-

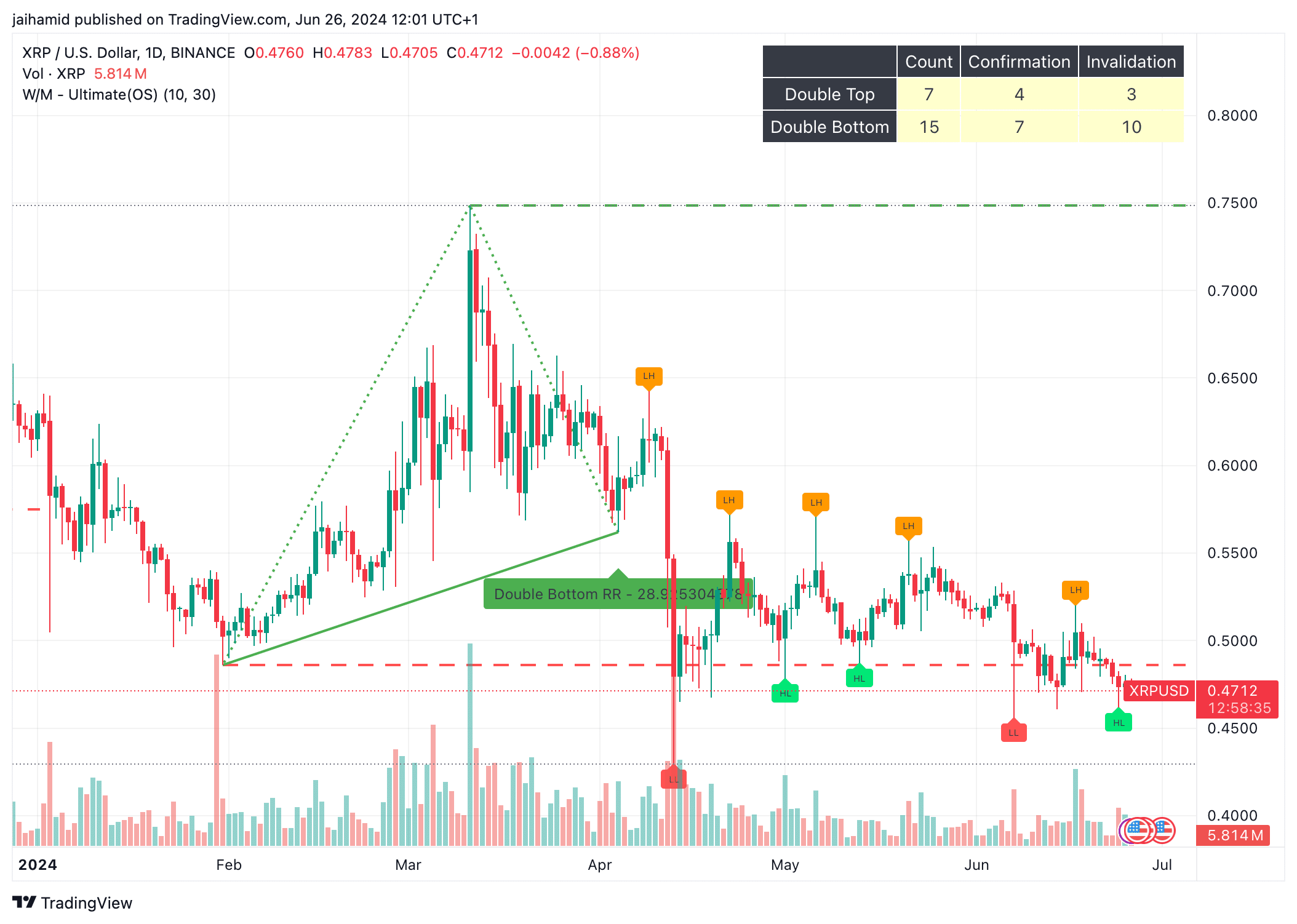

XRP showed signs of a bullish reversal, with a double-bottom formation at $0.40.

The Ultimate Oscillator and RSI suggested a balanced state without strong buying or selling pressure.

As a researcher with a background in analyzing cryptocurrency markets, I’ve been closely monitoring XRP‘s recent price action. Based on my observations and the technical indicators, I believe that XRP has shown signs of a potential bullish reversal. The double-bottom formation at $0.40 is a strong indication of this trend change. However, it’s important to note that the price has been facing resistance around the $0.55 level, which could lead to consolidation or a bearish turn if buyers lose momentum.

XRP has shown signs of a small-scale bullish turnaround lately, fueling anticipation among some investors for a significant price surge.

As a crypto investor, I’ve noticed the impressive upward trend of XRP lately, which has left me pondering if it has what it takes to sustain this momentum and ultimately trigger a significant market upturn.

Examining the XRP/USDt price chart, AMBCrypto identified a double-bottom pattern emerging around the $0.40 mark, signaling a potential bullish turnaround at that point.

After a bounce back following a double bottom formation, the price has encountered resistance around the $0.55 mark, as indicated by the latest high points.

If the continuous efforts to overcome this resistance fail, it may strengthen for another attempt at a higher level or weaken if buyer enthusiasm wanes.

Based on the latest Ultimate Oscillator readings near the average level, the market doesn’t show clear signs of being overbought or oversold, implying that there is currently insufficient momentum to make a significant price move in either direction.

What challenges XRP’s bullish outlook?

As a crypto investor, I’d say that my primary focus for XRP is to surmount the significant resistance level at $0.55 and sustain the growth above it. Overcoming this hurdle could be a promising sign of a bullish trend reversal and might pave the way for challenging higher resistances around $0.65.

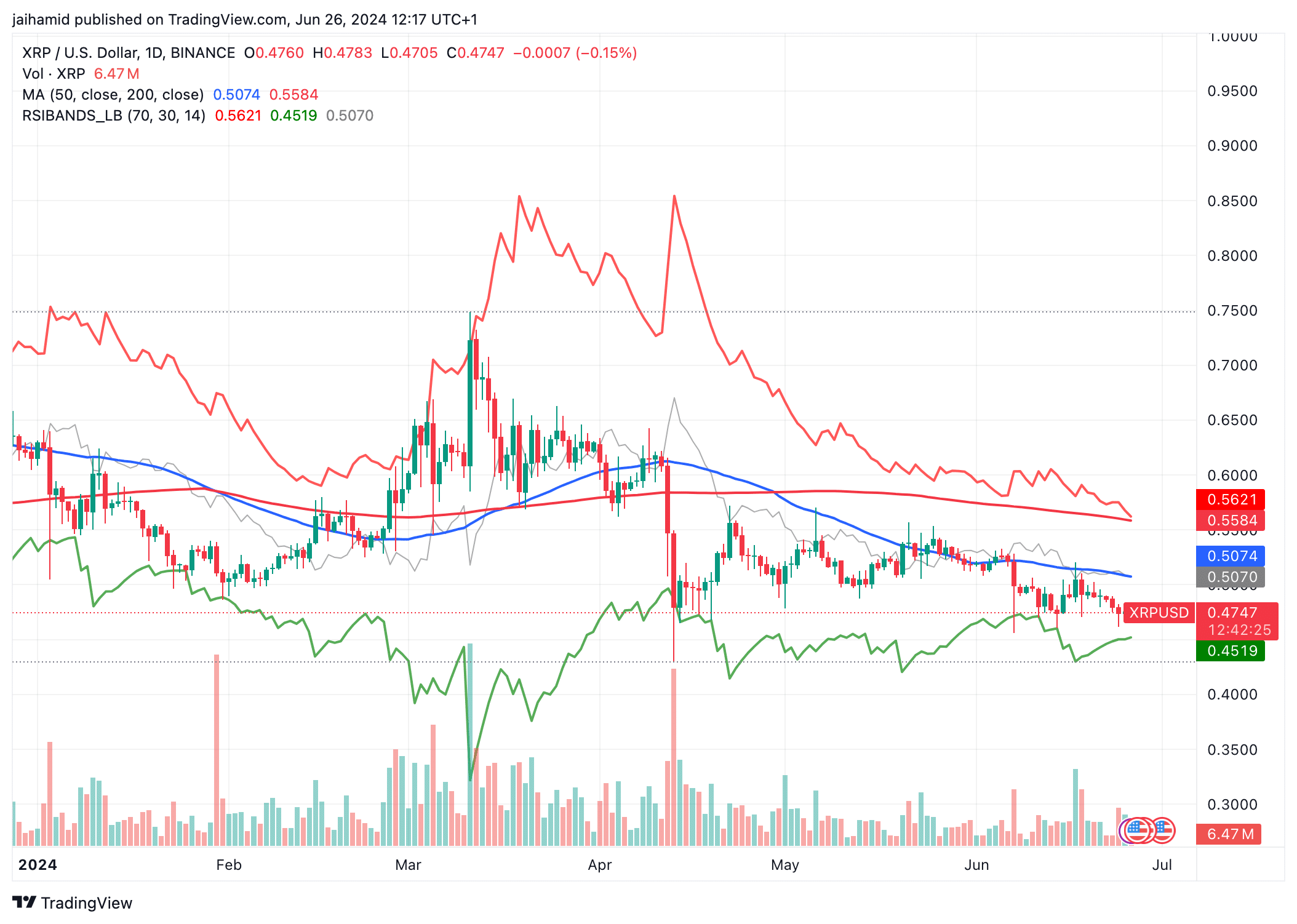

At present, the adjusted RSI value for Relative Strength Index, or RSI, hovered slightly beneath the neutral mark of 50. This signified that the asset’s price did not display clear indications of being either oversold or overbought.

As a researcher studying XRP‘s price movements, I’ve observed that its value has been bouncing around within a fairly consistent band, with the moving average (MA) of the past 50 days acting as both a resistance and a support level. Specifically, this level hovers around the $0.4519 mark.

Traders might be holding back from making significant trades, instead choosing to wait for a more definitive indication before doing so. Consolidation may occur during this time.

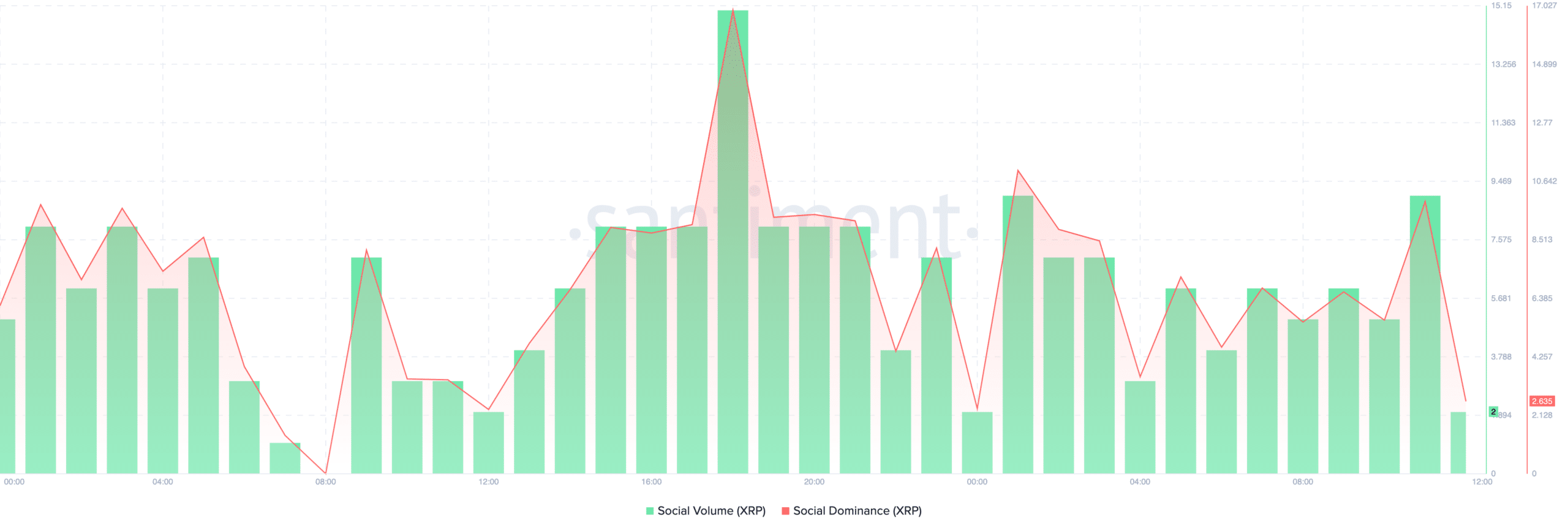

The alignment of moving averages suggests a bearish trend given the positioning of the 200-day moving average. At the same time, XRP‘s social dominance and trading volume stayed robust, mirroring significant market activity.

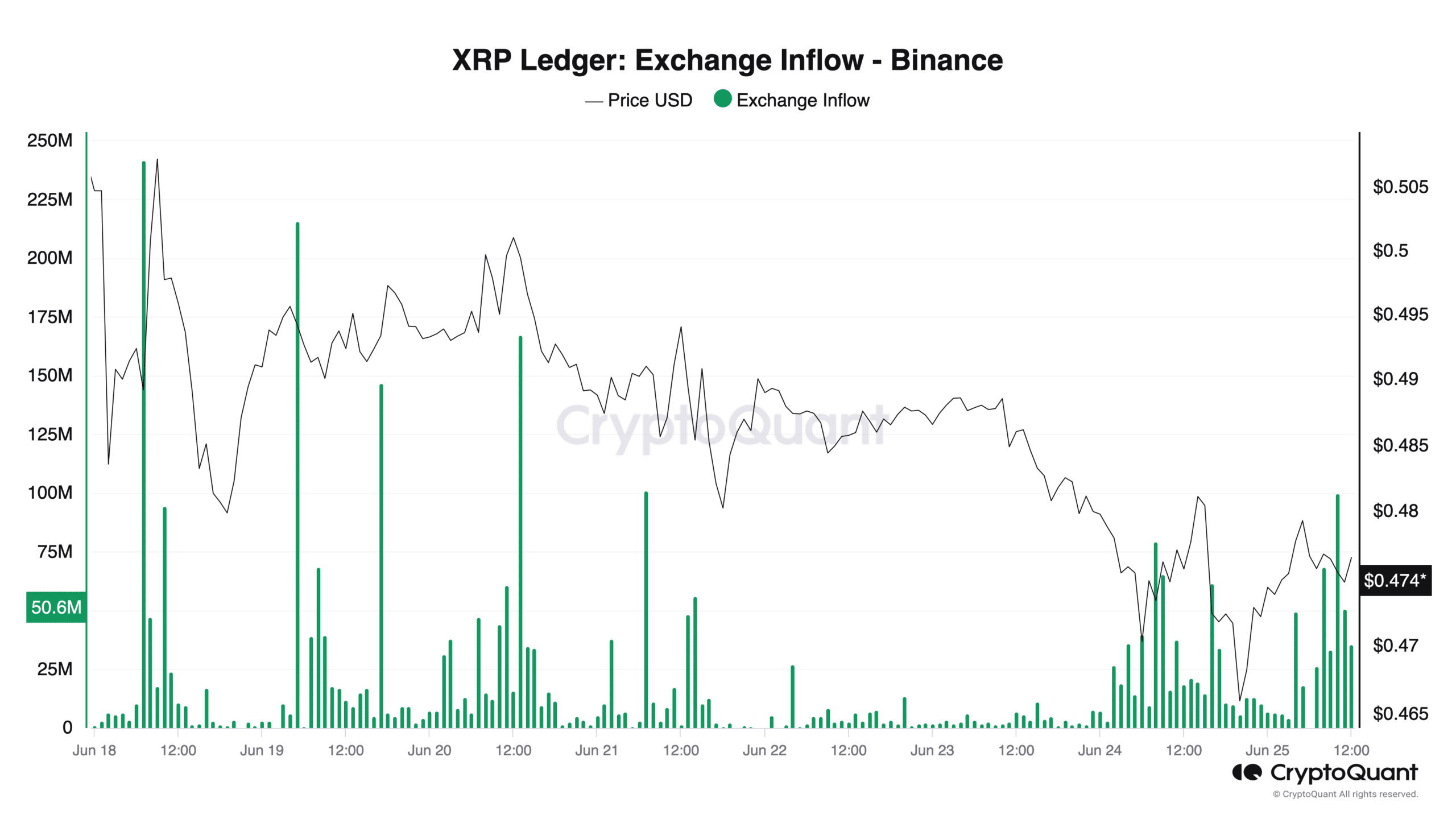

There is some degree of correlation visible between exchange inflows and price dips.

As a crypto investor, I’ve noticed that on the 19th and 22nd of June, there were significant increases in the amount of cryptocurrency flowing into my wallet. However, these inflows were followed by noticeable decreases in the price of the cryptocurrencies I held. This pattern suggests that sellers may have entered the market after the inflow, putting downward pressure on the prices.

As a crypto investor, I might interpret high inflows into the market as a sign of caution. This could mean that some investors are selling off their holdings due to bearish sentiment, likely in response to negative market news or price expectations.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-27 04:10