-

Ripple Labs made headlines after announcing a major partnership

XRP has the lowest total value locked among top 10 popular cryptocurrencies

As an investor with a decade of experience under my belt, I’ve seen quite a few cycles in the crypto market. The recent developments with Ripple and XRP have certainly piqued my interest, but they haven’t completely swayed my long-term perspective.

Over the past few days, XRP and Ripple have experienced some positive developments. Firstly, the well-known cryptocurrency has shown signs of recovery following a significant period of decline in its market value. Additionally, the company made headlines with its new collaboration with the DIFC Innovation Hub in the United Arab Emirates. This announcement comes on top of Ripple’s earlier disclosure about establishing a $1 billion XRP fund to support developers working on the XRP Ledger (XRPL).

Additionally, XRP has been approved by the DFSA for use by licensed firms in the DIFC.

Additionally, it’s important to note that the XRP ledger testnet is scheduled for a restart on August 19th at 3 AM Eastern Standard Time, lasting for approximately 15 minutes. This maintenance is aimed at enhancing its overall stability.

As a crypto enthusiast, I’m excited about the upcoming launch of Ripple’s RLUSD stablecoin. This innovative tool is designed to facilitate swift cross-border transactions. In this setup, XRP serves as the intermediary currency, ensuring there’s enough liquidity in the market for seamless transactions.

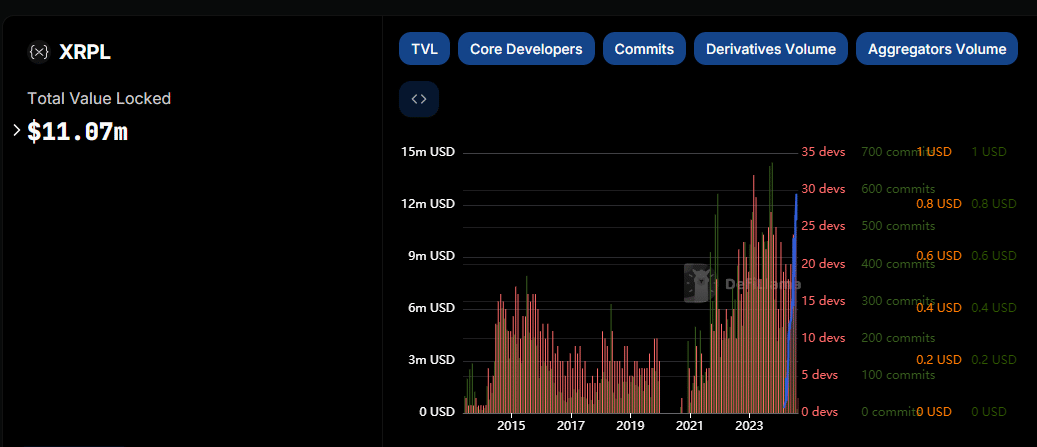

Although the foundational aspects of blockchain are promising, unfortunately, certain on-chain statistics continue to show negativity.

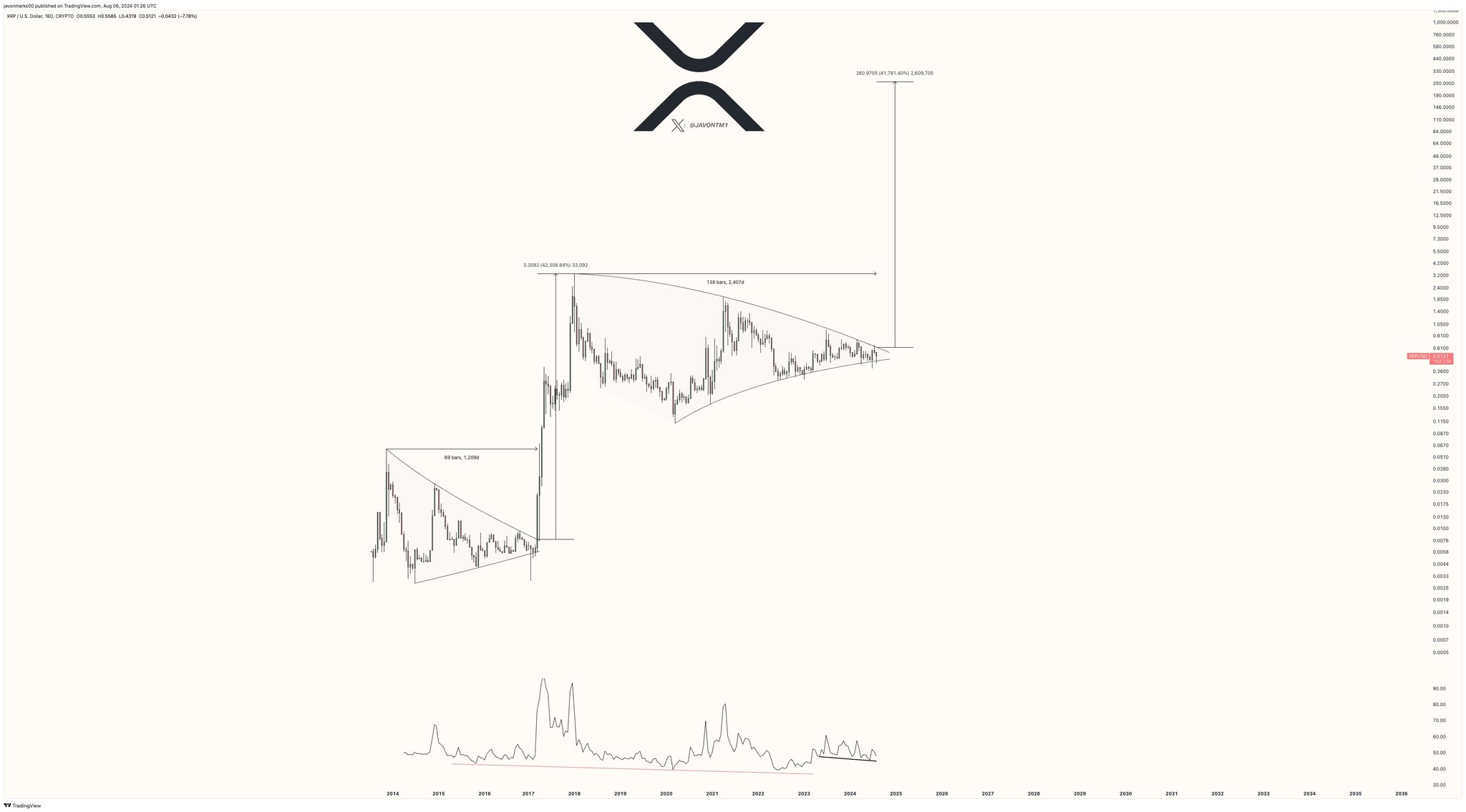

Deep dive into XRP’s 7-year consolidation

Although many other cryptocurrencies are reaching unprecedented peaks thanks to increasing acceptance, XRP has been caught in a prolonged consolidation stage for nearly eight years.

As a crypto investor, I’ve noticed that we’re in a prolonged phase where prices aren’t surging as expected, and it seems this stagnation may persist for some time yet. Some of us might need to confront the idea that XRP reaching new highs could be more of a dream than a realistic expectation for now.

By examining the graphs, it appears that the decreasing triangle shape could indicate a higher probability of the price continuing to fall instead of reaching new peaks and climbing upwards.

Simply put, this technical formation indicated that XRP could face more declines instead of achieving the anticipated breakout. This, despite the fact that the crypto has hiked by +10% in the last 24 hours alone since it doesn’t quite invalidate it’s long-term PoV yet.

An analysis of the metrics

A study of XRP‘s extended transactional data, encompassing price fluctuations, social engagement, network statistics, total circulation, and the count of wallet owners, indicates a prolonged period of stability might continue for XRP.

Examining the mentioned graph, for example, it showed a significant drop, suggesting little usage of digital wallets. Such reduced engagement might hint at XRP‘s ongoing sluggishness or inactivity among investors and traders.

Low numbers

Here, it’s worth pointing out that Ripple has only $11.07M in total value locked.

Instead, it’s worth noting that the market values of Ethereum ($47B), Tron ($7.3B), Solana ($4.8B), and Binance Smart Chain ($4.1B) significantly outshine Ripple’s valuation.

As someone who has closely followed the cryptocurrency market for several years now, I can’t help but notice a subtle shift in Ripple and XRP‘s performance lately. Despite a $3M increase in TVL (Total Value Locked) since February, this growth seems to be overshadowed by the immense stature that Ripple has built over time. To me, this could indicate some underlying struggles for the company, even though the recent increase may not seem significant based on its previous successes. In my experience, it’s essential to pay attention to such subtle changes in market dynamics and adjust strategies accordingly to stay ahead in this fast-paced industry.

Indicators such as developer engagement and transaction volume hint towards the possibility that XRP‘s 7-year period of stability could persist further.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-08-08 14:16