The spring of ‘25 found Ripple’s XRP in one of those moods, restless as the Salinas wind. April passed, and the old Ledger kept humming its tune, while newsfolk and speculators perched like grackles on the telephone wire, heads swiveling for SEC rumors or ETF whispers. People said the new Chair in Washington mattered, and money folks fidgeted with sweaty hands, watching ETF filings and re-filings and delays that stretched time like a tired mule.

Through all this heat and bluster, XRP shimmied up 5%, a little moonwalk on hardpan. The coin’s share of the market glued itself just north of 4%. Pretty rich company for what was once a backwater token just trying to mind its own business. Fourth spot, and climbing—though plenty of folks were still nursing old wounds from the last time it tripped over its own shoelaces.

Folks in the valley wondered: Is XRP about to run like a barn cat with its tail on fire, or are we all just whistling past the graveyard again? Folks spun their on-chain signals and measured out the data like beans, trying to decide if the next move was up or right off a cliff.

Ripple’s On-Chain Hocus Pocus: The Tale of Shrinking Addresses 🤡

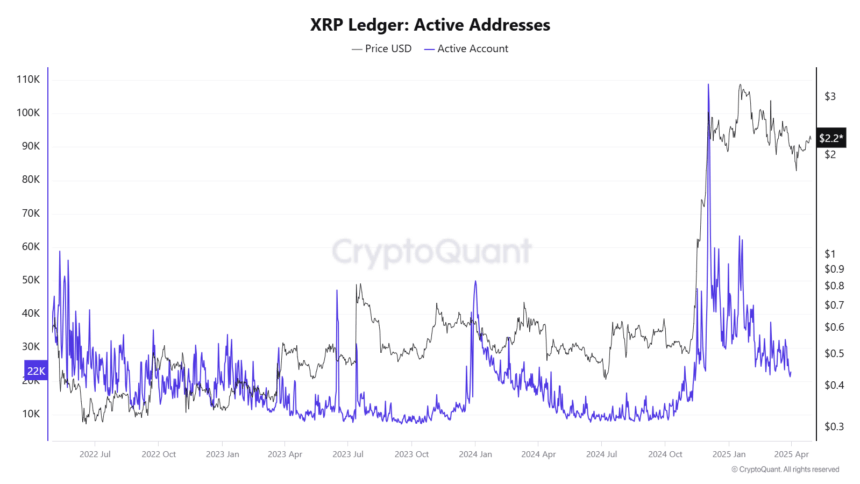

Active addresses on the Ledger drooped, sagging between $0.4 and $0.5 like a fence that hasn’t seen new posts since before the dust bowl. Used to be, right after Trump’s last rodeo, XRP’s addresses were thick as flies—110k buzzing—now it’s barely scratching at 22,000. They say it’s normal, that things settle, but even so, old-timers get nervous when the room empties out.

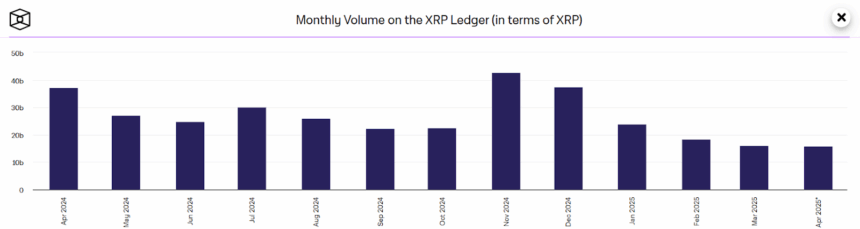

The number-crunchers in their glass towers pointed out that transaction volumes remained steady for three straight months—fifteen point eight-two billion in April, just a whisker under the month before. Steady, but not exactly an oil gusher. Something between “ho-hum” and “nobody panic.”

The barbershop chat is all grins about the long game. Maybe all these ETF filings are gonna make the price leap out of bed, and with governments suddenly pretending to understand crypto, the dream is, perhaps, not so far-fetched after all. Or maybe we’re all about to find out how hope becomes patience, and patience becomes, well, drinking alone.

XRP: The $2.25 Pillow Fight 🛏️

XRP took a few steps backward this week, shedding 4.5% with the carelessness of a kid dropping marbles. Once it was worth $128 billion, now it’s just about that—give or take a handful of dimes. Trading at $2.19, it’s like a melon in a roadside stand: Could go up, could get split wide open by the sun.

The 50-day EMA’s working overtime as support, propping up the Ripple chart like an old boy holding the barn door in a storm. The 200-day kind of lurks below, rolling about the $2 mark, like your uncle who sits quietly in the corner but is always first to the potato salad. The eggheads take this as a good omen for the long haul.

The RSI is kicking around neutral, not taking sides, which is how most folks get through family dinners. But see, the 14-day trend’s holding up its end, hinting that Ripple could see a bit of a chase upwards before the second quarter is out. If it stalls, though, there’s always potato salad.

Will XRP Ever Smell $3 Again? 🤞

Let’s suppose the price clings to its $2.20 support like a tick on a hound, it might make a break for $2.50, and if greased by a little wild-eyed optimism, maybe it’ll sniff $3 before anyone can say “moon mission.”

If the bears crack their knuckles and get to work, XRP could trip below $2. If the mood really sours, some say there’s a dark little burrow waiting at $1.80. Either way, someone’s going to declare themselves a prophet—probably on Twitter, probably in all caps.

In short: Hang onto your hats and your wallets. Ripple might gallop, might stagger, might just circle the barn a few more times. Either way, the critics and cheerleaders will be screeching at each other, and the rest of us will watch, popcorn in hand, hoping we picked the right side—or at least got a good story out of it. 🤑🍿

Read More

2025-05-01 00:44