-

XRP’s price trades close to its key moving averages.

This suggests that the market is in consolidation.

As a seasoned crypto investor, I’ve seen my fair share of market consolidations, and XRP‘s current situation is familiar to me. The token’s price trading close to its key moving averages suggests a period of uncertainty, with neither the bulls nor bears having a clear advantage. This equilibrium can be both exciting and frustrating as it leaves us guessing which direction the market will break in next.

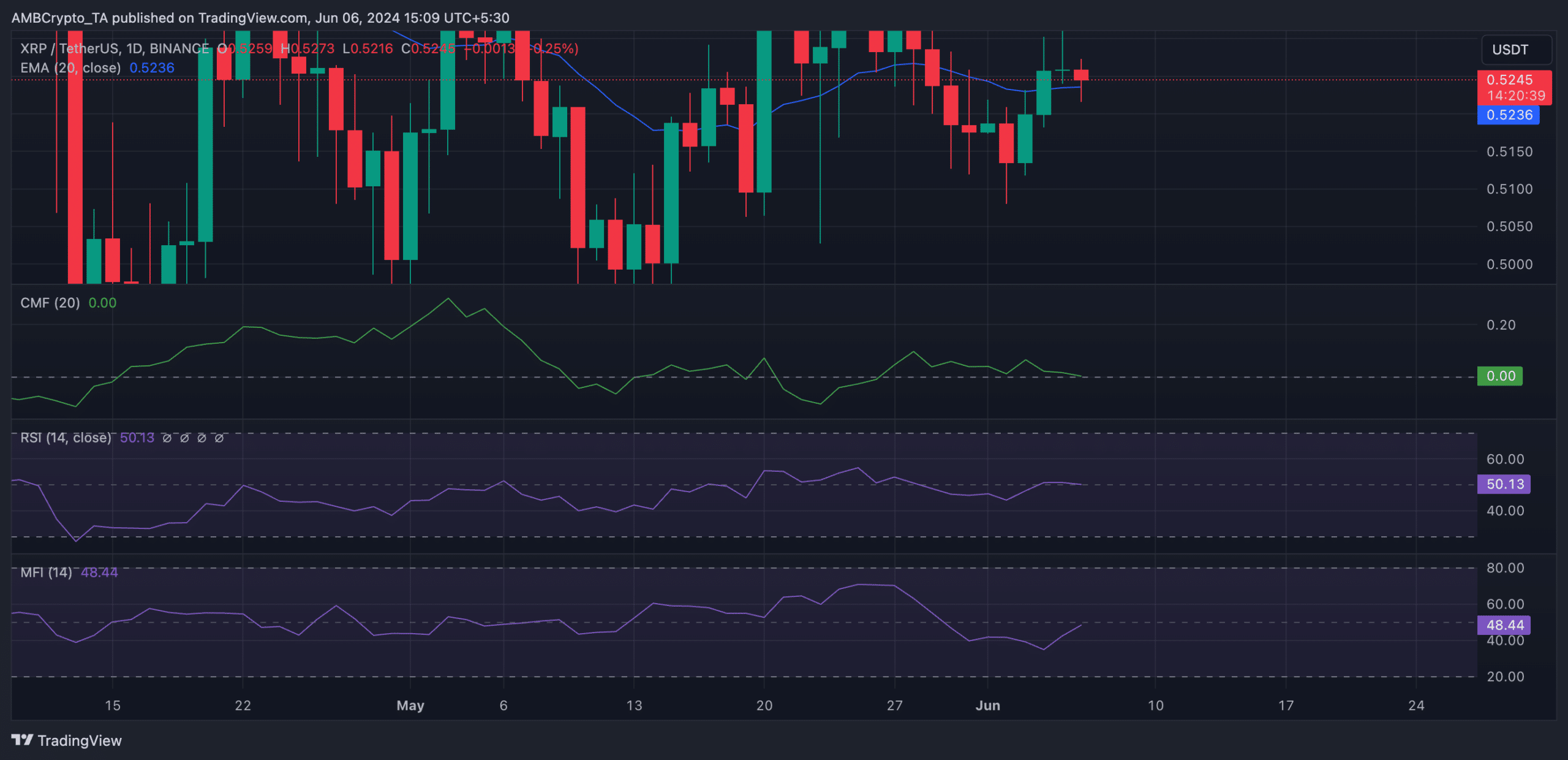

In recent days, XRP‘s price action around the 20-day exponential moving average (EMA) suggests a degree of ambiguity regarding the future pricing trend for Ripple [XRP].

As a researcher studying financial markets, I would interpret the situation differently when an asset’s price hovers around its significant moving average. In such cases, I believe the market is experiencing a consolidation phase. This indicates a state of equilibrium where the buying and selling forces are evenly matched, neither gaining a clear upper hand.

The bears and bulls are at equilibrium

Based on current market data from CoinMarketCap, I found XRP trading at an average price of $0.52. Indicating no clear trend, the important technical indicators for XRP were hovering around their neutral zones as of my research.

As a researcher studying the XRP market, I observed that its Relative Strength Index (RSI) stood at 50.13, while its Money Flow Index was recorded at 44.44. Based on these readings, it appears that the XRP market was in a consolidation phase. The altcoin wasn’t exhibiting signs of being overbought or oversold at these levels.

At present, XRP‘s Chaikin Money Flow (CMF) hovered around the zero line and demonstrated a descending trend. Such a development suggested that investors were withdrawing their funds from the XRP market.

The CMF index signifies the amount of funds moving into or out of a particular asset. If its figure is at zero or below, it’s indicative of capital leaving the market, which serves as a bearish signal. This situation frequently precedes a decrease in an asset’s worth.

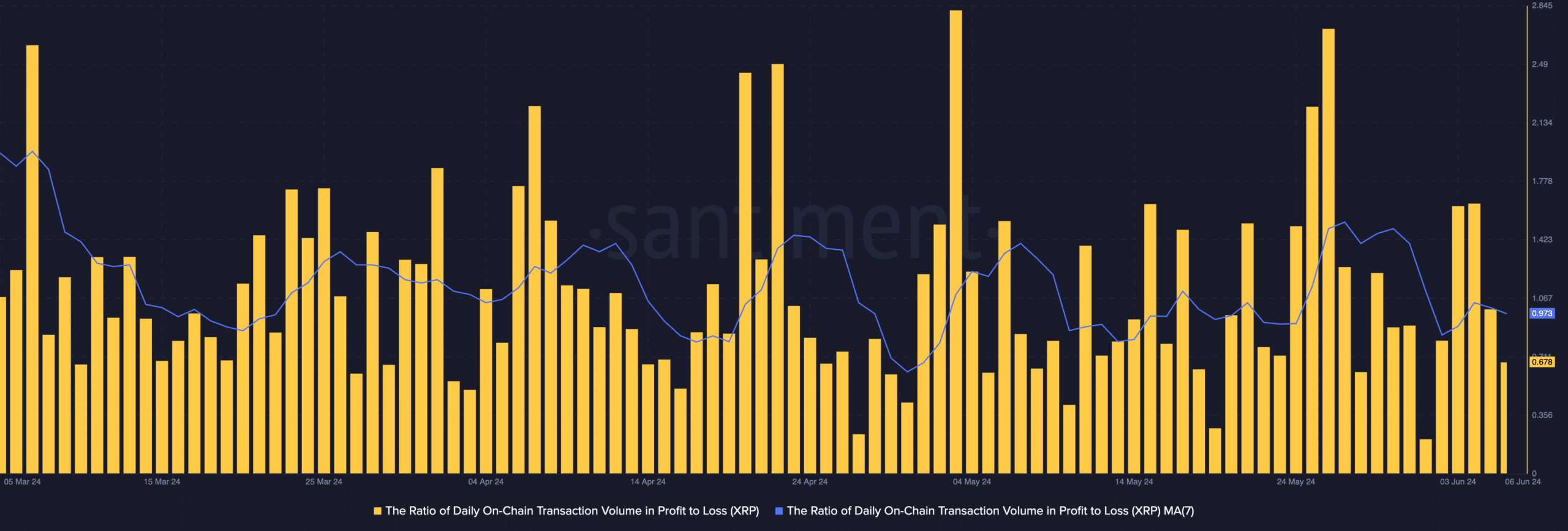

It’s not surprising that investors are selling off XRP recently, given that the majority of transactions surrounding this token have resulted in financial losses over the past week.

As a researcher studying XRP‘s transaction data, I calculated the daily ratio of XRP’s transaction volume in profits to losses using a seven-day moving average. The result indicated a value of 0.97.

For each XRP transaction resulting in a loss within the previous week, approximately 97 out of every hundred ended unfavorably.

Futures traders are looking to initiate a rally

As a market analyst, I’ve noticed a significant rise in open interest for XRP‘s futures market over the past few days. Currently, the open interest stands at approximately $661 million, marking a 7% growth since the beginning of the month, based on Coinglass data.

As a market analyst, I would describe open interest for a token’s futures contracts as follows: The sum of unfilled orders for futures contracts on a given token represents the current open interest. These positions have not been liquidated through closing or settlement transactions.

Read Ripple’s [XRP] Price Prediction 2024-25

When it grows, it means more traders are entering the market and opening new positions.

The favorable funding rate indicates that a significant number of new investors have been taking long positions in XRP futures contracts. In simpler terms, they’re betting that XRP’s price will increase.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-07 04:07