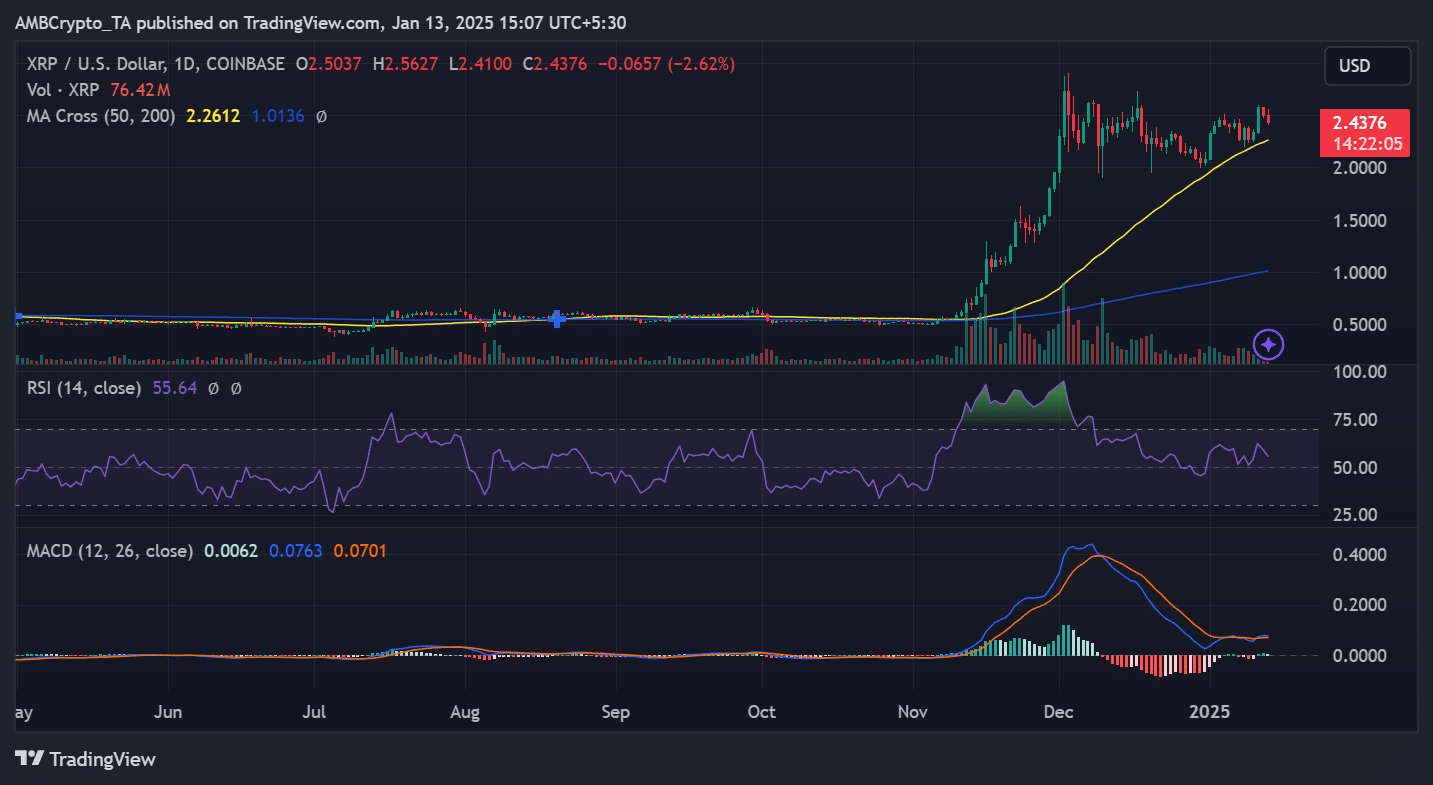

- RSI and MACD’s readings on XRP’s price charts highlighted minimal divergence

- XRP continues to hold above the 50-day MA at $2.26, despite losses over last 24 hours

In simple terms, talks about XRP remain prominent, driven by substantial price fluctuations and increased social activity. Currently, XRP is being exchanged at around $2.44, after experiencing a 2.62% decrease in the day’s trading so far. Even with this dip, its technical structure and broader market indications offer a complicated story for both traders and investors to decipher.

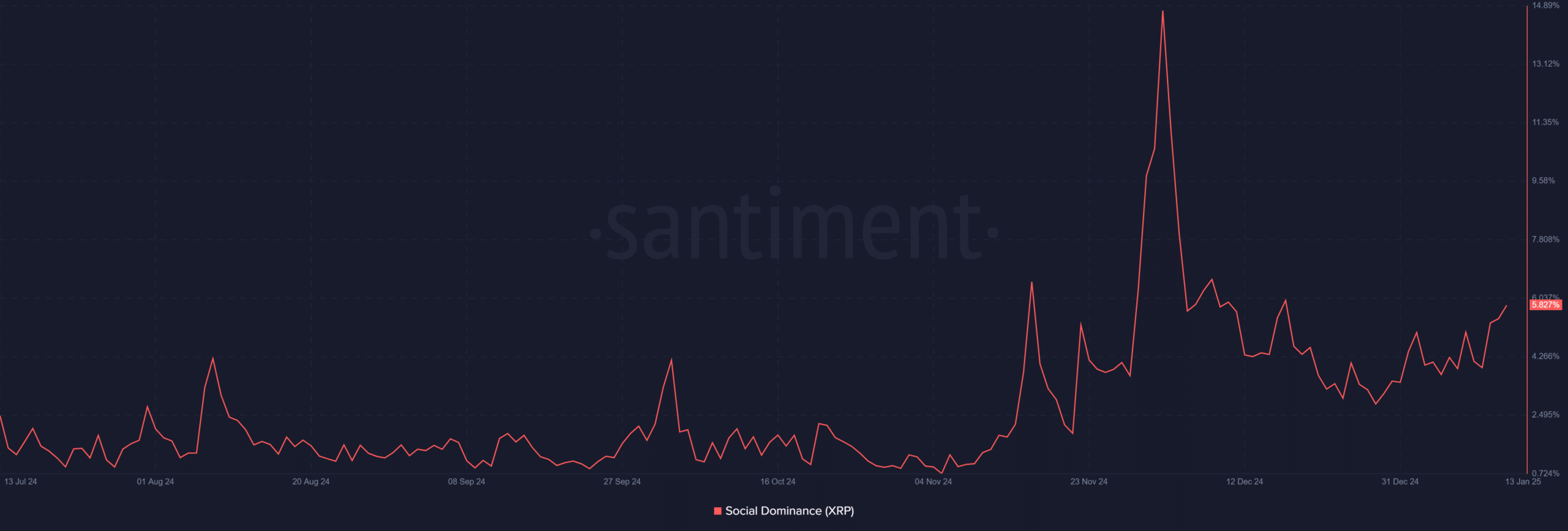

XRP’s social dominance surges

According to Santiment’s Social Dominance graph, conversations about XRP have significantly increased, reaching approximately 5.8% of all cryptocurrency discussions. This is one of the highest interaction rates seen recently for XRP, suggesting that it has captured the attention of many retail investors, indicating a growing level of interest.

As a researcher, I’ve observed that increases in social dominance tend to precede substantial changes in market prices, adding an element of unpredictability or volatility to the market dynamics.

As I delve into the dynamic world of cryptocurrencies, I’ve noticed an intriguing pattern with XRP. A surge in social activity around it might initially seem like a promising sign, fueling short-term enthusiasm. However, it could also indicate speculative behavior that might lead to either swift rallies or sudden corrections. Therefore, keeping a close eye on this metric is crucial for traders, as it can provide valuable insights into potential market movements.

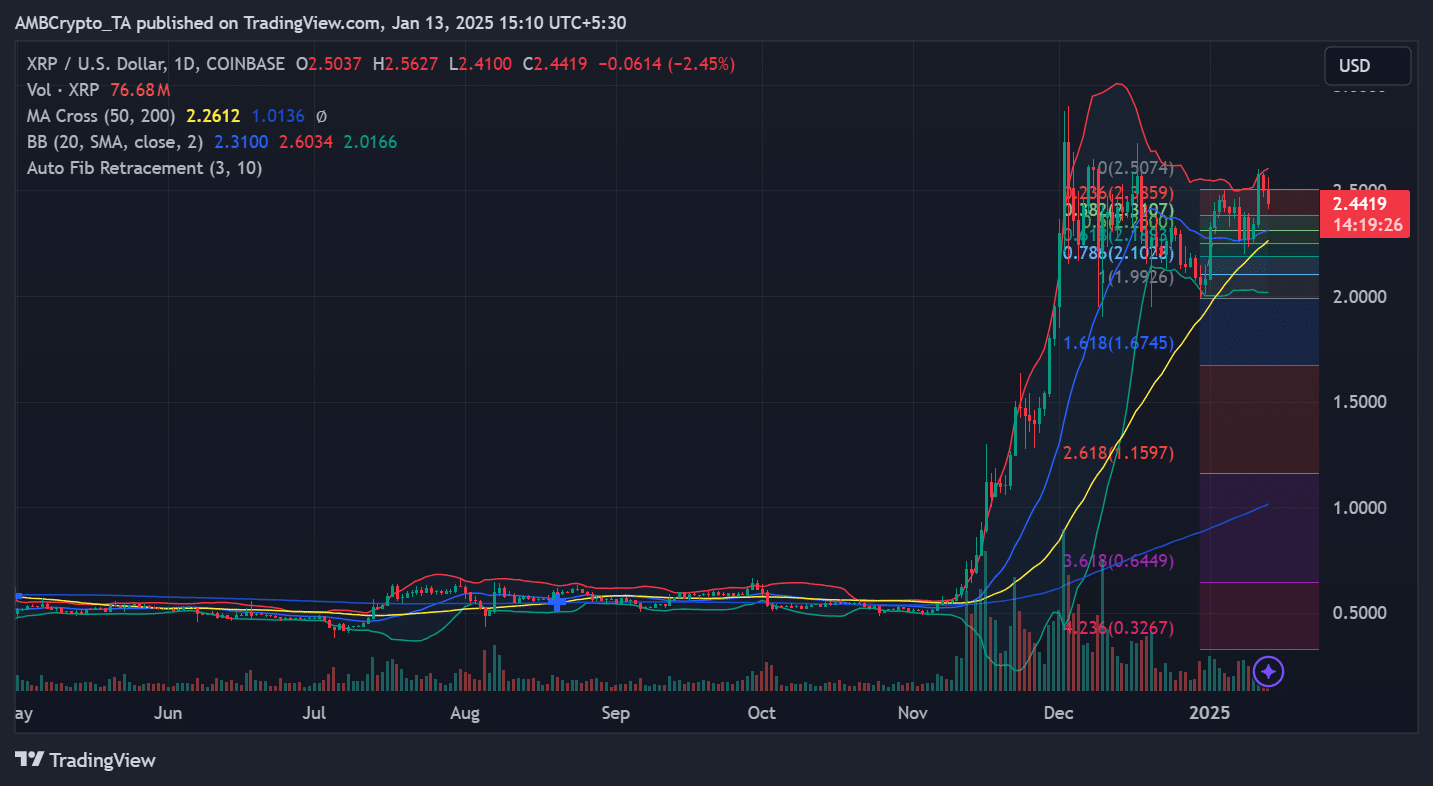

XRP’s support and resistance levels

On TradingView, XRP’s price graph showed a significant struggle between optimistic and neutral predictions. The 50-day moving average, positioned at approximately $2.26, was noticeably higher than the 200-day moving average, creating what is known as a ‘golden cross’. This bullish sign appeared to strengthen the positive outlook for XRP in the long term.

At the current moment, the price is still hovering under the significant level of $2.50, suggesting a period of stabilization or consolidation.

Based on Fibonacci retracement analysis, it’s proposed that $2.01 serves as a robust support point for XRP, while $2.60 presents a significant resistance level. If XRP manages to surpass $2.60, it could initiate a bullish trend, potentially reaching around $3. Conversely, if the price cannot maintain its position above $2.01, there’s a possibility of a more substantial correction, which might push the value down to approximately $1.50.

The Bollinger Bands suggest a period of low price fluctuations, as they are clustering around the midpoint. This pattern, in the past, has typically been followed by substantial price movements. As such, this could be a crucial juncture for traders to keep a close eye on.

Momentum indicators for signal consolidation

By examining momentum indicators, we gained additional understanding about XRP’s current situation. Specifically, the RSI (Relative Strength Index) was recorded at 55.64, suggesting a neutral trend in momentum. This observation appears to correspond with the consolidation period, where neither buying nor selling pressure is significantly stronger among market participants.

Moving beyond the 70 level suggests strong upward movement (bullish trend), whereas falling beneath the 30 level might indicate rising downward pressure (bearish trend).

Currently, the Moving Average Convergence Divergence (MACD) is signaling possible warning signs as it nears a potential bearish intersection. Should this intersection occur, Ripple (XRP) could experience temporary selling pressure, emphasizing the importance of staying alert in the upcoming period.

Stablecoin reserves and market stability

Despite mixed technical signals, however, broader market dynamics may offer some hope for XRP.

For example, data from Glassnode shows that there are higher levels of stablecoins like USDT and USDC stored in exchange wallets. This stored liquidity can quickly re-enter the market if needed. If the price weakens, this reserve could provide a stabilizing effect for XRP’s value, potentially protecting it from significant drops due to large sell-offs.

Current technological and market trends find XRP at a critical point. While its growing popularity and solid base levels suggest a possible bullish surge, there’s also a need to exercise caution due to conflicting trend signals and a significant barrier at around $2.60.

If XRP surpasses $2.60, it could spark another upward surge, potentially reaching $3 or even higher. But if it fails to maintain $2.01 as its base, we might see a more extensive drop, with the next notable level around $1.50.

– Realistic or not, here’s XRP market cap in BTC’s terms

In the coming days, the interplay between technical indicators and public opinion will play a crucial role in shaping the future of XRP cryptocurrency.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-01-14 01:11