-

XRP was down by more than 4% in the last seven days.

Most market indicators remained bearish on the token.

As a researcher with experience in cryptocurrency markets, I have observed XRP‘s recent performance with great interest. The token has been underperforming in the last seven days, with its value dropping by more than 4%. Most market indicators remained bearish on XRP, making it a challenging time for investors.

As a researcher studying the cryptocurrency market, I’ve noticed that XRP, like many other cryptos, has experienced some difficulties recently. The value of XRP has dropped significantly following the latest price adjustment, leaving it precariously close to a significant support level.

If the token manages to make a bullish shift to reverse the trend following this event, that’s great. But if it doesn’t successfully challenge the support level during this time, the situation could deteriorate further.

XRP bears are leading

According to CoinMarketCap’s latest findings, XRP experienced a significant decrease in value within the past week, with its price falling more than 4%. Moreover, within the previous 24 hours, there was an additional drop of over 2% in XRP’s price.

Currently, the value of the token is $0.4754 at the point of this composition, and its market capitalization exceeds $26 billion, positioning it as the seventh most valuable cryptocurrency in terms of market size.

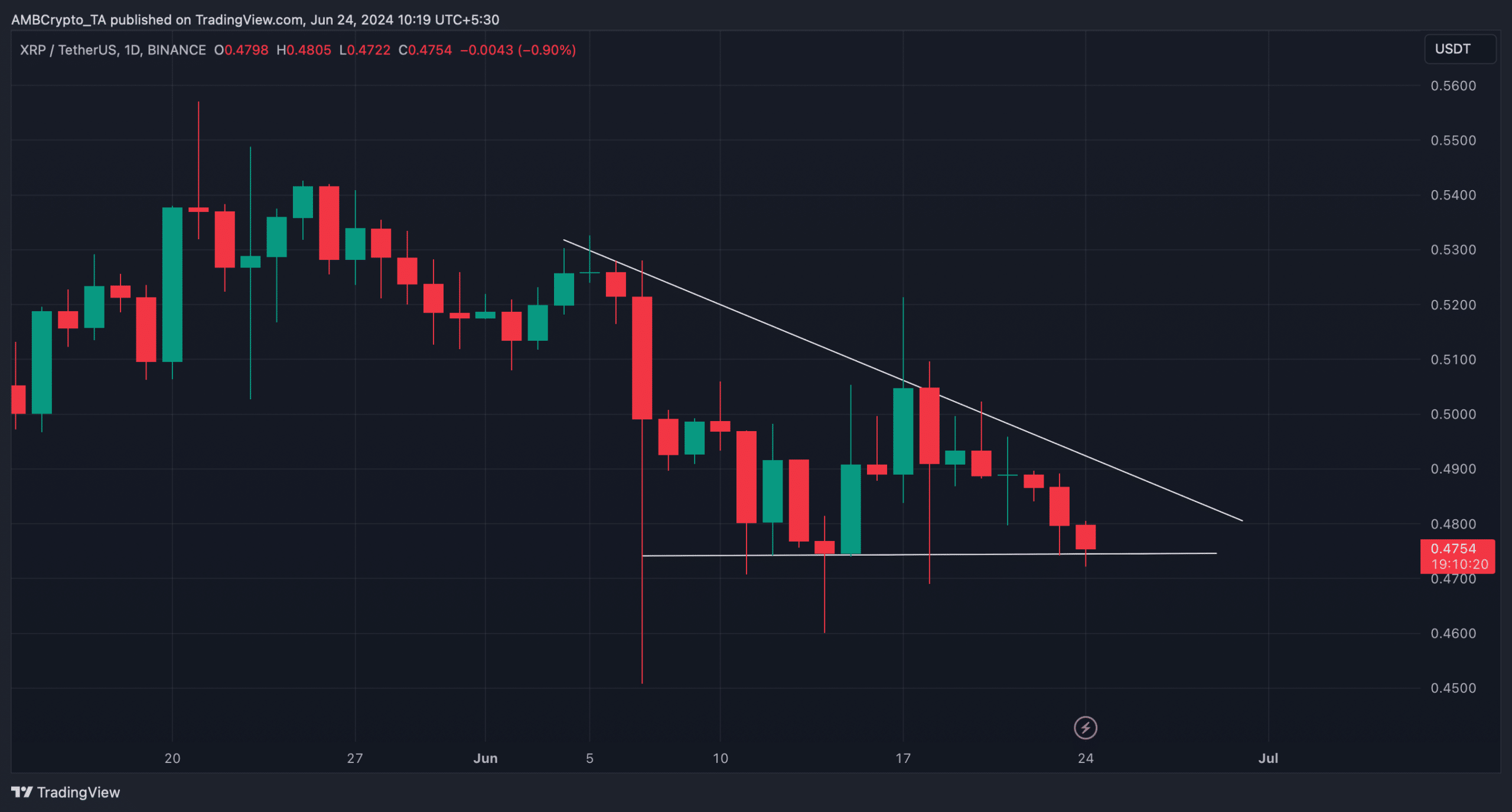

An examination of AMBCrypto’s daily token chart uncovered the emergence of a descending triangle configuration.

The token was putting its vital support level to the test, providing XRP with a chance to bounce back. However, should it fail to do so, investors could expect a potential price drop in the near future.

What to expect?

Due to the ambiguity surrounding XRP‘s future, AMBCrypto intended to examine its on-chain data for insights.

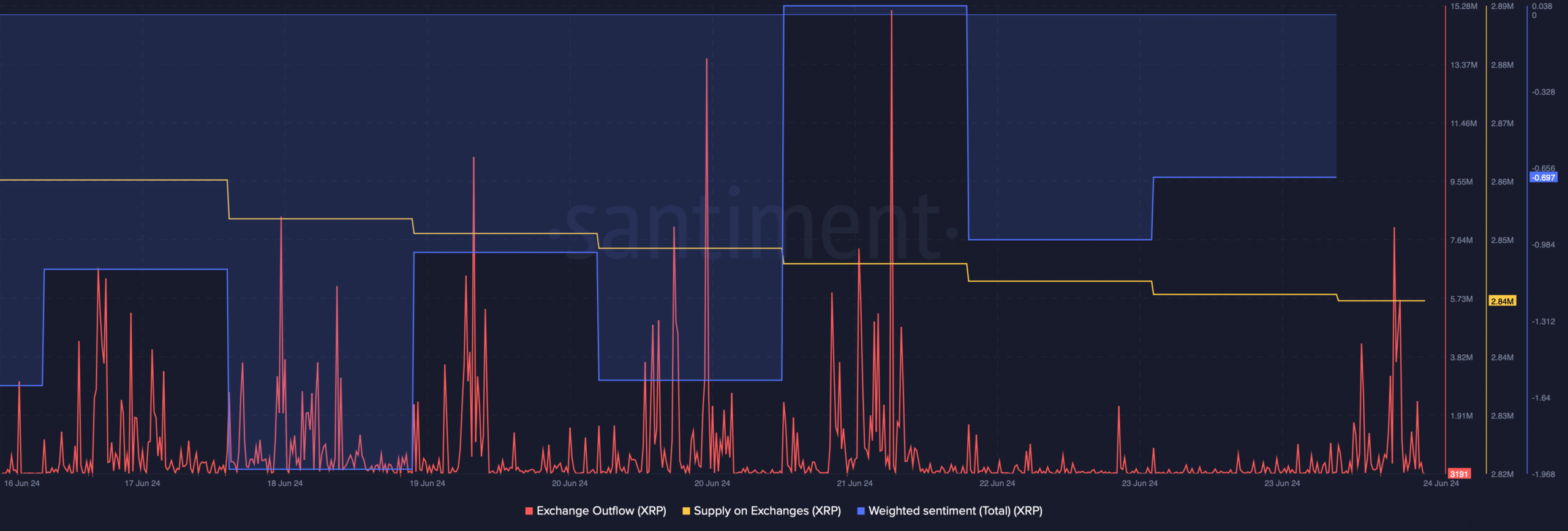

Based on our examination of Santiment’s data, it appeared that demand for XRP was increasing. This was indicated by the upticks in its exchange withdrawals over the past week.

Additionally, the token’s availability for purchase on exchanges decreased, indicating that investors were actively acquiring it.

Following a significant decline, the sentiment score for the token displayed an uptick. This surge in the metric signifies growing confidence among investors towards XRP, with optimistic views on the token becoming more prevalent.

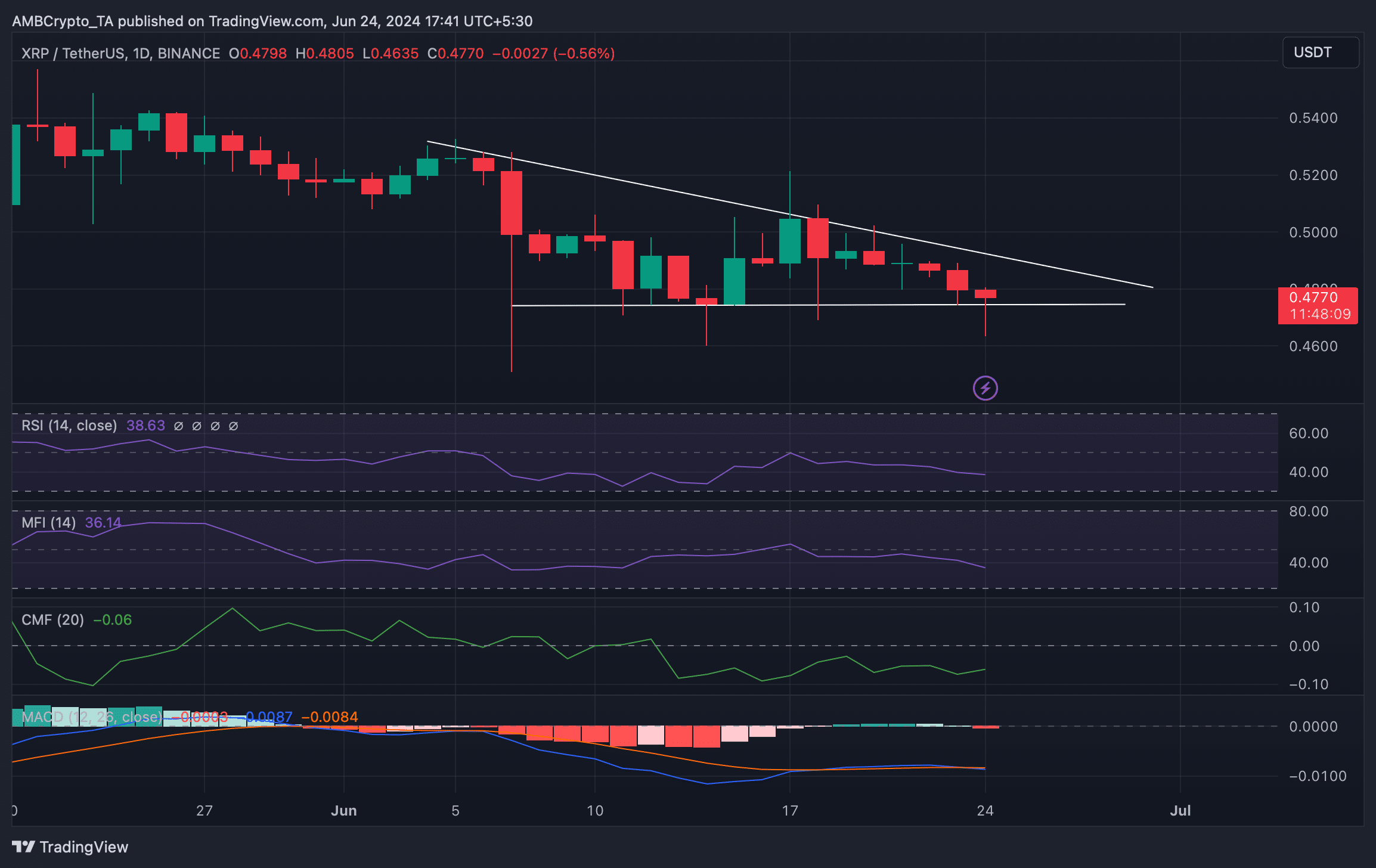

The Chaikin Money Flow (CMF) for the token indicated a positive outlook as it increased. Yet, other signals showed a bearish trend, implying that XRP could experience a significant decline below its support level.

The RSI and MFI indicators showed decreases for the asset, while the MACD suggested that neither the bulls nor the bears were gaining the upper hand.

After examining Hyblock Capital’s data, we found potential targets for XRP this week that the bears may aim to reach based on our assessment. The bearish trend remains strong.

As an analyst, I would interpret this scenario as follows: This week, the token could potentially dip to a price of $0.445 for investors. Yet, if the bulls manage to regain control and instigate a trend reversal, the token might be able to recover and surpass the $0.5 mark once more. However, it’s important to note that as the price rises near this level, liquidation could also become an issue.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-25 02:15