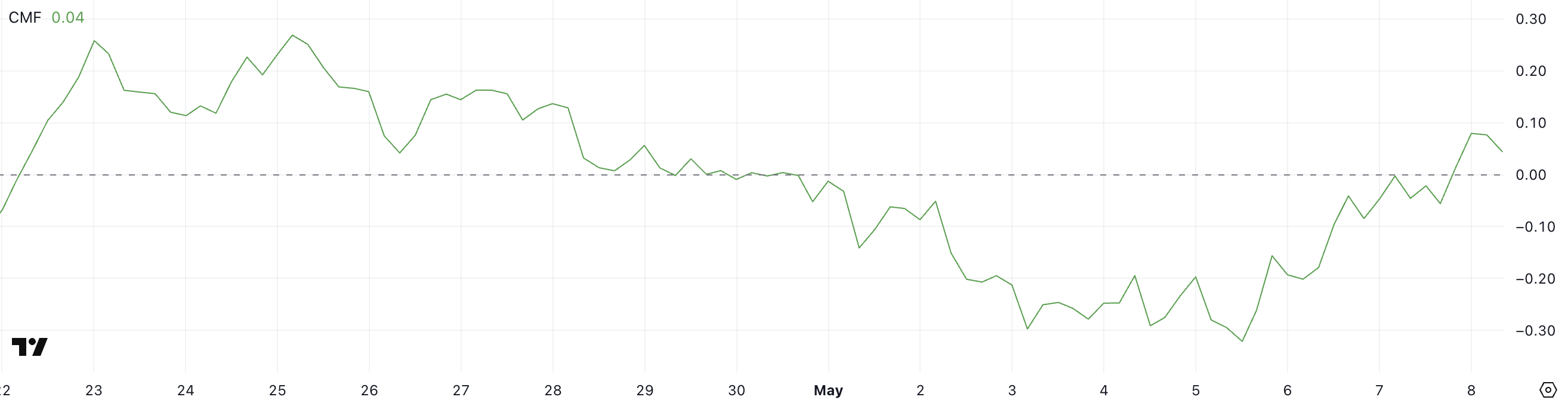

CMF Flirts With Positivity—But Commitment Issues Remain

Over on the CMF dance card, Stellar’s reading is now a cheeky 0.04, up from -0.32 a mere three days back. A short-lived bounce saw it flirt with 0.08 earlier, but, much like anyone who waxes poetic about going to the gym, it’s since retreated a bit. The 0.10 milestone hasn’t been conquered since April 28 and, let’s face it, “close enough” doesn’t count.

CMF, by the way, checks where the money’s sloshing around (think: a really nosey friend monitoring everyone’s drink level at a party). Above zero? Buying pressure. Below? Pass the tissues. Over 0.10? Proper party. At 0.04, the market is interested but not yet committed. Stellar needs bigger moves if it wants a truly bullish RSVP.

If CMF does mount a serious rally, expect the mood to shift from “maybe” to “definitely attending—with bells on.” Until then, cautious optimism abounds, with a dash of commitment-phobia.

Golden Cross Looms—Will XLM Finally Ditch Its Old Habits?

Price right now is sandwiched awkwardly between $0.279 resistance and $0.267 support—narrower than Bridget’s diary margins after a bad date. The EMA lines are bunching up, ready to possibly belt out the technical equivalent of “All By Myself”—the Golden Cross. It’s an old trader’s tale: if the short EMA crosses the long EMA, great things could follow (unless, of course, they don’t).

If Stellar punches through $0.279, next stops could be $0.30, then $0.349, and—dare we imagine—$0.375. If things get properly spicy, $0.443 is on the table. If it falls apart instead (because, well, markets), $0.267 awaits below. Go even lower and we’re eyeing $0.25, $0.239, and $0.230, at which point you may want to switch to comfort carbs.

Of course, just when you thought you could trust a good bounce, whale wallets swim in—top 10 XLM wallets now control 80% of the supply. Binance’s XLM hoard grew from 180 million to 1 billion in the last year, so if the big guys start panic-selling, expect volatility worthy of Mr. Darcy jumping into a pond.

Still, all is not doom and gloom! Stellar’s tokenized real-world asset scene is up 84% this year, with Franklin Templeton and Circle adding some serious corporate sparkle. Over $500 million in value on-chain is now a thing, so whether you’re along for the joyride or hiding under a duvet, Stellar is determined to stay interesting. 📈🎢

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-05-08 23:56