-

In case of a bullish breakout, XRP might reach $0.94.

However, a few metrics and market indicators looked bearish.

As a seasoned analyst with years of experience navigating the volatile crypto market, I have seen my fair share of bullish breakouts and bearish downtrends. After careful examination of XRP‘s chart and on-chain data, I am cautiously optimistic about its potential for growth in the near future.

As an analyst, I’ve noticed that XRP bulls have been taking a backseat in the market for some time now. Yet, it seems we could be witnessing a shift soon, given the emergence of a long-term chart pattern hinting at potential reversal.

Will XRP manage to successfully break above the bull pattern?

XRP’s long-term bull pattern

According to CoinMarketCap’s data, XRP’s price plummeted by more than 4% over the last seven days.

Currently, as I’m typing this, the value of the token is being exchanged for approximately $0.5659, and its total market worth surpasses an impressive $31.7 billion, positioning it as the seventh largest cryptocurrency in existence.

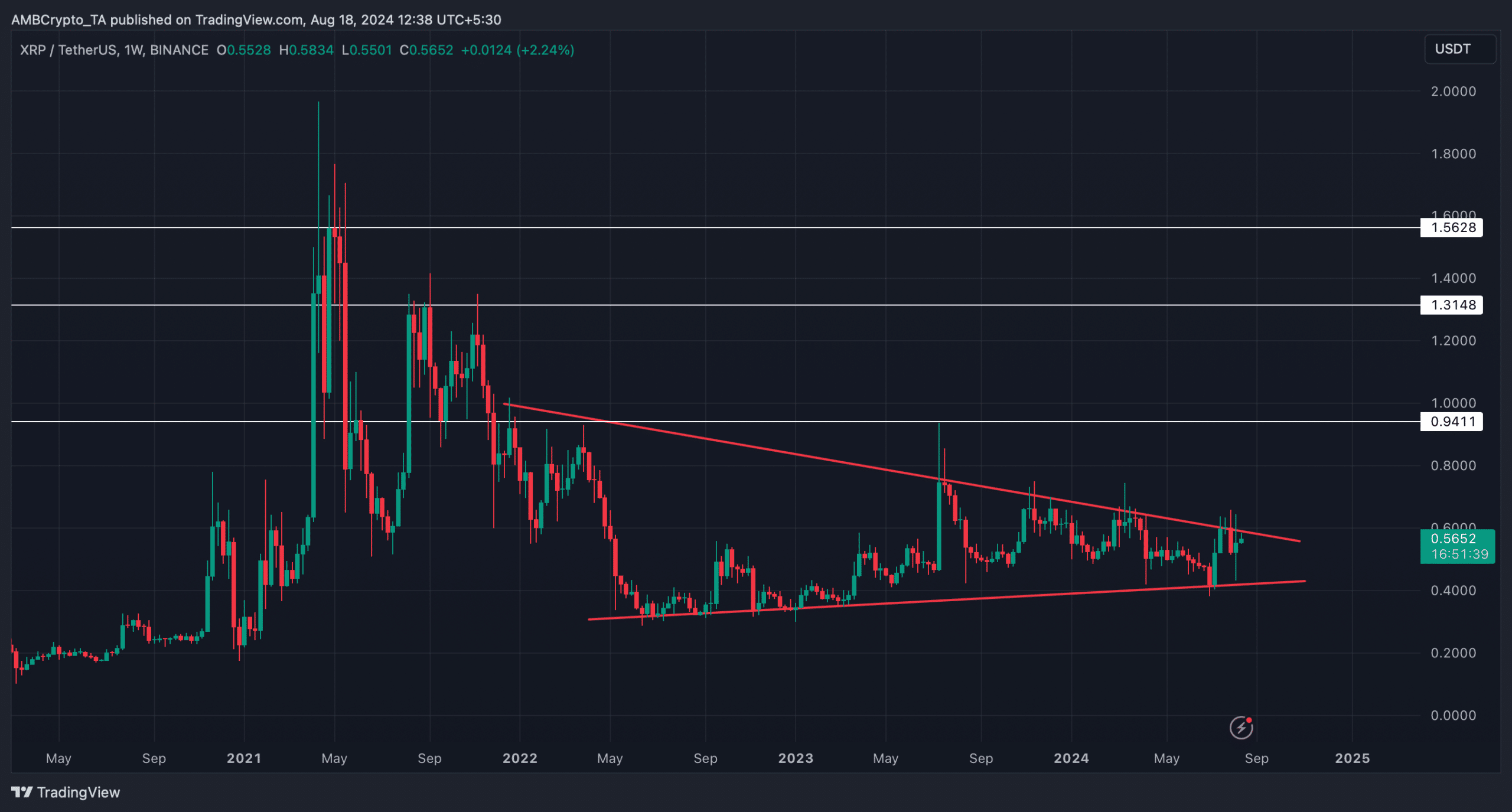

It’s intriguing to note that AMBCrypto’s examination of XRP‘s weekly chart suggests the formation of a bullish symmetrical trading pattern.

The shape that appeared in December 2021 serves as a structure for the token’s movement. Over this period, the token’s value has been fluctuating within this structure. As I type this, it appears that the token could potentially surge beyond this pattern during the forthcoming weeks.

Should such an event occur, it’s possible that XRP could experience rapid growth and potentially regain its former prominence. Initially, a potential price point to consider could be around $0.94. Subsequently, if growth continues, the next target could reach as high as $1.31.

If the token manages to surge past that threshold, it could potentially revisit its maximum historical value, and ideally, surpass that record in an ideal world.

Will the token break out in Q3?

To determine if a potential surge in XRP was imminent based on the suggested bullish trend, AMBCrypto examined its on-chain information over the next several weeks.

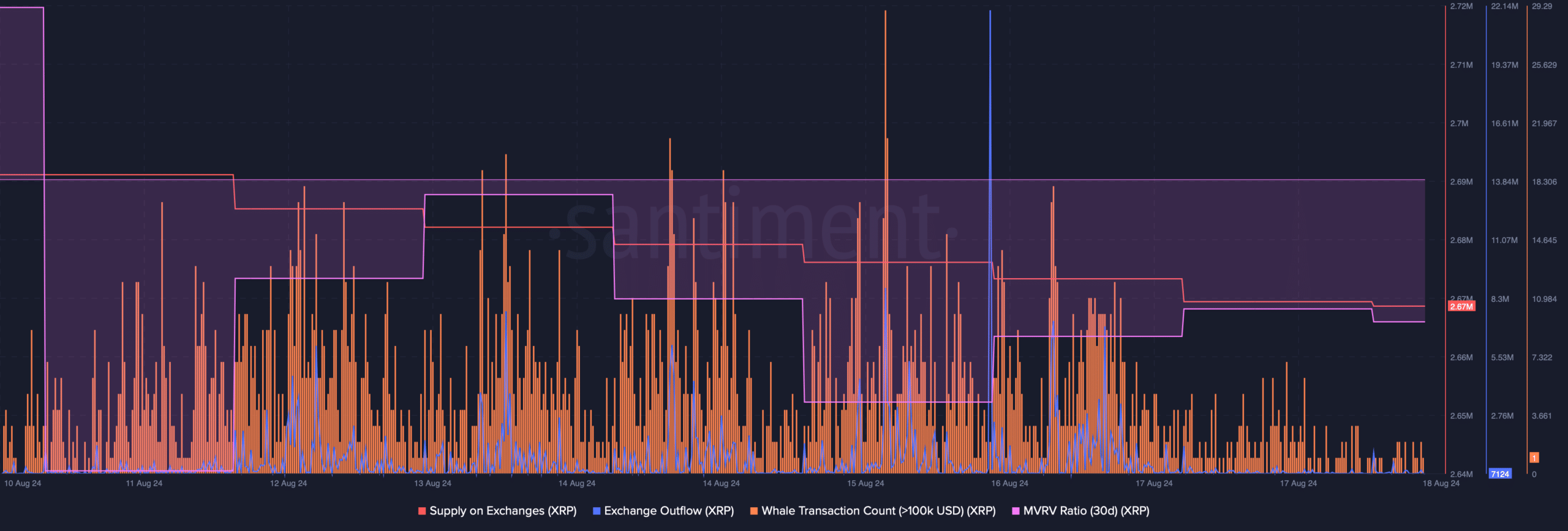

Last week, we found from Santiment’s data that there was an uptick in demand for the token due to a decrease in the token’s availability on exchanges, indicating fewer tokens were being sold and more were being held.

On August 16th, an increase in XRP‘s outflow from exchanges served as additional evidence that investors were actively purchasing this cryptocurrency.

Nevertheless, the remaining indicators showed a generally pessimistic trend. For example, the MVRV ratio continued to stay below zero. Furthermore, there was a decrease in significant transactions involving the token last week, suggesting that whales were not actively trading it.

In addition, the information gathered by Coinglass showed that XRP‘s Long/Short Ratio decreased, indicating a negative outlook or bearish signal.

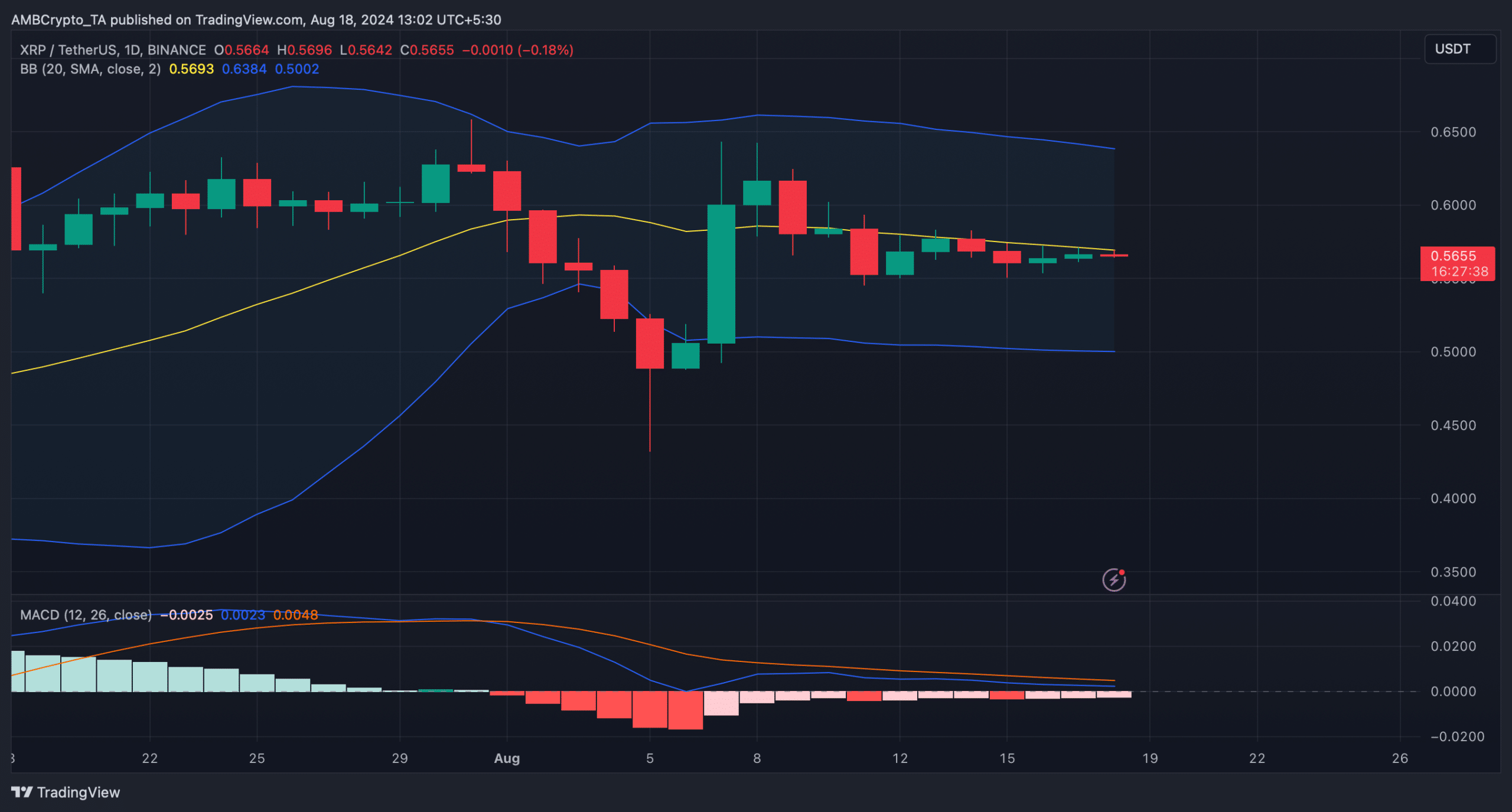

After examining XRP‘s daily chart, AMBCrypto looked for clues from various technical indicators. According to the Bollinger Bands, the token was approaching its 20-day Simple Moving Average (SMA).

Read Ripple’s [XRP] Price Prediction 2024-25

Yet, there’s a possibility that the token may need more time to surpass the resistance level, considering the MACD suggests a bullish edge is currently lacking in the market.

If the market remains bearish, the value of the token could potentially fall to around $0.55. Conversely, if we see a bullish trend reversal, it’s possible that the token price could climb up to $0.59 over the next few days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-19 01:11