- The crypto and financial market in Seoul reacted to the martial law declared.

- BTC and XRP saw major impact, but rebounded.

As an analyst with over a decade of experience in the crypto market, I have witnessed numerous instances where geopolitical events have significantly impacted the digital asset landscape. The recent martial law declaration and subsequent reversal in South Korea serve as a stark reminder of this interconnectedness.

As a researcher examining the global crypto market, I’ve noticed an intriguing pattern: South Korea’s temporary declaration of martial law and subsequent reversal has sparked a wave of volatility, particularly in their crypto market. Amidst President Yoon Suk Yeol’s accusations against the opposition for undermining democracy, the South Korean crypto landscape has seen intense turmoil, leading to sudden drops in Bitcoin and XRP values – what I would term ‘flash crashes’.

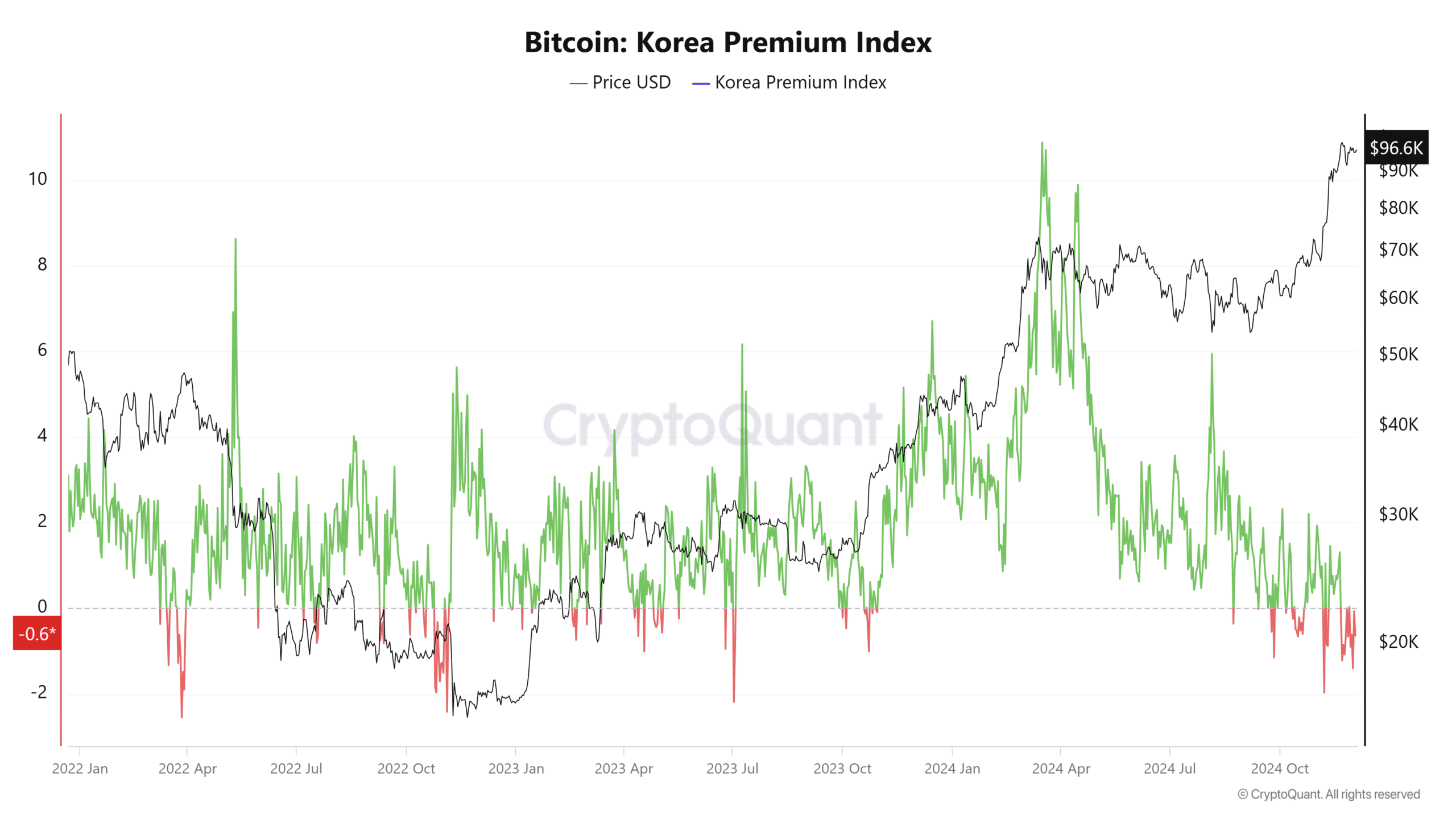

Experts often focus on the “Kimchi Premium” – the difference in Bitcoin’s price on South Korean trading platforms versus international markets – as a crucial sign reflecting the overall market’s sentiment.

Bitcoin’s Korea Premium Index reacts

The Korea Premium Index, showing Bitcoin’s price disparity between South Korean markets versus worldwide averages, saw a significant drop after the period of political instability.

As a researcher, I’ve observed historically that an increase in the index usually coincides with optimistic investment attitudes within South Korea, driven primarily by local demand. Yet, the current reversal into negative figures indicates a wave of selling off in the domestic market, likely due to a decrease in investor confidence during this crisis period.

The graph shows a significant drop in Bitcoin’s price premium, falling from about $93,000 to $96,525 after a dip, followed by an uptick toward the same vicinity.

The rapid withdrawal of funds from South Korean trading platforms suggests a mass departure of liquidity, which is often linked to increased political and financial instability.

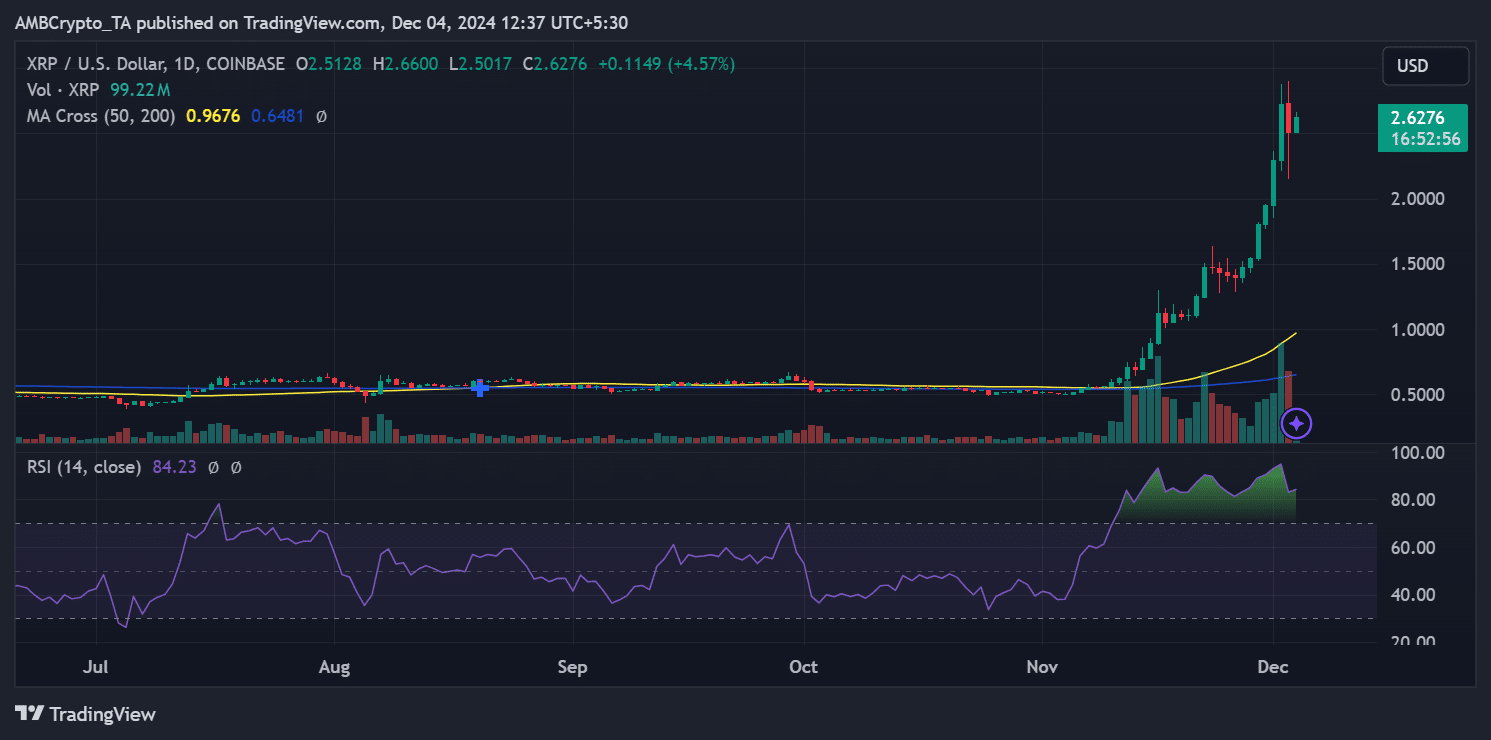

XRP faces parallel volatility

In South Korea, just like Bitcoin, Ripple (XRP) experienced a steep drop. Initially, XRP fell to around $2.15, but then bounced back to $2.63, according to the price graph.

Indicates that according to the Relative Strength Index (RSI), XRP could encounter resistance during its near-term recovery as it suggests potential overbought conditions.

As a crypto investor, I observed an alarmingly high trading volume during the recent market crash, which hints at widespread panic selling followed by strategic accumulation. Upon closer inspection, I noted that this surge in volume occurred in the final trading session on December 3, coinciding with significant price fluctuations.

Historically, South Korea has played a significant role as a key market for XRP. On many occasions, domestic exchanges contribute significantly to the overall global trading volume of XRP.

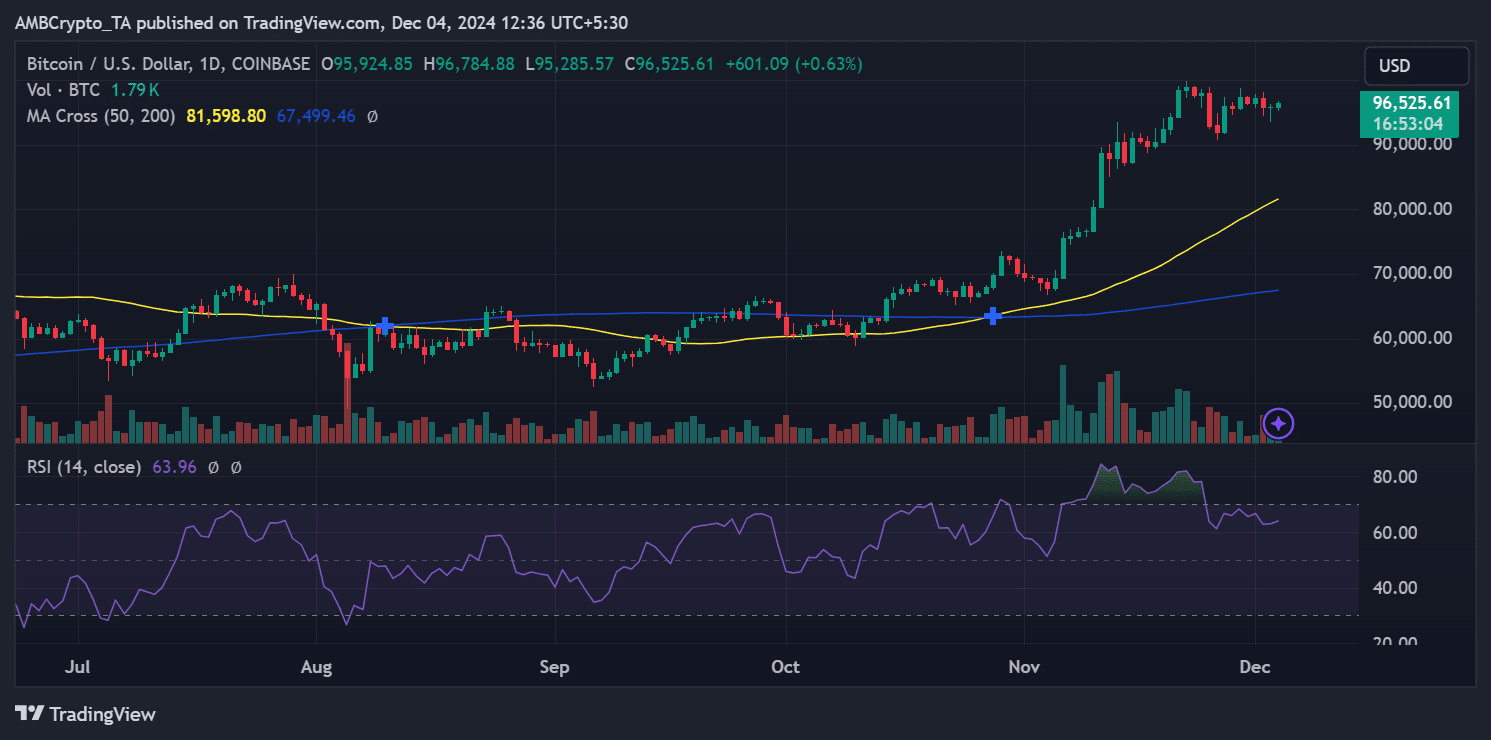

Bitcoin’s trend post-martial law lift

In spite of the sudden drop in value (flash crash) and market events happening in South Korea, Bitcoin’s price graph indicates a more general strength within the market. The 50-day and 200-day moving averages suggest that the upward trend is still ongoing, but there are hints that the momentum may be slowing down somewhat.

In simpler terms, the Relative Strength Index (RSI) for Bitcoin indicates a fairly balanced situation, which could mean that the sudden drop in price (flash crash) might have been an excessive response instead of a significant market decline.

After an initial drop, Bitcoin’s price bounced back, showing that the overall market can handle shocks, even in times of regional instability. Yet, the relatively low trading activity during this recovery indicates a sense of caution among international investors.

The ongoing political events in South Korea reveal that cryptocurrency markets can be highly sensitive to outside influences, especially in areas with a robust retail base for digital assets.

The significant changes in the prices of Bitcoin and XRP mirror a mix of local fear and global foresight among traders, who adjust their strategies based on changing circumstances.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-04 17:11