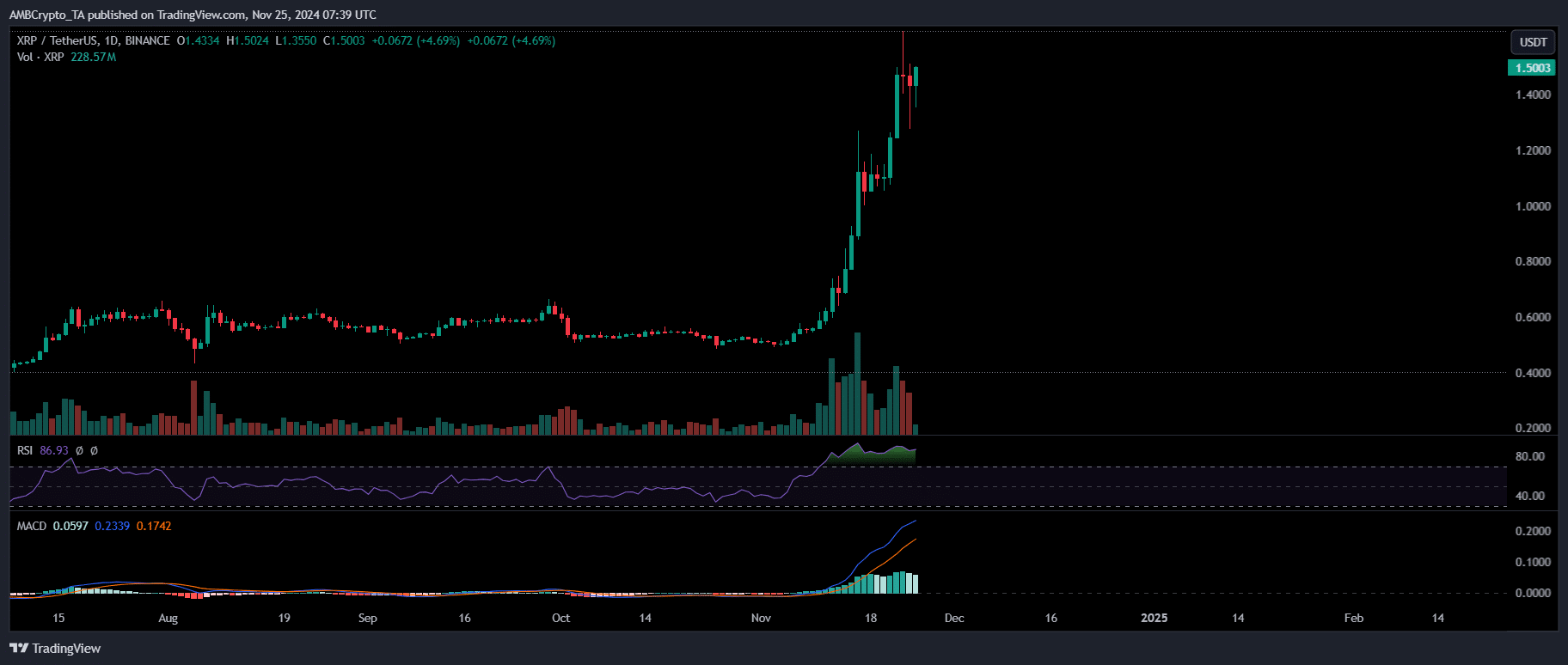

- XRP holds steady at $1.50, uncertain which way momentum will swing.

- More volatility is expected ahead as market forces battle for dominance.

As an analyst with over two decades of experience in the crypto markets, I have seen my fair share of bull and bear cycles. The recent surge in XRP has certainly caught my attention, and it appears that this digital asset is at a critical juncture right now.

After the election outcomes, there was a notable redistribution of funds during this market phase. Bitcoin (BTC) spearheaded these changes, whereas Ethereum recorded daily increases exceeding 10% at its highest point.

Following a week of rapid expansion, the market momentum began to taper off, and most digital currencies stabilized. However, during this period, Ripple [XRP] captured attention. A significant shift in investor attitudes propelled XRP to regain the $1 mark – a level it hadn’t reached in three years.

Despite striving for a return to its previous peak of $3.40, which was last reached over six years ago, the journey for XRP is anything but steady due to unpredictable price fluctuations disrupting its daily chart. These turbulent movements have made it challenging for XRP to sustain bullish momentum and surpass the $2 barrier.

Currently, as several indicators suggest potential overheating, it’s time for the bulls to prove their strength. They need to hold the $1.40 level steadfastly.

If the current level doesn’t sustain, there might be a retreat approximately to $1, providing a more inviting opportunity for entry. This pullback could delay XRP’s progression towards its significant goal and a possible new record peak.

XRP’s fate hangs at the midway point

As a researcher observing the digital currency market over the past three years, I’ve noticed a consistent decrease in XRP’s value. Yet, a recent surge in XRP’s price reignited a sense of fear-of-missing-out (FOMO) among investors. On the day XRP reached $1, active accounts on the XRP ledger peaked at approximately 48,000 for the year. However, within a single week, that number plummeted to 30,000, representing a significant decrease of 37.5%.

Recently, these sudden departures have halted the progress required to surpass the $2 mark, causing a drop of over 2% following its passage of the midpoint two days prior. Currently, XRP is trading at approximately $1.46 (as of this moment).

Normally, a fresh enthusiasm for a cycle arises in two main situations: either when a coin surpasses significant mental resistance levels, or when it reaches a temporary low point, offering potential buyers an opportunity to jump in at a lower price and hope for substantial profits in subsequent stages.

Consequently, it’s now up to the leading bulls to take action. If they successfully maintain the current price point and consider the recent decline as a misleading drop, a surge above $2 might serve as a psychological trigger, igniting renewed fear of missing out (FOMO) and stimulating increased market participation, much like in past patterns.

In case bulls start losing faith in XRP’s future prospects, there might be a dip toward approximately $1. This dip could potentially mark a local minimum, making it an appealing opportunity for new traders to invest, hoping for a subsequent price increase.

The current situation for Ripple is significant, as its next action could determine if it accelerates towards about $2 or retreats to potential new entry opportunities around $1.

Brace for more volatility ahead

Some experts predict that XRP might experience a pullback before potentially advancing to $2. Given its impressive 230% surge in just under three weeks, the token appears overvalued at the moment, making the $1.00 – $1.20 price range an attractive entry point for investors who anticipate a correction.

Instead, let’s say this: Over the weekend, whales (large investors) with holdings ranging from 1 million to 10 million XRP have remained undisturbed by recent market speculations, amassing approximately $50 million in XRP tokens collectively.

The buildup significantly contributed to XRP holding steady above the $1.20 threshold, a point it momentarily dipped to just two days prior, setting the lowest price for that day.

Source : TradingView

Currently in the derivatives market, there’s a trend among traders to short sell XRP, as they anticipate its price decrease. In such a scenario, the influence of large investors (whales) becomes significantly important in preventing a possible long position squeeze.

Realistic or not, here’s XRP market cap in BTC’s terms

In the upcoming period, it seems we’ll witness which team gains dominance in this ongoing struggle, much like a game of tug-of-war. Yet, the bulls have managed to maintain XRP at a steady level despite numerous obstacles, giving them a significant psychological advantage.

As bulls persistently strive to rekindle fear of missing out (FOMO) in the market, the chance of surpassing $2 becomes increasingly likely with growing certainty.

Read More

2024-11-25 16:40