- XRP is seeing its second day of positive trends after consecutive declines.

- Whale accumulation has yet to see a significant drop despite the slight price increase.

As a seasoned researcher who has navigated through numerous market cycles, I find XRP’s recent price movements and whale activity intriguing. The persistent accumulation of XRP by whales, despite the slight increase in price, is reminiscent of a game of cat and mouse—the whales are waiting for the right moment to pounce.

The current fluctuations in the price of XRP have generated considerable curiosity, especially regarding the involvement of large investors (whales), as it experiences a downturn.

The increase in the value of this digital asset to $2.43, combined with noticeable trends of large investors (whales) buying it, has sparked discussions about the longevity of its price surge and possible effects on individual investors.

XRP whales seize opportunity

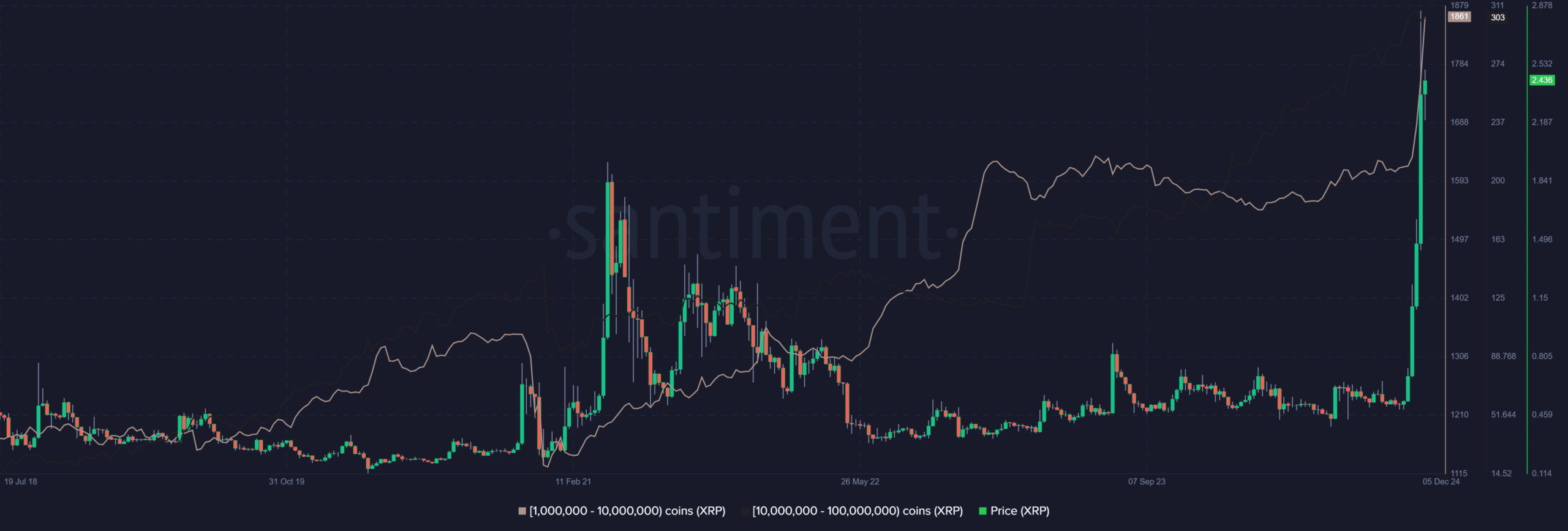

According to a study by AMBCrypto using data from Santiment, it was found that the number of XRP wallets containing between one million and ten million coins has grown during periods of price instability.

During a decline in XRP’s value from around $2.90 to $2.22, large investors (whales) bought approximately 120 million XRP, equating to a total investment of $288 million. Historically, such significant whale buying activity when prices are low has often indicated optimism about the asset’s future potential.

Examining the past events indicates that a buildup of interest (whales accumulating) typically occurs before an increase in market value (bullish price action). This pattern can be observed during XRP’s significant price surges in 2021 and mid-2023.

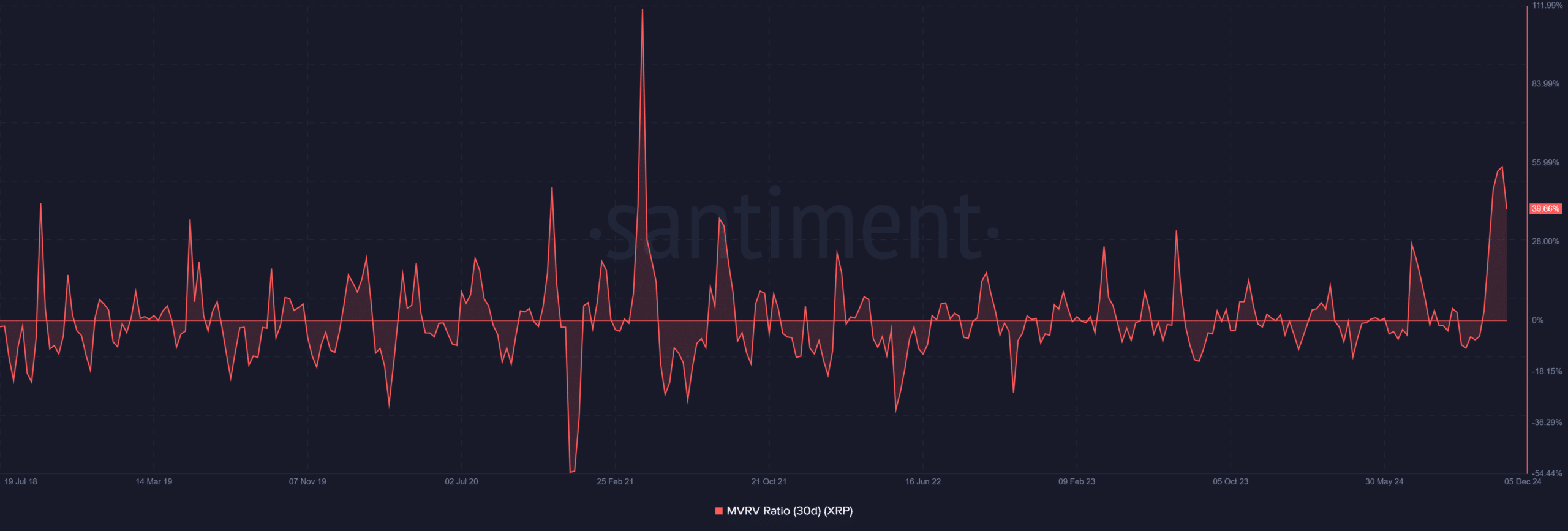

According to an analysis by AMBCrypto, a surge in coin accumulation occurred when the MVRV ratio was in the negatives, indicating that whales had purchased and held onto their cryptocurrency at a loss. At this time, the MVRV ratio hovered around -30%.

In contrast, the present situation reveals a greater disparity. Specifically, whales have amassed more of XRP, but the 30-day MVRV ratio stood at around 39.66%, indicating that XRP continues to be in an overbought state.

As an analyst, I’ve observed a profit ratio that indicates our returns are above the norm. This could potentially make our asset an attractive target for short-term profit-taking activities.

Price action and technical indicators

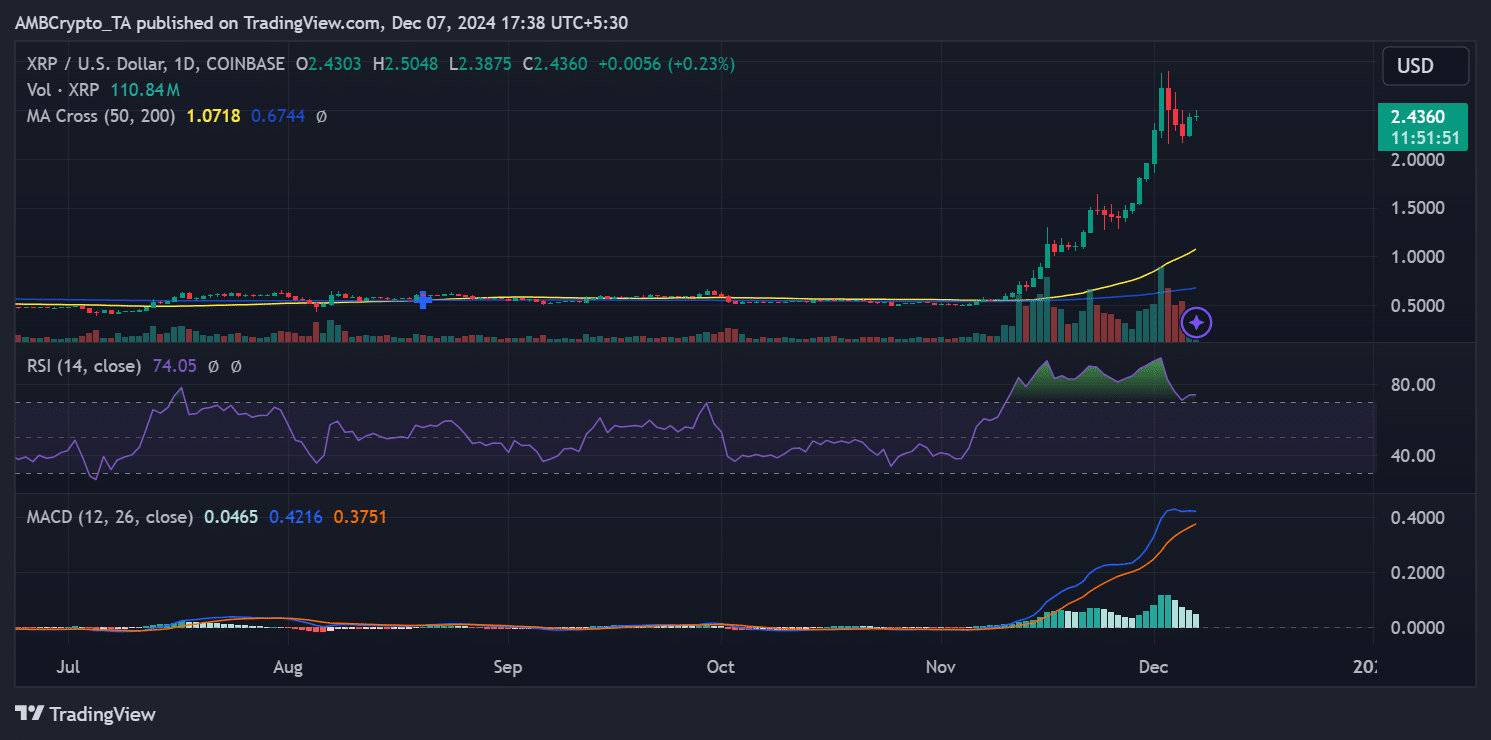

The graph showing XRP’s price movement displayed an uninterrupted climb, hinting at overbought status as the Relative Strength Index (RSI) stood at 74. Furthermore, the Moving Average Convergence Divergence (MACD) suggested a bullish push, reinforced by a favorable crossover.

Although there are positive indications, the upward trend of the asset might encounter obstacles close to $2.50 because of increased selling activity. At present, it’s being traded approximately at $2.55, showing a modest rebound.

A comparison with previous whale activity during dips reveals mixed outcomes.

For instance, whales that accumulated during dips in early 2021 saw substantial profits as XRP rallied, while those who bought during its mid-2023 dip experienced extended stagnation before recovery.

Market sentiment and broader context

The overall market sentiment plays a crucial role in determining whether whale accumulation can sustain XRP’s upward momentum.

If the demand for XRP continues to grow due to whales’ purchases and if positive economic trends persist, XRP may attempt to surpass its upcoming resistance barriers.

Realistic or not, here’s XRP market cap in BTC’s terms

Alternatively, large investors cashing out or a change in overall market opinion might trigger a period of stabilization or adjustment.

Based on historical trends and present blockchain data, the forecast indicates a combination of optimistic and pessimistic possibilities. While there are signs pointing towards an uptrend, there’s also a likelihood of a temporary decline in the near future.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- Elevation – PRIME VIDEO

- Serena Williams’ Husband Fires Back at Critics

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

2024-12-08 10:16